This Briefing sets out the headline changes that UK incorporated main market and AIM listed companies should be aware of from the past year and a timeline of key upcoming developments. This Briefing also covers, at a high level, some topics which are not specific to listed companies.

Of particular note are (i) the current status of the Audit and Corporate Governance reforms and the Government's recent announcement regarding the withdrawal of the proposed Draft Companies (Strategic Report and Directors' Report) (Amendment) Regulations 2023; and (ii) the Economic Crime and Corporate Transparency Act 2023 having received Royal Asset, which will make fundamental changes to the role and powers of Companies House and introduce a new corporate criminal offence in respect of a failure to prevent fraud.

1 In the Pipeline

FOR FURTHER INFORMATION ON THE ITEMS SET OUT IN THE TIMELINE BELOW, PLEASE CLICK ON THE EMBEDDED LINKS WHICH WILL DIRECT YOU TO THE RELEVANT SECTION OF THIS BRIEFING.

-

Autumn 2023:

Expected further FCA consultation on the UK Listing Regime reforms. -

November 2023:

We expect that:- Glass Lewis will publish its revised shareholder voting

guidelines; and

- the Investment Association ("IA") will publish its annual letter to Remuneration Committee chairs and associated guidance.

- Glass Lewis will publish its revised shareholder voting

guidelines; and

-

17 November 2023:

Government consultation on the interpretation of VAT and excise legislation closes. -

22 November 2023:

Autumn Statement -

Winter 2023:

The Government is expected to launch a consultation on Transition Plan Taskforce ("TPT") disclosure requirements for large public and private companies. -

14 December 2023:

Government Call for Evidence on Scope 3 greenhouse gas emissions and the current Streamlined Energy and Carbon Reporting framework closes -

26 December 2023:

Majority of the provisions of the UK's Online Safety Act will come into effect. -

December 2023:

- We expect that ISS will publish its revised shareholder voting

guidelines.

- We expect the outcome of the UK Listing Regime reforms consultation to be

published.

- On 31 December 2023, UK multinational top-up tax rules come into

force

- FTSE 350 to have confirmed a percentage target for senior management positions that will be occupied by ethnic minority executives by December 2027.

- We expect that ISS will publish its revised shareholder voting

guidelines.

-

01 January 2024:

Certain types of retained EU law are sunsetted as a result of the Retained EU Law (Revocation and Reform) Act 2023. -

Q1 2024

- Revised UK Corporate Governance Code expected to be

published.

- Certain elements of the Economic Crime and Corporate Transparency Act 2023 to come into force.

- Revised UK Corporate Governance Code expected to be

published.

-

February 2024

We expect that the IA will publish its shareholder priorities for 2024. -

March 2024:

- We expect that the PLSA will publish its stewardship and voting

guidelines for 2024.

- 3-month synthetic sterling LIBOR setting will cease.

- We expect that the PLSA will publish its stewardship and voting

guidelines for 2024.

-

05 June 2024

Deadline for Phase 3 Energy Saving Opportunities Scheme ("ESOS") reporting. -

2024

We expect:- FCA consultation on the implementation of ISSB standards and the TPT Framework; and

- Government consultation on Non-Financial Information Reporting following the May 2023 Call for Evidence.

- FCA consultation on the implementation of ISSB standards and the TPT Framework; and

-

31 October 2026

Deadline by which all pension schemes and providers must have connected to the pensions dashboard. -

December 2027:

FTSE 350 companies to have achieved target for senior management positions occupied by ethnic minority executives.

2 Annual General Meetings

Pre-emption Group Statement of Principles

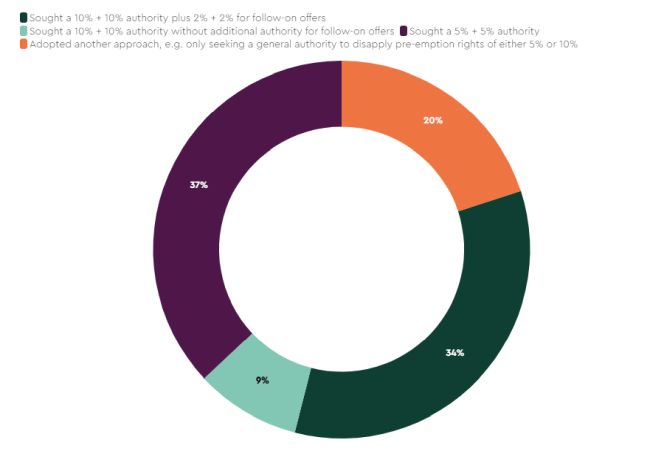

- A number of companies have opted to follow the Pre-Emption Group's revised Statement of Principles published in November 2022. This allows companies to seek disapplications of up to 10% for their general authority and an additional 10% for acquisitions and specified capital investments, with a further authority of up to 2% of their issued ordinary share capital, in each case, to be used for a "follow-on" offer. Further details are set out in our briefing.

- The approach taken by FTSE 350 companies who have published

their AGM notices since mid-December 2022 is set out below:

- While the votes in favour of disapplication resolutions have been slightly lower than in previous years, institutional investors have generally been supportive of the new thresholds. When deciding what approach to take companies should, of course, be mindful of their own shareholder base and, in particular, the percentages held by overseas shareholders who may not follow UK guidance.

PLSA Stewardship and Voting Guidelines

- Since the publication of our briefing on AGMs and Reporting in March 2023, the Pensions and Lifetime Savings Association (the "PLSA") has published its Stewardship and Voting Guidelines for 2023. Some of the key changes for this year, aligning with themes we have seen from institutional investor guidance published earlier in the year, include the following:

- As a result of the cost-of-living crisis, companies should show restraint in their executive pay decisions.

- An expectation that there should be governance and oversight structures in respect of cybersecurity risks.

- When assessing the suitability of a new Chair, shareholders should consider board diversity as well as balance.

- Updates to reflect the latest diversity requirements in the Listing Rules.

- A new section on workforce, including wellbeing, physical health, human rights and modern slavery and diversity and inclusion.

Climate Change Resolutions

- The 2023 AGM season did not see an increase in climate change

resolutions (either board proposed or shareholder requisitioned),

and among FTSE 350 companies there was in fact a decrease in such

resolutions compared to the previous year. One explanation for this

decrease is companies having passed resolutions that only require

them to seek a shareholder advisory vote on climate change every

three years (i.e. so it was not required in 2023), but it was

notable that there were not further new companies proposing, or

being required to propose, these resolutions.

- Climate change is still an important area of interest and no doubt both companies and shareholders will be considering climate change ahead of the 2024 AGM season, particularly those issuers in the finance and energy sectors.

