Welcome to the Empowering Ideas 2011 report for the Energy & Resources sector.

This is the second year in which the Global Energy & Resources group of Deloitte Touche Tohmatsu Limited has published its power and utilities report for the year ahead.

The end of the global economic crisis has forced electric utilities companies to confront new challenges. While the demand for energy continues to increase as a result of the growing global population, security of supply represents a major challenge. The reputation of nuclear energy was hard hit by the recent Japanese earthquake and resulting tsunami. While renewable energy continues to enter mainstream utilization, unconventional gas has become more economically attractive based on improved drilling technology. LNG and coal are abundant sources and remain important parts of many nations' fuel mix but coal could be helped by clean coal technologies and coal-to-liquids processes. Investments in renewable energy, in the form of solar, wind and geothermal resources, continue to increase at the expense of new build nuclear energy which, in many countries, continues to be a subject of debate. In heavily regulated markets, mergers and acquisitions may be one option for utilities to grow as organic growth prospects may be limited. Energy efficiency and demand side management programs offer a 'win-win-win' for governments, utilities and consumers. A clear trend is the growing importance of data analytics applied by power companies. Advanced IT techniques are helping power companies to analyse enormous data sets to create scenarios and make informed decisions.

The methodology for developing this set of issues and trends comes from interviews with Deloitte's most senior partners that serve clients in the power and utilities marketplace. I am most grateful to all of them that offered up their insights and expertise at a time when their time and attention was in high demand.

As economic growth increases demand for electric power, the power and utilities sector will likely experience challenging conditions during 2011 and into 2012. The issues and trends in this report may stimulate debate, inform of possible industry directions and may even help identify potential courses of action to deal with these challenges

Introduction

According to the International Energy Agency, demand for energy is expected to increase by more than 50 percent in the next 30 years. This is mainly related to the expected growth of the world population from 7 billion now to a forecasted 9 billion people in 2040. In the next 10 years, China's population is expected to grow by approximately 80 million people and India's by 160 million. Energy consumption is expected to more than double in the next 10 years and both countries will be importing 70-80 percent of their energy needs. Key factors for increased energy demand will be fuel for vehicles and electricity for home use. Growth of international mobility will also lead to an increase of sea-bound and air-bound transportation.

On the supply side, hydrocarbons will definitely continue to be the main source of energy supply for the next 40 years. In the fuel mix we will need to keep all current energy supply options open. Experts predict that renewable energy supply from bio, solar, wind and geothermal will grow fast, and could count in 2050 for more than 35 percent of the total energy supply mix. Prior to the earthquake in Japan, Deloitte member firm nuclear practitioners had anticipated a revival of nuclear power, with over 100 new nuclear plants currently planned, but now the impact of the Fukushima disaster will most likely result in a downward adjustment of this forecast. Due to its abundance, coal will be increasing in importance in combination with carbon capture and storage and also helped by clean coal technologies, coal to liquids, zero emission power plants and the likes. Natural gas is, at the point of consumption, the cleanest hydrocarbon and supply is expected to grow fast as well, mainly due to the abundant unconventional gas resources that have recently become more economically attractive due to new extraction technologies.

This very significant anticipated increase in fuel supply obviously requires massive investments. The International Energy Agency anticipates US$25 trillion in investments in the energy industry over the next 25 years, or almost US$1 trillion of investments per year. At a time when natural disaster and fiscal crises have wiped billions of dollars of value off the boards, investors will pay heightened attention to the allocation of risk between the public and private sectors. Governments seeking to mobilize private sector capital will need to carefully consider the relationship between energy policy, fiscal policy and risk allocation on specific projects.

Carbon dioxide and other greenhouse gases are a key factor in investment decisions and it can be expected that there will be continued global focus and media attention for climate change. Sustainable principles will drive the economic and global system more and more and there will be an increased focus on renewable energy. In 2009 in Bali, 2010 in Copenhagen and 2011 in Cancun, world leaders aimed to set global targets for climate management. And although these efforts were not very successful so far, it is clear that emissions certification and trade schemes will increasingly become important in the future.

