AFRICAN UNION: Implementation of African Continental Free Trade Area Agreement postponed

The commencement of trade through the African Continental Free Trade Area ("AfCFTA"), which was scheduled to start on 1 July 2020, has been postponed due to the prevailing circumstances caused by the COVID-19 pandemic.

The Secretary General of the AfCFTA stressed that although the Assembly of the Heads of State and Government still upholds the political commitment and will to integrate the regional markets and to implement the AfCFTA agreement as was intended, priority has now been dedicated to fight the pandemic and save lives.

The Secretary General said that work on the AfCFTA will be resumed at an appropriate time.

ANGOLA: COVID-19 pandemic measures announced

The government, through Presidential Decree 98/20 of 9 April 2020, has approved various economic measures aimed at providing relief in the fight against COVID-19 pandemic, including:

- a special regime on the importation of foodstuffs, medicines and other essential goods providing for a temporary exemption granted in respect of import taxes on specified items;

- extension of the final filing deadline for Group A and Group B taxpayers, from May and April respectively until 30 June and 29 May 2020, respectively;

- a 12-month tax credit for companies on the value-added tax ("VAT") on the importation of capital goods and raw materials that are used for the production of goods that fall under the "basic basket" ("cesta básica") such as milk, rice, flour, and other items such as detergents, disposable diapers and cement, that are set out under Presidential Decree 23/19 of 14 January 2019;

- the payment of employee social security contributions (which responsibility lies with the employer, at the rate of 8% of the employee's salary) for the 2nd trimester of 2020 in six monthly instalments during the months of July to December 2020, without any interest payments; and

- private sector employers are required to pay employees their salaries plus the social security contribution (3% of the employee's salary) in April, May and June 2020.

ANGOLA: Government submits draft bill on the tax system to parliament

The Ministry of Finance announced that the Parliament of Angola has started discussing proposals to restructure the tax system, with a view to simplifying procedures, facilitating the business climate and improving the collection of revenue.

Proposed amendments to the Industrial Tax Code includes reducing the general industrial tax rate to 25% and reducing the tax rate applicable in the agricultural sector from 15% rate to 10%.

CABO VERDE: COVID-19 pandemic emergency tax measures announced

In terms of Decree-Law No. 37/2020 (Exceptional and Temporary Measures of Social Protection, Tax, Parafiscal and Human Resources Management in Response to the New SARS-CoV-2 Causing COVID-19 Disease) of 31 March 2020, with effect from 1 April 2020:

- a moratorium on the payment of taxes is to apply until 31 December 2020; and

- provision is to be made for the payment of tax debt in instalments, the suspension of tax enforcements in progress and exceptional arrangements for the hiring of retired employees.

CHAD: COVID-19 pandemic emergency tax measures announced

The president announced the following measures on 14 April 2020 To alleviate the economic impact of the COVID-19 pandemic:

- a 50% reduction of business licence duty and synthetic tax for the 2020 fiscal year;

- a suspension of all tax audits for a three-month period from April 2020;

- a more lenient attitude toward requests made by taxpayers that are most affected by the COVID-19 pandemic;

- an exemption from prior declarations and other time-consuming formalities for importers in respect of food and medical consumables transfer operations; and

- an exemption from taxes and customs duties on medical consumables and equipment used in the fight against the COVID-19 pandemic.

REPUBLIC OF CONGO: COVID-19 pandemic emergency tax measures in force

On 15 April 2020, the Minister of Budget issued a Circular Note No. 0247/MFB-CAB with measures aimed at alleviating the economic impact of the COVID-19 pandemic, including:

- an extension of the income tax return filing and payment deadline from 20 May to 25 August 2020, with the possibility of paying the balance of corporate income tax due for the 2019 fiscal year in instalments up to 31 December 2020;

- a one-month extension of the filing deadline for monthly direct tax statements until further notice;

- an extension of direct tax quarterly statement filing for the first quarter from 10 to 20 April 2020 to 10 to 20 June 2020;

- a deferral of payroll tax payments from April to 30 June 2020;

- a possible two-month payment deferral from 30 April to 30 June 2020 for occupancy tax, real estate tax on developed and undeveloped properties and entertainment taxes;

- the suspension of customs inspection fees and the acceleration of customs clearance procedures for goods used in the fight against COVID-19 pandemic;

- the suspension of penalties, fines and interest for late payments for a period of two months;

- the suspension of customs and other tax audits for three months from 1 April 2020 to 30 June 2020; and

- the extension of deadlines for taxpayers for responding to tax assessments for three months; but

- no extension for the filing of VAT and withholding taxes.

