Looking ahead: Will a NIP do the trick?

When the second National Infrastructure Plan (NIP2) was announced in November 2011, its key aim was to guarantee investment in infrastructure to support UK growth, and ensure that public and private investment would be effectively co-ordinated. This seminar, held in March 2012, debated the proposals from a funding perspertive.

"NIP2 prioritises nearly 500 infrastructure projects across the country. In fact, in the March 2012 Budget, we promised that the delivery of 280 of these projects would begin this year, with £250 billion worth of investment made available for the infrastructure pipeline. NIP2 outlined the need to attract more private investment into infrastructure. To do this, we aim to make the processes involved in the projects more efficient by reducing project costs, speeding up the consenting system and making the planning process more flexible. Benchmarking and best practice examples will also be reviewed alongside projects to find ways of making them more time and cost efficient."

Keith Waller, Senior Adviser at Infrastructure UK

Private investment is particularly important in the current economic climate, and as part of NIP2 the Government is hoping to encourage more investment from groups which have traditionally shied away from infrastructure projects, or which have previously been only minor stakeholders in these types of projects. One of the key groups here is pension funds.

To date, only the larger pension funds have invested in infrastructure, and their involvement has typically been very small – they currently invest only 2.5% of their total portfolio in this type of asset. However, with pension funds under management totalling £1,924 billion in 2009 in the UK alone, it is understandable that the Government should want to access a bigger slice of the available pie.

Likewise, gilt yields are so low that pension funds are beginning to see infrastructure projects as an attractive alternative asset class, which offers similar long-dated, inflation-linked cash flows to gilts, but with a much better rate of return.

"There are two significant trends driving pension funds to actively consider investments in infrastructure projects. The combination of the UK's population living longer and regulatory changes such as Solvency II mean that funds will have to keep taking in more money and, therefore, will need to find places to invest it."

Judith Donnelly, Partner at Clyde & Co LLP

However, if pension funds are to increase their investment significantly, certain barriers must be overcome. As Alan Rubenstein, CEO of the Pension Protection Fund (PPF), argued: "These include construction risks, the limited availability of brownfield assets, high private-equity style fee structures, a lack of trustee experience in the sector, and an insufficient amount of transparent data".

Such elements have driven the development of the Pension Infrastructure Platform, or "PIP":

"We are proposing the implementation of the Pension Infrastructure Platform to enable smaller pension funds to invest in infrastructure. Funds would join the Platform, and its managers would choose investments on behalf of the members. It would not be Government controlled, but it would be assisted by HM Treasury in measuring new approaches to bidding, for example, with an element of risk taken on by a third party".

Alan Rubenstein, CEO of Pension Protection Fund

PIP investments would be controlled by a management committee, an investment committee and an advisory committee. This structure would ensure that pension funds obtain exactly the information they need to make investment decisions, with in-house management to avoid third-party fees. Construction risk for investors would be minimised by having construction firms own the assets, with finance provided by the PIP. The construction firms would also run the project post-construction.

So far, around 12 pension funds have signed up, and the PIP aims to have around £2 billion to invest when it launches in 2013. Target returns will be in the region of 2% to 5%.

"There are great expectations that the Pension Infrastructure Platform will be a very positive step in overcoming barriers. While some of the detail is still to be established, the fact that 12 pension funds have signed up to the initiative is a very positive signal that there will be a trend towards investment in infrastructure by other pension funds in the future".

Judith Donnelly, Partner at Clyde & Co LLP

Rail: All on board?

Modernising and improving the UK's rail network is possibly the most demanding infrastructure challenge the UK faces, and the controversy over the recent announcement of the West Coast mainline franchise is just one example of the complex and often contentious issues that can arise.

This seminar, held in April 2012, included speakers and delegates from the UK's train operating and rolling stock companies, as well as contractors, consultants, government bodies and regulators.

The debate was wide-ranging, with clear consensus that 'something must be done', but with more diverse perspectives on what that 'something' should be.

The issues: Mind the gap

Sir Roy McNulty's report, Rail Value for Money1, was commissioned by the Government in 2011, and looked in depth at the issues facing the rail sector. These ranged from industry fragmentation (which encourages silo thinking), to the need for immediate returns (which is inherent in short franchises), to the lack of a structure to drive innovation across the industry, and the absence of up-to-date testing facilities.

It does not take an expert to see or experience the problems facing the UK's rail system: any commuter will tell you that the network is ageing and overcrowded, and prices (both for consumers and freight customers) are some of the highest in Europe2. The network is in need of radical and substantial improvements, but the investment required to do this is potentially vast and the Government is looking to reduce rather than increase the huge subsidies the industry already receives.