In this connection, the power and utilities sector faces significant challenges and perhaps the most pressing is reducing greenhouse gas emissions. Carbon capture and storage is one of the many solutions companies are employing to reduce their carbon output. Other power and utilities companies face particular challenges managing their ageing assets, streamlining project management or identifying their highest margin services. Many power companies must also determine how to transfer industry knowledge from an ageing workforce to a new generation of workers.

In the next 10 years, China's population is expected to grow by approximately 80 million people and India's by 160 million..

1. The future of nuclear: The post-Japan path

The earthquake and resulting tsunami in Japan are tragedies of enormous scale. In the days and weeks that have followed, much of the attention is being placed on one power plant, Fukushima and its reactors. The impact of these forces of nature on the nuclear industry will be both profound and long-lasting. This begs two questions: should the world turn its back on electricity powered by nuclear energy, and secondly, how will the global power sector be impacted by these series of events?

The answer to the first question is an emphatic "no". Nuclear energy still makes up a sizeable portion of many countries' portfolio mix, including France, Japan, Korea and the U.S., and features prominently in the future energy plans of countries such as China, India and Vietnam, who are embarking on large-scale nuclear new build programs. Many modern nuclear plants have multi-layered safety programs in place that provide a much improved hedge when compared to older plants. Add to the fact that energy produced by nuclear plants is virtually free of greenhouse gas emissions, is constant and provides a mechanism for energy independence, it's easy to see that nuclear power will be a major source of electricity for decades to come.

To answer the second question, there appears to be little doubt that new challenges will be faced by industry and government alike. These challenges will impact those nuclear plants already in service and those that are planned for construction.

While most countries have announced safety analyses for their nuclear fleets and some have suspended ongoing permitting procedures for new nuclear plants, the most dramatic changes have been in Germany. Recently, thousands of people protested for an immediate shut-down of all nuclear power plants. The governing coalition has reacted by enforcing a temporary downtime of three months for the oldest nuclear plants. However, at least one of those plants has been shut down permanently and the industry is expecting that several more will share this fate.

German operators so far have been very active in the media, essentially repeating the message that German nuclear plants are safe based on local conditions that are not comparable to the seismic and tsunami related conditions of Fukushima. However, they are very careful and taking precautionary measures. E.ON preemptively shut down the plant Isar 1 for a safety analysis based on the lessons learned from Japan.1

The Fukushima disaster will definitely result in a call for enhanced safety standards, especially in the areas of backup power systems, protection against terrorist attacks and airplane crashes as well as with the primary cooling cycle. These increased requirements could potentially spell the end for the older power plants, as especially the protection against the crash of a large current commercial plane basically means an entirely new concrete mantling of the reactor building, the cost of which is greater than the expected returns of those plants, even in favorable scenarios. There is an expectation for a re-evaluation of the entire risk catalog, as well as an expectation of major changes to policies and procedures regarding incident reporting, crisis handling, both on a voluntary and mandated basis.

The disclosure of information to regulators and the public in terms of operations is already very detailed, while key risks have only been shared with local regulators and costs are generally only disclosed on a much aggregated level, if at all. It is reasonable to expect increased information demand from regulators will result in mandatory reporting requirements for the operators

The regulators could also use this opportunity to increase their scope of jurisdiction to other company units that are not currently under their supervision, as they have tried in the past. German nuclear plants have very detailed procedures to follow in case of a crisis, but these and the roles of the operator and government differ between each federal state. At a certain point, the state government takes over making the strategic decisions (e.g. shut down), whereas the operational decisions are always made by the plant leadership.

