This update was originally published in July 2007.

This newsletter reports on two important decisions concerning community law released today, the House of Lords' decision in the Sempra Metals case (whether compound interest is recoverable on compensation for breach of community law claims) and the decision of the European Court of Justice in C-231/05 Oy AA (cross border contribution payments).

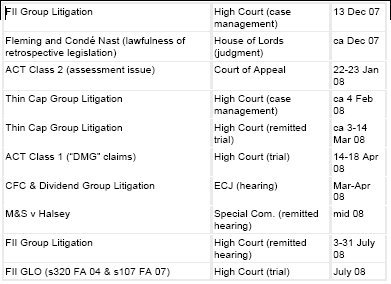

Upcoming and Anticipated Dates

Upcoming Seminars and Presentations

Discounts to these IIR and Lexis Nexis conferences are available for Dorsey clients (please contact us for the "VIP" number).

The Sempra Metals Case

In this case the House of Lords has asked what level of interest should be paid to compensate for the cash flow disadvantage in the early payment of corporation tax in breach of community law. The circumstances are of course the payment of ACT which, had a group income election been available cross border, could have been delayed until the corporation tax liability date some nine months or so later. In the Hoechst case the ECJ decided that this was a breach of community law and the UK had to compensate for the cash flow disadvantage suffered in the early payment of tax (or disgorge the benefit it had received by the early payment of tax). The question was, did the provision of an effective remedy of community law require interest to be calculated at any particular rate and on a compound or simple interest basis?

The case is directly relevant to any circumstance where tax had been paid earlier than it should in breach of community law, so that what has been suffered is a cash flow disadvantage. Such circumstances include not only the payment of both utilised and unutilised ACT but also circumstances like the early payment of corporation tax where interest payments have been deferred beyond 12 months by reason of the treaty clearance and thin cap provisions (ie. delaying when the interest deduction was taken into account). It will also arise where reliefs have been utilised to shelter unlawful tax imposts which subsequently result in lawful tax being paid earlier than it should.

The case may also have a relevance to the repayment of overpaid VAT or any interest based claims.

The House of Lords by a majority has used this occasion to re-state the law of restitution generally in England. In basic terms the tax payer has succeeded and interest for the cash flow disadvantage should be calculated on a compound basis. Lord Nicholls also suggests that the compounding effect should not stop at the end of the period during which the tax was paid early, but should continue to take into account the ongoing benefit received by the government from the early payment of tax. The Revenue however, have succeeded in arguing that the rate of interest should not be a commercial rate, but rather the actual rate of borrowing of the UK Government which would be on more preferential terms than could be obtained commercially.

Depending on the time periods concerned, this could of course greatly increase the value of current claims. However, perhaps of even more use to current claimants is the court's re-statement of the law of restitution. In recent weeks the Revenue have in several cases sought to raise new defences not previously relied upon by them against community law claims. The decision of the House of Lords would seem to make many of these arguments much more difficult for the Revenue to run and in some circumstances are no longer viable.

In the Thin Cap GLO the ECJ had held that certain types of tax disadvantages were damages claims which could only be compensated for if certain conditions were met, but with the proviso that that characterisation "does not preclude the state from being liable under less restrictive conditions where national law so provides". The re-casting of the English law of restitution in this judgment would seem to go a long way to suggest that even if claims are damages claims at community law, they are recoverable as of right under the English law of restitution without the need to meet these conditions.

All in all therefore, the Sempra Metals case is an extremely encouraging result.

C-321/05 Oy AA

The Marks & Spencer group relief case concerned the circumstances in which the losses of non resident subsidiaries could be surrendered cross border for group relief purposes.

Group contribution systems (eg. Sweden, Norway, Germany and Finland) achieve the same result by the reverse mechanism. The profit making company makes a cash payment to the loss making company which is deductible in the hands of the payer and creditable to tax in the hands of the recipient. The question in this case was whether group contribution payments could be permitted cross border to enable the Finnish subsidiary to obtain a deduction against its profits for a contribution payment made to its UK parent.

The EC Commission which had supported the tax payer in Marks & Spencer opposed the tax payer in the Oy AA case seeing important distinctions in practice. In particular a group contribution payment need not be matched against any loss (although it is accepted that that is its logical purpose). The UK also contended in its submissions to the ECJ that it would not tax the group contribution payment on receipt, giving rise to the curious possibility that group contribution payments from subsidiaries resident in those countries to the UK might be untaxable, whereas similar payments made as dividends would be.

The Advocate General in her opinion in September appeared to conclude that the taxability of receipt was not necessarily significant but that, applying Marks & Spencer, the payment could only be made to relieve a loss beyond use in the local jurisdiction which did not appear to be the case on the facts of Oy AA.

The court's judgment of today follows the Advocate General. Group contribution systems can legitimately prohibit deduction for contribution payments cross border in order to prevent the artificial movement of income to jurisdictions where it will be taxed more favourably. The exception in relation to group relief systems (whereby the loss can be surrendered cross border if it cannot be used locally) does not appear to the court to follow in relation to group contribution systems where the extension of deduction for cross border contribution payments would have the effect of allowing groups of companies to choose freely the member states in which their profits were taxed.

The outcome therefore appears to be that group contribution systems can be more restrictive in the availability of cross border group consolidation than group relief systems.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.