Introduction and Overview

A technical summary of the AIFMD, otherwise known as "Proposal for a Directive of the European Parliament and of the Council on Alternative Investment Fund Managers and amending Directives 2003/41/EC and 2009/65/EC.

The Directive sets out the rules for authorisation, ongoing operation and transparency of alternative investment fund managers (AIFMs), managing and/or marketing alternative investment funds (AIFs) in the European Union (EU), in order that new "competent authorities" to be created in each member state and empowered by law/regulation to supervise AIFMs can monitor and manage systemic risk. The European Commission (EC) will adopt measures specifying the precise details of how the obligations in this Directive are to be implemented (Level 2 Rules). The majority of these Level 2 Rules are anticipated to be finalised during Q3 2011.

There are several key themes dealt with by the Directive, and these have been segregated into ten chapters. A brief overview is presented below.

Chapter I: 'Scope and exemptions' introduces definitions and clarifies what types of entities are in and outside of the scope of the Directive.

Chapter II: 'Authorisation of an AIFM' deals with the authorisation process, and outlines what managers are permitted to do on behalf of their funds. It also outlines minimum capital requirements.

Chapter III: 'Operating conditions for an AIFM' is the most varied in the Directive, and deals with a myriad of notable topics such as delegation, valuation, depositaries, remuneration and risk management.

Chapter IV: 'Transparency requirements' deals with disclosures and reports to investors, and other reporting requirements to regulators.

Chapter V: 'AIFMs managing specific types of AIF' deals with the peculiarities of certain specialised funds, in particular, private equity and leveraged funds.

Chapter VI: 'Rights of an EU AIFM to market and manage EU AIF in the EU' deals predominantly with the mechanics of the proposed EU-wide fund passport system, and the conditions for utilising it.

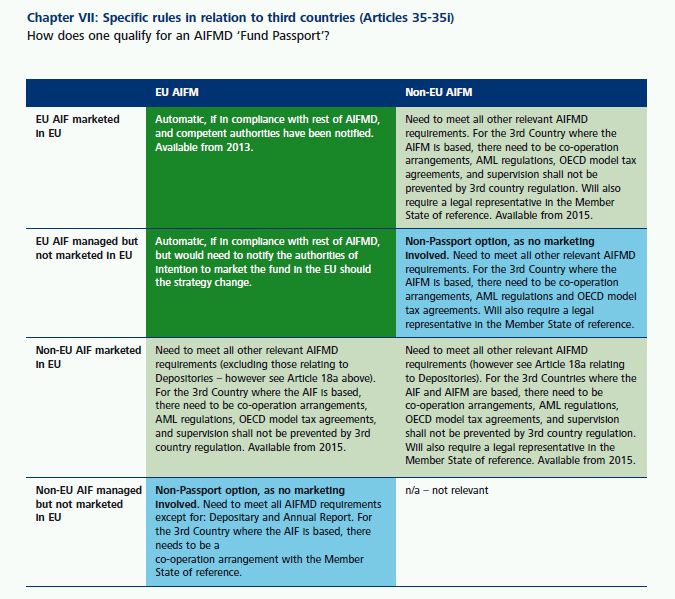

Chapter VII: 'Specific rules in relation to third countries' expands on the passport system, and discusses how this will be available to non-EU managers and funds, including additional conditions. Furthermore, the existing national private placement programs are also discussed.

Chapter VIII: 'Marketing to retail investors' discusses a proposed bridging mechanism to allow AIFMs to market to retail investors.

Chapter IX: 'Competent authorities' outlines the responsibilities of national regulators, as well as the role to be played by a pan-European regulator, ESMA.

Chapter X: 'Transitional and final procedures' deals with the timetable for implementation, as well as delegating the drafting of detailed procedures (known as 'Level 2' rules).

AIFMD Detail

Chapter I: Scope and exemptions

Scope (Article 2)

The Directive applies to:

- all EU AIFMs that manage one or more AIF;

- all non-EU AIFMs that manage one or more EU AIF; and

- all non-EU AIFMs that market one or more AIF to professional investors in the European Union.

It applies irrespective of the legal, economic or geographic characteristics of the AIF.

Exemptions (Articles 2 and 2a)

- Where the only investors in its AIFs are from the wider corporate group of which the AIFM is a part, provided that none of the investors is an AIF itself.

- Holding companies.

- Institutions covered by the 2003 Directive on the activities and supervision of IORPs.1

- Supranational institutions (e.g. the World Bank, IMF, ECB, EIB, EIF).

- National central banks.

- National, regional and local governments, including their social security and pension systems.

- Securitisation special purpose entities.

- Employee participation/savings schemes. AIFMs2 which manage portfolios whose AUM do not exceed:

- EUR 100m, including any assets financed through leverage; or

- EUR 500m when the portfolio is unleveraged and redemption rights are only exercisable 5 years or more after the date of initial investment.

Are only required to:

- Be subject to registration with the competent authorities in home Member State.

- Identify any AIFs managed by it, and provide information on their investment strategies.

- Provide regular information on the main instruments in which they are trading, principal exposures and most important concentrations.

- Notify the competent authorities if they no longer meet the size conditions above and seek full authorisation within 30 days.

They will however not benefit from any of the rights granted under this Directive, unless they choose to opt-in, and seek voluntary full authorisation under the Directive.