3 Corporate Reporting

International Sustainability Standards Board ("ISSB") Standards

- In its Primary Market Bulletin 45 published in August 2023, the Financial Conduct Authority ("FCA") set out steps that listed companies can take to prepare for the introduction of updated Listing Rules on the disclosure of sustainability-related financial information and climate-related disclosures, which it aims to introduce for accounting periods beginning on or after 1 January 2025. The rules will refer to the UK-endorsed version of ISSB standards IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and S2 Climate-related Disclosures.

Although the ISSB standards will not immediately replace the TCFD disclosure framework, the FCA recommends the following action to prepare for the future introduction of the standards:

- Continue to improve reporting in line with existing climate-related disclosure rules. As the ISSB standards build from existing rules, the FCA encourages listed companies to continue to improve their climate reporting by considering the TCFD recommendations and accompanying guidance.

- Engage early with IFRS S1 and S2, the associated guidance, and the Transition Plan Taskforce Disclosure Framework and Guidance and consider reporting on a voluntary basis.

- Engage with the UK endorsement and implementation process for the ISSB standards, including by responding to the FCA's consultation on implementation, which is expected to take place in the first half of 2024.

- While the requirements in IFRS S2 are broadly consistent with

the TCFD core recommendations and recommended disclosures, there

are some differences, which the IFRS Foundation has summarised in

this comparison. Companies that apply the ISSB

Standards will meet the TCFD recommendations and so do not need to

apply the TCFD recommendations in addition to the ISSB

Standards.

- The Government has recently launched a Call for Evidence seeking views on the costs,

benefits and practicalities of Scope 3 greenhouse gas emissions and

the current Streamlined Energy and Carbon Reporting framework. The

responses will help inform the Government's decision on whether

to adopt the IFRS S1 and IFRS S2 to create UK Sustainability

Disclosure Standards. The Call for Evidence closes on 14 December

2023.

- In October 2023, the TCFD published its 2023 Status Report and the Financial Stability Board published its 2023 Annual Progress Report on climate-related disclosures, which covers the TCFD's findings as well as the progress made by the ISSB following the issue of IFRS S1 and IFRS S2.

For more information on the ISSB Standards and other developments in sustainability reporting in the EU and UK, see our briefing.

Financial Reporting Council ("FRC") Lab Report on ESG Data Distribution and Consumption

- In July 2023, the FRC Lab published its Phase 2 Report on ESG data distribution and

consumption, which forms the second part of the FRC Lab's

project about the production, distribution and consumption of ESG

data, having published its Phase 1 Report in August 2022 on improving ESG

data production.

- The Phase 2 Report:

- focuses on how investors access and collect ESG data, how they

use it and recommendations as to how ESG data flow can be better

optimised; and

- identifies key areas which include motivation (the key drivers of why investors are collecting data), method (how ESG data is collected and prepared for investors) and meaning (how investors integrate ESG data into their investment processes).

- focuses on how investors access and collect ESG data, how they

use it and recommendations as to how ESG data flow can be better

optimised; and

FRC Thematic Review of Climate-related Metrics and Targets

- In July 2023, the FRC published a review of climate-related metrics and targets,

including net zero pledges, published by listed companies as part

of their TCFD disclosures. Metrics and targets was an area for

improvement identified by the FRC in its July 2022 report on TCFD

disclosures by premium listed companies.

- The 2023 report analysed disclosures by 20 listed companies across the materials and buildings, energy, banking and asset management sectors. The report found that although there have been incremental improvements in reporting of metrics and targets, clarity and detail were sometimes lacking, as well as reporting of progress.

European Sustainability Reporting Standards

- The Directive on Corporate Sustainability Reporting

("CSRD") entered into force on 5 January

2023. As a reminder, it will impact non-EU companies with

significant operations in the EU (and a legal presence by way of

large/listed subsidiary or branch) from 2028 with the first

sustainability report due in 2029. Any entity listed on an EU

regulated market is caught regardless of EU turnover (provided the

entity is above "micro" size) and will need to comply in

one of the earlier waves of CSRD applying.

- The standards to enable reporting under the CSRD were finalised in July 2023 and are awaiting publication. The reporting requirements remain extensive and are anticipated to require significant preparatory work for in scope entities. See our recent briefing.

FRC Lab Report on Net Zero Disclosures

- In October 2022, the FRC Lab published a report to assist reporting teams in preparing

disclosures on net zero and other greenhouse gas emission reduction

commitments to help improve the quality and usefulness of

reporting.

- As well as highlighting issues, interesting practice and practical questions for preparers to consider, the report is also supported by an example bank, which sets out practical examples of current good practice.

FRC Annual Review of Corporate Reporting

- The FRC published its findings and expectations relating to its

corporate reporting review carried out up to 31 March 2023. Despite

high interest rates, persistent inflation and ongoing economic

uncertainty, the FRC was pleased that the quality of corporate

reporting for the FTSE 350 companies reviewed remained the same.

The most frequently raised issues related to impairment of assets

and judgements and estimates and the FRC "continued to

identify a significant number of issues with cash flow

statements."

- The FRC reviewed climate-related disclosures and remuneration reporting and the review notes areas where disclosures could be enhanced. The review also sets out ten areas for improvement including in relation to the strategic report, financial instruments, accounting policies and fair value measurements. The FRC confirmed that the separate Review of Corporate Governance Reporting for 2023 will be published later in the year.

FRC Lab Report on Materiality

- The FRC has published a Report on the materiality of information contained in a company's annual report and accounts to encourage boards and management to have a "materiality mindset" to strengthen their reporting. To help companies report more clearly, the FRC has created a toolkit which includes: (i) thinking about investor needs and decision-making; (ii) taking a holistic approach to materiality; and (iii) embedding a materiality mindset. These are suggested by the FRC in the context of reporting but the FRC notes they could also be used for wider strategic and risk management processes.

Transition Plan Disclosure Framework

On the 9 October 2023, the TPT released its first disclosure framework for effective transition plans. The framework aims to produce "the gold standards for credible and robust corporate transition plans for achieving net zero", recognising that the quality and detail in transition plans varies considerably, in the absence of any defined standards for their creation. See our briefing based on the consultation drafts.

The FCA intends to consult next year on rules and guidance for listed companies to disclose in line with the UK-endorsed ISSB standards and the TPT Framework as a complementary package.

4 Market Abuse Regulation

Unlawful Disclosure

- In its Primary Market Bulletin 42 published in

December 2022, the FCA provided some commentary and guidance in

relation to the unlawful disclosure of inside information.

- The bulletin:

- describes some of the key features of the FCA's decision with respect to the Sir Christopher Gent case (for further information on this case, including tips for best practice, see our briefing); and

- sets out some general themes and concerning behaviours in relation to suspected unlawful disclosures that have been identified as a result of recent enquiries carried out by the FCA's Primary Market Oversight Department.

Companies should consider whether their written policies and procedures are adequate to address these risks and update and socialise them as necessary.

