Key findings

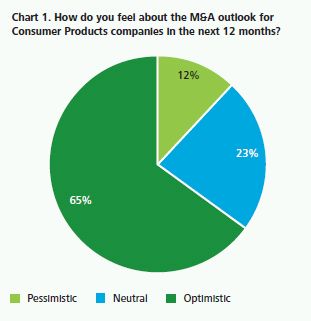

- Despite considerable economic uncertainty and fragile consumer confidence, two thirds of respondents are optimistic about the M&A outlook for the Consumer Products sector in the next twelve months.

- Delivering top line growth and realising economies of scale in challenging market conditions are cited as two key drivers of Consumer Products M&A activity. Respondents also highlight the increasing importance of M&A activity in emerging markets and faster-growing categories to drive growth in the future.

- Continuing economic uncertainty and price expectation gaps between buyers and sellers are predicted to be the key factors that are likely to constrain deal activity in the Consumer Products sector. Nevertheless some respondents believe that distressed opportunities will increase as sellers start to become more realistic on valuation levels.

- Consumer Products leaders are also broadly optimistic on the outlook for business profitability with only a quarter of respondents anticipating falling profits in the next twelve months.

- Companies are working hard to respond to current changes in consumer behaviour, however, in the longer term, survey respondents were more divided on whether the recent challenging economic conditions represent a watershed in consumer behaviour.

M&A outlook

Larger scale consolidation and future growth

Around two thirds of respondents were optimistic on the M&A outlook for Consumer Products companies in the next 12 months.

In response to an open question on M&A outlook they noted:

"Overall positive ... as the search for growth in low growth western economies becomes more challenging."

"Optimistic but with a bit of caution."

"Consumer Products companies are cautiously looking for growth opportunities to maintain and improve returns, but with previous financing routes being constrained, such growth has to be very sure and delivered quickly."

"Tack-on acquisitions (international expansion) and clean-up divestments will be the main activity aside from in a few categories where larger scale consolidation is needed."

"There are definitely deals to be done for those with available finance, but it is the ability to get those holding identified targets to sell, that is key."

So whilst the general feeling for prospective M&A activity is positive, a number of potential barriers were also identified which, in turn, could hamper deals completing.

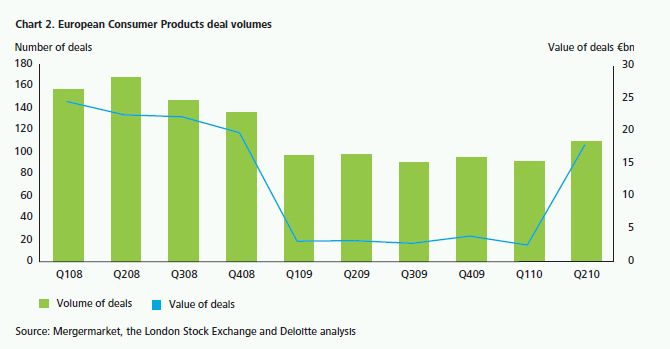

The deal data in Chart 2 reflects disclosed deal values where the target or seller is European. Deal values and volumes fell significantly from the end of Q408 but show some signs of recovery with the uptake in Q210, partly reflecting the return of the megadeal with Kraft/Cadbury (€15bn) recorded in this period.

M&A drivers: What will cause increased activity?

In terms of the main drivers for M&A activity, the need to continue to deliver economies of scale was by far the most critical factor, perhaps reflecting the pressure many companies have felt to offset reductions in gross margin, as well as the need to drive further cost base efficiencies if profitability levels are to be maintained or grown.

Interestingly, the next ranked deal driver (distressed driven deals) indicates that rapid economic recovery is an unlikely scenario. Distress driven deals reflect the opportunity for companies who have managed cash carefully and/or have access to available funds, to target those who either face financing constraints, are unloved by analysts and shareholders, or need to undergo major restructuring to return to profitable growth.

"Share prices for (a number of companies) are trading close to all time lows and receiving unflattering expert comment ... some industry consolidation/change is inevitable. 2011 could be a year of structural change."

"I believe consumers remain cautious and do not expect demand to pick up materially in the next 12 months. I do not expect much 'positive M&A' activity but believe there are likely to be a number of opportunities to acquire distressed businesses at low prices."

The search for growth by international expansion was also identified as an important driver by a number of companies. However, a number of respondents identified that there was a lack of suitable targets of scale available in emerging markets.

In terms of other drivers of future deal activity, re-shaping existing product portfolios, accessing adjacent platforms and enabling category leadership were also highlighted by respondents.

"Deals would be more defensive in nature in that they are intended more to protect a company's position rather than expand the business."

Whilst the return of private equity buyers and presence of cash rich corporates were seen as an important deal driver, it was noticeable that the relatively low ranking of undervalued targets may indicate that active buyers did not see significant bargain pricing in the current market.

M&A outlook: Restrictive factors

We were also interested in our respondents' view on potential obstacles to M&A activity over the next 12 months.

Price expectation gaps between buyers and sellers was by far the most common response.