Determination of an AIFM (Article 3a)

Each AIF is deemed to have a single AIFM responsible for ensuring compliance with this Directive. The AIFM will be either:

- An external manager, legally appointed by the AIF to manage the AIF.

- The AIF itself, where legally permissible.

Where an AIFM is unable to ensure that an AIF for which it is responsible complies with the requirements of the Directive, the AIFM should inform the competent authorities of that AIF.

The AIFM will also be required to take remedial action by the competent authorities in its home Member State and if the non-compliance persists, may be required to resign as AIFM.

Chapter II: Authorisation of an AIFM

Conditions for taking up activities as an AIFM (Article 4; Annexure I)

No AIFM may manage an AIF unless it has been authorised under this Directive. Once authorised, the AIFM must comply with the conditions for authorisation at all times.

When managing an AIF, an AIFM must at least perform the portfolio management and risk management thereof.

In the course of the collective management of an AIF, an AIFM may perform the following additional activities only:

- Administration: e.g. legal and fund management accounting services, customer inquiries, valuation and pricing (including tax returns), regulatory compliance monitoring, maintenance of unit-/ shareholder- registers, distribution of income, unit/share issues and redemptions, contract settlements (including certificate dispatch), record keeping;

- Marketing;

- Activities related to the assets of AIF.

AIFMs may additionally be authorised to manage IORP portfolios, and provide non-core services in that respect.

Application for authorisation and conditions for granting authorisation (Articles 5 and 6)

AIFMs should apply in the home Member State of the AIFM to the competent authorities, providing:

i. Information on the AIFM itself:

- the persons effectively conducting the business of the AIFM;

- the identity of the owners that have qualifying holdings and amounts of those holdings;

- a programme of activity setting out the organisational structure of the AIFM including how the AIFM intends to comply with its obligations under the Directive;

- information on the remuneration policies and practices; and

- information on arrangements made for delegation and sub delegation to third parties.

ii. Information on each AIF it intends to manage:

- investment strategies including types of underlying funds (if a fund of funds), leverage policy, risk profiles, country in which established;

- if the AIF is a feeder AIF, where the master AIF is established;

- fund rules/instruments of incorporation;

- information on depositary arrangements;

- all information required by the disclosure to investors rules (Article 23).

Information already provided where a management company is already authorised under the 2009 Directive on the coordination of laws, regulations and administrative provisions for UCITS3 does not have to be re-submitted, as long as it is still up-to-date.

The European Securities and Markets Authority (ESMA) will keep a central public register of all registered AIFMs, the AIFs they manage/market in the EU and their competent authority.

Authorisation will not be granted unless the AIFM meets all the conditions in the Directive, its owners and management are appropriate, and the head office and the registered office of the AIFM are located in the same Member State. This authorisation will be valid for every Member State.

The relevant competent authorities of other Member States involved will be consulted before the authorisation of a group company of another AIFM, a UCITS management company, investment firm, credit institution or insurance undertaking authorised in another Member State.

Furthermore, the competent authorities of the home Member State shall refuse authorisation of an AIFM if the effective exercise of their supervisory functions is prevented by:

- Close links between the AIFM and other natural or legal persons.

- The laws, regulations or administrative provisions of a third country in which the AIFM has close links with a natural/legal person.

- Difficulties involved in the enforcement of these laws, regulations and administrative procedures.

The scope of authorisation may be restricted, especially re. investment strategies the AIFM is allowed to manage.

The AIFM will be notified in writing of the result of an application for authorisation within 3 months; on notification this may be prolonged by an additional 3 months if necessary.

Initial capital and own funds of AIFMs (Article 6a)

The minimum initial capital requirements are as follows:

- For an AIFM which is an internally managed AIF4: EUR 300,000.

- For an AIFM appointed external manager of one or more AIF:

- A minimum of EUR 125,000, plus an additional 0.02% of AUM over EUR 250m (capped at EUR 10m).

- The above calculation includes AIFs whose functions the AIFM has delegated, but excludes portfolios that the AIFM is managing under delegation.

- AIFMs must also meet EU capital adequacy requirements5 (own funds equivalent to one quarter of their preceding year's fixed overheads).

- AIFMs may obtain up to 50% of the additional amount of own funds required in the form of a guarantee of funds given by a credit institution or insurance undertaking registered in a Member State or a third country with EU-equivalent rules.

All AIFMs must have sufficient additional own funds (invested in liquid assets, not including speculative positions) to cover professional liability risks; or appropriate insurance.

Apart from the professional indemnity requirements, these capital requirements do not apply to AIFMs which are also authorised under the UCTIS Directive.6

Changes in the scope of the authorisation (Article 7)

The AIFM must notify the competent authorities of their home Member State of any material changes to the conditions for initial authorisation, prior to their implementation, in particular changes to the information provided on application for authorisation.

The competent authorities may impose restrictions or reject the changes and inform the AIFM within one month of the receipt of the notification (prolonged to two months if necessary).

Withdrawal of the authorisation (Article 8) The competent authorities may withdraw an AIFM's authorisation where national law provides for withdrawal and also if it:

- does not use the authorisation within 12 months;

- expressly renounces authority;

- ceases the activity covered by this Directive for the preceding 6 months, unless the Member State has authorised the lapse;

- has seriously or systemically infringed the provisions of the Directive;

- no longer fulfils the conditions for authorisation;

- obtained authorisation by falsehoods or other irregular means; and

- provides the additional portfolio management services and no longer complies with the 2006 Directive on the capital adequacy of investment firms.