Insider Lists

- In December 2022, the FCA published Market Watch 71, which provides useful

commentary on insider lists and the management of inside

information. The FCA has observed a downward trend in the number of

persons included on permanent insider lists as a result of firms

limiting the number of staff who have access to inside information

and the FCA considers that this ongoing decrease in access reduces

the opportunities for unlawful disclosure of that information, and

therefore enhances the integrity of UK markets. The newsletter

includes a list of methods used to reduce access.

- The FCA has also noted that it has received insider lists in response to regulatory requests that do not contain all of the personal information required under the UK version of Implementing Regulation (EU) 2016/347 (the "Technical Standards") (i.e. telephone numbers, dates of birth and national identification numbers).

Companies should review their insider lists to:

- Consider whether access to inside information should be further

restricted and therefore reduce the number of permanent

insiders.

- Ensure that insider lists are in the correct format and include all information, as set out in Annex 1 to the Technical Standards.

Multimedia Content

- In its Primary Market Bulletin 44, the FCA noted that some primary information providers are offering the option for issuers to include multimedia content in announcements. The FCA confirmed that regulatory announcements containing multimedia content could breach certain requirements of the Disclosure Guidance and Transparency Rules and the UK Market Abuse Regulation ("UK MAR"), in particular, the requirement to release information in unedited full text.

5 Derivative Climate Change Action

- In ClientEarth v Shell plc, a derivative claim was

brought against the directors of Shell for alleged failures in

connection with climate change strategy. The High Court originally

dismissed the action, and permission to appeal has been refused by

the High Court, with ClientEarth being ordered to pay Shell's

costs (which is a departure from the norm). This is not, however,

the end of the case as ClientEarth has sought permission to appeal

from the Court of Appeal.

- Although claims of this type face significant procedural and evidential hurdles even to get off the ground, it is clear that activist and other claimants can and will use such claims (or even simply the threat of such claims) to try to exert pressure on directors, focus attention on a company's strategy and influence its decision-making, and to publicise their agendas more generally. For further information see our briefing on the Shell case from March 2023 and our briefing on directors' duties.

6 Disqualification of Directors

- The Secretary of State for Business and Trade has discontinued

the director disqualification proceedings against five

non-executive directors of Carillion plc, with the trial having

been due to start in October 2023. Proceedings had originally been

taken against three executive directors (the former CEO and two

former finance directors) and five non-executive directors, with

the three executives having agreed to give disqualification

undertakings.

- The case against the non-executive directors was the first case of its kind, arguing that they had a strict duty to know the true financial position of Carillion at all times, and the standard it could have set would have been concerning for non-executive directors of UK incorporated listed companies.

7 Diversity

Listing Rules Diversity Disclosures

- This year's annual reports have been the first with the mandatory diversity disclosures required under the Listing Rules, which apply to reporting periods beginning on or after 1 April 2022. The FCA's Primary Market Bulletin 44 sets out its expectations for disclosure and the steps that listed companies are expected to consider. There are also proposals for a separate diversity and inclusion framework in the financial sector and our briefing sets out further details.

Ethnic Diversity on Boards: Parker Review Update Report

- In March 2023, the Parker Review Committee published an update report, which provides an update on the

progress of FTSE 350 companies meeting the Parker Review target of

at least one minority ethnic director on their boards. The report

also sets out new targets, including for FTSE 350 companies to

confirm a percentage target by December 2023 for senior management

positions that will be occupied by ethnic minority executives by

December 2027.

- Companies are also strongly encouraged to describe in their annual reports the management development plans they have in place to help create a diverse and inclusive pipeline of talent.

8 Consultations

Non-financial information reporting call for evidence

In May 2023, the Department for Business and Trade ("DBT") published a Call for evidence: Non-financial reporting review, which sought views on the non-financial information UK companies are required to include in their annual reports. Responses to the call for evidence were requested by 16 August 2023 and a full public consultation is expected in 2024.

The call for evidence is the first phase of the Government's

non-financial reporting review, which will consider potential

options for refreshing and rationalising current reporting

requirements to ensure that the UK's non-financial reporting

framework is fit for purpose and provides useful information to the

market. The call for evidence focused primarily on the requirements

in the Companies Act 2006 and equivalent legislation for

LLPs.

Audit and corporate governance reform

Following the publication of the Government's response to the White Paper, Restoring Trust in Audit and Corporate Governance (the "Response to the White Paper"), there have been a number of developments towards the implementation of the proposals:

Draft Companies (Strategic Report and Directors' Report) (Amendment) Regulations 2023 (the "Regulations"):

- The draft Regulations, which would have amended the Companies

Act 2006, would have introduced new reporting requirements for

large companies (those with 750 employees or more and an annual

turnover of at least £750 million), were laid before

Parliament in July 2023

- The additional reporting requirements would have required those

large companies (both public and private) to provide information

about distributable profits, distributions and purchase of own

shares as a note to the accounts, an annual distribution policy

statement and material fraud statement in the directors'

report, an annual resilience statement in the strategic report and

a triennial audit and assurance policy statement in the

directors' report.

- However, on 16 October 2023, the Government announced that it had withdrawn the Regulations in response to concerns raised by companies about the imposition of additional reporting requirements and confirmed that it would shortly be setting out options to reform the wider reporting framework to reduce the "burden of red tape on business", following on from the Non-Financial Information Reporting Call for Evidence (see above).

Changes to the UK Corporate Governance Code:

- The FRC recently published a consultation on the proposed

changes to the UK Corporate Governance Code (the

"Code"). The majority of the changes

were driven by the audit and corporate governance reforms set out

in the Response to the White Paper.

- The new Code was expected to be published in Q1 2024 and to

apply to financial periods beginning on or after 1 January 2025.

The FRC had also confirmed that updated Audit Committee Guidance

and Guidance on Board Effectiveness would be published before the

new Code comes into effect.

- Following the Government's announcement on 16 October 2023 confirming it had withdrawn the Regulations, there will be an impact on the Code reforms as many of the amendments mirrored or were linked to the proposed requirements in the Regulations and, as at the date of this briefing, it is not clear what the timetable will be for the new Code to be published.

For further information on the proposed Code changes, see our briefing.

Audit Committees and the External Audit: Minimum Standard:

- In May 2023, the FRC published a minimum standard for audit

committees in relation to the committee's responsibilities for

external audits (the "Minimum

Standard"). The Minimum Standard applies to audit

committees of FTSE 350 companies, although the FRC states that

other companies may wish to voluntarily apply it.

- The FRC has also proposed amendments to the Code that would require audit committees to follow the Minimum Standard and report against it in their Annual Reports (with the requirements in the draft Code not currently being limited to FTSE 350 companies).

Companies should consider updating their Audit Committee Terms of Reference to reflect the Minimum Standard.

