OVERVIEW

Organizations face a myriad of internal and external challenges that compete for attention, resources, and time. The Top Five Total Rewards Priorities Survey seeks to uncover the most critical challenges as we manage in 2012. This year's survey showed a dramatic shift in focus as employers pointed to concerns about talent. When asked to identify the most significant challenge facing their organization over the next three years, employers identified the shortage, motivation and retention of talent.

Despite the long stretch of high unemployment and slowing of voluntary turnover, companies are still worried about a talent shortage, especially among highly-skilled employees that drive performance and fuel growth. Recent findings from Deloitte's Talent Edge 2020 longitudinal survey series offer little comfort, revealing that only about one-third of employees at larger companies expect to stay with their employers once the economy gains traction.

While the talent shortage has taken center stage among the 2012 Top Five Survey respondents, nearly half of the respondents are individually concerned about their own job security. This concern may also be a reflection of persistent economic uncertainty that continues to weigh heavily on employees' minds. Another primary personal concern is the ability to afford retirement, including post-retirement health care. There is clearly a good deal of angst about the future in the HR trenches.

At the same time, there are some daunting organizational challenges that are not going away and cannot be ignored. When asked to identify the Top Five Total Rewards challenges facing their organizations today, the cost of health care was at the top of the list for the fourth consecutive year. Sponsored jointly by Deloitte and the International Society of Certified Employee Benefit Specialists, the 2012 Top Five survey marks its 18th year as a barometer of strategic challenges facing organizations. Here's how the 330 respondents ranked the Top Five priorities for 2012:

- The cost of providing health care benefits to active employees

- The willingness or ability of employees to pay for benefit plan coverage and to manage their own reward budget

- The ability of reward programs to attract, motivate and retain the talented employees needed to effectively run the organization

- The ability to adjust to and comply with current and future provisions of health care reform legislation

- Clear alignment of Total Rewards strategy with business strategy and brand

Other key findings in the 2012 survey:

- An overwhelming majority (85%) of respondents believe benefit costs per employee will rise over the next five years as a result of health care reform.

- Over two-thirds (68%) of employers planning a redesign of their Rewards Program expect to reevaluate their benefits strategy in light of health care reform.

- The majority of survey respondents (70%) are considering expanded wellness programs to help manage health care costs.

- Half of employers are planning to increase employee communication and education around rewards with 36% focused on providing employees with better tools to plan for retirement needs.

- One in five organizations has integrated social media into their Total Rewards communication campaigns.

- Outsourcing is gaining high marks on satisfaction, but organizations are still looking for improvements.

TALENT SHORTAGE IS THE TOP CHALLENGE

Even with an apparent surplus of job seekers

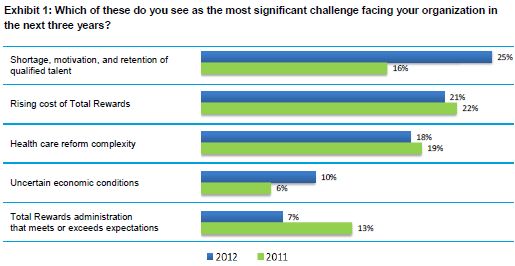

In a striking shift from last year, the 2012 Top Five Survey reveals that concerns about a shortage of qualified talent has emerged as the most significant challenge facing organizations over the next three years. A quarter of respondents pointed to the shortage, motivation and retention of qualified talent, which is up from 16% last year. This result also moved talent from third in 2011 to the top spot among the most significant challenges. This upward swing from a year ago comes at a time when unemployment remains near historical highs.

This may suggest that HR professionals believe today's surplus of job seekers has not translated to a talent surplus. Rather, employers are facing heightened competition for highly skilled talent that is not necessarily present in the large pool of unemployed.

These findings are consistent with those highlighted in Deloitte's new survey series Talent Edge 2020, which states: "The talent paradox is already creating key shortages. High unemployment rates have not created the talent surplus as predicted. On the contrary, many executives predict talent shortages across key business units." Thinking in terms of supply and demand, it appears that the large supply of talent upon which organizations can draw does not – for the most part -- possess the skills and expertise in demand at those organizations.

This point is further reinforced by the study of manufacturing organizations conducted by Deloitte and The Manufacturing Institute. The 2011 report, Boiling Point? The Skills Gap in U.S. Manufacturing, indicates that the jobs most difficult to fill are those with the biggest impact on performance ‒ skilled production, engineering technologists, and scientists. At the same time, high unemployment is not making it easier to fill positions, particularly in these high-skilled workforce segments.

The 2012 Top Five survey respondents represent a diverse cross-section of the U.S.-based employer population by industry and size, and the survey results show that smaller organizations (1,000 employees or less) are the most concerned about the shortage of talent, followed by those with 1,000 to 5,000 employees. From an industry perspective, this concern is highest among insurance and professional services firms.

TAKING IT PERSONALLY

Worried about job security and retirement affordability

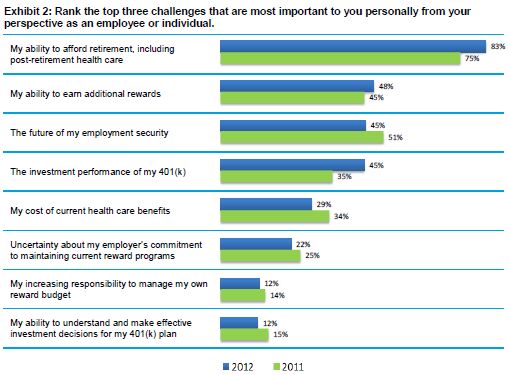

While the talent shortage is top-of-mind among HR professionals, at the personal level, 45% are worried about their own job security. Being constantly attuned to the shifting forces within the jobs and talent marketplace could lead to a higher level of anxiety about one's own position. While job security is clearly a major personal challenge, it ranks behind two other pocketbook issues in this year's survey.

