Introduction

The International Accounting Standards Board (IASB) and the U.S. Financial Accounting Standards Board (FASB) (collectively the "Boards") are undertaking a joint project that would overhaul the current leasing model. The objective of the project is to develop a new approach that would better reflect the economics of a lease and provide greater transparency to users of financial statements. In March 2009, the Boards issued a Discussion Paper (DP) that resulted in the receipt of over 300 comment letters including letters from a number of the world's largest retailers. It was clear from these comment letters that many of the tentative views expressed in the DP would have a significant effect on financial reporting in the retail industry. After close to a year of joint deliberations, the Boards issued an Exposure Draft, Leases, (ED) on 17 August 2010. The ED proposes new models for lessees and lessors and would replace the existing standards and related interpretations under IFRS and US GAAP.

This publication highlights many of the key proposals in the ED and provides insights on how these proposals could affect the retail industry.

Overview of lessee accounting

At the heart of the proposals for lessees is the elimination of the operating lease accounting model and the introduction of a right-of-use model. A lessee would recognise an asset representing its right to use the underlying asset during the lease term and a corresponding liability for its obligation to pay rentals. The key requirements of the ED for lessee accounting can be summarised as follows:

Contracts with service components

If a contract contains a lease, but also contains a service component, the ED would generally not apply to the 'distinct' service components within the contract (the distinct service components would be accounted for in accordance with other GAAP).

A service component would be considered distinct if the entity or another entity either sells an identical or similar service separately or the entity could sell the service separately because the service has a distinct function and a distinct profit margin. Lessees would allocate the payments required under the contract between the distinct service and lease components based on the guidance in paragraphs 50-52 of the Revenue Recognition ED, Revenue from Contracts with Customers (i.e., on the basis of the standalone selling prices). However, a lessee would treat the entire contract as a lease if it is unable to allocate the payments between the distinct service and lease components or if the service component is not distinct.

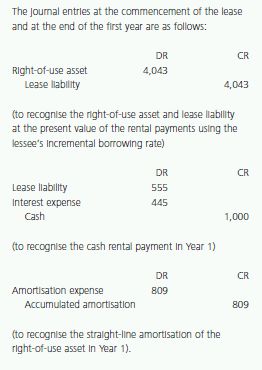

Apply basic lease model

Under the proposed model, a lessee would recognise at the lease commencement date a right-of-use asset representing its ability to use the leased asset for the lease term, and a corresponding liability for its obligation to pay rentals. This is a change from today's lease accounting rules that distinguish between operating and finance leases (referred to as "capital leases" under U.S. GAAP).

A lessee would recognise a right-of-use asset and a lease liability for all leases. Other than short-term leases (discussed below), the initial measurement of the lease liability would be at the present value of the lease payments, discounted using the lessee's incremental borrowing rate or the interest rate implicit in the lease, if it can readily be determined. The right-of-use asset would be initially measured at the same amount as the lease liability plus any initial direct costs. The ED does not address the effect of non-monetary lease incentives on the initial measurement of the right-of-use asset and lease liability.

After the date of commencement of the lease, a lessee would measure the lease liability at amortised cost and recognise interest expense using the interest method. A lessee would amortise the right-of-use asset on a systematic basis over the lease term or useful life, if shorter. IFRS preparers would be permitted to revalue their right-of-use assets in accordance with the revaluation model in IAS 16 Property, Plant and Equipment if they revalue (1) all owned assets in the class of property, plant and equipment and (2) all rightof- use assets relating to the class of property, plant and equipment to which the underlying asset belongs. Revaluation of the right-of-use asset would not be permitted under US GAAP.

Lessees would be permitted to use a simplified form of lease accounting for those leases that have a maximum possible lease term of twelve months or less. Under this simplified accounting, lessees could elect on a lease-bylease basis to measure the lease liability at the undiscounted amount of lease payments and the right-of-use asset at the undiscounted amount plus initial direct costs. Lease payments would be recognised in profit or loss over the lease term.