UK Capital Markets regulatory reforms

Reform of the Main Market Listing Regime:

- In May 2023, the FCA published its latest consultation paper as part of its Primary

Markets Effectiveness Review. As expected from the discussion paper that was published in 2022,

the proposed way forward is a single segment listing for equity

shares in commercial companies ("ESCC"),

removing the current two-tier listing regime comprising premium and

standard listings.

- The revised proposals no longer include a split between

mandatory and supplementary continuing obligations; instead, there

will be one set of continuing obligations for all companies in the

ESCC category.

- The consultation closed in June 2023 and the FCA intends to consult further on the detail of the proposed rules changes in autumn 2023.

For further information on the UK capital markets regulatory reforms, including with respect to the UK prospectus regime and secondary fundraisings, see our briefing.

9 Other non-listed company specific updates

Corporate

Economic Crime and Corporate Transparency Act

2023

- The Economic Crime and Corporate Transparency Act

2023 (the "ECCT Act") has received

Royal Assent. The reforms focus on tackling economic crime and

improving transparency over UK corporate entities, including

fundamental changes to the role and powers of Companies

House.

- The Registrar of Companies will have increased powers to

protect the integrity of the register, including by querying

filings, removing information from the register, requiring the

provision of information and sharing such information with

regulatory bodies. The ECCT Act also introduces identity

verification measures for all new and existing registered company

directors, people with significant control, and those who file on

behalf of companies.

- Earlier this year, an amendment was proposed to the bill (as it

then was) to introduce a new corporate criminal offence in respect

of a failure to prevent fraud (for large organisations), and this

has been included in the ECCT Act. A business will have a defence

if it can prove that it had in place reasonable procedures to

prevent fraud and further guidance on this will be published by the

Government in due course.

- Many of the changes set out in the ECCT Act will require

amendments to the Companies Act 2006 and will be implemented

through secondary legislation so the timing is not yet clear.

However, Companies House's blog post notes certain changes that are

expected to come into force in early 2024.

- The ECCT Act also reforms the way in which corporate entities can be held liable for certain economic crimes, including primary offences under the Bribery Act and the Proceeds of Crime Act. Companies or partnerships can commit such crimes where they are committed with the involvement of a "senior manager", significantly broadening the potential triggers for prosecution of corporate bodies.

For more information on the ECCT Act, including with respect to the enhanced role and powers of Companies House, see our guide for UK company directors and secretaries on the reforms, which also sets out a summary of the practical implications of the changes in the ECCT Act on the day-to-day management of UK companies, including proposed changes to the PSC regime and new verification requirements for directors.

People, Diversity and Inclusion

Ethnicity Pay Gap Reporting

- The Economic Crime and Corporate Transparency Act

2023 (the "ECCT Act") has received

Royal Assent. The reforms focus on tackling economic crime and

improving transparency over UK corporate entities, including

fundamental changes to the role and powers of Companies

House.

- The Registrar of Companies will have increased powers to

protect the integrity of the register, including by querying

filings, removing information from the register, requiring the

provision of information and sharing such information with

regulatory bodies. The ECCT Act also introduces identity

verification measures for all new and existing registered company

directors, people with significant control, and those who file on

behalf of companies.

- Earlier this year, an amendment was proposed to the bill (as it

then was) to introduce a new corporate criminal offence in respect

of a failure to prevent fraud (for large organisations), and this

has been included in the ECCT Act. A business will have a defence

if it can prove that it had in place reasonable procedures to

prevent fraud and further guidance on this will be published by the

Government in due course.

- Many of the changes set out in the ECCT Act will require

amendments to the Companies Act 2006 and will be implemented

through secondary legislation and so the timing is not yet clear.

However, Companies House's blog post, notes certain changes that are

expected to come into force in early 2024.

- The ECCT Act also reforms the way in which corporate entities

can be held liable for certain economic crimes, including primary

offences under the Bribery Act and the Proceeds of Crime Act.

Companies or partnerships can commit such crimes where they are

committed with the involvement of a "senior manager",

significantly broadening the potential triggers for prosecution of

corporate bodies.

- For more information on the ECCT Act, including with respect to the enhanced role and powers of Companies House, see our guide for UK company directors and secretaries on the proposed reforms, which also sets out a summary of the practical implications of the changes in the ECCT Act on the day-to-day management of UK companies, including proposed changes to the PSC regime and new verification requirements for directors.

Non-compete Covenants

- The Government has announced plans to limit the length of

non-compete clauses in employment contracts to three months. This

would represent a significant change to the current position. While

non-competes must be no longer than necessary to protect the

employer's interests, case law suggests the upper limit for a

non-compete clause for a senior executive is currently six to

twelve months. The new law would mean employers could never enforce

a non-compete longer than three months. The aim of the new limit is

to boost competition and innovation, by making it easier for

employees to switch jobs or start up a rival business.

- No changes are proposed to other types of covenant, such as non-solicitation clauses, or to garden leave. In addition to garden leave, we are increasingly seeing employers use indirect restrictions, e.g. incentives which are lost if the employee competes. It seems likely that such indirect restrictions will become more common when the limit on non-competes is introduced. In the meantime, employers may wish to start thinking about alternative ways to protect their business so that their contracts and arrangements are fit for purpose when the new rules come in.

We have produced a short briefing on the proposed changes to non-compete covenants and how employers can prepare.

Government Review of UK Whistleblowing Legislation

- The Government has launched a review of UK whistleblowing

legislation, which will gather evidence to help determine whether

changes should be made to the categories of individuals covered by

whistleblowing protections and whether whistleblowing protections

need strengthening. The review will also consider: (i) the

availability of information and guidance for whistle-blowers; and

(ii) best practice for how employers respond to disclosures.

- There is clearly an increased focus from regulators, investors, service-users and employees on how employers respond to allegations of wrongdoing in the workplace. The Government research is expected to conclude by autumn 2023, with policy announcements to follow.

Pensions

Pensions Dashboards

- Delays in establishing the 'ecosystem' for pensions

dashboards has led the Government to postpone the deadlines for

pension schemes and personal pension providers to connect to the

dashboard. There is now a single legal deadline of 31 October 2026

by which all schemes and providers must connect but forthcoming

Government guidance will set out earlier expected connection dates.

These are likely to be staged by reference to scheme type and size.

Schemes are required to "have regard to" this guidance

and so may need to explain any failure to meet the deadline that

applies to them under the guidance.

- In the meantime, the Pensions Regulator is urging schemes to continue their work towards connecting to and interacting with pensions dashboards. In this regard, please see our article "10 actions for getting to grips with pensions dashboards" and video discussions.

