Games Go Online and on Sale: The Audience Grows, But at What Price?

Deloitte predicts that in 2011 the global computer and video game industry will continue growing but from a more diverse set of revenue streams. The industry is forecast to generate $52 billion in software revenues in 2011, 6 percent higher than in 2010, while hardware is predicted to generate only $13 billion, a decline of 19 percent154.

An increasingly large percentage of games revenue is likely to come from monthly subscriptions, peripherals, fees for services and in-game purchases and advertising in the free-to-play (F2P) and "Freemium" markets. Deloitte forecasts that the total revenue from these relatively new sources could be as high as $10 billion, or 16 percent of total game revenues, by the end of 2012, and over time could represent 50 percent of all revenues for the industry.

The existing PC and console game business is confronting various challenges. Increased software piracy has had a profound effect on sales over the past few years, costing the industry billions155. Meanwhile, the higher costs and lengthening development times for high-end games have made game development riskier (publishers need blockbusters) and has reduced profits across the industry as whole156. For PC game developers and publishers, more and more computing devices are being sold – but many of them are smartphones, tablets and netbooks that do not have the hardware to support conventional high-end games.

Console revenues and profits tend to be highly cyclical as both hardware and software purchases are linked to the console upgrade cycle157. Five years have passed since the current generation of consoles was released; the result will likely be relatively flat growth in 2011. Moreover, there are some concerns that the console refresh cycle, which has averaged five years for almost two decades, is about to lengthen into a 10-year cycle, as existing games are not yet putting stress on the hardware capabilities of existing consoles. This would delay the next expansion phase. Console makers hope to bridge the gap by introducing add-on features such as motion control, camera peripherals and 3D.

Three major technological drivers – powerful portable devices such as smartphones, ubiquitous network connectivity, and social gaming – are transforming the industry and creating new sources of revenue. As these new revenue streams emerge, the industry should see growth that is both more stable and more profitable. Also, the global audience of gamers will likely continue to expand rapidly, primarily due to an increase in casual gamers on consoles, web and social networks, and most recently smartphones and tablets. However, worldwide games revenues are forecast to grow more slowly than the number of gamers: revenue per gamer is expected to fall.

Only a few years ago, very few gamers were connecting to the Internet for any reason. But today, an estimated 53-78 percent of gamers (depending on their console) in the United States use a connected console to play multi-player online games, download new content and converse with other players while gaming. Connected consoles are also used as PC substitutes for applications such as streaming video158. The benefits to the gamer of a connected machine are enormous – but the benefits to the games industry are even greater: the arrival of connected gaming has not only slowed the growth of piracy, but actually reversed it, especially in geographies where piracy was particularly high159.

As more of their customer base gets connected, game publishers are likely to see expanding contributions from revenue sources that aren't entirely new, but are becoming increasingly important: micro payments from selling additional levels, characters and costumes; online stores; and, possibly, real-time ads placed in games (although this has not been a big market so far)160. Also, some high-end games are being sold as monthly online subscriptions. The cloud gaming market (or GaaS, gaming as a service) is still nascent but could become a significant revenue source for companies that have customers with fast Internet connections – even people with relatively low-powered netbooks or small, cheap thin-client devices that can be connected to TVs should be able to enjoy console-like experiences161.

The fastest growing games segment will probably continue to be F2P and Freemium games. These games are typically based on a revenue model where basic game play is free, but a premium is charged for add-ons that enhance the game experience such as extra levels, accelerated progress and special in-game accessories such as weapons, supplies and costumes (micropayments). Many subscription games are converting to F2P and seeing their revenues increase by 100 percent or more162. Total F2P revenues in 2009 were about $2 billion163; in 2011, that number could reach $5 billion.

The upshot of all these trends is that the gaming industry will likely see smoother revenue streams, higher revenues and profitability and massive user growth. The existing market of core gamers isn't about to go away, but the mix of people who play games is likely to shift in many ways: age, gender and income, among others.

