For many years, Ticino was among the only Cantons interpreting Federal tax legislation by not allowing professional expenses tax deductions to executives benefitting from a lump-sum expense allowance paid by their employer.

A Swiss Federal Supreme Court Decision of 24 July 2023 has now granted a taxpayer's appeal and reversed the established practice of the Ticino tax authorities.

This means that, effective immediately, executives benefitting from a lump-sum expense allowance may claim the professional expenses deductions (worth approximately CHF 1'000 in tax savings) for all open tax returns not yet entered into force.

It is not yet known whether the new practice will be considered spontaneously by the tax authority, but in any case it is advisable to take action and explicitly request the deduction in the tax return or, if already filed, in a formal request addressed to the tax authority.

INTRODUCTION

According to Swiss employment law, employees have a right to be reimbursed for expenses incurred in the interest of the employer. Instead of reimbursing all expenses individually, employers may enact an expense regulation, to be approved by the tax authority at the employer's seat, to reimburse small expenses (i.e., individual expenses of up to CHF 50.- each) with a monthly or yearly lump-sum payment.

Such lump-sum regulations approved by the competent authorities typically apply to executives and the related payments are treated as tax-free in the hands of the receiving employee.

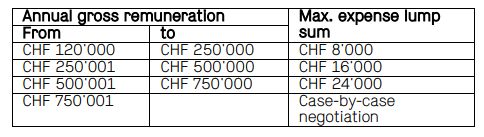

The admissible lump sums depend on the practice of each Cantonal tax authority. The current schedule applicable in Ticino is as follows:

THE PROFESSIONAL EXPENSES TAX DEDUCTION

All Swiss resident employees may avail themselves of a tax deduction for so-called "other professional expenses", i.e., expenses incurred in their own interest (and therefore not paid by the employer), but work-related, such as professional clothing, specialized magazines subscriptions, etc. Employment law does not provide for reimbursement of such expenses by the employer, so from a tax perspective they may be deducted because it is assumed that the expenses were related to the employment income generated.

This tax deduction is usually taken as a standard (lumpsum) deduction, but proof of higher expenses is allowed.

The amount deductible in Ticino is as follows:

- Federal income tax: 3% of the net remuneration (min. CHF 2'000 and max. CHF 4'000)

- Cantonal and communal income tax: CHF 2'500

The value of the combined deduction is approximately CHF 1'000 in taxes, depending on the municipality of residence.

THE PREVIOUS TAX PRACTICE IN TICINO IN RELATION TO PROFESSIONAL EXPENSES

For years the Ticino authorities have denied the standard deduction for "other professional expenses" to executives benefitting from a lump-sum expense payment. The motivation for this was the assumption – made by the Ticino tax authority – that the lump-sum payment did not only cover the professional expenses incurred in the interest of the employer, but also such expenses as covered by the deduction for "other professional expenses" (i.e., expenses to be borne by the employee).

In the past 15 years, the practice has been upheld by the Ticino tax court. Although several decisions were issued that discussed the topic, the Federal Supreme Court never had the opportunity to scrutinize the practice of the Ticino tax authorities in detail.

THE DECISION OF 24 JULY 2023

In its decision of 24 July 2023 (9C_643/2022), the Federal Supreme Court acceded to the request of a Ticino resident and found the practice of the Ticino tax authority to be in contrast with federal legislation.

According to the ruling of the Federal Supreme Court, insofar as the employer's expense regulation has been approved by the competent tax authority, the payments made in accordance with said regulation must be assumed to be in line with the expenses incurred in by the executives of the company. In other words, there is no reason to assume that the lump-sum payments would include any expenses that the employer must not bear according to employment legislation.

CONSEQUENCES AND CALL FOR ACTION

As a result of the ruling, it is fair to assume that Ticino resident executives benefitting from a lump-sum payment under a regulation approved by the competent tax authority (in Ticino or elsewhere) have the right to claim the standard deduction for "other professional expenses"

The ruling is immediately applicable and any taxpayer in the same position may request the tax authority to apply the mentioned tax deduction for all tax years that have not yet entered into force.

The procedures for claiming the deduction differ based on the submission status of the tax return/assessment:

- If the respective tax return has not yet been filed, the return may be amended and the deduction claimed;

- If the tax return has already been filed, but the tax assessment has not yet been issued by the tax authority, the deduction may be claimed with a simple letter to the tax authority:

- Should the tax assessment already have been issued, but not yet entered into force, the taxpayer needs to file an opposition to the assessment within the legal deadline.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.