In addition, the following COVID-19 related amendments were proposed to the Finance Law 2020:

- reduction of the corporate income tax rate from 30% to 28%;

- reduction of the lump-sum tax rate from 7% to 5% for individuals taxed on turnover and from 10% to 8% for those taxed on profit; and

- tax exemption for donations made to the COVID-19 Pandemic Fund.

DEMOCRATIC REPUBLIC OF CONGO: COVID-19 pandemic emergency tax measures VAT exemption

On 20 April 2020, the prime minister issued Decree n.20/015, exempting, for three months (until 20 July 2020), several basic necessity products, including meat, fish, milk, fruits, cereals, non-alcoholic beverages and soaps from VAT on imports.

GHANA: COVID-19 pandemic emergency tax measures announced

The Minister of Finance, in a statement to the parliament on 30 March 2020, announced a number of measures relieving businesses and households during the COVID-19 pandemic. The Ghana Revenue Authority ("GRA") confirmed these measures on 30 April 2020, including:

- extending the due date for the filing of self-assessment returns from 31 March 2020 to 30 April 2020;

- extending the filing deadline for annual company income tax and personal income tax returns from four months to six months after the end of the basis year. Companies that can file returns before the extended date will be classified as compliant and will be eligible for an early tax clearance certificate and a withholding tax exemption certificate;

- postponing the annual tax month from April to June 2020;

- requiring taxpayers to file their monthly returns by the due dates using email addresses provided;

- encouraging taxpayers to pay their taxes by swift transfers using bank details provided by their local tax office;

- granting a remission of penalties on principal debts to taxpayers who redeem all their outstanding debts due to GRA by 30 June 2020;

- allowing a tax deduction for donations and contributions toward fighting the COVID-19 pandemic; and

- extending the due date for the sale of vehicle income tax stickers for the second quarter by one month to 15 May 2020.

IVORY COAST: COVID-19 pandemic emergency tax measures announced

On 23 March 2020, the General Director of Taxes ("DGI") informed taxpayers liable for real estate taxes and those subject to synthetic tax that, in view of conforming with medical protocols existing under the COVID-19 pandemic, it preferred payment made by electronic means, in particular using the DGI-Mobile solution.

On 31 March 2020, the prime minister announced several measures to alleviate the economic impact of the COVID-19 pandemic, including:

- exemption from customs duties and taxes for health equipment, materials and other health-related efforts used in the fight against COVID-19 pandemic;

- the postponement for three months of synthetic tax payment for small businesses and craftsmen (ie, restaurants, nightclubs, bars, cinemas and entertainment places);

- the postponement of payment of taxes and social contributions for a period of three months;

- the reduction of the transport business license duty by 25%;

- a postponement for three months of the payment of capital income tax granted to tourism and hotel businesses that are experiencing difficulties;

- the alleviation of prior check procedures of VAT credits to allow their refunds within two weeks; and

- the suspension of tax audits for a period of three months.

KENYA: COVID-19 Pandemic Tax Laws (Amendment) Act 2020 enacted

The Tax Laws (Amendment) Act 2020, containing measures to alleviate the effect of the COVID-19 pandemic, was enacted on 25 April 2020. The Act confirms some of the measures announced by the president on 25 March 2020 and generally apply with effect from 25 April 2020 (please see our April Africa tax in brief for more information).