|

Bottom Line The games industry appears to be following in the footsteps of the enterprise software market. Two decades ago, 90 percent of enterprise software revenues were one-time license sales – analogous to buying a game disc – and there were virtually no follow-on revenues or service fees. Today, many software companies derive more than half of their revenues from services and subscriptions, and license fees are much less critical. Although this change was disruptive to the industry, most enterprise software companies found that after the transformation they were still able to grow profitably while enjoying less revenue volatility. The games industry might be able to learn from their experience, leveraging best practices from the enterprise software industry while developing new best practices of its own. The F2P/Freemium revenue model is interesting and potentially lucrative. However, it could pose a serious disruptive threat to existing console hardware and software manufacturers if they respond too slowly. The new model will likely give rise to new competitors; also, it might reduce the perceived value of all games.164 The growing number of non-console and non-PC games and gamers suggests that companies focused on traditional console and PC hardware sales may need to diversify. We are already seeing high-end graphics chip manufacturers use their technology in non-gaming markets165. Also, the peripheral market seems to be shifting from single-purpose accessories (musical instruments, etc.) to multi-purpose peripherals that provide image recognition and motion capture. Peripheral manufacturers and game developers alike may need to adapt to this market shift. |

Keeping the Life in Live: A&R Diversifies

Deloitte predicts that in 2011, the live music sector, with festival organizers at the forefront, will start expanding its talent creation and nurturing role, either as individual companies or joint projects. Until now, that role has been left largely to music labels' artist and repertoire (A&R) divisions. The live sector will identify, invest in, develop and commercialize the next generation of stadium-filling artists, using a variety of approaches, from talent contests at festivals to dedicated facilities for nurturing new talent. All aspects of the live music sector may get involved: venue owners, concert promoters, television production companies, ticket sales agencies and even some established recording artists.

The recorded music industry has traditionally built a pipeline of up-and-coming music acts through their A&R divisions. In 2010, the industry spent almost $5 billion on development and promotion of all acts, with about half going to foster new talent166. However, after a decade of declining sales, the labels' A&R spending is shrinking both in absolute dollars and as a percentage of sales. In some countries, A&R investment as a percentage of revenues is down about 25 percent since 2006.167

By contrast, the first decade of this millennium has been particularly prosperous for the live music industry. Revenues rose steadily and even fared relatively well during the recent recession168. However, the decade ahead looks to be more challenging, perhaps due to the ongoing decline in A&R investment by the labels.

There are two cyclical factors that could soften live music revenues in 2011 and beyond, forcing the live sector to pick up some of the slack in terms of identifying and commercializing new acts.

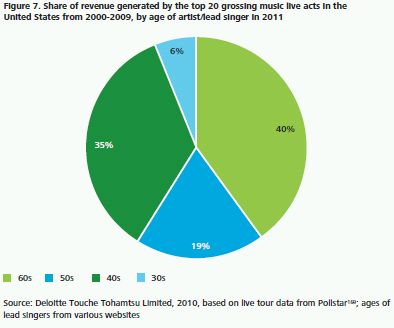

One factor is the vintage of the current highest grossing live acts. Some of the last decade's biggest draws appear to be approaching the twilight of their touring careers. In 2011 the lead singers for eight of the 20 highest grossing live acts in the United States from 2000-2009 will be 60 or older. Only one of the top 20, Rascall Flatts, released its first album this century (in 2000). Through 2009, Rascall Flatts grossed $222 million from touring. The other 19 acts, the majority of which rose to prominence on the back of single and album sales (and the associated promotional activity) grossed a cumulative $6 billion in ticket sales during the last decade: the sexagenarians alone brought in more than $2.5 billion (see Figure 7).

A second factor is the economy, particularly in industrialized countries. Stubborn unemployment, increases in value added tax, and an austerity-focused public sector might keep consumer confidence low and concert attendance down170. In fact, a weak economy might have been one of the key factors behind the 17 percent decline in the U.S. live market in the first half of 2010171.

While record companies will always exist, they might be unable or unwilling to handle their previous level of investment in new acts. If so, another part of the industry might need to take up the slack of identifying and publicizing new talent to a point where fans are willing to pay $100 or more per ticket to see them perform. The live music industry will need to build this new role into its long-term business model.

The role of festivals in A&R is likely to increase as festivals rely most heavily on musicians to sell their tickets. This differs from an arena or stadium whose major motivation is to book any act that can fill up its seats, including, for example, stand-up comedians whose staging costs are generally far lower.