Assess the lease term

In what is a significant change from the current leasing rules, the expected lease term would be based on "the longest possible term that is more likely than not to occur". A lessee would need to estimate the probability that each possible term would occur by taking into account explicit and implicit renewal options or early termination options included in the contract and by operation of the statutory law. The ED lists factors that a lessee would consider in assessing the probability of each possible term.

Assess the impact of contingent rentals, term option penalties and residual value guarantees

In another significant change from today's rules, a lessee would be required to determine the lease payments payable during the lease term using an expected outcome approach that is described in the ED as "the present value of the probability-weighted average of the cash flows for a reasonable number of outcomes". The lease payments include estimates of contingent rentals, payments under residual value guarantees between the lessee and lessor and payments to the lessor under term option penalties. When determining the present value of the lease payments, a lessee would develop reasonably possible outcomes, estimate the amount and timing of cash flows for each outcome, calculate the present value of those cash flows and probability weigh the cash flows for each outcome.

The ED includes other guidance for contingent rentals that depend on an index or a rate. A lessee would determine the expected lease payments that are based on an index or a rate using forward rates if they are readily available. If forward rates are not readily available, the lessee would use the prevailing rates.

Reassess lease term and lease payments

The estimated lease term and lease payments would need to be reassessed at each reporting date with a corresponding adjustment to the lease liability (although a detailed examination of every lease would not be required unless there is a change in facts or circumstances that indicate that the lease term may need to be revised). A reassessment of the lease term would be recognised as an adjustment to the right-ofuse asset. A reassessment of the expected amount of contingent rentals, term option penalties and residual value guarantees arising from current or prior periods would be recognised in profit or loss to the extent those changes relate to the current or prior periods. Changes related to future periods would be recognised as an adjustment to the right-of-use asset. A lessee would not change its discount rate unless the contingent rentals are contingent on reference interest rates in which case the lessee would need to revise the discount rate for changes in the reference interest rates and recognise changes in profit or loss.

Lessor accounting

The ED also addresses lessor accounting. Two accounting models are proposed for lessors – the performance obligation approach and the derecognition approach. A lessor that retains exposure to significant risks or benefits associated with the underlying asset would apply the performance obligation approach; otherwise, the lessor would apply the derecognition approach.

- Under the performance obligation approach, the underlying asset remains recognised in the lessor's statement of financial position. The lessor recognises a receivable for the expected rental payments, and a corresponding liability. The lessor would recognise income as the performance obligation is reduced over the lease term and interest income on the receivable.

- Under the derecognition approach, a lessor would recognise an asset for the right to receive rental payments, remove a portion of the carrying amount of the underlying asset from its statement of financial position and reclassify as a residual asset the portion of the carrying amount of the underlying asset that represents the lessor's rights in the underlying asset that it did not transfer. Additionally, a lessor would recognise income and expense in profit or loss.

Key industry concerns

A key feature of the Discussion Paper (and Exposure Draft) was the proposal to introduce a single accounting model for lessees that would reflect the assets and liabilities arising from all lease contracts in the statement of financial position (i.e. to capitalise the leases currently classified as operating leases). For entities in the retail industry, leases for retail space (mainly store and warehouse locations as well as corporate offices) that have historically been accounted for as operating leases with rental expense recognised on a straight-line basis would no longer be "off balance sheet". The majority of the retail industry expressed their concerns over the proposals in the Discussion Paper as they believed that the proposals would increase the complexity of financial reporting and decrease the understandability of a business model that currently relies on the use of "simple" operating leases. There was some support in the retail industry to develop a principle-based approach based on an approach similar to current IFRS requirements.

The key themes of many of the comments letters on the DP from the retail industry were:

- Risk of reduced transparency – many respondents shared the view that the proposed guidance in the DP was extremely complex and its adoption might lead to a decreased understanding of the financial statements. Retailers were concerned that their financial statements would become incomprehensible for their key stakeholders.