Corporate taxation

- the corporate income tax rate for resident companies has been reduced from 30% to 25%;

- concessionary income tax rates for companies newly listed on any securities exchange, companies engaged in business under a special operating framework arrangement with the government and the companies operating a plastics recycling plant have been repealed:

- payments by a Kenyan resident or permanent establishment in respect of sales promotion, marketing, advertising services and transportation of goods are deemed to be sourced in Kenya (excluding air and shipping transport services);

- the 30% additional deduction for electricity cost previously available to manufacturers has been scrapped;

- the following exemptions have been repealed:

- dividends received by registered venture capital companies, special economic zone ("SEZ") enterprises, developers and operators licensed under the Special Economic Zones Act;

- gains arising from trade in securities listed in any securities exchange operating in Kenya by any dealer licensed under the Capital Markets Act;

- interest income generated from cash flows passed to the investor in the form of asset-backed securities; and

- dividends paid by SEZ enterprises, developers or operators to non-residents;

Personal taxation

- annual resident personal relief has been increased from KES16 896 to KES28 800;

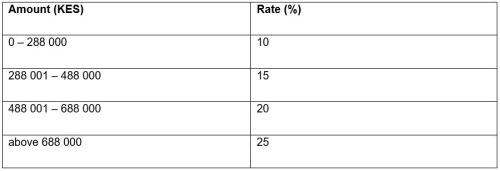

- the individual income tax rates for individuals have been revised as follows:

Other direct taxes

- withholding tax on dividends paid to non-residents has been increased from 10% to 15%;

- payments made to non-resident persons in respect of insurance and reinsurance premiums (excluding insurance or reinsurance premiums paid in respect of aviation insurance) will be subject to withholding tax at a rate of 5%;

- payments made to non-resident persons in respect of sales promotion, marketing, advertising services and transportation of goods (excluding the transportation of goods through air and shipping transport and the transportation of goods to citizens of the East African Community) are subject to withholding tax at a rate of 20%;

- turnover tax provisions have been revised as follows:

- the turnover tax rate has been reduced from 3% to 1%;

- turnover tax is now applicable to companies;

- turnover tax will apply to resident businesses where the turnover is more than KES1-million but does not exceed KES50-million; and

- persons liable for turnover tax are no longer required to pay presumptive tax;

- the provisions relating to investment allowances have been

repealed and replaced with the following:

- buildings used in manufacture, hotel, hospital and petroleum or gas storage facilities: a 50% allowance in the first year of use and the residual value subject to capital allowances at the rate of 25% per year on the reducing balance method; and

- educational buildings, including hostels and commercial buildings: an allowance of 10% per year on the reducing balance method.

- the wear and tear rates for plant and equipment have been amended as follows:

| Assets | Depreciation rate and method |

| machinery used for manufacture, hospital equipment, ships or aircrafts | 50% in the first year of use, with the residual value being depreciated at the rate of 25% per year on the reducing balance method |

| motor vehicles and heavy earth moving equipment | 25% per year on the reducing balance method |

| computer and peripheral computer hardware, calculators, copiers and duplicating machines | 25% per year on the reducing balance method |

| software | 25% per year on the reducing balance method |

| furniture and fittings | 10% per year on the reducing balance method |

| telecommunications equipment | 10% per year on the reducing balance method |

| filming equipment by a local film producer licensed by the cabinet secretary responsible for filming | 25% per year on the reducing balance method |

| machinery used to undertake operations under a prospecting right | 50% in the first year of use and subsequently 25% per year on reducing balance |

| other machinery | 10% per year on reducing balance |

| purchase or an acquisition of an indefeasible right to use fibre optic cable by a telecommunication operator | 10% per year on reducing balance |

| farm works | 50% in the first year of use and subsequently 25% per year on reducing balance |

VAT

- VAT on fuel was increased from 8% to 14% with effect from 15 April 2020;

- taxpayers are allowed to issue credit notes within 30 days of determination of a tax dispute in court;

- the period during which applications for refunds for bad debts may be made has been reduced from five years to four years;

- the requirement to keep records for five years has been extended from registered persons to all persons;

- a number of supplies are no longer exempt, including:

- the transfer of a business as a going concern by a registered person to another registered person;