The elephant in the room is the so-called 'efficiency gap': a 2010 report by the Office for Rail Regulation3 determined that it costs Network Rail up to 40% more to maintain and renew its infrastructure than the best four European operators. Some of this can be attributed to years of under-investment, but there are also systemic problems with the UK industry, ranging from a lack of collaboration to an extended and over-complex supply chain which drives up costs.

"Aggressive revenue forecasting still exists despite the economic crisis, but with most costs fixed and the variables hard to reduce, a lack of innovation and investment is leaving businesses out of pocket."

Gianluca Favaloro, Director at Ernst & Young

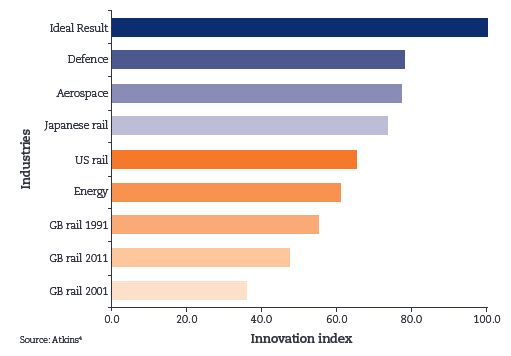

The level of innovation in the industry is also too low: Graham Smith of the Rail Delivery Group shared research published by Atkins4 showing that, while innovation in the UK rail industry has improved over the last 10 years, we still lag behind overseas railways and other industries:

The answers: Collaborate, innovate, decentralise?

One immediate result of Sir Roy McNulty's report was the creation of the Rail Delivery Group, comprised of the CEOs of passenger rail-owning groups, major freight operators and Network Rail. This group is spearheading practical change to bridge the efficiency gap.

"We are leading the charge for change in this area but if the challenges we face were easy, they would have been dealt with before. A key role for the Group is to close the efficiency gap."

Graham Smith, Secretary of the Rail Delivery Group

Participants at the seminar agreed that greater alignment behind common objectives, a more proactive approach to innovation, and more integrated supply chains will be the most positive ways to accomplish this.

"There is a real need for new and evolving business processes, tools and techniques. Sometimes it is in the detail that the best savings can be found. We need clients, contractors, operators and investors to work together to achieve efficiency and an integrated service."

Richard Graham, Head of Strategic Development at Balfour Beatty

'Service' is an important word here. Some attendees observed that there is much the rail industry could learn from the airline business, ranging from the details of ticketing and service standards to the wider way in which the industry organises itself. As private businesses in competition with each other, the airline companies benefit from a relatively flexible regulatory regime. As one of the delegates who attended pointed out, many of the rail sector's complaints about excessive Government intervention might be mitigated if the industry took a leaf out of the airlines' book and assumed greater control of its own destiny.

"The cost to the taxpayers is considerable which is why rail needs to be seen in the context of the broader public policy debate. The irony is that, if the industry does not grip the issues and really deliver, then the Government will feel a need for more – not less – intervention".

Cathryn Ross, Director at the Office of Rail Regulation

Some attendees were strong advocates of more de-centralisation as a way to cut costs per passenger mile. The Government has recently been consulting5 on the possible benefits of devolving more decision-making from the Department of Transport to local bodies such as Passenger Transport Executives and local authorities.

Alexander Jan, Head of Transport at Arup, believes this could lead to cost savings of £100-300 million per year by 2018/19, rising to £300-900 million from 2023/24. It could also improve innovation and benchmarking, make the industry more accountable to its users, with infrastructure decisions made in response to customer demand, and address the need for economic development. Crossrail is a perfect example of a project where local involvement and multi-party funding is contributing to successful implementation.

As Britain's railways carry more and more passengers and freight, the need to find new ways of increasing capacity and efficiency is critical for future growth. Embracing innovative solutions to these high-level problems is something that is pre-occupying the rail industry, and is a priority for the Rail Delivery Group (RDG).

The RDG has focused its activities in the areas where Sir Roy McNulty identified the greatest potential for cross-industry efficiencies. In some cases the RDG has set up powerful ad-hoc groups to look at specific subjects, for example in the areas of asset, programme and supply chain management. In other areas the RDG has undertaken to give guidance to existing cross-industry groups which were looking to improve industry efficiency. It has also recognised the benefit of working with organisations such as the Rail Safety and Standards Board (RSSB) that were supporting the industry in a range of initiatives.

Full support was provided by the RDG to the creation of a rail innovation team, which is now being put in place. It will be led by David Clarke (formerly of the DfT) and will be hosted by the RSSB. The team will manage an innovation fund, with initial pilot funding from the DfT of £16 million. A key part of the programme of innovations will be to offer to support early practical cross-industry projects.

