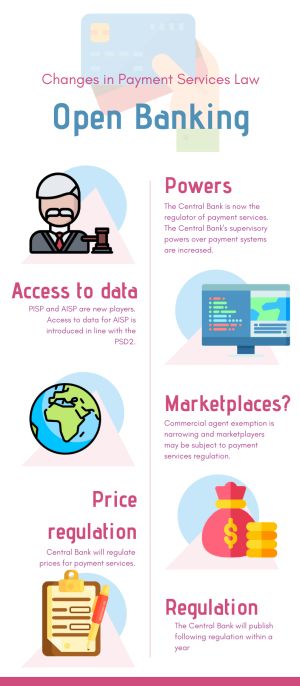

Turkey recently amended the Law on Payment and Securities Settlement Systems, Payment Services and Electronic Money Institutions (Payment Services Law), in a way to harmonize national legislation on payment services with EU's Payment Services Directive 2 (PSD2). The recent change introduced open banking services such as payment initiation service and account information service. Fintech players who want to provide payment services will be benefiting from rules that are lifting the barriers in front of account data. The amendments also concern marketplaces, due to narrowing commercial agent exemption. We summarized the notable changes below.

Regulator of payment services

The regulatory powers which were previously exercised by the Banking Regulation and Supervision Agency (BRSA) are now transferred to the Central Bank of the Republic of Turkey (Central Bank). The Central Bank will be regulating the payment service providers along with system operators.

Supervision over payment systems

The Central Bank's supervisory authority over payment systems is widened to include system users. Previously, the Central Bank's supervision power for payment systems was set to an extent to only cover system operators. For the payment and securities settlement systems to operate without failure, the Central Bank is now able to be a shareholder in system operators which it deems systemically important. Currently, payment systems authorized by the Cental Bank are the following:

- Interbank Card Center (BKM) - Domestic Clearing and Settlement System

- Istanbul Clearing, Settlement and Custody Bank Inc. (TAKASBANK)

-

- Equity Market Clearing System

- Debt Securities Market Clearing System

- Takasbank Cheque Clearing System

- Central Registry Agency (MKK) - Central Registry System

- Garanti Payment Systems Inc. (GÖSAŞ) - Takasnet System

- Paycore Payment Services Clearing and Settlement Systems Inc. (Paycore) - Paycore Clearing System

New services relating to open banking

Payment initiation services and account information services are now acknowledged as payment services within the framework of the Payment Services Law and are regulated for more open and secure payment market. With these amendments, payment initiation service providers (PISP) and account information service providers (AISP) are becoming key players in the market. For AISP to exercise its functions, the Payment Services Law requiring other payment service providers to open access to account information of their customers, mainly forcing incumbent banks to open access to their data. This resembles the access to essential facility doctrine, however, the aim and the functioning of access to account information differs in many ways from access to essential facility. The access to account information is subject to the account owner's prior approval.

Marketplaces' exposure to narrowing commercial agent exemption

Under the Payment Services Law, there is an exemption called commercial agent exemption, which the marketplaces are benefiting from. According to the commercial agent exemption, payments between a payer and payee made through a commercial agent with permission to negotiate or to conclude the sale or purchase of goods and services on behalf of the payer or payee are not considered as payment services, therefore, such commercial agent is exempt from regulation. Marketplaces are relying on this commercial agent exemption, however, their elbowroom is narrowing. The recent amendment enables the Central Bank to determine payment transactions reaching certain thresholds as payment services within the meaning of the Payment Services Law, even if they are benefiting from commercial agent exemption. Therefore, marketplaces may be subject to Payment Services Law in the coming future, given the size of their pay-ups are reaching the Central Bank's limits.

Price regulation

The price regulation for payment service providers is yet to come. With the recent change, the Central Bank is authorized to regulate maximum rates and prices for payment services.

Regulation and entry into force:

The related regulation in line with the amendments will be published by the Central Bank in a year. PISP and AISP are required to file for authorization before the Central Bank within a year following the publication of related regulation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.