Television's role in identifying new talent may start placing an increased focus on acts that are great recording acts but are even better at touring.

|

Bottom line As festivals start to become more involved in nurturing talent, one of the promotional activities they are likely to take on is the release of new albums and singles (and all of the marketing activity that goes with it). This is likely to remain the principal way to raise awareness of bands and their latest outputs; for many fans, seeing a number one single performed live is likely to remain a key selling point172. The live music industry might want to co-invest in the A&R process with companies outside of the music sector that wish to use music to promote their products. Given society's seemingly limitless affection for music, most vertical sectors – from fashion to mobile phones to automobiles – would likely value an association with music. Live music businesses could tap these brands to help pay for part of the talent development process, such as the funding of recording studios173. The record companies' traditional A&R process was very effective, but also very resource intensive. In today's environment where music fans seem to value a live experience more than a recording, the live music industry might be in a better position to identify top talent – specifically, the talent that can really deliver on stage. The various players in the live music industry must recognize their common need for an ongoing pipeline of new acts to replace the existing big draws – and they must take combined action. Over the next few years, label-sourced A&R is likely to decline by roughly $500 million per year globally. It seems reasonable to assume that the live music industry – or other source of funding – will need to step in to prevent the well from running dry. |

Pop Goes Pop-Up: Music Retail Goes Seasonal and Temporary

Deloitte predicts that 2011 revenues for digitally distributed music will exceed physical music sales in at least one major market, most likely the United States. This long-anticipated event will probably be driven by a sharp decline in CD sales, rather than a significant increase in digital music subscriptions or downloads174.

This likelihood leads to a related prediction: CD retail will start becoming a seasonal or event-driven purchase. By the fourth quarter of 2011, there could be 1,000 temporary "pop-up" music outlets created to meet occasional surges in demand. Pop-up outlets will be a small, but growing, niche segment175.

In 2011, the United States will likely be the first of the big-three recorded music markets to see digital music revenues from downloads, subscriptions and streaming services advertising surpass revenues from physical music. The UK is likely to follow, either in 2011 or by the end of 2012176, assuming CD sales continue their steep decline177. To put the severity of this decline in perspective, CDs made up 75 percent of record labels' 2009 revenues in the United Kingdom.

The decline in the CD market is likely to cause a marked reduction in year-round shelf space dedicated to physical music. Even with fewer competitors, dedicated music retailers may decide that their shrinking revenues and profit margins make physical music retailing less viable178. Some may diversify, shifting their focus from recorded music to equipment for playing music, concert and festival tickets, or music-related clothing.

Rather than selling popular hits, other music retailers may specialize in music genres that would be harder to discover on the Web. Their aim would be to attract fervent music fans who are willing to pay for music. These niche markets will likely make up only a small portion of total album sales, similar to vinyl record sales. For example, in the United States, vinyl sales grew 250 percent from 2006 to 2009. However, the end result represented only 2.5 million units out of a total album market of 374 million179.

Despite the shift toward digitally distributed music, physical music retailing will not vanish: while demand for CDs in the medium term will continue, it will become increasingly seasonal. In 2010, nearly half of all CDs sold in the United Kingdom were expected to be purchased during the fourth quarter, driven by seasonal gifting and the finale of music talent shows180.

Retailers will likely respond to variable demand by creating pop-up stores. Current music retailers might establish a variety of temporary stores, including conventional retail spaces with short-term leases181, temporary outlets in high traffic locations182 and small-scale outlets offering curated, exclusive merchandise183. These curated outlets could be located wherever and whenever there are people who want to buy CDs, such as at live music venues184.

In the medium term, pop-up stores may also be set up to coincide with major record releases. A long line of fans eager to purchase a new release from a pop-up store could generate marketing buzz and increase record sales.

General retailers, such as department stores and supermarkets, may abandon selling CDs year-round if their turnover and margin targets are not met. Instead, they may only stock CDs when demand is stronger, such as during gift-giving seasons or major music events. In some cases, music might be sold from a pop-up outlet physically located within the main store185. During the rest of the year, music might only be available from the main store's website186.

|

Bottom Line The next few years will probably remain challenging for music retailers. The one bright spot is that CD prices could rise over the medium term as dedicated CD buyers have fewer outlets to choose from. CDs could follow the path of vinyl LPs, which rose significantly in price following their exit from the mainstream. Music fans who prefer CD audio quality might be willing to pay a higher price. However, price increases will not compensate for a continuing decline in unit sales; net revenues from recorded music will continue to decline. Nevertheless, because recorded music provides crucial exposure for musicians, it is likely that record labels and other music promoters will continue to produce CDs – even at a loss. |