- Comparability – many respondents thought that the subjective nature of the estimates related to the lease term and contingent rentals might lead to lack of comparability among retailers with identical contractual commitments. These concerns result from the need to estimate lease terms and contingent rentals over long periods (often up to 30 years).

- Risk of increased administrative burden – many respondents thought that the proposals in the DP would significantly increase the administrative burden on retail businesses to analyse all leases in the organisation. Several retailers indicated that the requirement to estimate the lease term and contingent rentals would not only result in substantial costs upon transition but would also lead to substantial increase in on-going operating costs related to regular updates for what could be hundreds or thousands of leases.

- Significant measurement uncertainty – many respondents indicated that a potential consequence of adopting the proposals in the DP would require long-term forecasts of potential store level revenues as well as long-term country inflation rates for purposes of estimating contingent rentals. Many respondents believed that making estimates over a long period of time would be prone to error and would not be reliable.

We have reviewed the responses from retailers to the questions posed in the Discussion Paper and have identified six key areas of the ED that we believe may result in a significant change in accounting practice within the retail industry.

The examples herein are intended to illustrate the application of the proposals using very simple fact patterns. The calculations may be considerably more complex in practice depending on facts and circumstances.

Issue 1 – Impact of capitalisation of all leases on financial statements

The proposals would significantly affect the accounting for lease contracts for lessees. The effect of the proposals is not limited to complex leases (those that include options and guarantees). The accounting for "simple" leases will also be significantly impacted by the proposals. The main effects of the proposals are:

- Operating lease treatment would be eliminated and assets and liabilities would be recognised in the statement of financial position for all leases. The increase in debt could lead to a possible deterioration of key financial ratios related to leverage, interest cover and debt to equity ratios. A higher asset base could also lead to lower asset turnover ratios and could lead to a lower return on capital.

- The pattern of expense recognition would change for leases currently classified as operating leases. Total lease related expense would be front-end loaded as compared to current operating lease treatment due to the recognition of interest expense using the interest method.

- The classification of interest and amortisation expenses as financing and operating expenses, respectively, would affect operating income as well as increase Earnings Before Interest Taxes Depreciation and Amortisation (EBITDA).

- Lease payments would be treated as financing cash outflows in the statement of cash flows. Under current IFRS and US GAAP guidance, operating lease rental payments are treated as an operating cash flow. Thus, for leases currently classified as operating leases, operating cash flows under the new model would be higher than under current rules.

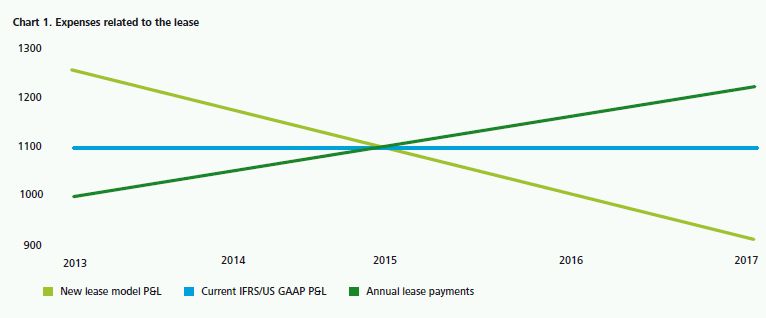

The proposals would modify the pattern of expense recognition. Despite the fact that total expense would be unchanged over the entire lease term, rental expense will be front-end loaded compared to current straight-line expense recognition for operating leases due to interest expense being greater in the earlier years of a lease. This can have a significant negative impact on earnings for companies that enter into an increasing number of new leases. As can be seen in the table total lease related expense under the proposals decreases from CU1,254 in Year 1 to CU928 in Year 5, compared to a rental expense of CU1,105 for each year using the straight-line method under current accounting guidance. In Year 1, the expense is 13 percent greater and in Year 5 is 16 percent lower as compared to the straight-line method. These differences increase for longer term leases which are more common in the retail industry.

