Read the Original Blog Here.

The European Commission's Regulation on indices used as financial benchmarks in financial instruments and financial contracts (the Regulation) goes live on 1 January 2018. It forms part of the EU's response to a series of high profile investigations in recent years into the alleged manipulation of key financial benchmarks, including LIBOR. These investigations raised concerns over the reliability and integrity of financial benchmarks, which underpin transactions worth trillions of dollars. The Regulation aims to reduce the risk of manipulation, bolster the reliability of benchmarks administered and ultimately provide a safer environment for the use of benchmarks in the EU.

As the countdown to the Regulation begins, we examine some key considerations for firms in the upcoming weeks and months.

What is an EU Benchmark?

An important starting point is for EU and non EU firms to consider whether a benchmark or index that they administer, contribute to, or use falls within the scope of the Regulation. Considering that there has been much industry debate regarding how this provision should be interpreted, we encourage firms to apply the following decision tree (based on Regulation Article 3) in order to identify whether a figure determined by the firm should be considered an EU index or an EU benchmark :

- Is the figure "published" or "made available to the public"1 ?

-

- NO - NOT an EU BMR Index

- YES. Go to the next question (2)

- Is the figure "regularly determined"?

- NO - NOT an EU BMR Index

- YES, the figure is an "Index". Go to the next question (3)

- Is the index used to determine: (i) the amount payable under a

"financial instrument2" or a "financial

contract"; or (ii) the value of a "financial

instrument"?

- NO. Go to the next question (4)

- YES – EU BMR BENCHMARK

- Is the index used to measure the performance of an

"investment fund" with the purpose of: (i) tracking the

return of such index; or (ii) defining the asset allocation of a

portfolio; or (iii) computing the performance fees?

- NO - NOT an EU BMR Benchmark.

- YES - EU BMR BENCHMARK

Timeline and Transitional Arrangements

The second step is to consider the timeline and transitional arrangements. Importantly, the Regulation also applies to non-EU Supervised entities that administer financial benchmarks which are used by EU Supervised entities. While the Regulation applies from 1 January 2018, "existing" EU Administrators as well as non-EU Administrators currently providing benchmarks used by an EU Supervised Entities, benefit from transitional provisions in the text.

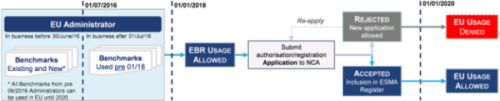

Existing EU Administrators

EU Administrators providing benchmarks up to 1 January 2018 will have until 1 January 2020 to apply to their EU National Competent Authority ("NCA") for authorisation or registration. During this time, they can continue to administer benchmarks unless their application is rejected by the NCA (administrators can reapply for authorisation if rejected).

As we close on 2017, we encourage these firms to consider the commercial impact of the timing of their application. In the meantime, administrators should take the initiative to develop a market outreach programme, providing progress alerts and updates regarding their timeline for compliance which can be distributed to EU supervised entities.

Non EU Administrators

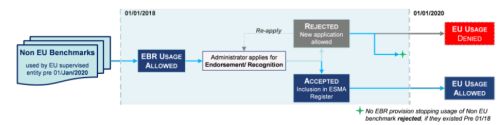

Non EU Administrators ("Third Country Administrators") providing indices pre 20203 and used by EU supervised entities, can continue to do so until 1 January 2020. During the transitional period, the Third Country Administrator must apply to ESMA either for Endorsement of their specific benchmarks, or Equivalence Recognition of their activities as a benchmark administrator. If approved, the administrators can carry on providing benchmarks used by the EU supervised entity.

If the application is rejected, and the benchmark was provided before 2018, the EU supervised entities can continue to use the benchmark until 1 January 2020, but not beyond.

Considering the lack of practical guidance around the application process, we encourage Third Country Administrators to identify the benchmarks used in EU (traded on a trading venue - TOTV) before 1 January 2018. This process may be onerous for Third Country Administrators providing several benchmarks to EU supervised entities, however it forms the basis upon which they can:

- Define and establish their strategy for compliance with the Regulation; and

- Apply the Transitional Provision, preventing any market disruption.