Footnotes continued

154. World Video Games Market: Data and Forecasts 2010-2014, IDATE, 2 June 2010: http://www.idate.org/en/Research-store/Collection/Market-Data-Reports_23/World-Video-Games-Market_515.html

155. One study suggests $41.5 bilion for portable game piracy alone. Japan's Computer Entertainment Supplier's Association report dated 4 June 2010 cited in Slashdot, 8 June 2010: http://games.slashdot.org/article.pl?sid=10/06/08/057245 and http://www.cesa.or.jp/news/1393/51/ (in Japanese)

156. Homefront Studio: Rising dev costs post greatest challenge to games industry, Interview with Zack Wilson of Homefront/THQ, 14 September, 2010: http://www.nowgamer.com/news/4226/thq-studio-dev-costs-biggest-industry-issue

157. Xbox birthday signals death of 5-year console cycle, CNET News, 29 November 2010: http://news.cnet.com/8301-13772_3-20023926-52.html

158. PlayStation 3 is "most connected" console in US, The Diffusion Group Research, 12 April 2010: http://tdgresearch.com/blogs/press-releases/archive/2010/04/06/sony-ps3-most-connected-game-console.aspx

159. An article titled 'Game Hacking 101' which is sample chapter from the book 'Exploiting Online Games: Cheating Massively Distributed Systems' published by Addison-Wesley Professional, InformIT, 21 November 2007: http://www.informit.com/articles/article.aspx?p=1074291

160. Microsoft redeploys Massive technology, Microsoft website, 20 October 2010: http://community.microsoftadvertising.com/blogs/advertising/archive/2010/10/20/microsoft-redeploys-massive-technology.aspx

161. Cloud gaming means sky's the limit for any PC, Guardian, 24 November 2010: http://www.guardian.co.uk/technology/2010/nov/24/cloud-gaming-pc-onlive-gaikai. Although the issue is complex: some think that GaaS is being pushed out by F2P, while others who went from subscription to F2P are now going back to subscriptions.

162. Lord of the Rings Online Revenue Doubles Since Going F2P, MMO Hut, October 2010: http://mmohut.com/news/lord-of-the-rings-online-revenue-doubles-sincegoing-f2p

163. A blog on 'Top Moneymaking Online Games Of 2009', Forbes, 10 June 2010: http://blogs.forbes.com/velocity/2010/06/10/top-moneymaking-online-games-of-2009/

164. EA: Free-to-play will threaten console business, News at GameSpot, 5 November 2010: http://www.gamespot.com/news/6283592.html

165. Nvidia describes 10 teraflops processor, EE Times Europe, 18 November 2010: http://eetimes.eu/en/nvidia-describes-10-teraflops-processor.html?cmp_id=7&news_id=222904640&vID=209

166. To provide context of the scale of investment that can go into promoting a new release, Taylor Swift's October 2010 release, "Speak Now", which sold a million copies in its first week on release, was backed by a two-year long marketing campaign. Source: Taylor Swift Album Is a Sales Triumph, New York Times, 3 November 2010: http://www.nytimes.com/2010/11/04/arts/music/04country.html

167. New report shows how much record companies are "investing in music", Music Industry Report Press Release, 10 March 2010: http://musicindustryreport.org/?p=17865

168. Live music boom drives off recording blues, Financial Times, 20 August 2010: http://www.ft.com/cms/s/0/c8ff8d50-ac85-11df-8582-00144feabdc0.html

169. Top tours of the decade 2000 – 2009 in North America, Pollstar: http://pollstarpro.com/files/TopTourOfTheDecade.pdf

170. See attached for a discussion on the potential impact of a rise in value added tax on the live music sector. Source: Budget threatens ticket price hike as global live music biz sags, Beehivecity.com, 17 June 2010: http://www.beehivecity.com/politics/budget-threatens-ticket-price-hike-as-global-live-music-biz-sags191049/

171. One other factor cited for the performance of the U.S. box office was the concentration of events within the same few months. Source: Live Biz Hit By Summer Slump, Cancellations, Billboard.biz, 16 June 2010: http://www.billboard.biz/bbbiz/content_display/industry/e3ic9efda4c1138e1a1d77221cc685b20ae

172. One reason attributed to lacklustre demand for some U.S. touring acts was the lack of recent album or single releases. Source: Live Biz Hit By Summer Slump, Cancellations, Billboard.biz, 16 June 2010: http://www.billboard.biz/bbbiz/content_display/industry/e3ic9efda4c1138e1a1d77221cc685b20ae

173. For example, Converse has set up a community-based recording studio in Brooklyn, New York. See: We are opening a community-based recording studio in Brooklyn. For real., Converse, 5 October 2010: http://play.converse.com/play/blog/?p=2809

174. According to the IFPI, in 2009 CD sales fell by 12.7%, losing $1.6 billion in value; digital downloads grew by 9.2%, gaining less than $400 million in value.

