The average person, when purchasing a property, will borrow money from a bank. When the loan is approved, the bank will instruct its attorney to attend to the registration of a bond over the property. The bond serves as security for the loan which means that if the borrower defaults on the monthly bond instalments, the bank will be able to sell the property in order to recover the moneys owed to it by the borrower.

However, more often than not, the bond is not registered in favour of the particular commercial bank who lends the money, but rather in the name of a different legal entity usually referred to as a security "SPV" (special purpose vehicle) or a "guarantee company". The structure is commonly referred to as "securitisation" which, especially to a first-time home buyer, could seem fairly complicated. This article aims to explain the structure briefly and in simplified terms.

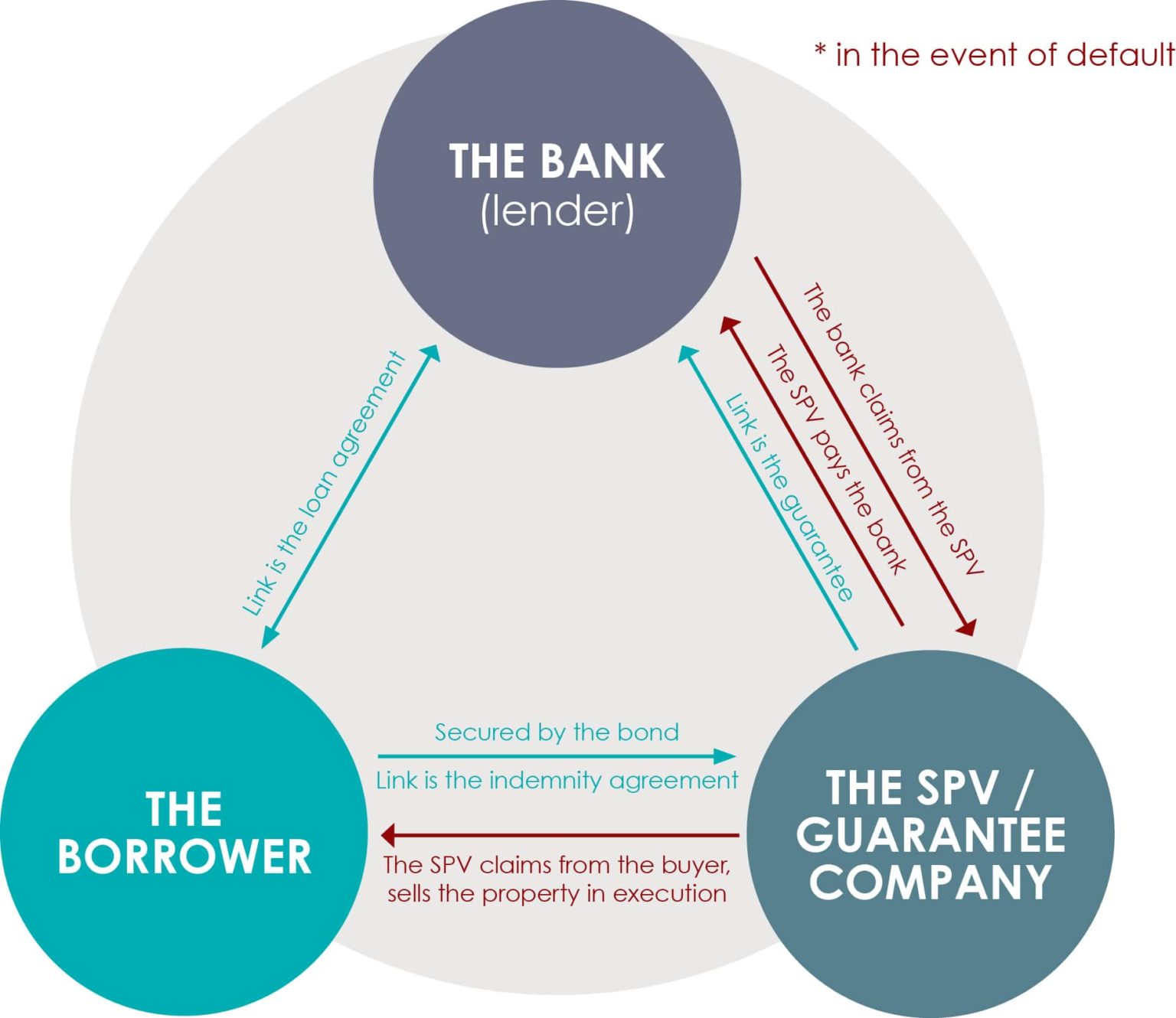

A simple form of securitisation basically looks as follows

- The bank, as lender, lends the money to the borrower. The link between the bank and the borrower is the loan agreement which the borrower signs and which contains the terms and conditions of the loan. The borrower repays the monthly bond instalments to the bank.

- The SPV then provides a guarantee to the bank, guaranteeing that the borrower will fulfil its obligations towards the bank in terms of the loan agreement.

- The borrower, in turn, signs an indemnity agreement in favour of the SPV, indemnifying the SPV against a claim from the bank in the event of the borrower's default. As security for the indemnity that the borrower is giving to the SPV, a bond is registered over the property in favour of the SPV.

The securitisation explained above poses no risk to the borrower. The borrower is not affected and remains liable towards the bank for repayment of the loan in terms of the loan agreement. In practice, if the borrower defaults on the bond instalments, the bank will rely on the guarantee given to it by the SPV which will settle the borrower's debt with the bank. The SPV will in turn rely on the indemnity given to it by the borrower in order to claim the money from the borrower. If the borrower fails to pay the SPV, then the SPV can institute legal action against the borrower, attach the property (as the bond is registered in favour of the SPV) and sell the property in order to recover the losses suffered by the SPV.

How does securitisation benefit the bank?

Loans (such as home loans which are secured by bonds) are regarded as cash flow producing assets which generate ongoing income for the bank in the form of borrowers who repay their monthly bond instalments. All these "assets" are then pooled together in one place (the SPV) and are sold to investors in the capital markets.

A more complicated securitisation structure is used in instances where a commercial property developer requires a large amount of funding, usually hundreds of millions of rands, to fund a new commercial development. Often, funding is obtained from more than one lender to limit risk and exposure to a single lender. Instead of registering a bond in the name of each individual lender, a single bond is registered in the name of the SPV. This allows for more than one financial institution to be a party to the project. It also makes it possible for new lenders to fund the project at a later stage or for initial lenders to withdraw from the project without affecting the security (the bond which is registered over the property in the name of the SPV).

The only changes needed relate to the underlying finance documents, such as the loan agreement, the guarantee and counter indemnities which are amended or replaced, depending on the circumstances. It will therefore not be necessary for the developer to register a new bond each time that a new lender joins or leaves the project, thus a cost-effective way for the developer of providing security.

Article originally published May 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.