Moreover, we encourage Third Country Administrators to consider their progress in relation to adherence to the International Organization of Securities Commissions (IOSCO) Benchmarks Principles. Regardless of whether Third Country Administrators provide or will provide benchmarks to EU supervised entities or not, independent assurance over compliance with the IOSCO Principles has been, and continues to be, important in sending a message to the market on the quality and robustness of administrators' benchmarks. Furthermore, certified compliance with IOSCO Principles is a pre-requisite to gaining Recognition for the purposes of the Regulation.

Whatever authorization path the administrators will take over the coming months, they should ensure that they establish a communications program which allows them to provide updates on their progress and timelines to the regulators and their users.

Users of EU Benchmarks

Whilst much has been debated and considered in recent times regarding the requirements for benchmark administrators and contributors, much less attention has been paid to the impact on users of financial benchmarks.

EU Supervised Entities are entitled only to make use of financial benchmarks from an EU Authorised Administrator, or a Third Country Administrator that is either recognized, or endorsed, under the Regulation, after 2020. In addition, users of financial benchmarks will have to consider repapering the contracts (post 2018) to identify alternative benchmarks.

We encourage users of benchmarks to undertake in depth analyses of their use of benchmarks, and engage with benchmark administrators, in order to determine the extent to which they (benchmark users) can continue to rely upon these benchmarks.

Applications to EU national competent authorities and ESMA role

ESMA's Level 2 RTS4 , issued on 29th March 2017 includes guidance on the specific information required in the application forms for the assessment for authorization and/or registration. EU NCAs have published their own consultation papers for guidance on applications and currently the applications forms are available on their websites5.

From a UK perspective, the Financial Conduct Authority (FCA) opened the window to submit the draft applications from 1 October 2018, with an invitation to firms to obtain feedback before the year end on applications received prior to this date. The FCA has strongly encouraged all the UK administrators to submit their draft application as soon as possible, this will allow time for an in-depth review offering detailed feedback that can help to submit a final version aligned with the FCA expectations.

The Commission recently proposed that ESMA becomes the direct supervisor of critical benchmarks and third country benchmark administrators, and that the ESMA assumes responsibility for monitoring third-country equivalence decisions. This would include any equivalence decisions that could be granted to the UK under certain provisions of financial regulation post-Brexit. Administrators should monitor further developments regarding these proposals.

Conclusion

There is much still to do, whether you are an existing EU or Third Country Administrator, a new entrant to benchmark Administration, or importantly, an EU Supervised Entity that uses financial benchmarks. As 2017 comes to a close, the commercial impact of the Regulation is becoming much more apparent, with quality standards required by the Regulation having the potential to tip the balance and drive the strategy of compliance by administrators, and selection by users.

Footnotes

1. Whilst there is no clear definition of what constitutes whether a figure is "made available to the public", we would encourage firms to consider the methods in which figures are distributed to the market (e.g. streaming platform, routine publication), and the commercial basis upon which the figures are provided (e.g. free of charge, through a licensing agreement).

2. The Regulation defines "financial instruments" as the MiFID2 financial instruments that are traded on a trading venue (TOTV) or available via a systematic internaliser (SI). Both SI and TOTV concepts are result of MiFID2 regulation that is expected to kick in January 2018, with one year of delay. This scenario is creating high uncertainty, with the risk to not be able to identify financial instruments existing prior to 2018.

3. ESMA published additional Q&A on the 8th November 2017 which clarify how the transitional provisions under the European Benchmarks Regulation ("EBR") apply to third country benchmarks. https://www.esma.europa.eu/sites/default/files/library/esma70-145-114_qas_on_bmr.pdf

4. https://www.esma.europa.eu/sites/default/files/library/esma70-145-48_-_final_report_ts_bmr.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.