When talking about moving money between investments, there is often a reference to "the dock and the boat": this simply compares the transition to taking a step between two moving points. The more closely they are "lashed together" (aligned), the safer the move. Clearly in more turbulent waters the higher the apparent likelihood of getting wet. Given the current market conditions, we wanted to shed some light on how extreme market conditions impact transitioning.

The initial reaction of investors when markets experience such extreme dislocations is generally to hold position. Indeed, a straw poll of transition managers has indicated that many events are delayed, unsurprisingly... but not all.

Looking at current market conditions we note a mixed rationale for keeping your transition on track.

Transition Exposure Risk

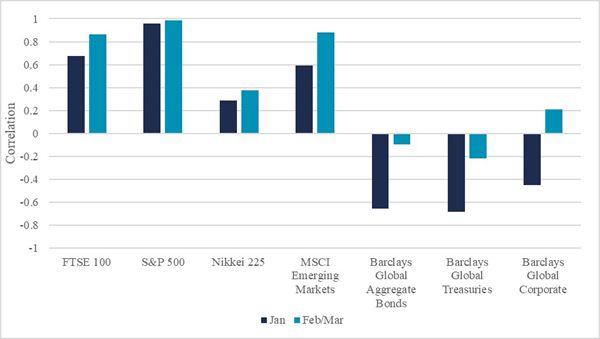

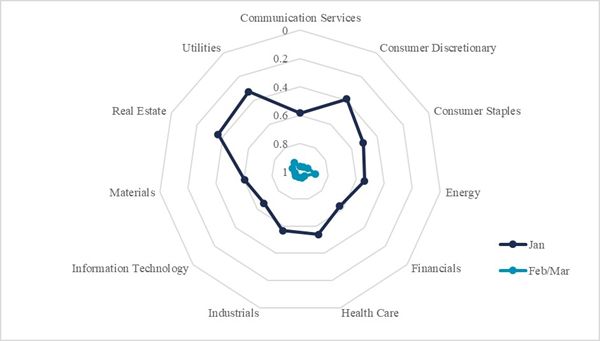

One of the main risks in transitions is driven by correlation between legacy (what you own currently) and target (where you need to be). The reason for delaying most transition events relates to the fear of these risks increasing (or falling between the dock and boat). However, during times of market stress, asset classes generally become more, not less, correlated. Indeed, sector returns surprisingly so. Chart 1 below shows selected correlations for major equity and bond indices vs the MSCI World in January and February/March, whilst Chart 2 shows the "average" correlations for the 11 GICS sectors of the S&P 500 for the same periods- note how they have nearly all "gone to 1" (fully correlated).

Chart 1: Correlation of Major Indices to the MSCI World

Correlations calculated using daily return data from 31/12/2019 to 31/01/2020 and 16/02/2020 to 16/03/2020 respectively.

Chart 2: Average Correlation of the 11 S&P GICS Sectors to Each Other

Correlations calculated using daily sector return data from 31/12/2019 to 31/01/2020 and 16/02/2020 to 16/03/2020 respectively. Numerical average (not weighted by S&P sector %) then calculated from the 11 correlation values of each sector to itself and the other 10.

Don't assume increased volatility means increased tracking error.

Transition Liquidity

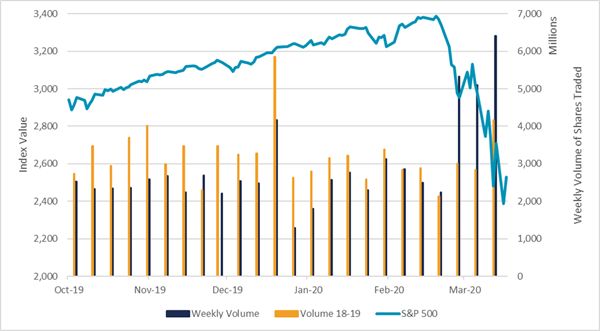

The liquidity of target (buys) and legacy (sales) is critical in determining the costs of transitioning between investments. Lower liquidity implies wider asset price spreads and greater impact on trading, which either increases costs or requires a slower pace, which increases risk. Again, during times of market stress, market volumes are generally significantly higher (see Chart 3). Current trading volumes are around 1.5-2x the previous averages. However, the dynamics of buying and selling are not necessarily a zero-sum game in directional markets (i.e. buys are not necessarily as cheap as sells are expensive).

Chart 3: Value and Volume of the S&P 500, 1 October 2019 to 17 March 2020

The volume spike in December is expected due to the quarterly re-balance of the index. Large trading flows happen on this date due to passive funds needing to re-balance match the new index weights.

Don't assume high levels of liquidity equate to low overall impact.

Transition Asset Volatility

So, whilst volumes are increased and asset/sector correlations are higher, this doesn't necessarily mean transitions will be less expensive and lower risk. In an ideal world, moving between legacy and target investments should be seamless or at least retain the same level of risk. Given transitions rarely live in an ideal world, they are often subject to a tail of illiquid sales or purchases, which restrict progress resulting in disinvestment. During times of market stress any disinvestment will expose returns to value at risk (VaR) which in significantly elevated in line with market volatility. For example, the 95% 1-day VaR of the FTSE 100 stood at 2.07% on the 16 March compared to 1.13% at the end of January.

Be wary of tails which in "normal" conditions would be inexpensive.

Transition Asset Pricing

Probably the main reason for not transitioning at times of market stress is the likelihood that you could be selling and buying mispriced assets. For example, selling underwater equities to buy overpriced government bonds, may be strategically sound, but tactically painful. Furthermore, this also might impact strategic asset allocations, which could be temporarily dislocated by current events. Making changes on an assumption that "normal" conditions will return, could require further corrective action if they don't. Equally, delaying a change of investment in the hope of a return to "normal" conditions, might further increase portfolio risks, if they don't.

Decision to transition should balance tactical risks & costs, with strategic requirements.

Originally published March 19, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.