Welcome to the sixteenth edition of Hotel Market Outlook by Deloitte – our quarterly publication for the UK hotel sector. The outlook is produced using data from an inconsistent sample of hotels collected by STR Global Limited. This data is input into an econometric model developed by the independent economic research firm, e-forecasting Inc, to produce hotel performance outlooks for London and Regional UK.

Hotel Market Outlook capitalises on Deloitte's extensive knowledge of the hospitality industry, enabling us to provide you with commentary and analysis on future trends, as predicted by the e-forecasting model, as well as historic ones.

As always, we hope you will find this publication of interest and we would be delighted to receive your feedback.

Marvin Rust

Managing Partner – Hospitality Deloitte

Overview

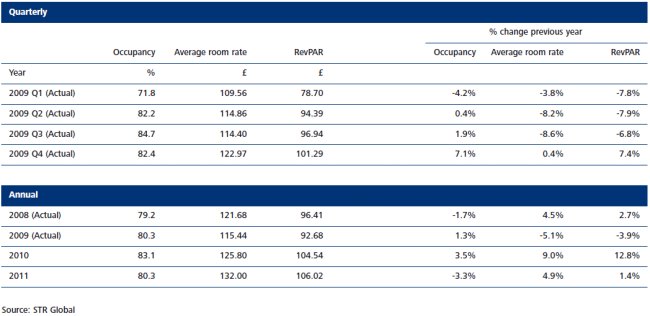

The final quarter of 2009 posted some impressive results for hoteliers in London with revenue per available room (revPAR) rising out of the red, up 7.4% to £101.29. Occupancy was the key driver of growth, while average room rates – which typically lag occupancy in a recovery – saw only marginal improvements. As a result of this strong performance, year-end revPAR was not as gloomy as previously predicted and fell just 3.9%. Meanwhile, hotels across Regional UK posted further revPAR declines for the quarter, down 5.7% as both occupancy and average room rates remained in negative territory. Occupancy is yet to see growth here, the first step towards recovery for the regions and as a result, year-end revPAR saw double-digit declines of 10.4% – the worst performance in the last 20 years when hotel performance suffered as a result of the combined effects of the 1991 Gulf War and the early 1990's recession.

The UK economy has been slowly picking up over the last few months and in Q4 2009, the preliminary estimates are that GDP grew 0.1% – signalling a technical end to the recession. Some analysts are predicting a double-dip recession and with a combination of bad weather in January and a VAT rise will both put downward pressure on at least the Q1 2010 performance. However, the consensus is that economic recovery is most certainly expected to be slower than previously forecast and it is unlikely that GDP will return to pre-recessionary levels for a considerable time. Although inflation spiked to 3.5% in January, as the economy remains relative weak, inflation could drop back below the Bank of England's 2% target later this year.

Retail sales were also hit hard during Christmas and New Year with a 1.8% reduction in sales between December and January. The cold snap which hit the UK early in the year was blamed for the drop in sales, combined with the recession. In addition, as a result of the marginal Q4 GDP growth, the pound has continued to fall against the dollar and euro.

Elsewhere in the world, the Consumer Price Index (CPI) in the US rose at a lower rate than expected during January, up 0.2%. Primarily, the CPI was led higher following a rise in oil, petrol and gas, while house prices fell 0.3%. During the same month, unemployment in the US fell to its lowest level in five months at 9.7%, according to figures from the Labour Department. In Europe, a bailout package worth up to £22 billion is being put together by finance ministers in the euro zone to assist the Greek government claw its way out of debt. The financial assistance would be provided by members of the European single currency through loans and guarantees. Greece's debts currently amount to more than 100% of its GDP.

Outlook For The London Hotel Market

London

Hotels in the capital went from strength to strength during the final three months of 2009 and reported a 7.4% rise in revPAR during Q4 and, as the author predicted in the last edition of Hotel Market Outlook, smashed the model's previous forecast of revPAR falling 3.5%. Occupancy was the key driver behind this growth, rising 7.1% and reaching an impressive 82.4% while average room rates – which lag occupancy in a recovery – saw only marginal increases of 0.4% to £122.97. This strong performance enabled the capital to record a 3.9% revPAR decline for the year, a more favourable result than the 6.5% decline previously forecast and again in line with the author's assumption that the capital would post a revPAR decline of less than 5% for the year.