Defined Benefit Scheme Funding

- Last year we reported on a consultation on draft regulations

and a future consultation on a Pensions Regulator code of practice,

which will together provide the detail of a revised regime for

funding defined benefit ("DB") pension

schemes. This will be based on schemes having a long-term objective

(for example, buy-out, consolidation or run-off) and a funding and

investment strategy and journey plan to get them there. The

emphasis is on security for scheme members by requiring low

investment risk and low dependency on the employer for future

contributions by the time a scheme reaches a specified level of

maturity. The regulations and code are still not in place but are

expected to be finalised later this year, to take effect in respect

of scheme valuations with effective dates from April 2024. For more

detail, please see What's Happening in Pensions Issue 99 and

our Pension Schemes Act 2021 briefing.

- The latest delay follows Parliament's Work and Pensions

Committee expressing concerns about over-concentration of

investment in gilts, which in part contributed to the

liability-driven investment ("LDI")

crisis that followed the September 2022 'mini-Budget' and

which the above policy encourages. There are also notable conflicts

between the DB funding proposals and the Government's newer

policy of encouraging more pension scheme investment in equities

and other "productive assets", rather than gilts, in

order to support economic growth (see below).

- As regards the LDI crisis, our November 2022 briefing "LDI – Reflections on the mini-budget and the road ahead" explains what happened and why and our May 2023 briefing "Lessons from the LDI crisis" which considers the resulting Pensions Regulator and FCA guidance.

'Mansion House Reforms'

- The 'Mansion House reforms' include

multiple proposals for enlisting DB and defined contribution (DC)

pension schemes in the push for economic growth whilst also

maintaining security and improving outcomes for pension savers. The

detail was announced in various calls for evidence, consultations

and responses published the morning after the Chancellor's

Mansion House speech. News of the next steps is now awaited.

- Most of the announcements are to encourage:

- DB schemes to invest more adventurously (ideally in the UK) in

order to help grow the economy. That means reducing investment in

gilts – though not excessively because the Government needs

that investment - and increasing investment in 'productive

assets' such as private equity and infrastructure. This is

against a backdrop of many DB schemes having moved significantly

(and increasingly) out of equities and into gilts, corporate bonds

and other liability-aligned strategies in recent years (see above).

Increases in interest rates have meant that many DB schemes are now

in surplus. This is leading to an even greater extent to low-risk

investment strategies that protect the funding position.

Additionally, many schemes have secured liabilities with insurers

or are now able to do so.

Options under consideration by the Government include making surplus easier to access and increasing the consolidation of schemes, perhaps involving a non-commercial consolidator.

- DC schemes to allocate more of pension savers' default fund

assets to 'productive investments'. Recent changes to the

charges cap have facilitated more investment in illiquid assets

such as private equity and infrastructure, provided certain

criteria are met. The Pensions Regulator's continued pressure

on small schemes (which are less likely to have good governance and

which rarely invest in illiquid assets) to consolidate into master

trusts should also make a difference, but the asset scale is small.

Another development that should have a greater impact includes

major personal pension and master trust providers targeting 5%

default fund asset allocation to unlisted equities by 2030.

- The Government is also pressing ahead with new value for money assessment and reporting requirements requiring schemes to offer members options for 'decumulation' of pension pots at retirement and a regime for the automatic consolidation of small deferred pension pots.

- DB schemes to invest more adventurously (ideally in the UK) in

order to help grow the economy. That means reducing investment in

gilts – though not excessively because the Government needs

that investment - and increasing investment in 'productive

assets' such as private equity and infrastructure. This is

against a backdrop of many DB schemes having moved significantly

(and increasingly) out of equities and into gilts, corporate bonds

and other liability-aligned strategies in recent years (see above).

Increases in interest rates have meant that many DB schemes are now

in surplus. This is leading to an even greater extent to low-risk

investment strategies that protect the funding position.

Additionally, many schemes have secured liabilities with insurers

or are now able to do so.

- This is all to be done through a variety of non-compulsory measures. For more detail, please see What's Happening in Pensions Issue 104.

Automatic Enrolment Extension

- A new statute lays the ground for extending employers' pensions automatic enrolment duties. No timescale has been fixed but a consultation on regulations is expected soon. The legislation allows the lower threshold of the 'qualifying earnings' band to be removed, perhaps on a phased basis, so that contributions are payable on pay from the first penny. It also allows the minimum automatic enrolment age, currently 22, to be lowered to 18.

Climate Change and Environment

ESOS – Updates to Phase

3

- The UK's implementation of Article 8 of the EU Energy

Efficiency Directive is coming up to its third reporting phase

("Phase 3"). ESOS requires in-scope companies to measure

and audit their energy use and report them to the UK's

Environment Agency. For Phase 3, this reporting deadline was due to

fall on 5 December 2023. However, this will now be extended to 5

June 2024 to allow the Government time to pass legislation

implementing changes to the scheme.

- Last year the Government announced several changes to ESOS,

including the reduction of the 10% de minimis exemption to "up

to 5%", the addition of an energy intensity metric in ESOS

reports and a requirement for participants to set a target or

action plan following the Phase 3 compliance deadline, which they

will be required to report against for Phase 4. See our briefing for further details.

- The Environment Agency has also recently indicated that the Government will consider broadening the scope of ESOS to medium-sized companies in Phase 4 (this was considered but rejected for Phase 3).

EU Supply Chain Due Diligence Proposals

- The EU Corporate Sustainability Due Diligence Directive remains

in draft form. On 1 June 2023, the European Parliament adopted its

negotiating position and significant differences remain between the

positions of the European Council, Commission and Parliament. The

substance of the drafts remains largely aligned and would impose a

duty for businesses to identify, assess and prevent human rights

and environmental impacts based on a system of effective due

diligence. It would also require companies (and their subsidiaries)

to have in place a code of conduct describing rules and principles

to be followed by their employees and subsidiaries and, where

relevant, their direct or indirect business partners.

- However, which companies will be subject to the new rules is

far from decided, with the European Parliament favouring lower

thresholds (EU companies with 250 employees or more and net

worldwide turnover of €40 million or more, regardless of

sector), while the Council and Commission proposals would capture

EU companies with over 500 employees and net worldwide turnover of

€150 million or more with lower thresholds for companies in

high-risk sectors.

- All drafts continue to include companies based outside the EU but who operate and generate significant turnover in the EU. Given the differences, agreement on the final text is not expected before the end of 2023 at the earliest, with the first obligations not expected to apply until 2027 or later.

EU's Sustainable Finance Disclosure Regime

- On 14 September 2023, the European Commission issued a Targeted Consultation and a Public Consultation on the implementation of

the Sustainable Finance Disclosure Regulation ("SFDR"),

which will close on 15 December 2023. The Consultations include a

series of questions on the practical functioning of the SFDR and

its possible reform. The EU appears to have recognised that the

SFDR is not as user-friendly as it had hoped and is seeking to

assess its potential shortcomings and explore potential

changes.