Chapter III: Operating conditions for an AIFM Section 1: General principles (Articles 9 through 14)

- act honestly, with due skill, care and diligence and fairly;

- act in the best interests of the AIF or the investors of the AIF it manages and the integrity of the market;

- have and employ the resources necessary to perform its activities properly;

- take all reasonable steps to avoid conflicts of interest, including steps to identify, prevent, manage and monitor these and ensure the AIFs are treated fairly;

- comply with all regulations;

- treat all investors fairly; no investor may obtain preferential treatment unless disclosed in the AIF rules/instruments of incorporation.

If the AIFM's authorisation covers a discretionary portfolio management service, they must receive prior general approval from the client before investing a client's portfolio in units/shares of an AIF it manages and are also subject to the provisions in the Directive on investor-compensation schemes.7

Remuneration (Article 9a and Annex II)

An AIFM must have remuneration policies in place that:

- promote sound and effective risk management;

- do not encourage risk-taking which is inconsistent with the risk profiles, fund rules or instruments of incorporation of the AIF it manages.

Significantly sized (not yet defined) or complex AIFMs (or AIFMs that manage significantly sized AIFs) must establish a remuneration committee, chaired by a non-executive director that exercises competent and independent judgement on remuneration policies and practices.

The Directive sets out the following additional rules for senior management, risk takers, control functions and any equivalently paid employee whose professional activities have a material impact on their risk profile/the risk profile of the AIF they manage:

- the remuneration policy must be in line with business and strategy, objectives, values and interests of the AIFM and the AIF it manages or the investors of the AIF and include measures to avoid conflicts of interest;

- management must adopt and periodically review the general policies of the remuneration and is responsible for implementation;

- the policy must be subject to central and independent internal review at least annually;

- staff engaged in control functions should be compensated in accordance with the achievement of objectives linked to their functions, rather than the performance of the firm;

- remuneration of senior officers in risk management and compliance should be directly overseen by the remuneration committee;

- performance-related remuneration should be based on the performance of the individual as well as the business and financial and non-financial criteria must be taken into account;

- performance should be assessed and remuneration paid in line with the life-cycle of the AIF;

- guaranteed variable remuneration must be exceptional; it can only occur when hiring new staff and limited to the first year;

- the fixed component must be sufficient to allow a fully flexible policy on variable remuneration, including paying no variable remuneration;

- early termination payments must reflect performance over time and not reward failure;

- where allowable, 50% or more of the variable remuneration should be in the form of units/shares of the AIF concerned or equivalent non-cash instruments

- These should be subject to an appropriate retention policy designed to align incentives with the interests of the AIFM, the AIF and its investors.

- The 50% is not applicable if the management of the AIF accounts only for a limited share of the total portfolio managed by the AIFM.

- at least 40% of variable remuneration should be deferred over a period which reflects the life-cycle and redemption policy of the AIF; at least 3-5 years, unless the life cycle is shorter:

- if the variable remuneration component is particularly high (not yet defined), at least 60% must be deferred;

- variable remuneration only vests if it is sustainable, being subject to clawback where subdued or negative financial performance occurs;

- the pension policy must be in line with the strategy and long-term interests of the AIFM and the AIF it manages:

- if an employee leaves before retirement, discretionary pension benefits should be held by the AIFM for 5 years as units/shares in the AIF concerned or other equivalent non-cash instrument;

- if an employee reaches retirement, discretionary pension benefits should be paid in the form of units/shares in the AIF concerned or other equivalent non-cash instrument, subject to a 5 year retention period

- staff members may not undertake personal hedging strategies or remuneration- and liability-related insurance to undermine the alignment effects embedded in their remuneration packages;

- variable remuneration should not be paid through vehicles or methods that facilitate the avoidance of the requirements of the Directive.

These rules apply to any type of remuneration paid by the AIFM and any amount paid directly by the AIF itself, including carried interest and transfer of shares/units of the AIF to those categories of staff whose activities have a material impact on their risk profile or the risk profile of the AIF.

Conflicts of interest (Article 10)

Member States will require AIFMs to take all reasonable steps to identify, prevent, manage and monitor conflicts of interest. These are general good governance requirements likely to already be in place.

Risk management (Article 11)

The risk management function must be functionally and hierarchically separated from the operating units, including portfolio management.

The AIFM must implement adequate risk management systems to identify, measure, manage and monitor all risks for each AIF and investment strategy. These must be reviewed at least once a year and be adapted when necessary.

Minimum requirements:

- implement an appropriate, documented and regularly updated due diligence process when investing on behalf of the AIF according to its investment strategy and risk profile;

- ensure that the risks associated to each investment position of the AIF and their overall effect on the AIF's portfolio can be properly identified, measured, managed and monitored on an ongoing basis including appropriate stress testing procedures;

- ensure that the risk profile of the AIF shall correspond to the size, portfolio structure and investment strategies and objectives of the AIF as laid down in its rules or offering documents.

AIFMs shall set a maximum leverage for each AIF and the extent of the right of the re-use of collateral/ guarantee that could be granted under the leveraging arrangement, taking into account, among others, the type of AIF, its strategy and sources of leverage.

Liquidity management (Article 12)

To ensure the liquidity profile of the investments comply with obligations, the AIFM must adopt an appropriate liquidity management system and monitor the liquidity risk of each AIF managed that is not unleveraged and closed-ended, including conducting regular stress tests, under normal and exceptional liquidity conditions.

