As part of our series on the key areas of transfer pricing, here we will talk about its importance for businesses that are in the midst of, or are considering, international expansion.

In our experience in working with businesses across a wide range of industries and stages of expansion, we have observed various situations that require strong knowledge and expertise in transfer pricing. International expansion may take the form of moving into new countries by incorporating new entities, acquiring existing businesses in new territories, or establishing physical presence overseas. Such expansion measures bring with them considerations that businesses must consider to ensure that the new transactions between related entities are priced in accordance with transfer pricing guidance/rules. A key objective of doing so, amongst others, is to manage the risk of double taxation.

MATTERS TO CONSIDER WHEN PLANNING YOUR EXPANSION STRATEGY

Businesses will have a plethora of considerations when going into new markets. These typically include assessment of local demand for products and services, analyses such as SWOT and PEST, regulatory matters, supply chain structuring, recruitment of appropriate personnel, market penetration strategies, etc. Tax should also be taken into account as a potential area of risk that needs to be carefully managed. One such area is transfer pricing, which most tax authorities around the world would expect to be applied to transactions that arise between entities within the same group.

A PRACTICAL EXAMPLE – SOFTWARE BUSINESS

To illustrate transfer pricing considerations, we have outlined below a practical and simplified example that relates to the expansion of a U.K.-headquartered B2B software provider.

These principles may be applied regardless of the industry or countries in which the business operates.

UKCo develops, owns and provides business software to the banking sector. UKCo's customer base is increasing, and hence UKCo management have been considering the feasibility of setting up a subsidiary, USCo. This is partly to satisfy customer demands to set up contracts with a local U.S. entity

UKCo is also looking to continually develop and enhance its underlying software. UKCo plans to also set up a Bulgarian subsidiary called BUCo. This entity aims to employ local personnel and undertake software development work under the supervision of UKCo. The above expansion is likely to lead to related party transactions, which are depicted below:

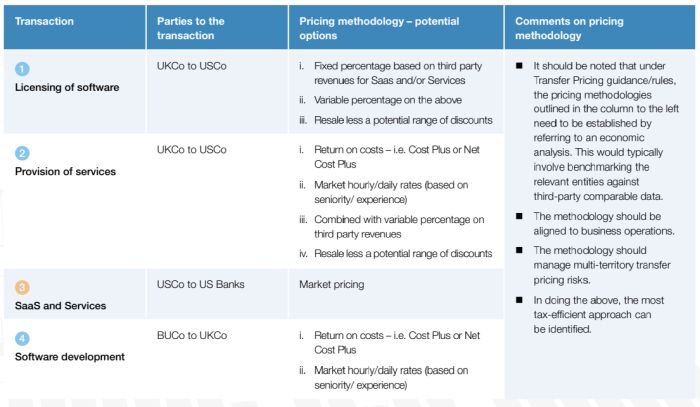

There are several approaches which can be taken to price these transactions. They depend on the facts and circumstances pertaining to the different entities, together with management preferences and other business considerations, e.g., alignment to KPIs. The overriding objective should be to manage multi-territory transfer pricing risk (i.e. the risk of double taxation). In doing so, it is often possible to select the option that is most tax efficient for the group. Furthermore, the option should fundamentally be aligned to, not interfere with, the business operations.

The table below outlines the variety of pricing options available for the related party transactions.

Finally, there is the question of funding. It is likely that UKCo may finance the overseas entities with a combination of debt and equity. What represents arm's length levels of debt and associated financing costs is a separate transfer pricing question that we will answer in a future article.

Addressing these transactions within the transfer pricing legislative framework would ensure that the group is compliant with local rules and regulations from the onset. It will prove more complex, and likely costly, to fix such issues with retrospective effect due to a tax audit, or in preparation for an exit/IPO. For companies looking to grow internationally, our recommendation would be to consider transfer pricing as early as possible to avoid potential pitfalls that could lead to double taxation, penalties and/or "price chipping" on exit.

Originally Published February 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.