- taxable supplies, excluding motor vehicles, imported or purchased for direct and exclusive use in the construction of a power generating plant, by a company, to supply electricity to the national grid;

- taxable supplies, excluding motor vehicles, imported or purchased for use in geothermal, oil or mining prospecting or exploration;

- taxable supplies for the construction of liquefied petroleum gas storage facilities with a minimum capital investment of KES4-billion and a minimum storage capacity of 15 000 metric tons as approved by the Cabinet Secretary for the National Treasury upon recommendation by the cabinet secretary responsible for energy;

- plastic bag biogas digesters;

- biogas;

- parts imported or purchased locally for the assembly of computers;

- taxable goods and services purchased or imported for use in the construction and infrastructural works in industrial parks of 100 acres or more including those outside special economic zones approved by the Cabinet Secretary for the National Treasury;

- materials and equipment for the construction of grain storage, upon recommendation by the cabinet secretary for the time being responsible for agriculture;

- taxable goods supplied to marine fisheries and fish processors upon recommendation by the relevant state department;

- taxable goods and services imported or purchased locally for direct and exclusive use in the implementation of projects under a special operating framework arrangement with the government;

- insurance agency, insurance brokerage, and securities brokerage services; and

- asset transfers and other transactions related to the transfer of assets into real estate investment trusts and asset-backed securities.

- Newly introduced exemptions include:

- vaccines for human medicine;

- medicaments containing penicillin or derivatives of penicillin or streptomycin or their derivatives; and

- personal protective equipment;

Excise duties

- goods imported or purchased locally for direct and exclusive use in the implementation of projects under special operating framework arrangements with the government are no longer exempt from excise duty;

Miscellaneous taxes

- goods imported for the construction of liquefied petroleum gas storage facilities, as approved by the cabinet secretary responsible for liquefied petroleum gas, are no longer exempt from the import declaration fee and railway development levy;

- the importation of raw materials for use in construction by developers or investors in industrial parks of 100 acres or more located outside the municipalities of Nairobi and Mombasa as approved by the Cabinet Secretary to the National Treasury are no longer exempt from an import declaration fee and railway development levy;

- a processing fee of KES10 000 will apply to importation of motor vehicles; and

- samples which, in the opinion of the Kenya Revenue Authority ("KRA"), have no commercial value are no longer exempt from an import declaration fee;

Tax administration

- the time within which the KRA must issue a private ruling has been extended from 45 days to 60 days;

- the requirement for the KRA to publish all private rulings has been repealed; and

- the penalty for late filing of turnover tax return has been reduced from KES5 000 to KES1000.

KENYA: VAT rate reduced

Parliament has approved the reduction of the VAT rate from 16% to 14% with effect from 1 April 2020 as set out in the Value Added Tax (Amendment of the Rate of Tax) Order 2020 (published as Legal Notice 35 in Kenya Gazette Supplement No. 30 of 26 March 2020). The Order amends section 5(2)(b) of the VAT Act 2013 dealing with the VAT rate for taxable supplies of goods and services.

KENYA: Tax Appeal Tribunal rules on assessments based on bank statements

The Tax Appeals Tribunal ("TAT"), in a judgment delivered on 17 December 2019 (Tax Appeal No. 70 of 2017), held that an assessment by the KRA based solely on a taxpayer's bank statements is in breach of section 23 of the Tax Procedures Act, section 15 of the Income Tax Act and basic accounting standards and, if allowed, would be prejudicial to taxpayers. The TAT put the KRA on notice regarding its habit of relying on bank statements to issue assessments to taxpayers, which in the TAT's view was unacceptable as the KRA should only collect what is due.