175. In 2010, one chain, ToysRUs opened 600 pop-up toy stores in the U.S. alone. Source: Boo! Pop-Up Stores Popping Up All Over, NPR, 19 September 2010: http://www.npr.org/templates/story/story.php?storyId=129942010

176. Deloitte's view is that it is feasible that physical sales recapture the lead over digital distribution in markets where it had already been overtaken. If in 2012 there were a strong roster of album releases by the type of artist that is favored by mature audiences, this would boost CD sales, as this age group tends to buy physical product rather than downloads, particularly in gift-giving season. Any regained lead would probably be short-lived.

177. For perspectives on other markets, see: for Canada: Industry looks to the titans to revive flat sales, Metro News, 25 November 2010: http://www.metronews.ca/halifax/scene/article/702329--industry-looks-to-the-titans-to-revive-flat-sales

178. One of London's largest music stores is scheduled to close in 2011. Source: HMV to leave Oxford Street store, Retail Gazette, 18 November 2010: http://www.retailgazette.co.uk/articles/22302-hmv-to-leave-oxford-street-store

179. U.S. vinyl record sales. Source: Top Ten Selling Vinyl Albums of 2009, Musicbyday.com, 10 January 2010: http://www.musicbyday.com/top-ten-selling-vinylalbums-of-2009/768/; U.S. 2009 album sales. Source: U.S. album sales fall despite Michael Jackson boost, Reuters, 6 January 2010: http://www.reuters.com/article/idUSTRE6055R020100106

180. X Factor finalists top UK chart with Bowie's Heroes, BBC News, 28 November 2010: http://www.bbc.co.uk/news/entertainment-arts-11858000; Take That album sales frenzy, itv.com, 16 November 2010: http://xfactor.itv.com/2010/music/viewer/read_take-that-album-frenzy_item_100929.htm; Industry looks to the titans to revive flat sales, Metro News, 25 November 2010: http://www.metronews.ca/halifax/scene/article/702329--industry-looks-to-the-titans-to-revive-flat-sales

181. HMV to open pop-up shops, BBC 6 Music News, 19 October 2009: http://www.bbc.co.uk/6music/news/20091019_hmv.shtml; Pop up shops, LoveCamden.com: http://www.lovecamden.org/pop-up-shops

182. For an example of this approach in the jewelry sector, to address demand in the run-up to Valentine's day, see: Signet Group jewellers open pop-up stores for Valentines, MarketingWeek.co.uk, 8 February 2010: http://www.marketingweek.co.uk/signet-group-jewellers-open-pop-up-stores-for-valentines/3009713.article

183. For an example of how pop-up stores have worked in other sectors, see: The pop-up shop phenomenon, Sunday Times, 28 December 2008: http://www.timesonline.co.uk/tol/life_and_style/food_and_drink/eating_out/article5388955.ece; for an example of how pop-up stores have worked in food retail, see: Marmite reopens pop-ups, Marketing Week, 20 October 2010: http://www.marketingweek.co.uk/sectors/food-and-drink/marmite-reopens-popups/3019578.article

184. For some examples of deployments of music stores, see: Third Man pop-up stores to hit London this week, DrownedinSound.com, 27 October 2009: http://drownedinsound.com/news/4138263-third-man-pop-up-stores-to-hit-london-this-week; The Black Keys release Brothers + NYC pop-up store + 2010 tour dates, bandweblogs .com, 11 May 2010: http://bandweblogs.com/blog/2010/05/11/the-black-keys-release-brothers-nyc-pop-up-store-2010-tour-dates/

185. Popping for Shoppers, Hub Magazine, February 2010: http://www.hubmagazine.com/archives/the_hub/2010/jan_feb/the_hub34_tracylocke.pdf

186. 'X Factor effect' boosts profits, says Sainsbury's boss, Independent, 10 November 2010: http://www.independent.co.uk/news/business/news/x-factor-effectboosts-profits-says-sainsburys-boss-2130007.html

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.