Where an AIFM manages the investment strategy of an AIF, it must ensure that the liquidity profile and redemption policy are consistent.

Investment in securitisation positions (Article 13)

The EC will adopt measures laying down:

- the requirements that need to be met by an originator in order for an AIFM to be allowed to invest in securitised financial instruments issued after 1 January 2011 on behalf of one or more AIF, including ensuring that the originator retains a net economic interest of not less than 5 per cent; and

- qualitative requirements that must be met by the AIFM.

Section 3: Organisational requirements (Articles 15 and 16)

AIFMs must use appropriate human and technical resources at all times to ensure the proper management of AIFs, including:

- Sound administrative and accounting procedures.

- Control and safeguard arrangements for electronic data processing.

- Adequate internal control mechanisms, including rules:

-

- for personal transactions by its employees.;– the holding or management of investments in order to invest on its own account.

- Ensuring that:

-

- each transaction can be traced to its origin, the parties to it, its nature and the time and place it was effected;

- the assets of the AIF are invested according to the fund rules/instruments of incorporation and law.

Valuation (Article 16)

Appropriate and consistent procedures must be established by AIFMs so that a proper and independent valuation of the assets of the AIF can be performed.

Net asset value per share/unit must be calculated at least once a year, depending on the law of the country where the AIF has its registered office or based on the instruments of incorporation.

If the AIF is open-ended, the frequency of valuations must be appropriate to the assets held by the fund and its issuance and redemption frequency. If the AIF is closed-ended, valuations will be carried out in case of an increase or decrease of capital by the relevant AIF.

The rules applicable to and disclosure of valuations and calculations to investors will be set out in the instruments of incorporation which must be adhered to.

Valuation should be performed either by:

- an independent, external valuer without any link to the AIFM or AIF:

-

- this cannot be the depository, unless its depository and external valuation functions are functionally and hierarchically separated with potential conflicts of interest identified, managed, monitored and disclosed to investors of the AIF;

- the external valuer may not delegate the valuation function to a third party;

- the AIFM, if the valuation task is functionally separated from portfolio management and the remuneration policy and other measures ensure conflicts of interest are mitigated and undue influence on employees is prevented.

The AIFM must notify the competent authorities of the appointment of an external valuer, who may reject their appointment.

Where the valuation is not performed by an independent external valuer, the competent authorities of the AIFM's home Member State may require an external valuer or auditor to verify it.

The AIFM is responsible for the valuation of AIF assets, although the external valuer is liable to the AIFM for losses suffered in cases of negligence or intentional failure.

Section 4: Delegation of AIFM functions (Article 18)

- AIFMs must notify the competent authorities of their home Member State before delegating one or more of their functions and must be able to justify the delegation objectively.

- The delegate must be reputable and dispose of sufficient resources to perform the tasks.

- Portfolio/risk management can only be delegated to authorised and supervised asset managers. Prior approval from the competent authorities of the AIFM's home Member State must be sought in all other cases. If delegation is to a non-EU undertaking there must be co-operation agreements between the competent authority of the home Member State and the supervisory authority of the undertaking.

- The delegation must not prevent the AIFM from acting in the best interest of investors or the effectiveness of supervision of the AIFM.

- The AIFM must be able to demonstrate that the delegate is qualified and capable of performing the task, selected with due care; and it can monitor the delegated activity, give further instructions at any time and withdraw the delegation with immediate effect.

- Portfolio management and risk management cannot be delegated to the depositary, or a delegate of the depository, or any other entity where there may be conflicts of interest with the AIFM, AIF or investors unless functionally and hierarchically separated with controls.

- The AIFM must review the services provided by each delegate on an ongoing basis.

- The AIFM must not delegate to such an extent that it becomes a letter-box entity.

- The third party may sub-delegate any of the functions, subject to the same conditions, as long as the consent of the AIFM is gained prior to the subdelegation and the AIFM notified the competent authorities in advance.

- Where functions are further delegated, the conditions apply mutatis mutandis.

Section 4a: Depositary (Article 18a)

AIFMs must appoint a single depository for each AIF managed, either:

- a credit institution with its registered office in the EU and authorised in accordance with the relevant 2006 Directive;8

- an investment firm with its registered office in the EU authorised in accordance with the relevant 2004 Directive9 and subject to the capital adequacy requirements of the relevant 2006 Directive

- other institutions subject to prudential regulation and ongoing supervision, eligible to be depositories under the UCITS Directive;10

- for non-EU AIFs, the entity must be subject to effective prudential regulation and supervision that would meet the requirements of EU law (no guidance on this yet).

The appointment must be evidenced by a contract in writing.

Where an AIF:

- has no redemption rights exercisable for 5 years from initial investment; and

- generally does not invest in assets that must be held in custody, or generally invests in issuers or non-listed companies in order to acquire control.

Then the depositary may be an entity which carries out depositary functions as part of its professional or business activities (for which it is subject to mandatory professional registration), provided it can provide guarantees it can effectively perform the function, and meet any commitments in that regard. (i.e. attorneys or notaries, etc.)

Restrictions

The depositary may not be:

- An AIFM.

- A prime broker acting as counterparty to an AIF, unless the functions are functionally and hierarchically separated with sufficient controls around conflicts of interest in place. Delegation of custody tasks by the depositary to such prime broker is allowed if the conditions in the Directive are met.

