The UK financial services industry, including fund management, is likely to go through a stressful period over the next two years, and early indicators – based on comments made by both sides – would suggest negotiations will commence on a tense footing. Management fees

While many in financial services (and beyond) had initially anticipated a "soft Brexit" (a divorce but with retained benefits such as Single Market access), it has become increasingly apparent that this would be politically unpalatable for the UK government, regardless of how important it might be for the asset management industry.

Although the June 2017 General Election results didn't deliver the Conservative government the strong mandate it was seeking, even with a weaker hand, exiting the Single Market and removing the European Court of Justice's (ECJ) remit over UK legal issues remains high on the agenda.

Going down the hard Brexit path and leaving the Single Market would mean that UK financial institutions would not be permitted, for a period at least, to passport services seamlessly throughout the EU. This would come as a consequence of leaving the AIFMD and UCITS frameworks that make this possible for EU-domiciled funds.

This will result in UK UCITS and AIFs becoming third country funds, subject to individual national private placement regimes (NPPR). To complicate matters further, NPPRs across the EU are very different, with some simple to navigate, but with other countries effectively banning passport-less distribution outright (e.g. France).

A loss of access to EU markets was cited by a number of respondents to our survey as their biggest Brexit fear.

What's so scary about Brexit? Top investor fears

From the UK:

- Loss of staff and institutions

- Impact on the economy

- Loss of single market access/passporting

From Europe:

- Length/uncertainty of negotiations

- Impact on the economy

- Poor Outcome

From the rest of the world:

- More bureaucracy/regulation

- Further instability

- Impact on the economy

Third-country, second class citizen?

It should be added, however, that the European Securities and Markets Authority (ESMA, the independent EU financial system supervisory authority), is working to develop a framework for third-country passporting, with countries with equivalent regulatory regimes to the EU27 most likely to be granted access. In September 2016, for example, ESMA published its Advice to the European Parliament, the Council and the Commission on the application of the AIFMD passport to non-EU AIFMs and AIFs10, dealing with alternative investment funds. ESMA found, upon assessment, that "there are no significant obstacles impeding the application of the AIFMD passport to Canada, Guernsey, Japan, Jersey, and Switzerland"11. Depending on any changes the UK may make to its current regulatory regime, it may not be very difficult at all for UK domiciled funds to access a marketing passport, after all.

"Substance" abuse

One area the regulators are especially keen on is the status of management companies (ManCos or AIFMs), which provide substance to non-EU firms looking to passport AIFs or UCITS into the EU. Many of these ManCo providers are located in onshore fund centres like Ireland or Luxembourg, and enable non-EU managers to set up AIFs or UCITS without having to establish a physical presence in the EU. They simultaneously delegate portfolio management responsibilities back to the investment manager; this is a much-used cost-saving device.

EU regulatory focus on substance and delegation has, however, stirred concern, particularly as the UK could become a designated third country with no equivalence or passporting rights, according to AIMA. "One of the biggest concerns is whether EU regulators will allow ManCos to delegate investment management to a US or UK or non-EU jurisdiction, that does not have equivalence or passporting, but whose managers are reliant on working with an outsourced ManCo to obtain EU access. This is presently allowed today, but it could hypothetically be endangered in the future," said Jiri Krol, global head of regulatory affairs at AIMA.

Investor disquiet may get louder

Aside from the legal complications of distributing third country funds, many managers are engaging in challenging conversations with investors, who have bought AIFMD and UCITS compliant products. Some clients will withdraw assets from UK managers, nervous that they may not receive similar protections under a new UK funds regime or because they are mandated to purchase units only in onshore, regulated funds, as is the case with some European institutional investors.

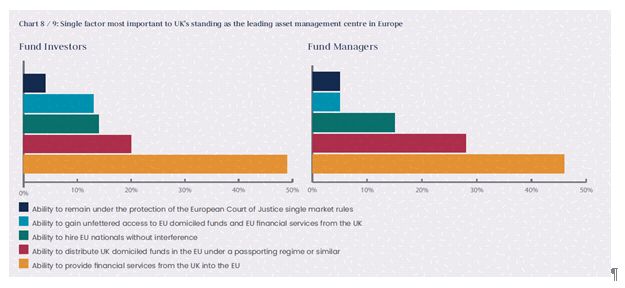

Post Brexit, fund investors, globally, are clear that retaining the ability to provide financial services and fund products from the UK into the EU is vital, if the UK is to remain Europe's leading asset management centre.

As can be seen below, fund managers agree.

Tears on my pillow

So: Brexit was a surprise to many in the European asset management industry, and it will have been a point of discussion for many investors based outside of Europe.

Owing to the popularity of regulated EU fund products in Asia-Pacific and Latin America, Brexit could lead to some divestments in these regions from UK firms.

"Loss of UCITS status would mean that flows from APAC and Latin America are at risk, particularly if a UK UCITS manager is selling a UK fund range. The risk is less so if the UK manager is promoting a Luxembourg fund range. The success of the UCITS brand has been driven by the fact it is a very well understood and good regulatory framework for funds," said Jorge Morley-Smith of the IA.

Even the US market has adopted a more conservative position when allocating to European managers. "Most of our fund products are aimed at US endowments. I have had a number of conversations with US investors who have said they do not want exposure to the UK economy or Europe citing the on-going uncertainty. Equally, others are saying they do not want exposure to European companies whose revenues are reliant on exports to the US market," said one London based hedge fund COO.

There are concerns that UK investors exposed to UCITS and AIFMs in the UK itself may face complications. "Will it be possible for an Irish UCITS vehicle controlled by a UK manager to market to UK investors? It is possible that some UK investors, such as pension funds may not feel comfortable investing in a Luxembourg or Irish fund with a UK manager. There is no evidence to suggest at present that it will be fine," said one UK equity fund manager.

This position, however, was questioned by some. "I am confident UK investors will continue to invest into UK funds even if they are no longer UCITS or AIFs, as the protections that previously existed are likely to continue in a similar form," said Morley-Smith. Should Morley-Smith be proven correct, and the protections post-Brexit are equivalent to EU protections, there seems to be nothing to prevent the UK from qualifying to market in Europe from the UK as a third country.

If European markets want to remain important to investors abroad, they will work hard with the UK team to agree a deal.

MJ Hudson's Brexit Report: Volume 1 can be downloaded at https://www.mjhudson.com/wp-content/uploads/2017/06/MJHudson_Brexit-Guide.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.