With the accented emphasis on risk management and regulatory oversight, developers of new build projects will face a different reality of risk and return. The challenges witnessed in recent years around cultivating private sector development of new projects appear set to continue – as highlighted by NRG's suspension of fresh investment at the South Texas Project. Societies and governments that elect to proceed with nuclear energy may need to re-calibrate the allocation of risk between public and private sector participants.

While the stock prices of many nuclear operators have taken large hits, the ratings have not been changed because of the safety requirements already in place. Thus far, the markets are only reacting to the expected lower earnings due to temporary shutdowns but have not "priced in" a larger safety risk than before the events. Funding might become a little more difficult due to increased public resistance and tighter permitting procedures, but probably not much more difficult than it already is – a notable exception being investor appetite for funding development stage costs – particularly for non-regulated facilities – until greater comfort with development risk is achieved.

There have been political shifts in various countries around the world that would not have been thought possible as recently as six months ago.

The political factor will dominate local markets, with some hardly changing at all and others introducing drastic changes. If the regulators demand substantial additional safety measures to mitigate reevaluated risks, counterbalancing measures may be required to bolster the business case for investment. Also, there are a few parties aiming for a European answer to the question what consequences should be drawn from Fukushima. With national interests diverging as far as France (nuclear power house with ~80% nuclear power) to Austria (no nuclear and deep anti-nuclear philosophy) this will be no easy task. Those countries introducing anti-nuclear measures, e.g. speeding up their phase-out process, will likely have to increase funding and subsidies for renewable energy sources and transmission/distribution lines to speed up their developments and meet their CO2 targets, which will further put pressure on many country's budget.

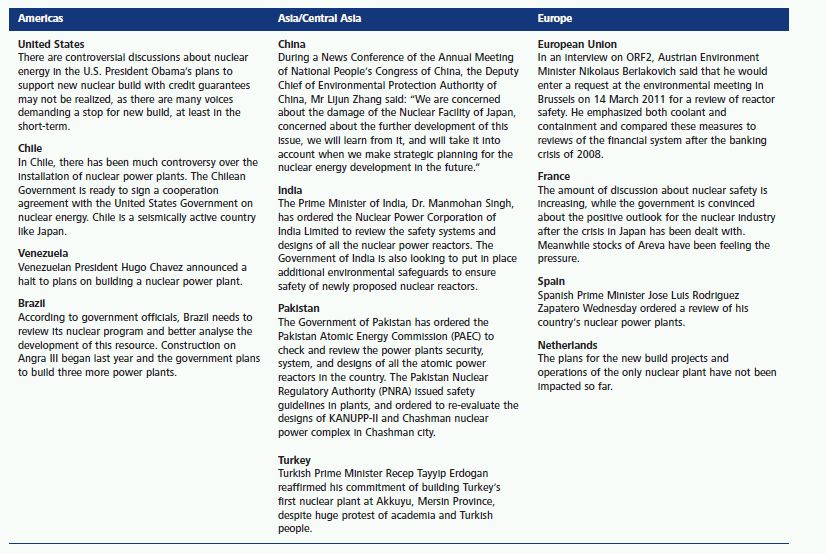

To place the events of Japan into perspective, a brief look on selected developed and developing nations' recent actions on nuclear energy is highlighted opposite.

Bottom line

Over the short-term, the debate surrounding the future of nuclear energy will be difficult as each nation's government and population debate the pros and cons, the length of which will depend on how fast the situation at Fukushima I can be brought under control. Countries in close proximity to oceans will give nuclear energy a more extensive and thorough review with an eye towards the safety and strength of their nuclear infrastructure and the potential of damage to the local population and water and food supplies. Longer-term, pro-nuclear nations are expected to unveil additional government review and oversight based on the events in Japan.