- There is an acknowledgement that, while the SFDR was designed as a disclosure regime, it is in practice being used as a labelling regime. As such, the Targeted Consultation asks whether the EU should impose uniform product level disclosure requirements for all financial products offered in the EU regardless of whether they make sustainability related claims or not. See our briefing here.

Packaging Waste

- The Government has delayed the introduction of extended

producer responsibility for packaging waste, after widespread

industry lobbying against a system "not fit for purpose".

A broad range of actions will be required to collect and in some

instances report data on the volume of packaging they supply, with

the aim of fully allocating liability for volumes of packaging

placed on the market.

- Brand owners, importers and distributors would be covered, as well as online marketplaces facilitating sales into the UK, and service providers supplying reusable packaging. Costs associated with the scheme have not yet been announced, and fees have been deferred from 1 October 2024 until October 2025. Reporting obligations still technically apply from 1 October 2023 as per the Regulations, but the Environment Agency has said that it will not take enforcement action against any business that submits packaging data by 31 May 2024.

Retained EU Law

Retained EU Law Act

- The controversial legislation to enable the Government to

revoke or reform retained EU law (the Retained EU Law (Revocation

and Reform) Act ("REUL Act")) received Royal Assent in

June 2023. The key implications for businesses are as follows:

- A more moderate approach to sunsetting: In a welcome move, the original "sunsetting" provisions have been replaced with a more modest list of measures to be revoked at the end of 2023. Our view is that for most businesses, the final list is unlikely to give rise to serious concern.

- But there will still be uncertainty: The legislation creates uncertainty over whether the meaning and effect of EU-derived law will remain the same. It may also make it somewhat easier to depart from retained EU caselaw and gives the Government additional powers to change retained EU legislation on a fast-track basis.

- Removal of directly effective rights: The REUL Act also provides for all "retained EU law rights" to be repealed at the end of 2023, removing rights derived from certain EU Treaty articles. This is likely to have an impact in areas such as employment and pensions.

- New terminology: The REUL Act states that after the end of 2023, retained EU law is to be known as "assimilated law" (even if it is unchanged by the legislation). Whilst "retained EU law" may well remain in use, formal documents such as pleadings will need to use the new term.

- For more details, see our briefing, which also discusses the impact of the legislation in the following areas: company law and M&A, consumer protection, contracts and applicable law, data protection, e-commerce and tech, employment, environment, financial services, intellectual property and pensions. See also under "Tax" below, which is one of the areas where the Government is proposing to legislate to disapply certain aspects of the REUL Act, with a view to minimising potential uncertainty in areas such as VAT.

Commercial contracts

Limiting liability

- Commercial contracts often require goods or services to be

provided over several years – so is it better to have a

single global limitation of liability for all claims over the life

of the contract? Or should you opt for multiple caps, where the

limit effectively "resets" for each year of the contract

or for each separate claim?

- A recent case (Drax v Wipro (2023)) highlights the potential for disputes: whilst the supplier maintained there was a single cap, limiting recovery to £11.5 million, the customer argued for multiple caps, giving it scope to recover over £130 million. Our briefing also looks at an earlier Court of Appeal case involving a similar dispute over liability caps.

Contract law

- Novation by conduct: In Musst Holdings Ltd

v Astra Asset Management UK Ltd & Anor (2023), the Court

of Appeal confirmed that it is possible for a novation to take

place by conduct. The case looks at a fairly common commercial

scenario where the novation was never formally documented, but the

parties acted as if a novation had taken place.

- Certification clauses: In Sara &

Hossein Asset Holdings Ltd v Blacks Outdoor Retail Ltd (2023),

the Supreme Court considered the meaning of a certification clause

in a lease relating to the service charge. Such clauses are often

found in other contexts, for example as part of indemnity wording.

The clause stated that the landlord could issue a certificate

setting out the total cost and the amount payable and that (in the

absence of manifest error or fraud) this certificate would be

"conclusive". Did this mean that the tenant couldn't

dispute the amount, as found by the Court of Appeal? The Supreme

Court thought not. It concluded that the certificate was conclusive

on the amount which the tenant had to pay (meaning it was not

entitled to withhold payment), but that the tenant could still

dispute the amount if it could show there was manifest error or

fraud.

- Agency commission/pricing: In Barton v

Gwynn-Jones (2023), the Supreme Court ruled that an agent was

not entitled to any commission where he failed to achieve the

target sale price for the relevant property, which was £6.5

million (it was sold for £6 million). The contract was agreed

orally, and the majority took the view that the bargain struck here

was an "all or nothing" deal. If the agent did not

achieve the target, he would not be remunerated at all, whereas if

he did meet it, he would receive a "bumper" commission of

£1.2 million (more than double the norm for this type of

work). The minority agreed with the Court of Appeal that, as the

parties did not appear to have turned their minds to what should

happen if the target was not met, it was not appropriate to

conclude that it was an "all or nothing" deal. Instead, a

term should be implied (under the Supply of Goods and Services Act

1982) allowing the agent to claim reasonable remuneration for the

services provided, based on the usual level of commission charged

(equating to about £435,000).

- Force majeure: In MUR Shipping BV v RTI

Ltd (2022), the Court of Appeal ruled that a force majeure

clause did not apply because the party unable to comply with its

obligations had offered suitable alternative performance (as

envisaged by the clause, which included a reasonable endeavours

obligation). In doing so, it reversed the decision at first

instance, where the court ruled that the shipowners were entitled

to insist on being paid in US dollars, not euros, as required by

the contract. The case highlights the difficulties in relying on

force majeure clauses, even where (as here) the contract is

affected by US sanctions. See our detailed briefing.

- Good faith: In Re Compound Photonics Ltd

(2022), the Court of Appeal provided some useful guidance on the

meaning of good faith in a shareholder's agreement. See our detailed briefing.

- Construction of settlement agreements: In Maranello Rosso v Lohomij (2022), the Court of Appeal confirmed that, where the natural meaning of the wording of a settlement agreement and its factual matrix indicate that it is objectively intended to cover claims of fraud or dishonesty, that agreement will be given effect, even where these is no express reference to such claims in the relevant clause. Although a court will not readily conclude that a release includes claims for fraud and dishonesty without express wording, there is no rule of law to that effect. This serves as a useful reminder to carefully consider what claims you are releasing in a settlement agreement and to take care in the claims asserted in pre-action correspondence. See our detailed briefing.

Spotlight on pricing and payment

Against the background of high inflation and challenging economic conditions, we have launched a series of briefings about pricing and payment issues in commercial contracts. So far, our briefings cover:

- Price review clauses: when can suppliers force through an increase?

- Linking prices to inflation: a short guide to indexation clauses

- Late payment clauses: time for a review?