Location of the depositary

The depositary must be located:

- in the home Member State of the AIF or any other EU country during the first four years following the AIFMD implementation; or

- if not an EU AIF, in the third country where the AIF is established, the home Member State of the AIFM or the Member State of reference of the non-EU AIFM.

The depositary can only be located in a third country where:

- Cooperation and exchange of information agreements between the competent authorities of the home Member State of the AIFM and of the third country exist.

- Regulation and supervision is in place, equivalent to EU standards.

- The country is not a Non-Cooperative Country and Territory per the Financial Action Task Force on antimoney laundering and terrorist financing.

- The Member States in which the shares are to be marketed have a signed an agreement which fully complies with Article 26 of the OECD Model Tax Convention, ensuring effective exchange of information in tax matters.

- The depositary is contractually liable to the AIF consistent with the provisions of this Article or investors of the AIF and explicitly agrees to comply with the delegation requirements of this Article.

Custody tasks

All financial instruments that can be registered in a financial instruments account opened in the depository's books (these must be registered in segregated accounts) and can be physically delivered to the depository, must be entrusted to the depositary.

For other assets, the depositary must verify the ownership of the AIF (or the AIFM acting on behalf of the AIF) and keep an up-to-date record of these assets.

Further responsibilities and restriction

Depositaries must ensure that:

- transactions and valuations are in accordance with applicable law;

- they carry out the instructions of the AIFM;

- transactions are remitted to the AIF within the usual time limits;

- the AIF's income is applied in accordance with applicable law;

- they do not carry out activities that may create conflicts of interest between itself, the AIF, investors and the AIFM, unless they are functionally and hierarchically segregated and adequate controls over conflicts of interest are in place;

- they do not re-use the assets deposited with them without the prior consent of the AIF (or AIFM acting on behalf of the AIF);

- the AIF's cash flows are properly managed and all payments made by/on behalf of investors upon subscription have been received and all the AIF's cash is booked in cash accounts opened in the name of the AIF or the AIFM or the depositary at either a central bank, a credit institution authorised in accordance with the 2000 Directive,11 a bank authorised in a third country or an equivalent institution in the relevant market where cash accounts are required;

- where cash accounts are opened in the name of the depositary, they must be segregated so that the cash can be clearly identified as belonging to the clients of the depositary at all times.

The depositary must make all information which it has obtained while undertaking its duties available on request to its competent authorities. This will be shared with the competent authorities of the AIF and AIFM if different.

Liability and delegation

The depositary must be liable by contract to the AIF or the investors of the AIF and shall explicitly agree not to delegate any of its functions to third parties, other than the custody tasks above, and only when a reason can be demonstrated for the delegation (esp. not if with intention to avoid the requirements of the Directive). In addition they must demonstrate that they have exercised due skill, care and diligence in the selection and appointment of a third party.

The delegated third party must meet the conditions of the Directive and be a reputable entity with adequate supervision, structures and expertise to carry out its role. For the custody of financial instruments that can be registered in a financial instruments account or physically delivered, they must be subject to effective prudential regulation (including minimum capital requirements) and supervision, including external periodic audit.

Further sub-delegation is permitted, applying mutatis mutandis.

The provision of services as specified by the 1998 Directive12 on settlement finality in payment and securities settlement services by securities settlement systems, or similar services provided by non-EU securities settlement systems, is not considered a delegation of custody functions.

If the depositary loses a financial instrument held in custody, it must return an identical financial instrument or corresponding amount to the AIF/AIFM without undue delay, unless it can prove that the loss occurred due to an external event beyond its reasonable control.

If a third party to which a depositary has delegated custody loses a financial instrument, the depositary will be discharged of liability:

- if all requirements in the Directive for delegation of custody tasks have been met and there is a written contract between the depositary and the third party explicitly transferring the liability of the depositary, making it possible for the AIF, AIFM or depositary acting on their behalf to claim against the third party; and also

- where the law of a third country requires that certain financial instruments are held in custody by a local entity and there are no local entities that satisfy the delegation requirements in the Directive; and:

-

- the AIF or AIFM instructed the depositary to delegate the custody of such financial instruments to a local entity; and

- there is a written contract between the depositary and the AIF/AIFM which expressly allows such a discharge; and

- the investors have been informed of the discharge and circumstances prior to investment.

Liability to the investors of the AIF may be invoked directly or indirectly through the AIFM depending on the legal nature of the relationship between the depositary, AIFM and investors.

Chapter IV: Transparency requirements

Annual report (Article 19)

For each EU AIF and for each AIF marketed in the EU, an annual report must be made available no later than 6 months following the end of the financial year and provided to investors on request, in the absence of any more stringent requirements the AIF may be subject to. This must also be made available to the competent authorities of the home Member State of the AIF and the AIFM.

The annual report must contain:

- the core financial statements (balance sheet and income statement);

- a report on activities for the financial year;

- any material changes in information required to be disclosed to investors;

- total remuneration split into variable and fixed, including the number of beneficiaries and any carried interest paid; and also broken down by senior management and members of staff of the AIFM whose actions have a material impact on the risk profile of the AIF;

- a registered auditor's report; accounting information must be audited and prepared in accordance with the relevant accounting standards/rules (either those required by applicable legislation, or those as defined in the AIF's rules).