2. Risk management: The new challenge

The utilities industry faces daunting challenges and intense scrutiny from all stakeholders – all the more so at this point in time. The events in Japan have awakened board rooms to the prospect that a single one-off event could drive even the largest of utilities to the brink of bankruptcy. Meanwhile, the about-face in Spanish energy policy has highlighted the interconnectity between shareholder value and government policy. For economically mature and industrialized nations, concerns surrounding carbon emissions is high while billions must be invested in ageing infrastructure. Some fuel prices are rising forcing utilities to take a second look at operating costs while the workforce is ageing indicating that future productivity could take a hit over the short term. The recent economic downturn and recovery is forcing utilities do deal with more payment defaults while cybersecurity is becoming a major risk in a digitally-driven economy. On the other hand, growing economies such as China and India are beginning to experience their own unique challenges ranging from non-technical loss during transmission to grid connectivity. But one issue they all have in common: how best to mitigate the risks of infrastructure capital projects.

Electric power projects are some of the most complex in the industry. The industry's complexity and continued globalization drives high risk in capital projects and failing to successfully execute these projects can significantly impact shareholder revenue. The trend toward planning, engineering, and construction to completion is increasingly being decentralized across globally distributed partners. To mitigate risks and execute successfully, capital-intensive power projects require clearly defined and auditable business processes and thorough planning upstream which sets the stage for improved construction completion downstream. The business case for improved processes is easy to see: a U.S. National Institute of Standards and Technology (NIST GCR 04-867) report estimates the costs of inadequate interoperability in U.S. general capital projects at US$15.8 billion a year. What this calls for is interoperability and efficient data management.

The most significant challenge for capital projects is managing and synchronizing the flow of large data sets that must be funneled into a unified and collaborative data warehouse. Regardless of the project – greenfield or refurbishment, partners in geographically dispersed regions around the world generate thousands if not millions of living documents containing multiple iterations and revisions of mission-critical project information such as requirements, contracts, designs, drawing, financial transactions including billing and maintenance instructions. This information should be maintained not only during construction but also for the operational life of the power plant. In most cases, the key question is not whether the information exists, but whether it exists in a format that is easily stored and accessed within the confines of the office but remotely as well. In the case of plants that were built in the pre-personal computer era, most facilities relied on paper drawings and typewritten documents. These documents should be made accessible in a digital format.

Beyond managing the challenges of large capital projects, investors, boards and senior management of power and utilities may wish to update their systems and processes for assessing, monitoring and managing risk across their businesses. At a project level, this may feature a more critical approach to modelling of shareholder value under alternative scenarios. Host governments seeking to attract private sector capital to their projects will need to understand the evolving perspective of investors on risk management.

Bottom line

For investors, now is a time to dust off risk registers, carefully vet investment decisions, and bolster the quality of data management on large projects. For governments, now is a time to reconsider the interconnection between energy policy and project level risk allocation – or risk watching capital flow elsewhere.

3. M&A: Is it time to buy or sell?

As companies in some markets look to renew growth in an anemic economic recovery, many power and utilities executives are being called upon to facilitate M&A driven growth strategies. With over a trillion dollars of cash on corporate balance sheets in the United States alone, and improving capital markets around the world, many companies are seizing the moment to become strategic buyers while others divest non-core assets. By and large, utility mergers are being driven by the challenge of finding growth opportunities within existing utility service territories due to reduced customer demand and associated reduced opportunity for power generation or electric transmission investments.