- Payment terms: what to watch out for

- Audit clauses and Paddington bear: key lessons from caselaw

- Cost plus and open book pricing: what to watch out for

- "Best prices" or "most favoured

customer clauses": key issues for customers and

suppliers

You can sign up to be notified of more content here.

Outsourcing spotlight – Autumn 2023

- Our regular look at key developments and issues affecting the world of outsourcing covers a wide range of issues, including the implications of deploying artificial intelligence as part of an outsourcing transaction.

IP & Technology

Artificial intelligence: regulatory, IP and

data protection risks

- Regulating AI: With governments worldwide urgently looking at

how to regulate AI, our briefing, The shifting sands of AI regulation, looks at

the different approaches being taken by the EU and the UK - and

what businesses wanting to deploy AI can realistically do now to

prepare for increased regulation in future, despite the current

uncertainty.

- AI and intellectual property: With AI developers facing

numerous challenges from content providers over alleged IP

infringement, our briefing looks at issues relating to IP

rights in AI systems and AI-generated content, the potential

infringement risks that can arise from training and AI and its

outputs – as well as the UK Government's response to

these issues.

- AI and data protection: Data is often described as AI's

"lifeblood" but there's widespread concern about

personal data being unlawfully exploited or processed using AI

tools. While the future approach to regulation of AI is still being

heavily debated, existing data protection legislation, such as the

GDPR and its UK equivalent, is likely to play an influential role

– not least because regulators already have powers which they

can use to oversee the new technology. Our briefing looks at how big a role data

protection can play in regulating AI and what lessons it may have

for other areas. We also discuss how regulators in the UK and EU

are responding and what businesses need to do to comply if they are

considering the use of AI tools to handle personal

data.

Cybersecurity

- Improving cybersecurity for essential services and

infrastructure is high on the agenda for the UK's and the

EU's legislators, in response to the ever-evolving threat

landscape. While the UK's and the EU's respective network

and information systems or "NIS" regimes are to be

strengthened (including bringing managed service providers into

scope), the two regimes also look to be diverging.

- Some fear that this may lead to inconsistent cybersecurity standards. In-scope organisations operating in both the UK and EU will need to monitor developments in relation to each regime and their suppliers should prepare for increased due diligence. Our briefing looks at some of the potential differences and their likely impact in practice. For more information about handling cybersecurity threats originating from within an organisation or its supply chain, see our 'Mitigating a Data Breach ' podcast series.

Regulating online content

- The EU and the UK are each determined to regulate online

content and protect users from online harms. The EU Digital

Services Act ("DSA") impacts all online intermediaries

operating in the EU at varying levels and is already in

force.

- Meanwhile, the journey of the UK's Online Safety Bill was a troubled one but it has now received Royal Assent (on 26 October 2023) and the majority of its provisions will come into effect two months thereafter. Our briefing looks at the obligations on online intermediaries under the DSA and the key similarities and differences compared with the Online Safety Act.

Counterfeit goods

- The Court of Justice of the European Union has ruled that Amazon could be held liable for trade mark infringement in relation to advertisements for 'fake' Christian Louboutin shoes placed on its website by a third party. This preliminary ruling, a departure from previous case law and the Advocate General's opinion in the case, is good news for brand owners (particularly for luxury products) and may cause online platforms, offering both their own and third party products for sale, to rethink their website design. Our briefing looks at the implications for brand owners and platforms both in the EU and the UK.

Data Protection

Data Protection and Digital Information

Bill

- The Government introduced the Data Protection and Digital

Information (no. 2) Bill to Parliament on 8 March 2023 ("DPDI

No.2"), withdrawing its previous Data Protection and Digital

Information Bill ("DPDI No.1"). Promoted as "a truly

bespoke, British system of data protection", as it transpires,

DPDI No.2 is a modest uplift to DPDI No.1 and, overall, the package

of reforms is not a dramatic departure from the UK GDPR, the

framework of which is retained.

- Given its current progress (as at October 2023), it looks unlikely that the Bill will become law before 2024. For more detail, see our briefing.

Transatlantic data transfers

- On 10 July 2023, the European Commission adopted its adequacy

decision for the EU-US Data Privacy Framework

("DPF") so that transfers of personal

data can be made compliantly from the EU to organisations in the US

that have certified to the DPF, without the need for additional

safeguards, such as standard contractual clauses, or for a transfer

impact assessment. See our briefing here.

- The UK Government has now also agreed a UK-US data bridge, as an extension to the DPF, that can be used in a similar way for transfers between the UK and DPF-certified organisations in the US. Our briefing explains what this means for data transfers to the US, what the next steps are, and whether these transfer mechanisms will last.

LIBOR

- The FCA has announced that the 3-month synthetic sterling

LIBOR setting (which is the last remaining tenor) will cease at the

end of March 2024 and will not be quoted after this date. Since the

end of June 2023, US dollar LIBOR is now published (for limited

settings) on a synthetic basis only until the end of September

2024. The latest FCA announcement outlines the limited use

cases for the synthetic dollar rate.

- Companies should have already worked with their lenders to remove any remaining LIBOR-related exposures in their loans. Please see our commentary on consequences for other commercial contracts which reference LIBOR (for instance in late payment clauses). We also discuss alternative rates such as central bank rates, Term SONIA (for sterling) and Term SOFR (for dollars).

Tax

Spring Statement 2023

Business Expensing / Capital Allowances:

- The Chancellor announced full expensing of qualifying capital expenditure incurred in the three years from 1 April 2023, with the intention of making this permanent afterwards. This means that 100% of any qualifying expenditure on main rate expenditure will be deductible in the year it is occurred, giving immediate relief in 25 pence in the pound (the same rate available under the previous super deduction). This is significantly more generous than the UK's previous system of capital allowances, which only allowed 18% of the expenditure to be deducted each year on a reducing balance basis, giving tax relief at 3.4p in the pound in the first year, and lower in following years. For "special rate" expenditure, a 50% first-year allowance will be available, with the balance being deducted at 6% a year on a writing down basis.

Pensions Tax Changes:

- The Chancellor announced major changes to pensions allowances

with the aim of encouraging the over 50s to remain in, or return

to, work.

- The key changes are as follows:

- The lifetime allowance (currently £1,073,100) will be abolished.

- The annual allowance was raised from £40,000 to £60,000.

- The tapered annual allowance was raised from £4,000 to £10,000, with the 'adjusted income' threshold increased from £240,000 to £260,000.

- The money purchase annual allowance was raised from £4,000 to £10,000.

- The maximum tax-free pension commencement lump sum (for those without protections for higher amounts), currently set at 25% of the lifetime allowance, will be retained and frozen at that level, which is £268,275.

- These changes took effect from 6 April 2023, although only the lifetime allowance tax charge has been abolished from April 2023, with the full lifetime allowance legislation to be repealed from April 2024.

