African Tax Administration Forum: Guidelines for Coronavirus (COVID-19) pandemic emergency tax measures published

On 8 April 2020, the African Tax Administration Forum published a guide on suggested COVID-19 emergency measures for revenue authorities. The purposes of such measures is to limit the impact of the pandemic on domestic resource mobilisation in African jurisdictions and includes measures pertaining to:

- extension of deadlines;

- suspension of penalties and interest;

- suspension of compliance and enforcement activities;

- expedited tax refunds;

- temporary reduction of tax rates;

- tax rebates;

- VAT exemption or zero-rating for essential goods; and

- the suspension of advance payments.

The proposed measures are a combination of short-term actions that can be immediately implemented and medium- to long-term interventions which may require legislative or policy changes for their effective implementation.

DEMOCRATIC REPUBLIC OF CONGO: COVID-19 pandemic emergency tax measures allow the submission of returns by email

The Congolese Tax Authority (Direction Générale des împots) issued instructions in two official statements n.01/0015/DGI/DG/IS/BSE/MM/2020 and n.01/0015b/DGI/DG/IS/BSE/MM/2020 of 3 April 2020 to allow the submission of tax returns which are due by 15 April 2020 by email in order to comply with the medical protocols for the COVID-19 pandemic. Physical submission of tax returns remains possible under strict conditions.

ETHIOPIA: COVID-19 pandemic economic response plans announced

The Ethiopian Government on, 27 March 2020, announced an economic response plan aimed at stabilising the economy and minimising the negative economic and social impacts of COVID-19. Measures include:

- an exemption from import duties and other taxes for materials and equipment to be used in the prevention and containment of COVID-19;

- an undertaking to speed up value-added tax ("VAT") refunds in order facilitate taxpayers' cash flow; and

- priority access to foreign currency to be granted by banks to importers that import goods for the prevention of COVID-19.

KENYA: COVID-19 pandemic economic response directives issued

On 25 March 2020, the president issued directives aimed at addressing various economic responses to the COVID-19 pandemic. Significant tax measures include:

- a reduction in the VAT rate from 16% to 14% with effect from 1 April 2020;

- 100% tax relief for persons earning gross monthly income of up to KES24 000;

- reducing the top income tax rate for resident individuals (pay-as-you-earn ("PAYE")) from 30% to 25%;

- reducing the residents' standard corporation income tax rate from 30% to 25%;

- reducing the turnover tax rate from 3% to 1%; and

- expediting the payment of all verified VAT refund claims amounting to KES10-billion within three weeks or allowing for offsetting of withholding VAT.

KENYA: Business Laws (Amendment) Act, 2020 gazetted

The Business Laws (Amendment) Act, No.1 of 2020 was published in the Kenya Gazette Supplement No. 26 of 20 March 2020, with a commencement date of 18 March 2020. Significant tax amendments include:

- tax incentives applying to the

construction of bulk storage and handling facilities with a minimum

capital investment of KES10-billion and a minimum storage capacity

of 100 000 metric tonnes of supplies for supporting the Standard

Gauge Railway operations, including:

- investment deductions equal to 150% of the capital expenditure incurred for the construction;

- VAT exemption of taxable supplies and taxable services procured locally or imported for the construction as approved by the cabinet secretary responsible for transport;

- an exemption from both import declaration fees and railway development levy in respect of goods imported for the construction as approved by the cabinet secretary responsible for transport; and

- the introduction of excise duty at a rate of 25% on imported glass bottles.

LESOTHO: 2021 Budget presented to parliament

On 26 February 2020, the Minister of Finance presented the 2021 Budget to parliament. Significant proposed tax amendments include:

- an increase of LSL15 on the oil levy; and

- a 3% and 1% adjustment on VAT on telecommunications and electricity respectively.