Continued uncertainty around the economy and shareholder caution were also flagged as potential constraints on M&A activity. However, one respondent noted:

"Vendors, particularly distressed vendors, will become more realistic about the acceptable valuation of the businesses they need to sell. Some deals won't happen because not every vendor is a forced seller, and they can afford to wait. Large corporates, particularly those with low P/E multiples will have to unload because of shareholder pressure."

M&A outlook: Valuation trends and drivers

In terms of valuation trends, around two thirds of our respondents expect valuation levels will be broadly unchanged over the next 12 months, with the balance split evenly between increases and decrease.

No respondents envisaged significant movements upwards or downwards in valuation. However, just over a quarter of our respondents saw the potential for a greater use of earnouts in transactions, perhaps reflecting the caution in pricing if anticipated future growth is to be factored in.

When asked an open question about valuation trends for Consumer Products companies in the next 12 months, the general sentiment was covered by the following responses:

"Overall, I expect valuations may fall as distressed exits represent a greater share of the overall transaction volume. For good quality assets though, I expect prices to remain high due to the levels of private equity funding still available."

"Valuations have been brought down by poor consumer confidence, reduced availability of finance and the increased cost of finance. As these issues reduce and then reverse, there will be some upward movement in pricing."

In terms of valuation drivers, synergy benefits for acquirers and strong, differentiated brand/product propositions were seen as having the largest influence on valuations of Consumer Products companies. The importance of anticipating, identifying and presenting a well defined synergy case and/or clear articulation of brand/product positioning appears key if sellers wish to optimise valuations and critical to buyers if they wish to succeed in competitive auctions.

Business profitability and strategic responses

In light of the significant level of negative sentiment expressed in the media over the weakness of the economic recovery and continued speculation over a double dip, asking respondents for their views on levels of business profitability over the next 12 months may have resulted in a bout of potential doom-mongering.

Encouragingly around three quarters of our respondents saw stable or improving levels versus only a quarter who anticipate profitability levels falling over the period.

It will be interesting to see if there are significant changes in sentiment in six months time following the government spending review and tax increases.

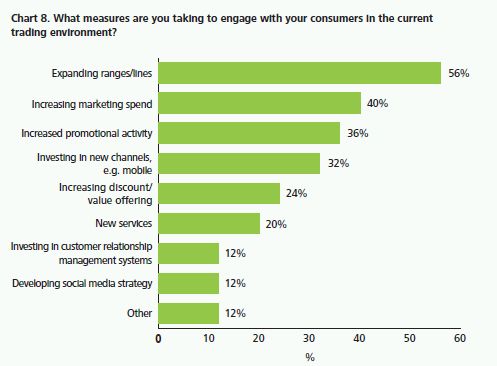

In response to changing consumer behaviour and markets, Consumer Products companies are looking to invest more money in expanding product ranges and lines, as well as increasing promotional and marketing spend to engage with consumers

"Differentiated product offering, ongoing cost reduction initiatives and ability to pass price increases on given commodity inflation (partly currency driven)."

"Need to focus on all aspects of the marketing mix. Relentless cost cutters will eventually run out of steam."

"Innovation and cost leadership, a difficult balance to achieve in practice. Still a strong emphasis on cash management to withstand further shocks to the system that may come."

"Be ready if we do see a double dip by developing/ re-launching the value end products to match consumer needs."

Macro outlook: Consumer confidence

Since the nadir in the level of consumer confidence in June 2008, the return to pre-Lehman Brothers confidence levels still has some way to go. Improvements in confidence levels since the recovery in the second half of 2009 appear to have flattened more recently reflecting continued uncertainty over the strength of the economic recovery.

Whilst a sizeable proportion of our recipients see little change in consumer confidence levels over the next 12 months, a higher proportion see confidence worsening rather than improving. Given the potential drag of fiscal measures on consumer spending (VAT increases, higher tax rates and reduced public spending), this overall response is perhaps not unexpected

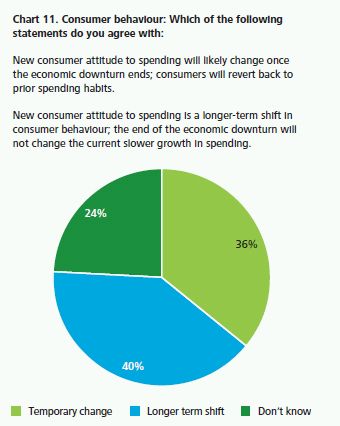

There has also been much public debate whether the slowdown has resulted in a permanent change in customer attitudes towards spending and whether the era of conspicuous consumption is over. Our respondents' views on this were finely balanced, with a broadly even split between those who saw reduced consumer spending as a temporary phenomena and those who saw a more fundamental long term shift had taken place.

When asked an open question about how consumer behaviour is impacting business respondents provided a number of themes:

"Consumers have become more discriminating, not necessarily buying the lowest priced offering, but seeking out value."

"We have seen an increasing cost to acquire new customers and a lower propensity among active customers to increase their average order value."

"A requirement for more value for money lines and more promotional activity."

"Changes to product mix (consumers down trading) consequently impacting profitability."

"We see a lot of churn as consumers cherry pick from the products on offer ... need to be innovative and resourceful to respond to this."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.