R&D Relief:

- A new enhanced R&D tax credit was announced. This tax

credit is payable at 14.5% to loss making SMEs whose R&D

expenditure makes up at least 40% of their total expenditure for an

accounting period. This announcement will go some way to relieving

SMEs following the reduction of the SME R&D tax credit to 10%

in the Autumn Statement 2022.

- The Budget documents also confirmed that the planned changes to

R&D relief which would include expenditure on data licences and

cloud computing within qualifying expenditure will go ahead as

planned for expenditure incurred from 1 April 2023 but that the

restrictions limiting R&D relief to UK expenditure will be

postponed until 1 April 2024.

- Draft legislation has been published for the merger of the two types of R&D relief (RDEC and SME relief) that was consulted on earlier this year. However, the Government has not yet decided whether to proceed with the merger; any such decision would not be announced until a future fiscal event – presumably the Autumn Statement that will be delivered on 22 November this year.

Multinational Top-up Tax

- The UK Government has gone ahead with its implementation of

OECD BEPS Pillar Two that seeks to establish a global minimum

corporate tax rate of 15% for multinational enterprises

("MNEs"). The rules will apply to MNEs

that meet a €750m turnover threshold test, but there are

various exclusions, including for investment funds and pension

funds. In the UK, the tax will be known as "multinational top

up tax" and, the main charging provision, the income inclusion

rule, will take effect in relation to accounting periods commencing

on or after 31 December 2023. A first draft of the backstop

charging mechanism, undertaxed profits rule

("UTPR"), was published in July 2023.

The UTPR is expected to be included in the Finance Bill 2024, but

it is not yet clear when it will come into force. The UK Government

has previously stated that the UTPR will not come into force before

31 December 2024.

- The UK has also a domestic top-up tax requiring large groups or standalone entities (again groups or entities that meet a €750m turnover threshold test) to pay a top-up tax where their UK operations have an effective tax rate of less than 15%. Unlike multinational top-up tax, domestic top-up tax will apply to large domestic groups and entities in additional to large multinational groups and entities. This will also take effect in relation to accounting periods commencing on or after 31 December 2023.

EU Retained Law

- As noted above, the recently enacted Retained EU Law

(Revocation and Reform) Act 2023 has provided for the sunsetting of

some types of retained EU law from 1 January 2024.

- As it is based on the EU's VAT Directive, there have been

concerns that the UK VAT regime could be disturbed by the

sunsetting provisions in the REUL Act. To address these concerns,

the Government has recently published draft legislation (which is open for

consultation until 17 November 2023) that provides that certain

types of retained EU law will continue to apply in relation to VAT

and excise law, including retained general principles of EU law

such as fiscal neutrality. The precise impact of the draft

legislation on the interaction between retained EU law and

post-REUL Act domestic law will need to be worked through, but it

is helpful that the Government considers that the draft legislation

"ensures that UK VAT and excise legislation continues to be

interpreted as Parliament intended, drawing on rights and

principles that currently apply in interpreting UK law" and

that that will ensure the stability of the VAT and excise regimes

and provide legal certainty.

- The Government has also recently published draft legislation to

address the concern that the 1.5% stamp tax charge arising on the

issue or transfer of UK shares to clearance services and

depositaries would be reintroduced as a result of certain

provisions of EU law ceasing to be part of UK law from 1 January

2024. The draft legislation provides that there will be (i) no SDRT

on issues of UK shares to clearance services and depositaries; and

(ii) an exemption from stamp duty and SDRT on transfers of shares

to clearance services and depositaries where such transfers are

part of capital raising transactions.

- It is expected that both pieces of legislation will be included within next year's Finance Act but will have temporary statutory effect through the budget resolution procedure from 1 January 2024 until the time that Act receives royal assent.

Incentives

Health and Social Care Levy scrapped but Off Payroll Working rules retained:

- Several of the measures set out in the 2022 September Growth

Plan were modified or dropped entirely by the new leadership team.

However, one change that was taken forward in the 2022 Autumn

Statement was the abolition of The Health and Social Care Levy. The

levy had taken effect from April 2022, initially as a 1.25%

increase to National Insurance contributions

("NICs") and dividend rates, with the

intention that it would operate as a separate charge from April

2023. The levy was cancelled and on 6 November 2022, NIC rates

returned to their 2021/22 levels. However, the dividend rates of

tax remain at 8.75%, 33.75% and 39.35% for basic, higher and

additional rate taxpayers respectively.

- The planned repeal of the Off Payroll Working Rules which apply to workers operating through intermediaries such as personal service companies has been cancelled. These rules apply to tax contractors operating through intermediaries in the same way as employees if their working relationship with the end client resembles employment. This means those engaging workers through intermediaries will continue to have to assess whether the arrangement is within the rules and, if it is, account for tax and NICs.

HMRC Tax Advantaged Share Plans:

- From 6 April 2023, the maximum value of shares an individual can hold under a tax-advantaged Company Share Option Plan ("CSOP") doubled from £30,000 to £60,000 (calculated by reference to the value of the shares at the time of grant). This increase is welcome news for companies operating CSOP plans as the previous limit, which had not changed for nearly 30 years, was soon reached by employees. The Government has asked for comments on how to simplify and improve the all-employee plans, Save-As-You-Earn ("SAYE") and Share Incentive Plans ("SIP"). Changes that have been called for include increasing the financial limits on individual participation and reducing the vesting/holding periods for tax relief to be available. The introduction of a new bonus rate calculation mechanism for SAYE participants means that from 18 August 2023, a bonus will be paid to new participants for the first time in nearly a decade.

Changes to the Capital Gains Tax ("CGT") annual exemption:

- The reduction in the annual CGT exempt amount (down to £6,000 on 6 April and then halved to £3,000 from 6 April 2024 onwards) was unwelcome news for participants in tax-advantaged share option plans. This is because many of them have been able to use the allowance against gains realised when they sell their option shares to make participation in the plan effectively tax free. Some participants can transfer their shares to a spouse or civil partner first, to take advantage of double the allowance. The same issues arise for participants in share incentive arrangements that are not tax favoured but benefit from capital gains tax treatment.

Official Rate of Interest for Employment Tax Purposes increased to 2.25% from 6 April 2023:

- Where a company makes a loan to an employee (for example, to fund the purchase of shares) an income tax and NICs charge would arise if the interest charged is less than the "official rate". From 6 April, the official rate rose from its previous level of 2% to 2.25%.

Recent tax rate changes

- 1 April 2023: main corporation tax rate increased from 19% to

25%.

- 6 April 2023: Additional tax rate threshold decreased from £150,000 to £125,140.

Further Reading

It may be of interest to take a look at our briefing on AGMs and Reporting published in March 2023, our 2022 Listed Company Update and our ESG timeline.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.