Disclosure to investors (Article 20)

For each EU AIF managed and each AIF marketed in the EU, the AIFM must disclose the following to prospective investors before they invest, (including any changes thereto):

- a description of the investment strategy and objectives of the AIF; information on where any master AIF is established or where any underlying funds are established (if a fund of funds); the types of assets the AIF may invest in, the techniques it may employ and all associated risks; any investment restrictions; when the AIF may use leverage, the types and sources of leverage permitted and the associated risks, any restrictions to the use of leverage and any collateral and asset re-use arrangements, and the maximum level of leverage allowed;

- a description of the procedures by which the AIF may change its investment strategy or investment policy, or both;

- a description of the main legal implications of the contractual relationship entered into for the purpose of investment, including information on jurisdiction, applicable law and on the existence, or not, of any legal instruments providing for the recognition and enforcement of judgments on the territory where the AIF is established;

- the identity of the AIFM, the AIF's depositary, auditor and any other service providers and a description of their duties and the investors' rights;

- how the AIFM is complying with the initial capital requirements of the Directive;

- a description of any delegated management functions as referred to in Annex 1 of the AIFM and of any safekeeping function delegated by the depositary, the identification of the delegate and any conflicts of interest that may arise from such delegations;

- a description of the AIF's valuation procedure and of the pricing methodology for valuing assets, including the methods used in valuing hard-to-value assets;

- a description of the AIF's liquidity risk management, including redemption rights in both normal and exceptional circumstances, existing redemption arrangements with investors;

- a description of all fees, charges and expenses and of the maximum amounts thereof which are directly or indirectly borne by investors;

- how the AIFM ensures fair treatment of investors and when an investor obtains preferential treatment, a description thereof, and the type of investors who obtain such preferential treatment and their legal or economic links with the AIF or AIFM;

- the latest annual report;

- the procedure and conditions of issue and sale of units or shares;

- the latest net asset value of the AIF or the latest market price of the unit or share of the AIF;

- where available, the historical performance of the AIF;

- the identity of the prime brokers and a description of any material arrangements with prime brokers and the way any conflicts of interests in relation thereof are managed and, as the case may be, the provision in the contract with the depositary on the possibility of transfer and re-use of AIF assets, and about any transfer of liability to the prime broker that may exist;

- how and when the periodical and regular disclosures below will be disclosed.

In addition the AIFM must:

- Inform investors prior to investing of any arrangements made by the depositary to contractually discharge itself of liability and inform investors of any changes with respect to depositary liability without delay.

- Periodically disclose:

-

- % of assets which are subject to special arrangements due to illiquid nature;

- new arrangements for managing the liquidity of the AIF;

- current risk profile and risk management systems employed;

- total amount of leverage employed.

- Regularly disclose:

-

- any changes to the maximum level of leverage and any right of the re-use of collateral granted under the leveraging arrangement;

- the total amount of leverage employed by the AIF.

Reporting obligations to competent authorities (Article 21)

AIFMs shall regularly report to the competent authorities of its home Member State on the principal markets and instruments in which it trades, including information on principal exposures and the concentrations of each AIF it manages.

For each AIF, the AIFM must provide to the competent authorities of its home Member State:

- % of assets which are subject to special arrangements due to illiquid nature;

- new arrangements for managing the liquidity of the AIF;

- the risk profile of the AIF and risk management tools the AIFM employs to manage the market, liquidity, counterparty, operational and other risks;

- the main categories of assets that the AIF invested;

- the results of the stress tests performed for risk management and liquidity management. On request, the AIFM must provide:

- an annual report;

- a detailed list of all AIFs which the AIFM manages for the end of each quarter.

Where an AIF employs substantial leverage (not yet defined), the AIFM must make available:

- Information on the overall level of leverage employed by each AIF it manages;

- a breakdown between leverage arising from borrowing of cash or securities and leverage embedded in financial derivatives;

- the extent to which their assets have been reused under leveraging arrangements;

- the identity of the 5 largest sources of borrowed cash or securities and the amounts of leverage received from each of those entities.

This information will be made available to other competent authorities and the ESMA, CESR and the European Systemic Risk Board.

In order to monitor systemic risk, competent authorities may require additional information on a periodic and/or ad-hoc basis. In exceptional circumstances ESMA may request the competent authorities to impose additional reporting requirements.

Chapter V: AIFMs managing specific types of AIF Section 1: AIFMs managing leveraged AIFs

Use of information by authorities, supervisory cooperation and limits to leverage (Article 25)

AIFMs must demonstrate that the leverage limits for each AIF managed are reasonable and that it complies with the set leverage limit at all times.

Competent authorities may impose limits to the level of leverage that an AIFM may employ, or other restrictions if necessary to ensure the stability and integrity of the financial system. Ten working days' notice will be given prior to imposing such a limit.

Section 2: Obligations for AIFMs managing AIFs which acquire control of non listed companies and issuers (Private Equity)

Scope (Article 26)

This section applies to an AIFM, or a group of collaborating AIFMs, managing one or more AIFs which acquire control of a non-listed company, either individually or jointly on the basis of an agreement aimed at acquiring control.

It does not apply where the non-listed companies concerned are:

- small and medium enterprises per 2003/361/EC;13 or

- SPVs with the purpose of purchasing, holding or administrating real estate. Notification of the acquisition of major holdings and control of non-listed companies (Article 27)

Notification of the acquisition of major holdings and control of non-listed companies (Articles 27)

- When an AIF acquires, disposes of or holds shares in a non-listed company, the AIFM managing this AIF must notify the competent authorities of its home Member State of the proportion of voting rights of the non-listed company held by the AIF whenever that proportion reaches, exceeds or falls below the thresholds of 10%, 20%, 30%, 50% and 75%.

