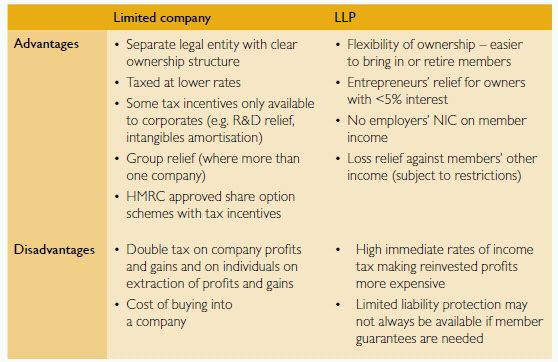

A summary of the main advantages and disadvantages of both structures.

Each structure has advantages, the choice is ultimately driven by your objectives such as profitability, tax and future strategy.

In our survey, nearly half of respondents said that they were considering changing their business structure. We therefore thought it would be helpful to set out a few advantages and disadvantages about two widely used structures for financial services businesses: a company and a limited liability partnership (LLP). The choice between the two structures depends on numerous factors such as commercial convenience, tax and future succession/exit.

Below is a summary of the main advantages and disadvantages of both structures:

As companies have distinct shareholders and employees, each may have different interests. These can be aligned by giving employees a share either as options or by using different categories of shares, with each category having varying rights. The share classes might, for example, prevent the owners giving up more of their value than they might wish, while still keeping management incentivised.

However, issuing shares in companies is complicated compared to using an LLP. For example, the Articles of Association may need to be amended as well as possible tax/NIC costs. A shareholders' agreement may be also be required. With an LLP, there are fewer formalities to bringing in new members. In order to maintain a similar distinction, LLPs have the option to issue income and full capital shares; with new members enjoying just a share of the profits. Company share options can, in some cases, be replicated in an LLP. With both entities, incentive arrangements need to be structured correctly in order to avoid future problems.

From a taxation perspective, there are several considerations; a key one is whether you need to draw all income earned. If you are interested in rolling up retained profits, thus building value, then a company may be the best choice as, from 1 April 2012, you are taxed on profits at an average rate of between 20% and 25%. If you want to draw all or most of the income from the business then an LLP may be better as there is likely to be less taxation overall, even with an effective rate of tax/NIC of 52%. The key point is that LLP profits allocated to individuals are taxed at high personal tax rates, even if the profits are not drawn down. One solution might be to have an LLP with a corporate member. The rationale is that you can take what income is needed from the LLP and roll up the remaining profits in the corporate entity.

From an individual perspective, directors and employees of a company must pay PAYE and national insurance each month on their salaries. For those individuals who are also shareholders, it is often possible to reduce tax costs by extracting profits as dividends, though these are non-deductible to the company. A member of an LLP does not suffer PAYE but income tax will be due in January and July each year. The LLP should have lower NIC costs overall compared to a company.

Each structure has advantages, some of which are covered in this article. The choice is ultimately driven by your objectives such as profitability, tax and future strategy but we can assist you in making the right choice for your situation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.