Key implementation issues

The elimination of the operating lease accounting model would have significant financial, business and operational consequences, including:

- The requirement to recognise an asset and liability for all leases may have a significant impact on a lessee's financial position and performance ratios such as asset turnover ratios, debt to equity ratios and EBITDA. Lessees need to consider carefully the effect of this change on their borrowing capacity, debt covenants, forecasting models and performance based compensation plans.

- The new lease model requires all leases other than short-term leases to be recognised initially at the present value of future lease payments. This calculation is significantly more complex than the current accounting for operating leases. Lessees will need to establish accounting policies with respect to how the calculations are performed and the selection of input variables, such as the discount rate. The complexity of the calculations increases significantly if terms such as contingent rents and variable lease terms are added as discussed in issues 2 and 3.

- The complexity of the calculations and the need to track the different components of the right-of-use asset and lease liability will mean that accounting systems will likely need to be updated or enhanced and lease contract management systems will need to be more closely integrated with lease accounting systems. Additionally, controls and processes may need to be adapted to ensure compliance with the final standard.

Issue 2 – Accounting for contingent rentals

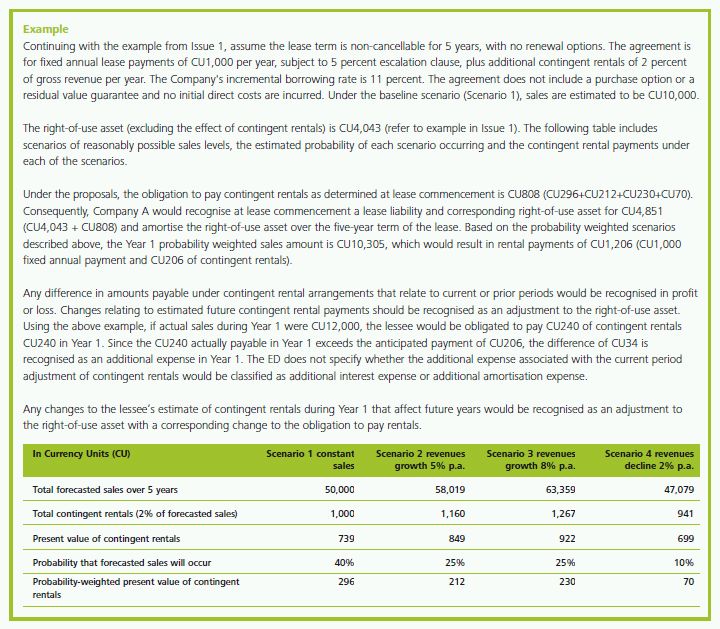

Contingent rentals based on a percentage of sales are common in the retail industry. Under the current accounting requirements, contingent rentals are generally recognised as an expense when they are incurred and do not affect the lease accounting at the date of lease inception. The proposals would require lessees to include an estimate of contingent rentals in the measurement of the lease liability at the date of lease inception, using a probability-weighted approach and reassess that estimate.

The following example illustrates this concept:

Key implementation issues

The requirement to develop estimates of contingent rentals in the measurement of the lease liability using a probability-weighted approach, and the requirement to reassess those estimates, will require significant implementation efforts. Estimates of contingent rentals based on percentage of future sales for very long periods of time (in practice often over 20 years) are highly uncertain and difficult to estimate. Since actual results are likely to differ from the estimates, lessees may be required to make adjustments continually to account for the difference between the estimates and actual contingent rentals for both the current period and future periods. Modifications to accounting systems and internal processes would be required to accommodate the ongoing re-assessment requirements, especially in the context of hundreds of outlets and thousands of leases. Substantial time and effort would be required to reassess estimates given that each lease could be unique. Changes in the estimates of the contingent rentals may lead to significant volatility in recognised assets and liabilities. Consequently, education of shareholders and analysts would be important.