- In addition, when an AIF acquires, individually or jointly, control over a non-listed company, the AIFM managing such AIF shall notify; – the non-listed company and it shareholders; and – the competent authorities of the home Member State of the AIFM.

- The notification required must include:

-

- the resulting situation in terms of voting rights;

- the conditions under which control was reached, including information about the identity of the different shareholders involved, and the date on which achieved.

In its notification to the non-listed company, the AIFM shall request the board of directors of the company to inform the employees of the information referred to above.

The notifications referred to shall be made no later than ten working days from the day on which the AIF has reached, exceeded or fallen below the relevant threshold, or, as the case may be, has acquired control over the non-listed company.

Disclosure in case of acquisition of control (Article 28)

When an AIF acquires control of a non-listed company, the AIFM must make available:

- the identity of the AIFM which either individually or in agreement with other AIFM manage(s) the AIF that has/have reached control;

- the policy for preventing and managing conflicts of interests, in particular between the AIFM, the AIF and the company;

- the policy for communication, in particular regarding employees of the company.

When an AIF acquires control of a non-listed company, the AIFM shall make available its intentions with regard to the future business of the non-listed company and the likely repercussions on employment, including any material change in the conditions of employment.

When an AIF reaches a position to exercise control of a non-listed company, the AIFM must provide the competent authorities of its home Member State and the investors of the AIF with information on the financing of the acquisition.

Specific provisions regarding the annual report of AIF exercising control of non-listed companies (Article 29)

When an AIF acquires control of a non-listed company the AIFM must:

- ensure that the board of the company draws up the annual report of the non-listed company including the additional information required below and makes it available to all representatives of employees, or to the employees themselves within the legal deadline; or

- include the information relating to the relevant nonlisted company in the annual report of each such AIF.

This additional information must include a review of the development of the company's business to the end of the period covered by the annual report, as well as an indication of:

- any important events that have occurred since the end of the financial year;

- the company's likely future development;

- information concerning acquisitions of own shares.14

Asset stripping (Article 29a)

For 24 months after the acquisition of control of a non-listed company by an AIF, the AIFM:

- is not allowed to facilitate, support or instruct any distribution, capital reduction, share redemption and/or acquisition of own shares by the company as described below; and

- if the AIFM is authorised to vote on behalf of the AIF at the governing bodies of the company, it may not vote in favour of any of these.

More specifically, these restrictions apply in the following situations:

- any distribution to shareholders that exceeds profit at the end of the previous financial year plus distributable reserves brought forward;

- any distribution to shareholders or repurchase of shares which would result in net assets being lower than subscribed capital plus undistributable reserves.

Chapter VI: Rights of an EU AIFM to market and manage EU AIF in the EU

Marketing of shares or units of EU AIF in the home Member State of the AIFM (Article 31 and Annex III)

The right to market to professional investors will be granted to an authorised EU AIFM as soon as the conditions are met. Where an EU AIF is a feeder AIF the right to market is conditional on the master AIF also being an EU AIF which is managed by an authorised EU AIFM.

The AIFM shall submit a notification to its home Member State's competent authorities (and those of the AIF, if different) in respect of each EU AIF it intends to market with:

- a notification letter with programme of operations identifying the AIF and where it is established;

- the AIF rules or instruments of incorporation;

- identification of the depositary;

- any information available to investors on the AIF, including required disclosures;

- if the AIF is a feeder AIF, where the master AIF is established;

- where relevant, measures established to prevent units or shares from being marketed to retail investors, including when investment services are provided by a third party.

The AIFM will be informed within 20 days whether it may start marketing.

The AIFM can only be prevented from marketing if the information in the notification demonstrates that the AIFM's management of the AIF will not be in accordance with this Directive.

Written notification of any material changes to the information submitted in the notification must be communicated to the competent authorities at least one month before implementation, or immediately if unplanned situations trigger a change

Marketing of shares or units of EU AIF in other Member States than in the home Member State of the AIFM (Article 34 and Annex IV)

An AIFM may proceed with marketing in other Member States once they have notified their home Member State's relevant competent authorities of the information in Article 31, plus an indication of the Member States in which it intends to market its AIFs.

The home Member State will transmit the complete documentation, including an attestation that the AIFM is authorised to manage AIFs with that investment strategy, to the competent authorities where the AIF is proposed to be marketed.

The AIFM will be notified of the transmission, upon receipt of which the AIFM may begin marketing.

Conditions for managing AIF established in other member states (Article 34a)

An authorised AIFM may provide management services in relation to an EU AIF directly or via a branch, provided the AIFM is authorised to manage that type of AIF.

The AIFM will communicate the following to the competent authorities of their home Member State:

- the Member State in which the management services will be provided;

- a programme of operations, including services it will perform and the identity of the AIF it will manage; and

- if a branch will be established, the organisational structure of the branch, the address and the names of the persons responsible for managing the branch.

Within one month of receiving the complete documentation, the home Member State will transmit it, along with an attestation that they have authorised the AIFM concerned to the competent authorities of the host Member State.

They shall immediately notify the AIFM of the transmission, upon receipt of which the AIFM may start to provide its services in the host Member State.

