Originally published in February 2007

Are you looking for a system that will best fit the treasury management needs of your organisation?

The selection and implementation of a treasury management system ("TMS") can be a difficult and complicated undertaking involving, in many cases, significant costs. As a result, expectations are justifiably high and as such a system must deliver significant benefits to maximise the return on the investment and become an acceptable working solution.

The benchmark Treasury Management System (TMS) now covers the following areas:

- cash and liquidity management;

- dealing management;

- settlements;

- interfaces with peripheral systems such as EFT, ERP, market data and on-line dealing;

- accounting including IFRS hedge accounting; and

- risk management.

The way a company measures and analyses its market risks and credit risks will highly influence which transactions will or will not take place. This should not be limited by either the technical ability to bring the critical information together to perform the required analyses, or the flexibility of the tool to calculate the exposure.

Straight Through Processing ("STP")

From front and back office processes to international cash management settlements and payments, automation and straight through processing is currently regarded as good practice.

Similarly, interfacing between the TMS and your financial systems is now no longer a hope, but a reality for the majority of TMSs on the market.

The business case

A key benefit of a TMS is that it gives you the ability to be in control of the overall positions and exposures within your organisation on a world-wide basis, and to achieve automation where manual processes previously prevailed.

Deloitte has significant experience in the identification of these benefits, both hard and soft, to support your business case.

Project scope & planning

Deloitte has considerable knowledge of the TMS market, keeping up to date with regular meetings with system vendors and system demonstrations. Deloitte can advise and support you through the whole chain of selecting and implementing a system, aiming to add value in every step of the process.

A typical approach will consist of a project structure, which will be adapted to the needs of your organisation. This normally consists of the following levels:

1. Steering Committee; and

2. Project Committee/Project Management/ Quality Assurance.

We will work alongside your project teams or provide a full solution for all required services. Our approach is to transfer skills and knowledge, to ensure a successful implementation and adoption within your organisation.

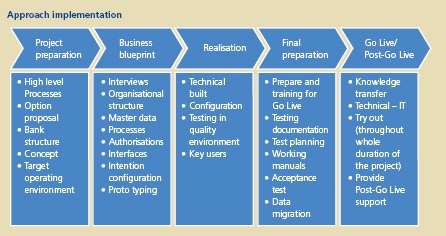

The implementation will be broken down into different phases. Due to our specialist treasury knowledge and experience in implementing TMS’s, Deloitte will provide you with the specific specialists during the different stages of the project (see also ‘Approach implementation’ diagram below).

Outsourcing

Up to a certain level outsourcing of a TMS system will focus on the same issues as described above, with the obvious difference that issues regarding IT-platforms and settings are exchanged for issues regarding for example accessibility and downtime. Outsourcing may bring along certain advantages for companies in terms of cost of ownership, contingency risks and risks which are related to upgrading and migration. In our view an Application Service Provider ("ASP") model is one of the solutions which may be considered in a selection process. Therefore, it needs to be assessed in the same way as any other solution.

Deloitte experience

The Deloitte Treasury and Capital Markets group has accumulated extensive experience of selecting and implementing a wide range of cash, treasury and risk management systems from small niche products to enterprise-wide systems (e.g. Deloitte has been acknowledged by SAP as a ’Special Expertise Partner’ for implementing the SAP treasury module CFM).

On a world wide basis we have experience in supporting organisations in selecting their cash, treasury and risk management systems. The close co-operation between Deloitte professionals from all over the world provides our clients with services which follow their own business models

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.