MALI: Amendments introduced by fiscal appendix 2020

The fiscal appendix of Law 2019-70 of 24 December 2019 relating to Budget 2020 introduced the following amendments effective from 1 January 2020:

- subjecting non-governmental organisations to corporate income tax when they perform commercial transactions, execute public contracts or carry out real estate work for remuneration;

- reducing the deadline for taxpayers subject to spot tax audits to introduce claims from 20 days to 10 days;

- allowing the reopening of an establishment closed due to the non-payment of taxes only if the taxpayer pays the total taxes due either in a lump sum or instalments.

MOZAMBIQUE: COVID-19 pandemic response measures gazetted

Measures introduced to alleviate the impact of the COVID-19 pandemic include:

- the introduction of an exceptional regime of licensing for the import of essential supplies (food, medicine, biosafety material, diagnosis tests, etc.) in order to speed up the importation process, including the deferral of payment of taxes and customs duties under the terms to be defined by the Ministry of Economy and Finance, the ministers overseeing the areas of transport, industry and trade and the Bank of Mozambique;

- suspending the issuance of official documents, such as commercial registration certificates, licences of any type and tax identification numbers. Licences, authorisations and other administrative acts will be valid for the duration of the state of emergency, regardless of their expiry date; and

- suspending all procedural and administrative deadlines. All tax processes currently under court analysis and any other tax deadlines pertaining to tax litigation and administrative procedures will be suspended during the period of the state of emergency, ie, from 1 to 30 April 2020.

MOZAMBIQUE: Procedures for payment of tax announced

The Mozambique Tax Authorities published notices in the newspaper (Jornal Notícias) on 1 and 2 April 2020 announcing that:

- with effect from 2 April 2020, payment of taxes to any relevant tax agency that has its bank account with the Bank of Mozambique may be made through bank transfer and the taxpayer may present to the respective tax agency the proof of transfer with indication of its name, tax identification number and type of tax or other charges being paid. The relevant bank account details can be obtained at the respective tax agency; and

- taxpayers can still opt for payment through debit on account, postal order or using any other services available through financial and credit institutions that are expressly authorised by law.

NAMIBIA: COVID-19 pandemic economic stimulus and tax administrative measures announced

On 1 April 2020, the Minister of Finance announced the first phase of the economic stimulus and relief package to address the negative social and economic consequences arising from the country's 21-days' partial lockdown. Announced tax measures include:

- the acceleration of the payment of all overdue and undisputed VAT refunds in order to assist businesses' cash flow; and

- a tax-back loan scheme available to businesses in the non-mining sectors, as well as tax-registered and taxpaying employees in terms of which they can borrow up to one twelfth of their tax payment in the previous tax year at a lower interest rate (prime lending rate less 1%) and repayable after one year. The loan will be guaranteed by the government and applications will be made through the commercial banks.

On the same day the Commissioner of Inland Revenue extended the filing deadline for employment income (PAYE) reconciliations from 31 March 2020 to 30 May 2020. All other tax returns remain due as per the statutory deadlines.

NIGER: Tax amendments introduced by Finance Law 2020

Law 2019-36 of 5 July 2019 relating to the rectification of Budget 2019 and Law 2019-76 of 31 December 2019 relating to Budget 2020 (Finance Law 2020) introduced, inter alia, the following amendments to the General Tax Code:

Corporate taxation

- interest on doubtful or litigious loans will not be deductible with effect from 1 January 2020;

- amendments to incentive benefits under the NGOs Law, public-private contracts, investment, and the Mining and Petroleum Code;

Real estate tax

- granting a 50% tax allowance to public establishments that fulfil the requirements of the specific taxation;

Transfer tax

- a donation made as a payment is now registered at the rate of 3% of the transfer value, and the fixed rate of 1 000 F.CFA collected in addition to transfer taxes was abolished;

Business licence duty

- reducing the rental value applicable rate to public establishments, eligible under the real estate special tax from 3% to 1.5%; and

Administration

- introducing a mandatory invoice system for companies subject to VAT.

NIGERIA: COVID-19 pandemic Emergency Economic Stimulus Bill, 2020 passed second reading

On 24 March 2020, the Emergency Economic Stimulus Bill, 2020 passed the second reading in the House of Representatives and will be referred to the relevant House Committee for further deliberations.