MAURITIUS: COVID-19 pandemic emergency tax measures announced

The Mauritius government, in a series of press releases dated 20 March 2020, 23 March 2020, 24 March 2020 and 31 March 2020, issued a number of measures to help stabilise the economy during this challenging period of the COVID-19 pandemic, including:

- introducing a self-employed assistance scheme ("SEAS"), in terms of which eligible self-employed individuals and tradespersons have to register with the Mauritius Revenue Authority ("MRA") to benefit from an allocation of MUR5 100 for the period 16 March 2020 to 15 April 2020;

- introducing a wage assistance scheme ("WAS"), in terms of which a business entity in the private sector is entitled to receive, in respect of its wage bill for March 2020, an amount equivalent to 15 days' basic wage bill for all its employees drawing a monthly basic wage of up to MUR50 000 subject to a cap of MUR12 500 of assistance per employee;

- setting up a COVID-19 solidarity fund to which public and enterprises are encouraged to voluntarily contribute. A deduction will be allowed in respect of any amounts donated and any unrelieved deduction in the income year may be carried forward for a maximum period of two successive income years;

- removing VAT on masks, hand sanitisers and other breathing appliances; and

- levying no late payment penalties for filing of statements and returns due in the lockdown period.

On 17 April 2020, the government decided to extend the financial support under the SEAS and WAS for one month after extending the lockdown to 4 May 2020. Under the SEAS, eligible self-employed individuals and tradespersons will receive financial support of MUR2 250 for the period from 16 to 30 April 2020. To ensure that all employees working in the private sector are also duly paid their salary for April 2020, the government will provide also support up to an amount of MUR25 000 per employee under the WAS. To benefit from the WAS, a business entity will have to re-apply for this support, whereas individuals benefiting under the SEAS need not re-apply.

In terms of a notice published on its website on 28 April 2020, the MRA has extended the deadline for filing obligations under the US Foreign Accounts Tax Compliance Act from July 2020 to 30 September 2020.

MOZAMBIQUE: Further COVID-19 pandemic emergency tax measures announced

In continuing efforts to curb the impact of the COVID-19 pandemic on business, the Mozambique Tax Authority has issued the following two documents regarding the suspension of tax audits:

- in terms of Circular No. 04/GAB-DGI/132/2020, of 8 April 2020, issued by the General Directorate of Taxes, all tax audits are temporarily suspended with immediate effect. All paperwork relating to ongoing audits, regardless of the audit stage, must be remitted to the Tax Audits Unit by 17 April 2020; and

- in terms of Service Order No. 12/AT/DGA/132/2020, of 14 April 2020, issued by the General Directorate of Customs, all post-clearance audits are temporarily suspended with immediate effect. The Customs Authorities must complete all ongoing post-clearance audits by 30 April 2020, regardless of the audit stage.

The Council of Ministers has announced a number of tax and customs concessions for the private sector on 14 April 2020. These measures were approved and gazetted, with clarifying details, through Decree No. 23/2020 of 27 April 2020 and include:

- expedited clearance of goods imported for the prevention and treatment of COVID-19, with the importation procedures and duties/taxes effected within a 90-day period. This measure is valid up to 31 December 2020 and is subject to the presentation of a statement of responsibility (termo de responsabilidade);

- taxpayers with an annual turnover not exceeding MZM2 500 000 in

2019 enjoy the following benefits regarding corporate income tax

("CIT"):

- waiver of CIT advance payments that should normally be made in the months of May, July and September of 2020; and

- postponement of the CIT special advance payment to the months of January, February and March of 2021 (this payment is normally due annually in the months of June, August and October).

- the CIT measures above are available only upon submission of an application to the Ministry of Economy and Finance; and

- exceptionally, and up to 31 December 2020, taxpayers will be able to offset their VAT credits against any other taxes due.

On 17 April 2020 the Maputo Municipality through a newspaper of wide circulation (Jornal Notícias) announced the extension of the payment deadline for municipal vehicles tax to 30 April 2020. Taxpayers are also exempt from late payment penalties in respect of the tax during the extended payment period. Municipal vehicles tax is payable on all vehicles registered with the municipality and is due annually in the period from 1 January to 31 March.

MOZAMBIQUE: 2020 National Reconstruction Tax Rates announced

The rates for the national reconstruction tax (imposto de reconstrução nacional, NRT), due by individuals aged between 18 and 60 resident in areas of the country that are not formally municipalities and earning taxable income as defined by the Individual Income Tax Code, have been revised and approved by Ministerial Diploma No.16/2020 of 1 April 2020.