2010 was characterized by a lack of mega deals but several were prominent. According to Dealogic, the largest deal by value was the US$21.5 billion merger between GDF Suez and the UK's International Power Plc. The combined business creates an independent power generation group with over 66GW of gross capacity in operation and committed projects expected to deliver 22GW of gross capacity by 2013.3 Williams Pipeline Partners LP and Williams Partners LP was the second largest deal of 2010 at US$13.2 billion. This deal forms one of the largest natural gas partnerships in the U.S. Coming in at third was EdF Energy's sale of its UK electricity distribution networks to Hong Kong-based Cheung Kong Infrastructure Holdings Ltd for US$9 billion. More recently, Cheung Kong, controlled by billionaire Li Ka-Shing, agreed to acquire 75 percent of a Canadian power plant for C$91.4 million (€68 million, US$93 million).4 These two deals will help propel the company's acquisition momentum into 2011. Another U.S. – focused deal involved FirstEnergy's bid for rival electric company Allegheny Energy. The deal had been subject to a number of regulatory formalities at public utilities commissions in several states before being given their formal approval. The planned merger between FirstEnergy and Allegheny Energy cleared its final hurdle on February 24 after the Pennsylvania Public Utility Commission gave its blessing to the deal in a 3-2 vote.5 Together the companies would include 10 electric distribution companies in seven states serving six million customers. The combined company would have about 24,000 MW of generation, US$48 billion in assets and US$16 billion in annual revenue.6 Rounding out the top 5 largest deals announced during 2010 was PPL Corp's US$5.6 billion deal for Central Networks from E.ON which will nearly double the size of PPL's global customer base to 10.2 million and expand its geographic reach.7

This deal follows the completion of PPL's US$7.6 billion purchase of two Kentucky utilities in 2010. This appears to be a trend being used by other utilities of investing in government-regulated businesses which provide a more stable revenue source for energy companies compared with the volatile, unregulated electricity sales that have slumped since the recent recession.

Several other M&A trends will continue to evolve during 2011:

New regulatory hurdles to cross. Previous M&A deals were subject to the "cause no harm" edict where the proposed deal would cause no harm to consumers. This is now being replaced with a "net benefit to the public" edict where future M&A deals are likely to be judged on the benefits they bring to the consumer. As part of this new operating model, the net benefit will also help localities meet their new goals of reliance on renewable energy and by cutting greenhouse gas emissions.

Going for scale. In fragmented electricity markets, reaching a certain scale will allow merged entities to provide more service offerings and to spread new technologies such as smart grids and pass cost savings on to a larger base of consumers. Merged utilities can install systems that shut down home air conditioners when the system is under strain – or switch two-way water heaters between gas and electric. A case in point is the current situation in Ontario, Canada.

The city currently has 90 local electric utilities, mostly owned by municipalities.8 Further, 30 of them have less than 10,000 customers each and will likely have to look at a certain degree of collaboration or through consolidation activities to get scale. But they'll need financing for the capital costs, and sometimes size matters. A renewed interest in renewable energy. The political unrest in the Middle East and North Africa combined with the tragedy in Japan point to a predicted increase in interest in renewable energy. The WilderHill Clean Energy Index, which had previously underperformed the Standard & Poor's 500 by nearly 9 percent from the beginning of the year until the day of the earthquake, has more recently, out-performed the market by more than 4 percent.9 However, some countries have begun to pull-back their subsidies on renewable energy – potentially leading to M&A activity as incumbents seek to reposition their portfolios. Germany recently cut certain industry payments by about 15 percent. During 2010, it had spent 18 percent on renewable energy subsidies.10

Political uncertainty over the renewal of federal tax credits for renewable energy production and slumping electricity prices saw wind power installation in the U.S. fall 71 percent in the first half of 2010 versus the previous year. The most severe reversal came from Spain. Since the beginning of 2002, the Spanish government spent €23 billion into solar but recent subsidy cuts will likely threaten the very existence of some developers. But with the nuclear industry firmly at center stage of the naysayers, renewables may find that private equity firms have an increased appetite for investment.

Bottom line

Over the short term, the power sector will continue to witness increased industry consolidation as many markets remain fragmented. Regulations on coal-fired generation are expected to increase, steering buyers toward cleaner baseload generation. Chinese power companies are only just now getting started in mergers and acquisitions; China's giant utility State Grid Corporation spent nearly US$1 billion to buy seven Brazilian power transmission companies, the latest in a series of big bets by Chinese corporations in Latin America. Outbound China M&A will definitely continue to display rapid growth.

To view this article in full please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.