Tax measures include:

- the granting of a 50% income tax rebate on the total actual amount due or paid as PAYE under the Personal Income Tax Act, 2004 to Nigerian companies that retain all their employees from 1 March 2020 to 31 December 2020; and

- the suspension of import duties on medical equipment, medicines and personal protective gears required for the treatment and management of COVID-19 for three months with effect from 1 March 2020.

NIGERIA: COVID-19 pandemic emergency tax measures introduced

On 23 March 2020, the Federal Inland Revenue Service ("FIRS") announced a number of measures to mitigate the impact of the ongoing COVID-19 pandemic, including:

- extension of the deadline for filing of VAT and withholding tax returns from the 21st day to the last working day of the month, following the month of deduction;

- extension of the due date for filing of corporate income tax returns by one month;

- use of an electronic platform ( firs.gov.ng) for filing of tax returns or an alternative use of designated email addresses;

- use of electronic platforms for tax remittance and processing of tax clearance certificates;

- filing of tax returns by taxpayers without audited financial statements. However, the taxpayer must submit the audited financial statements to the FIRS not later than two months after the extended due date of filing; and

- the proposed creation of a portal where documents required for desk reviews and tax audits will be uploaded by taxpayers for online access by the tax authority.

NIGERIA: Public notice on automated VAT filing and collection system issued

On 10 March 2020, the FIRS issued a public notice confirming the roll-out of its automated VAT collection system for branded shops, superstores, general supermarkets, standard restaurants and eateries with effect from 1 April 2020. All taxpayers covered by this initiative are required to contact the nearest FIRS office to connect to the FIRS eVAT platform.

RWANDA: COVID-19 pandemic emergency tax measures announced

On 20 and 25 March 2020 the Rwanda Revenue Authority announced emergency tax measures aimed at curbing the impact of the COVID-19 pandemic, including:

- suspending all comprehensive tax audits and post clearance audits by the Rwanda Revenue Authority ("RRA") for a period of one month;

- allowing taxpayers required to file certified financial statements to declare and pay income tax for the 2019 year based on uncertified financial statements. The deadline for filing certified financial statements has been extended to 31 May 2020;

- suspending the 25% downpayment required for taxpayers seeking amicable settlement of their tax disputes with the RRA; and

- extending the deadline for filing and paying income tax for 2019 tax from 31 March 2020 to 15 April 2020 for large taxpayers and to 30 April 2020 for small and medium-sized taxpayers.

SEYCHELLES: COVID-19 pandemic economic response plan and tax measures announced

On 20 March 2020, the president announced economic and tax measures to support the economy amid the COVID-19 pandemic, including:

- postponing the due date for all tax payments due in March to September 2020;

- postponing corporate social responsibility tax, tourism marketing tax, and business tax payments for April, May and June to September 2020. However, payments for all other taxes whose deadlines are in April, May and June will remain unchanged; and

- contributions that employers are required to make towards the Seychelles Pension Fund (ie, the 3% on the salary of their employees) for April, May and June, will now be due in September 2020.

SIERRA LEONE: Finance Act 2020 enacted

On 13 November 2019, parliament passed the Finance Bill, 2020 into law as the Finance Act, 2020, which entered into force on 1 January 2020. Significant amendments include:

Income Tax Act

- the introduction of the following

definitions in the Income Tax Act, 2000:

- large taxpayer: a taxpayer with an annual turnover exceeding SLL600-million or other additional requirements as may be prescribed by the Commissioner-General;

- medium taxpayer: a taxpayer with a turnover of an amount above SLL350-million but not exceeding SLL600-million;

- small taxpayer: a taxpayer with a turnover above SLL10-million but not exceeding SLL350-million; and

- micro taxpayer: a taxpayer with a turnover not exceeding SLL10-million;

- a requirement for persons that dispose of chargeable assets to withhold the capital gains tax due and pay it to National Revenue Authority ("NRA"). Where the person disposing of the chargeable assets is a non-resident, the buyer is required to withhold the tax due;

- mandating the Minister of Finance to make transfer pricing regulations to be administered by the Commissioner-General of the NRA;