NAMIBIA: COVID-19 pandemic social security measures announced

On 7 April 2020, the Social Security Commission ("SSC") announced an economic stimulus package amounting to NAD320-million to employers and employees in response to COVID-19. Measures that are expected to be implemented as soon as possible (effective dates are yet to be provided) include a contribution waiver of NAD142-million for a period of three months for all employers and employees registered with the SSC.

NIGER: COVID-19 pandemic emergency tax measures announced

To alleviate the economic impact of the COVID-19 pandemic, the president, on 27 March 2020, urged the government to implement the following tax measures for the next three months:

- exemption from import duties and VAT for all products which are part of the fight against COVID-19 pandemic;

- extension of the vehicle licence tax deadline payment from 31 March 2020 to 30 June 2020 and the suspension of tax audits for two months from 1 April 2020;

- exemption from VAT on inter-urban public transportation for the entire period of suspension of activities and extension of the synthetic tax payment deadline from 31 March 2020 to 1 May 2020;

- grating the following tax reliefs to hotels:

- application of a VAT-reduced rate of 10%;

- increase in the amortisation rate from 2% to 5%; and

- exemption from minimum lump-sum tax for the 2019 financial year;

- suspension of tax recovery procedures for travel agencies until 20 June 2020; and

- suspension of tax recovery procedures for taxpayers carrying on activities in areas of bars, sports and leisure for two months from 1 April 2020.

NIGERIA: COVID-19 pandemic waiver of penalties and interest by FIRS

The Federal Inland Revenue Service ("FIRS"), in a public notice dated 6 April 2020, has announced a number of measures to cushion the effect of COVID-19 on taxpayers, including:

- the waiver of late returns penalty for taxpayers who pay early and file the corresponding returns at a later date. Taxpayers can send supporting documents to the FIRS' dedicated email addresses or submit at a later date to the tax offices;

- taxpayers facing challenges in sourcing forex to offset their liabilities may opt to pay in Naira at the prevailing investors and exporters forex window rate on the day of payment; and

- field tax audit, investigations and monitoring visits have been suspended until further notice.

The FIRS, in a public notice dated 30 April 2020, has also announced a waiver of interest and penalties on tax liabilities resulting from desk reviews, tax audits and investigations, provided that such tax liabilities will be settled on or before 31 May 2020.

NIGERIA: FIRS issues information circulars on tax laws amended by Finance Act 2019

The FIRS has issued seven information circulars (numbers 2020/02 to 08) providing guidance on the interpretation of the amendments to tax laws by the Finance Act 2019, and practical issues associated with their implementation.

REUNION: COVID-19 pandemic: emergency tax measures implemented

The French Government has implemented several COVID-19 emergency tax measures that also apply in French overseas departments, such as Reunion, including:

- a three-month extension of the monthly remittance of social security contributions for March and April 2020 without any tax penalties being imposed;

- a three-month extension as from 15 March 2020 for the remittance of the 2019 corporate income tax payable without any tax penalties being imposed;

- an extension of utility and lease payments until the activity restarts;

- the availability of a specific form to request extension of taxes payable;

- an extension of payment of taxes under certain conditions further to the administrative guidelines published on 6 April 2020. Large companies (with more than 5 000 employees and consolidated turnover of more than EUR1.5-billion) may not proceed to distribute dividend or repurchase shares in 2020;

- an extension of deadlines applicable to both the tax authorities and the taxpayer, in particular with regard to tax proceedings, tax audits and rulings/prior approvals, relating to direct investments in French overseas departments (article 217 of the CGI) further to Ordinance no. 2020-306 of 25 March 2020 and the related guidelines; and

- the extension of deadlines is, in principle, not applicable to tax returns, with the exception of the 2019 corporate income tax return which can be submitted on 31 May 2020 instead of 20 May 2020.

