The D&O team offer a state of the market for the retail sector with focus on rates, claims, risks and an outlook for the remainder of 2023.

Market Overview

The Directors and Officers (D&O) insurance market, both in Great Britain and globally, has experienced significant volatility over the past 3-4 years. From a capacity collapse in 2019-2020 to subsequent extreme price hikes, the past 12 months have brought about a remarkable turnaround. Rising rates attracted new entrants and rekindled the interest of cautious insurers, fostering increased competition and leading to noteworthy price reductions.

Fluctuations in Retail Sector Rates

Comparatively, the Retail sector's D&O rates have displayed even more turbulence than the broader market, with Q1 witnessing a sharp decline. Notably, as of March 2023, median rates in the Retail sector remain notably higher than those in April 2020.

Changing Rate Landscape

The following charts depict the evolution of D&O liability insurance rates for the Retail sector from April 2020 to March 2023:

Primary ROL

Source: Data from WTW FINEX FINMAR placements for clients in the Retail sector, sourced as 13 July 2023

Tower ROL

Source: Data from WTW FINEX FINMAR placements for clients in the Retail sector, sourced as 13 July 2023

While the average whole tower rate exhibited substantial fluctuations over the past 3 years, particularly with declines in Q1 2023, the scenario for excess layers is notably favourable. Retail sector clients consistently observed a trend of decreases in excess layer rates over the past year. This difference can be attributed to intense competition among insurers for excess layers, while primary layers face fewer willing insurers.

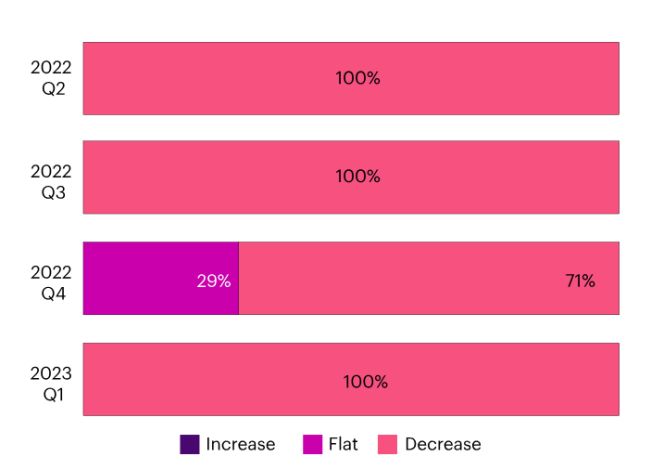

Change to primary ROL seen at renewal

Source: Data from WTW FINEX FINMAR client placements, sourced as 13 July 2023.

Change to excess layer ROL seen at renewal

Source: Data from WTW FINEX FINMAR client placements, sourced as 13 July 2023.

Trends in Claims Notifications

Notifications in D&O claims between 2020 and 2022 show declining trends since their peak in 2019. This trend holds across the market as a whole:

Commercial D&O - Number of notifications

Source: WTW client notifications from GB placements only, between 1 January 2007 to 31 December 2022

The Retail sector, however, presents a slightly different picture. Few notifications occurred between 2010 and 2014, followed by heightened levels in 2020 and 2021. After a substantial drop in 2020-2021, Retail sector notifications climbed again in 2022. Worth noting is the considerable increase in notifications across all sectors in H1 2023.

Retail industry D&O - Number of notifications

Source: WTW client notifications from GB placements only, between 1 January 2007 to 31 December 2022

Analysis of Claims

Between 2007 and March 2023, improper business practice losses emerged as the most frequently notified type of loss among our D&O Retail clients. These losses involve regulatory breaches, contractual violations, civil liability matters, and instances of website/disability discrimination. Notably, internal fraud stood out as a major loss type, comprising only 9% of notifications but accounting for a striking 65% of costs. Instances of internal fraud encompassed wrongful accounting, trading while insolvent, insider trading, and other fraudulent activities.

Retailer / wholesaler D&O - types of loss

Source: Retailers D&O Claims Report 2023

D&O Risks in the Retail Sector

Our Global Directors' and Officers' Liability Survey revealed that Regulatory risk ranked as the fifth most significant out of twenty-eight risks, among respondents from the Retail sector. This aligns with the types of D&O claims experienced by Retail sector clients. Noteworthy deviations from other sectors include the Retail sector's emphasis on becoming a focal point of social media campaigns and exposure to insolvency-related risks.

Directors and Officers Survey 2023 Risk Ranking - Retail vs All Sectors

Source: 2022/2023 Directors & Officers Liability Insurance Survey

Outlook for 2023

Retail sector rates have bucked the general trendline, but a downward trajectory has been observed since late 2022, and likely to continue in 2023. Increased competition is expected in the GB D&O market, with new players like Westfield Specialty and Kayzen Specialty joining the crowded D&O landscape. However, it's worth noting that factors like geopolitical turmoil, high inflation, and recent banking collapses could reshape D&O market dynamics in 2024.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.