- determining that payments due on income tax will be made in the following order: interest; penalty; and finally the principal amount of tax;

- introducing a 10% withholding tax on technical fees paid to a professional service provider whether resident or not where the source of income is in Sierra Leone. A professional service provider is defined as accountants, economists, lawyers, doctors engineers, management and tax consultants and other consultants in similar fields of practice that provide expertise and other technical services for the payment of a fee;

- allowing a member of a group of companies to apply to the Commissioner-General to offset an income tax payment under the Income Tax Act against a similar income tax liability of a member of the same group, provided both companies are resident in Sierra Leone and one has at least 25% ownership of interest in the other;

- increasing the non-taxable threshold for rental income from SLL3.6-million to SLL7.2-million while the tax deductible allowance has been reduced to 10% from 20%;

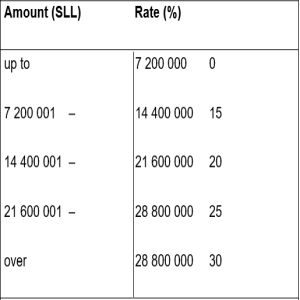

- increasing the rates of tax and tax bands applicable to individuals resident in Sierra Leone as follows:

Extractive Industries Revenue Act, 2018

- The rate of mineral resources rent

tax and the rate of petroleum resources rent tax for a year of

assessment are calculated by using the following formulas:

- mineral resource rent tax = 40%-income tax rate/100%-income tax rate;

- petroleum resources rent tax = 58%-income tax rate/100%-income tax rate;

Goods and Services Act, 2009

- defining exempt supplies under the second Schedule as follows: "financial services" mean operations of financial institutions licensed, regulated and supervised under the Bank of Sierra Leone Act, 2019 or any other similar enactment and include but are not limited to commercial banks, financial associations, micro-finance institutions, Apex Bank and cooperatives, capital markets, discount houses, home mortgage finance, leasing companies and foreign exchange bureaus;

- adding to the list of exempt items:

- the supply of services in the aviation industry within Sierra Leone, ie,. services within the international airport zone, including handling, profiling, airline catering, airline fuel, lounge, cargo, and screening;

- the supply of buses imported exclusively for commercial public transportation. This applies to a one time import of least 10 buses with sitting capacity of not less than 18 passengers imported for commercial use for transporting passengers; and

- taxing the supply of telecommunications services without consideration, which are defined as any free or promotional call or data use that exceeds 10% of the total billable and unbillable calls and data use. Tax shall be charged at the existing fair market price of SLL650 per minute, or the applicable rate from time to time, for both voice and data use.

UGANDA: Tax Amendment Bills, 2020 presented to parliament

On 30 March 2020, the Minister of Finance, Planning and Economic Development tabled the Tax Amendment Bills 2020 for discussion by parliament. Once the Bills are passed by parliament and assented to by the president, they will be effective from 1 July 2020. Significant proposed amendments include:

Direct tax

- introducing a minimum tax at a rate of 0.5% on the gross turnover of a taxpayer after the sixth year;

- exempting the income of the Deposit Protection Fund established under section 108 of the Financial Institutions Act, 2016;

- exempting the income of approved investors acting as an operator in an industrial park or free zone or the income of any person carrying on business outside the industrial park or free zone, and investment capital of that operator or that other person, that, over a period of at least 10 years from the date of commencement of business, is USD10-million for a foreigner or USD1-million for a citizen or, in the case of an operator or other person carrying on business outside the industrial park of free zone, from the date on which the operator makes an additional investment equivalent to USD10-million for a foreigner or USD1-million for a citizen who, subject to availability, uses at least 50% of locally sourced raw materials and employs at least 100 citizens, will be exempt from tax;

- allowing expenses of a person who purchases goods or services from a supplier who is designated to use the e-invoicing system only as deduction if the expenses are supported by e-invoices or e-receipts;

- requiring a resident person who purchases land from a resident person, other than land which is a business asset to withhold tax at a rate of 0.5% of the purchase price;