RWANDA: further COVID-19 pandemic emergency tax measures announced

On 9 May 2020, the Ministry of Finance and Economic Planning announced new tax measures to cushion businesses against the effects of the COVID-19 pandemic, including:

- allowing the computation of quarterly corporate and personal income tax prepayments based on business transactions of the current tax period instead of the previous tax period as per the provisions of article 34 of the Income Tax Act. Implementation modalities for this measure will be issued by the Rwanda Revenue Authority;

- an exemption from employment income tax for a specified period of time for all teachers in private schools and employees of companies operating in the tourism and hotel industry earning a monthly net income not exceeding FRW150 000. The exemption for teachers will apply for a period of six months from April to September 2020 and for hotel and tourism employees for a period of three months from April to June 2020; and

- an exemption from VAT for all masks made in Rwanda to contain the spread of the COVID-19 pandemic.

São Tomé and Príncipe: COVID-19 pandemic emergency tax measures announced

In terms of Law No. 4/2020 (Extraordinary Budgetary Measures to Deal with the COVID-19 Pandemic) of 21 April 2020, with effect from 17 March 2020:

- the following benefits are granted for a period of three months

to businesses showing a decrease in revenues of 50% or more in the

last two months on account of the COVID-19 pandemic:

- exemption from interest on the late payment of tax debts accumulated during the period of the state of emergency or which have been accumulated with reference to the previous period, and which are assessed during the state of emergency;

- the suspension of tax executions; and

- contributions to the Resilience Fund are being made by way of a solidarity tax.

SENEGAL: COVID-19 pandemic emergency tax measures announced

On 3 April 2020, the president announced the following tax measures:

- VAT credits are to be refunded within limited deadlines to be announced by the government;

- rebates and suspension of payroll tax and social security contributions are to be granted to taxpayers that agree to keep their employees active for the duration of the crisis or pay more than 70% of wages to furloughed employees;

- small and medium-sized taxpayers (with turnover up to CFA100-million), and taxpayers operating in sectors most affected by the COVID-19 pandemic, in particular tourism, catering, hotels, transportation, education, culture and media, are to be granted tax payment deferral until 15 July 2020;

- the suspended VAT payment deadline for investors will be extended from 12 to 24 months;

- partial reduction of taxpayers' tax debts recognized as at 31 December 2019 will be granted for a total amount of CA200-billion;

- tax and customs duties debt collection from businesses most affected by the COVID-19 pandemic will be suspended, provided that they maintain their employees' salaries or continue payment at more than 70% of the salary of furloughed employees; and

- all donations to the COVID-19 Response Fund (FORCE COVID-19) will be tax deductible.

TOGO: COVID-19 pandemic emergency tax measures announced

On 22 April 2020, the government announced a number of tax measures to be implemented by the tax administration (Office Togolais des Recettes), including:

- a 10% reduction on taxation rates granted to businesses operating in the hotel and restaurant sectors;

- suspension of tax audits in progress, with the exception of non-citizen corporates;

- suspension of late penalties for taxes due during this second quarter;

- review of penalties for companies which have undergone tax audits; and

- support on a case-by-case basis for companies that are unable to file their financial statements before the deadlines set at 31 March 2020 for individuals' businesses and 30 April 2020 for companies.

ZAMBIA: COVID-19 pandemic emergency tax measures announced

The Minister of Finance has announced the following additional measures to mitigate the impact of COVID-19 on businesses on 20 April 2020:

- waiver of tax penalties and interest on outstanding tax liabilities resulting from the impact of Covid-19. Guidelines on qualifying criteria, the period of relief and other related modalities will shortly be published by the Zambia Revenue Authority ("ZRA"); and

- extending the list of medical supplies not subject to import duty and VAT for an initial period of six months. The comprehensive list of affected items is to be published by the ZRA.

ZIMBABWE: COVID-19 pandemic VAT and customs duty measures announced

The Minister of Finance has granted a rebate of customs duty and VAT on the importation of various materials and equipment related to the fight against Covid-19. Goods for the testing, protection, sterilization and other medical consumables as gazetted in the Statutory Instrument Number 88 of 2020 qualify for duty rebate with effect from 30 March 2020.

Sources include IBFD's Tax Research Platform; www.allafrica.com; http://tax-news.com

Originally published 19 May 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.