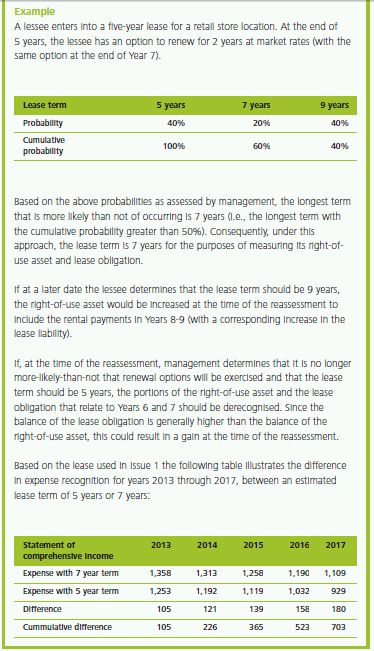

Issue 3 – Determination of lease term

The ED defines the lease term as "the longest possible term that is more likely than not to occur". An entity would need to estimate the probability that each possible term would occur by taking into account explicit and implicit renewal options or early termination options included in the contract and by operation of the statutory law. This is a change from the current requirement to consider optional periods as part of the lease term only when they are reasonably certain (under IFRS) or reasonably assured (under US GAAP) of occurring. Consequently, there would be a lower threshold for evaluating renewal periods. This requirement to estimate the lease term would be particularly significant for the retail industry, as it is common for a lease contract to include a relatively short initial contractual period with multiple optional renewal periods that may extend beyond 20 years.

The ED lists factors that a lessee would consider in assessing the probability of each possible lease term, including:

- contractual factors such as level of lease payments (e.g., bargain renewal rates) and contingent payments (e.g., termination penalties, residual value guarantees, refurbishment costs);

- non-contractual factors such as the existence of significant leasehold improvements, costs of lost production, relocation costs, and tax consequences;

- business factors such as whether the underlying asset is crucial to the lessee's operations or is specialised in nature; and

- past experience or future intentions of the entity.

Like the estimate of contingent rentals discussed in Issue 2, the estimate of the longest possible term that is more-likely-than-not to occur will involve a high degree of judgement based on all relevant facts and circumstances. For example, the existence of significant leasehold improvements and the strategic importance of the retail space to the lessee's continuing operations would be important factors to consider in determining the expected lease term. Given how leases are typically structured in the retail industry, it is likely that at least some renewal periods would need to be included as part of the estimated lease term.

Key implementation issues

The requirement for a lessee to evaluate regularly whether there are new facts or circumstances related to lease term assumptions will be particularly challenging for entities that enter into a large number of leases and would represent a significant change from the current lease accounting model. Although lease accounting is performed on a lease by lease basis, entities with large portfolios of leases may need to develop robust accounting policies that are not only compliant with the ED's requirements but also allow for a practical application of those requirements (e.g., entities may need to develop typical indicators that would trigger a change in the accounting lease terms for a particular type of leased asset). Additionally, an increased level of subjectivity of management estimates might lead to a lack of comparability among retailers. Changes in the estimates of the lease term might lead to significant volatility in recognised assets and liabilities and in profit or loss. As discussed under Issue 1 and 2, this may require changes and enhancements to information systems and education of shareholders and analysts.

Issue 4 – Service and lease components of the contract

If a contract contains a lease, but also contains a service component, the ED would generally not apply to the service components within the contract if they are "distinct". A service component would be considered distinct if the entity or another entity either sells an identical or similar service separately or the entity could sell the service separately because the service has a distinct function and a distinct profit margin. Lessees would allocate the payments required under the contract between the distinct service and lease components based on the guidance in paragraphs 50-52 of the Revenue Recognition ED, Revenue from Contracts with Customers (i.e., on the basis of the standalone selling prices). However, a lessee would treat the entire contract as a lease if it is unable to allocate the payments between the distinct service and lease components or if the service component is not distinct.