- requiring a person who makes a payment for a commission to an advertising agent to withhold tax on the gross amount of the payment at a rate of 10%;

- reinstating the withholding tax on agricultural supplies at 1% (repealed in 2019);

- requiring that tax clearance certificates are to be obtained from the commissioner by a taxpayer who provides passenger transport services or freight transport services before the renewal of operational licences;

- requiring a withholding agent who makes payments from which tax is required to be withheld under the different sections of the Income Tax Act to furnish a withholding tax return for every month in the form specified by the commissioner not later than 15 days after the end of every month to which the withholding tax relates;

- introducing a new tax regime for small taxpayers;

VAT

- allowing manufacturers a claim for input tax incurred not more than 12 months prior to the date of registration;

- requiring owners of more than one commercial building to account for VAT for each commercial building separately. It is not allowed to claim tax credits or inputs used in the construction of an incomplete building against the tax collected from a completed commercial building;

- allowing a taxable person a tax credit on the purchase of goods and services from a supplier that is designated to use the e-invoicing system only if the expenses are supported by e-invoices or e-receipts;

- allowing an amount carried forward as an offset for a maximum period of three months after which the taxable person must claim a VAT refund;

- including the Islamic Development Bank, under the First Schedule of the VAT Act, as an international public international organisation; and

- extending the list of exempt supplies.

On 3 April 2020, the Sectoral Committee on Finance, Planning and Economic Development requested all stakeholders and other interested parties, via a press release, to submit their written comments on the Tax Amendment Bills, 2020 to clerk@parliament.go.ug or ibakyenga@parliament.go.ug by close of business on 7 April 2020.

UGANDA: COVID-19 pandemic emergency tax measures announced

On 24 March 2020, the Uganda Revenue Authority ("URA") issued a public notice on new tax measures to deal with the effects of the COVID-19 outbreak, including:

- granting an extension to taxpayers with an accounting period ending on 30 September and who are required to file by 31 March 2020, to file returns by 31 May 2020;

- granting all taxpayers whose monthly returns (VAT, PAYE, excise duty and withholding tax) are due on 15 April 2020 but are unable to file by the due date have an extension to file by 30 April 2020; and

- granting an option to all taxpayers who have executed various Memoranda of Understanding ("MOU") with the URA and have payments due in March 2020 to defer and reschedule this instalment payment. The MOUs will accordingly be restructured and resumed in May 2020.

UGANDA: High Court decides that rent payments for leasehold land are tax deductible

On 9 March 2020, the High Court gave its decision in the case of Vivo Energy Uganda Limited versus Uganda Revenue Authority confirming that rent payments in respect of leases are deductible expenses.

The court held that rent is a recurring expenditure that is periodically paid to maintain occupancy of the leased facilities or premises. The lease agreements provided for payment in advance in instalments for periods ranging from one month, quarterly, half yearly up to the entire tenure of some of the leases unlike a premium which was incurred to acquire the lease.

The Income Tax Act defines rent as a consideration for use or occupancy, or right to use of an occupied land or building and this definition does not confer title on the lease beyond the time of use. Therefore, unless rent payments lead to acquisition of the property, they are not categorized as a capital expenditure to acquire the property. In the case at hand, the rent was a recurrent revenue expenditure and therefore a deductible expense within the provisions of section 22 of the Income Tax Act.

ZAMBIA: COVID-19 pandemic emergency tax measures announced

On 27 March 2020, the Minister of Finance announced the following tax measures to mitigate the impact of the COVID-19 pandemic:

- suspension of excise duty on imported ethanol for use in alcohol-based sanitizers and other medicine-related activities subject to guidelines to be issued by the Zambia Revenue Authority;

- removal of provisions relating to claims of VAT on imported spare parts, lubricants and stationery to ease pressure on companies;

- suspension of import duties on the importation of concentrates in the mining sector to ease pressure on the sector; and

- suspension of export duty on precious metals and crocodile skin.

Sources include IBFD's Tax Research Platform; www.allafrica.com; http://tax-news.com

Originally Published 21 April, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.