It will:

- Transfer innovation from other sectors into the rail industry

- Cultivate, identify and exploit innovation in UK universities and SMEs

- Secure funding and investment for innovation

- Support the implementation of the outputs of research

- Direct resources at the most transformative and value-adding innovations

- Create a clear and direct pathway for the introduction of innovation

- Support a new culture of innovation in the rail industry

While it would have been easy for the rail industry to just focus on today's challenges, the need to be prepared to take advantage of future opportunities is equally important. The way in which the Technical Strategy Leadership Group (one of the cross-industry groups established by RGD to provide guidance on industry efficiency) and the RSSB have stepped up to the mark on innovation is a demonstration of the forward thinking of the industry.

The support and leadership of the RDG for this new approach illustrates that, by working together, the UK rail industry can recognise and tackle the fundamental issues facing the railways today.

Graham Smith Secretary of the Rail Delivery Group

Air: Turbulence ahead?

In recent weeks the issue of airport capacity in the South East has once again hit the headlines, with a high-profile and increasingly strident public debate about the competing merits of a third runway at Heathrow or an entirely new airport in the Thames Estuary.

The Government insists that all options remain open, and David Cameron has said6 he is fully aware of the need to increase airport capacity: "we are acting now to make use of existing capacity – Gatwick is emerging as a business airport for London, under a new owner competing with Heathrow. But we need to retain our status as a key global hub for air travel, not just a feeder route to bigger airports elsewhere in Frankfurt, Amsterdam or Dubai."

If we are to act, decisions will have to be made – and quickly: if current DfT forecasts prove correct, the three largest London airports will be at full capacity by 20307.

The issue: Keeping London competitive

At this seminar, held in May 2012, the one issue on which all panel participants – and 100% of the audience members – agreed was that London needs to catch up with other major world airports if it is going to maintain its status as an international hub.

As panel member Daniel Moylan (Board Member of Transport for London (TfL) and lead advisor on aviation policy at the Mayor's office) illustrated: twenty years ago, both Heathrow and Paris CDG served 159 destinations; today, however, Heathrow has slipped to 156, while CDG is connected to 231 destinations, and Frankfurt and Amsterdam have seen an even greater increase. Britain has 39 flights a week to three Chinese cities, while Germany has 84 flights to five cities, and France can offer more than double the number of flights to South America as the UK and to twice as many cities.

In the medium to long term, the UK aviation industry will see its competitive position further eroded without significant increases in capacity. As other hubs capture transfer flows, UK aviation will lose its share of lucrative long-haul passenger and freight traffic.

Daniel Moylan spoke for everyone when he commented: "Aviation is crucial to London's future. It pays to concentrate flights out of a hub and encourage people to come to the country to change flights." David Leam, of London First, added: "Doing nothing is not an option".

"We will not be able to lead new industries without the infrastructure in place to support them. We would end up outsourcing all our trade, sending our capacity overseas, just as we did with the docks."

Huw Thomas, Partner at Foster and Partners

The answer: Heathrow, or the Thames Estuary?

Where attendees disagreed, predictably enough, was on the best way to achieve the increased capacity the region and the country needs. Some argued for a third runway at Heathrow, while acknowledging that the campaign to oppose this was possibly the most bitterly fought in recent planning history and that a similar level of opposition would no doubt be encountered again. Even if planning permission could be secured, the practical challenges would be enormous, from clearing a large residential area, to building new access links, and ensuring adherence to European air pollution limits.

A far larger number of attendees were in favour of a new 4-runway airport on an artificial island in the Thames Estuary on the basis that, even if it could be built, a third runway at Heathrow would only succeed in postponing the need for a completely new airport at some future date. Committing to a new airport now would build on the legacy of the Olympics and would support further regeneration in East London.

"Creating a new airport in this location would ensure less noise, less loss of amenity for Londoners and would mean a state-of-the-art hub built for the 21st Century. We need a tough aviation policy from the Government; we need leadership to make the big decisions."

Daniel Moylan, Board Member of TfL

Others agreed with the idea of a new airport in theory, while arguing that the Isle of Grain, which sits further out in the Thames Estuary, would be a better location.

"What we really need is joined-up infrastructure which allows people in London and the rest of the UK quick, simple access to a new airport. A brand-new hub is a possible and viable option, but will require rail, road and sea transport to be coordinated. The current system, where all transport ends in London, leads to over-crowding and the underperformance of systems in the city centre. If, for example, we have a new rail network circumnavigating the city, this would take the pressure off. The Isle of Grain airport – which would displace far less people than building a new runway at Heathrow – would be a very logical step in this debate".

Huw Thomas, Partner at Foster and Partners

To read the entire Report please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.