Leases of retail space may include services such as common area maintenance and security. These leases often include a single amount to be paid to the lessor that covers both the lease and service components and are generally treated as "gross" leases (i.e., the lease and service components are not separated but rather treated as a single lease arrangement). Under the proposal, a lessee would need to evaluate the service component to determine whether it is distinct and whether it can allocate the payments regardless of how the contract is structured.

Key implementation issues

Lessees would need to identify the service components within a lease and assess whether the service components are distinct and whether payments can be allocated between the lease and distinct service components. The identification of service components will become more important under the proposed lease model as distinct service components would continue to be accounted for as executory contracts and would therefore not be included as part of the lease asset and liability. The distinction between rentals and services is often blurred and therefore significant judgement may be required. This may lead to inconsistency amongst retailers in how they evaluate whether lease and service components are distinct.

Modifications to accounting systems might be necessary to capture the details of the lease and service components.

Issue 5 – Subleases

An entity may lease an asset from a lessor and then lease that same asset to a different party (commonly referred to as subleases). The same entity is both a lessee that leases an asset from a head lessor, and an intermediate lessor that subleases the same underlying asset to a sub-lessee. Under the ED, an intermediate lessor would account for its assets and liabilities arising from the head lease in accordance with the lessee model and would account for its assets and liabilities arising from the sublease in accordance with the lessor model. This could result in a different measurement of the head lease and a sublease because a reliability threshold would exist for measuring lease payments for lessors which does not exist for lessees. As discussed above, the ED proposes two accounting models for lessor accounting, the performance obligation model and the derecognition model.

Illustration

A sublessor that does not transfer the significant risks and benefits associated with the underlying asset (which under a sublease is the right-of-use asset) would apply the performance obligation approach; otherwise, the lessor would apply the derecognition approach. The following illustrates the financial statement presentation of a sublessor under both the performance obligation and derecognition approaches:

The intermediate lessor (as lessee under the head lease) would recognise interest expense on the lease liability from the head lease. The lessor would recognise interest revenue on the lease receivable from the sublease as well as any up-front profit on the derecognition on the right-of-use asset.

Key implementation issues

An entity that subleases its retail space to a third party would need to consider the lessor accounting models which would bring an extra layer of complexity. The determination as to which lessor model to apply may require a significant amount of judgement as well as the development of accounting policies and possible changes to information systems. Additionally, the sublease accounting under the proposed lessor models could have a significant impact on a lessee's financial position and profit and loss. Performance ratios, such as asset turnover ratios, debt to equity ratios and EBITDA, could also be affected.

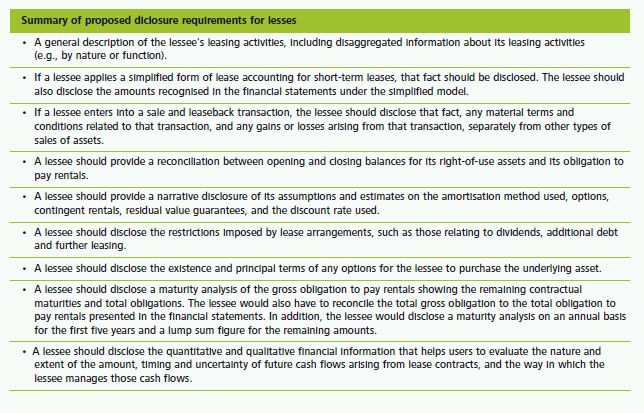

Issue 6 – Disclosure

In comparison to existing accounting standards, the ED increases the level of disclosure required, including both qualitative and quantitative financial information about lease contracts and the key judgements made in applying the standard to those contracts.

Key implementation issues

Disclosure of the proposed information would represent a considerable challenge to companies in the retail sector and is likely to require system and internal process changes to capture and extract the relevant data.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.