With sterling still weak against a basket of currencies, London seems set to continue on a fast track to recovery. 2010 is expected to see hotels in London report a staggering double-digit revPAR increase of 12.8% with average room rates driving much of this growth.

The first three quarters of the year will each post double-digit revPAR increases, although this will decelerate towards the latter part of the year. More than £10 is expected to be added to average room rates as they rise to £125.80. Occupancy will also continue to grow and is expected to reach a peak of 87.2% in Q3. This strong performance will extend to all markets with each reporting positive revPAR growth during 2010. Luxury hotels in the capital are expected to see the strongest performance with occupancy increases of 8.1%, allied with increases in average room rates of 9.1%.

The first outlook for 2011 suggests that the strong growth this year will not be sustained next, with revPAR falling back to report a 1.4% increase. According to the model, it is expected that occupancy will fall again in 2011 by 3.3% to just above 80%. Meanwhile, average room rates will continue to rise, albeit at a lower rate than expected this year. In the lead up to the 2012 Olympic Games and the additional room supply expected in the capital, it is not uncommon for there to be a dip in hotel performance before the actual event is hosted.

Outlook For The Regional UK Hotel Market

Regional UK

Unlike the capital, the picture for hotels in Regional UK was not as bright during Q4 2009. RevPAR continued to report declines here, down 5.7% to £41.70. Occupancy only fell 0.4% to 64.3%, while average room rates fell more significantly, down 5.3% to £64.80. With every quarter bar the last posting double-digit revPAR declines during the year, it is therefore not surprising that year-end 2009 saw revPAR fall 10.4% – slightly worse than the 10% predicted by the model in the last edition of Hotel Market Outlook.

Looking ahead, the model predicts a strong start to 2010, with occupancy starting to claw its way back during Q1 and continuing to post growth throughout the year. Although it will take until Q3 for Regional UK to see any meaningful gains in average room rate growth however, it will eventually ensue. Year-end 2010 revPAR is expected to rise 6.3% to £45.20. This will be the result of occupancy rising 4.8% to 68.5%, while average room rates will grow 1.5% to £65.97. All levels of the market in Regional UK will see revPAR growth during 2010 around or above 5%.

The first outlook for 2011 predicts that the strong rebound expected throughout Regional UK during 2010 will continue the following year, with revPAR posting stronger growth than the capital, up 5.6%. While occupancy stabilises at around 2% growth for the year falling just short of 70%, average room rates will post more robust growth, up 3.5% to £68.31.

Future ProspectsHoteliers in London will no doubt be pleased with the results during Q4 2009 after witnessing a year of revPAR decline. With the model predicting solid growth in the capital during 2010, hoteliers should be in for a fruitful year. Regional UK hotels are also expected to return to growth, although at a more muted level than the capital. Growth in Regional UK will be sustained through to 2011 however, with each quarter from Q2 2010 turning in revPAR gains of more than 5%. On the flip side, London hoteliers will start to see revPAR slow from Q4 2010. |

Authors Comment

Throughout 2009 the model lagged the author's views on London's hotel performance. That has certainly now changed with the models prediction jumping from 1.6% to a massive 12.8% in three months. So what happened and is this prediction a possible outcome? Well, Q4 revPAR came in at 7.4% rather than a decline of 3.5% (an improvement of 10.9%) and the start to Q1 2010 has been impressive. Year-to-date gains of 10.1% have been recorded and while I think Q1 will be softer due to the bad weather, Q1 does look set to end with gains in the 10-15% category and if the momentum in recent weeks is maintained, performance will be at the higher end which would be consistent with the model. Whilst the risks seem to be all on the downside, with no further shocks, this could be a year that sees double-digit growth in the capital.

The results for Regional UK are not so heady, with steady and sustained growth expected during the course of this year and into next.

The author's concern in the last edition of Hotel Market Outlook was that hotels in the regions had yet to report occupancy growth but it looks like hotels have now reached a turning point. Year-to-date results for Regional UK have shown a 4.4% rise in occupancy. Although average room rates are still showing declines, this is not unexpected as they will lag occupancy in a recovery.

With the future prospects for the UK economy still hanging on tenterhooks, it does appear that Regional performance is now at a turning point. Occupancy gains are growing with the prospect that Q1 2010 may see revPAR growth. Absent further shocks this could be sustained through 2010.

To keep you up-to-date, Hotel Market Outlook will be available each quarter with the latest monthly indicators that shape the future of the industry.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.