The host Member State cannot impose any additional requirements on the AIFM.

Written notification of material changes to the information submitted must be communicated at least one month before implementation, or immediately if unplanned circumstances trigger a change.

Note that the 'Member State of reference' refers to the Member State in which the Non-EU AIFM registers with the relevant competent authorities. In all cases, the Member State of reference's competent authorities will need to be notified of any of the above arrangements before they can be authorised.

The Directive also leaves open the existing private placement option of marketing in individual Member States outside of the passport framework. The intention appears to be that this option will lapse once the passport framework is well and truly in place (currently scheduled for 2018).

Chapter VIII: Marketing to retail investors (Article 35j)

Member States may allow marketing to retail customers on their territory, although they may impose stricter conditions on the AIFM or AIF than those for professional investors in this Directive.

However, they may not impose stricter/additional requirements on EU AIFs established in another Member State and marketed cross-border than on AIFs marketed domestically.

Member States that permit this shall inform the EC within one year of the types of AIF which AIFMs may market to retail investors and any additional requirements imposed and subsequent changes

Chapter IX: Competent authorities Section 1: Designation powers and redress procedures (Articles 40-44)

This section deals with the powers assigned to the competent authorities and their relationship to each other and ESMA. Not much of relevance to AIFMs or AIFs included herein.

Section 2: Cooperation between different competent authorities

Obligation to cooperate (Articles 45; 47 and 47a)

Member States shall cooperate with each other and ESMA and the ESRB and will facilitate cooperation, with competent authorities using their powers for cooperation even where an infringement of regulations is not made. They will supply one another with the information required to carry out their duties under this Directive immediately.

Exchange of information (Articles 45a-46)

Data will be retained for a maximum of five years and may be transmitted to third countries on a case-by-case basis.

There will be communication between the competent authorities of information relevant for monitoring and responding to the potential activities of individual AIFMs and AIFMs collectively for the stability of systemically relevant financial institutions and the orderly functioning of markets. ESMA and ESRB will be informed and forward information to competent authorities of other Member States.

Chapter X: Transitional and final procedures (Articles 47b-51)

- The Directive details various transitional procedures, including details on how the Directive will come into effect through delegated acts (largely to ESMA) and that: The Directive will enter into force 20 days after it is published in the Official Journal of the European Union.

- EU AIFMs which are managing and/or marketing AIFs before the date that the Directive comes into force in local law of Member States must adopt all necessary measures to comply with it and submit an application for authorisation within one year of that date.

- Non-EU AIFMs which are managing EU AIFs and/or marketing AIFs in the EU before the date that the Directive comes into force into force in local law of Member States must adopt all the necessary measures to comply with this Directive within one year of that date.

- Member States will bring into force the laws, regulations and administrative provisions necessary to comply with the Directive within 2 years of the Directive coming into force.

- The EC will review the application and the scope of the Directive three years after it comes into force.

Timeline

- Q1 2011 – Directive enters into force (no real effect).

- 2011/2012 – ESMA negotiations/implementation/ consultation (Level 2 Rules). Most rules are expected to be drafted by Q3 2011.

- Q1 2013 – Directive implemented into Member States' local regulation/law.

- Q1 2013 – Once authorised, EU passport available for EU managers of EU Funds (Private Placement continues for non-EU fund structures).

- Q1 2014 – Firms under the scope of AIFMD must submit an application for authorisation.

- Q1 2015 (Depends on ESMA) – EU passport for 3rd country funds/managers.

- 2016 – Wholesale review of Directive.

- 2018 (Depends on ESMA) – National private placement regimes may be turned off.

Footnotes

1 Directive 2003/41/EC of the European Parliament and the Council of 3 June 2003 on the activities and supervision of institutions for occupational retirement provision (IORP)

2 Directly or indirectly through a company with which the AIFM is linked by common management or control, or by a substantive direct or indirect holding

3 Directive 2009/65/EC of the European Parliament and of the Council of 13 July 2009 on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities (UCITS) In other words, the AIF is its own fund manager, so the AIFM and the AIF are the same party (e.g. some listed investment trusts)

4 In other words, the AIF is its own fund manager, so the AIFM and the AIF are the same party (e.g. some listed investment trusts)

5 Article 21 of Directive 2006/49/EC of the European Parliament and of the Council of 14 June 2006 on the capital adequacy of investment firms and credit institutions (recast)

6 Authorised under Directive 2009/65/EC of the European Parliament and of the Council of 13 July 2009 on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities (UCITS)

7 Directive 97/9/EC of the European Parliament and of the Council of 3 March 1997 Directive 2006/48/EC of 14 June 2006 relating to the taking up and pursuit of the business of credit institutions

8. Directive 2006/48/EC of 14 June 2006 relating to the taking up and pursuit of the business of credit institutions

9 Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments (MiFID)

10 Article 23 (3) Directive 2009/65/EC of 13 July 2009 on the coordination of laws, regulations and administrative provisions relating to UCITS

11 Directive 2000/12/EC relating to the taking up and pursuit of the business of credit institutions

12 Directive 98/26/EC of the European Parliament and of the Council of 19 May 1998 on settlement finality in payment and securities settlement systems

13 EC Recommendation of 6 May 2003 concerning the definition of micro, small and medium-sized enterprises

14 As prescribed by Article 22 (2) of Directive 77/91/EEC.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.