When asked to identify the top three personal challenges, findings show respondents continue to be concerned about their ability to afford retirement and post-retirement health care, selected by 83% of respondents. According to the U.S. Department of Health and Human Services, the cost of health care for a person over age 65 is, on average, 3.3 times higher than the cost of health care for a working-age person, and these costs are expected to grow. The number two challenge, selected by 48% of respondents, is "the ability to earn additional rewards that allow me to stay on top of inflation and advance in real economic terms."

When comparing responses while wearing the "employer hat" vs. the "employee hat," some interesting contrasts arise. At the personal level, health care costs rank fifth, while it's the number one employer Total Rewards challenge. Financial concerns – affording retirement, inflation, job security, and investment performance – dominate personal challenges. In contrast, employers are focused on more strategic concerns around talent, health care reform, and rewards program strategy and alignment.

With personal challenges in mind, the survey asked respondents about personal action steps planned over the next one to three years. Maximizing health status for today – in an effort to reduce future health care expenses in retirement – ranks highest among personal actions with 58% indicating they will actively participate in wellness and disease management programs. This finding aligns with organizations' willingness to invest in wellness programs and reflects a growing awareness that organizations and their employees share responsibility for managing the cost of health care.

Other action steps are tightly linked to retirement concerns, as 50% are planning to increase their level of contributions to private savings plans (e.g., stocks, bonds, mutual funds, bank accounts) and 43% are planning to increase the level of contributions to qualified retirement plans, (e.g., 401(k)). Still, 41% indicated they will delay their planned retirement age – an increase over the 34% that planned to delay their retirement age in 2011. This result supports employee concerns over their ability to afford retirement, but it also suggests that organizations may need to adjust their talent strategies to accommodate this demographic shift.

HEALTH CARE STILL NUMBER ONE

Cost and reform are inescapable forces

Among the wide range of Total Rewards priorities facing an organization, the cost of health care and the impacts of health care reform legislation are front and center. These issues are ever present in the media, the political conversation, and the C-suite. While health care costs have dipped below their historical highs, they are still projected to increase approximately 10 percent in 2012 and beyond.

In this environment, it is not surprising that for the fourth year in a row, survey respondents ranked "the cost of providing health care benefits to active employees" as the top Total Rewards challenge facing their organization today, with 75% of respondents identifying it as a Top Five priority. The cost of health care negatively impacts the income statement, reducing profits and an organization's ability to invest in its business. This drives HR leaders and CFOs to continually seek new strategies aimed at controlling and flattening the trend.

Further complicating the picture is the uncertainty surrounding the future of health care reform. With challenges pending in several state courts and a Supreme Court hearing on the Patient Protection and Affordable Care Act (PPACA) slated for this March, the future of health care reform is still taking shape. The one significant regulation that was to take effect this spring – the need for employers to provide Uniform Summary of Benefit Coverage forms on each of its health plans – has been delayed until September 2012 to allow adequate time to meet the compliance requirements. At the same time, health benefit exchanges are ramping up for 2014.

Within this cloudy climate, it is clear that PPACA remains a significant concern and an area of focus for HR leaders across the nation as reflected in the Top Five Survey in which "the ability to adjust and comply with current and future provisions of health care reform" registered at number four with 34% of respondents identifying it as a Top Five priority.

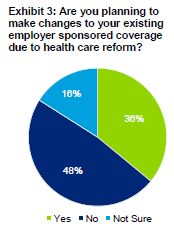

The survey sheds additional light on what organizations are thinking, projecting and planning. When asked what alternatives are being considered for employer-sponsored coverage, 48% seem to be taking a "wait and see" approach, indicating there are no plans to change existing coverage.

At the same time, of those planning to make changes, 37% are planning to maintain their grandfathered health plans for as long as possible in order to remain immune to certain provisions of the law. Another 17% indicated they will consider dropping employer-sponsored coverage for full-time employees and pay the penalties, and 23% are considering reducing hours below the threshold for part-time employees to avoid mandatory health coverage.

The finding that stands out relates to the expected impact of health care reform on the employers' workforce and business. An overwhelming majority (85%) of respondents believe benefit costs per employee will rise over the next five years as a result of PPACA. At the same time, limited impact is seen with respect to competitiveness and overall headcount. This may reflect the view that since all organizations are experiencing the same changes and impacts, health care reform provisions will not create any clear competitive advantages or disadvantages.

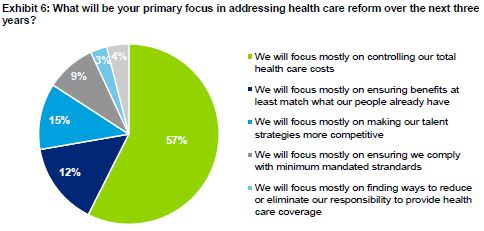

These cost-cutting considerations point directly back to the number one priority in this year's survey – the cost of providing health care benefits to active employees. This is further reinforced by 58% of respondents who stated that the primary focus in addressing health care reform over the next three years will be mostly on controlling total health care costs.

What initiatives will be put in place to help control these costs? Survey results indicate that investing in wellness strategies to encourage healthy lifestyles within the workforce is high on the list. The majority of survey respondents (70%) are considering expanding wellness programs to help manage costs, and 42% want to introduce incentives to participate in fitness, wellness or disease management.

REDESIGN ACTIVITY

Focused on employee engagement

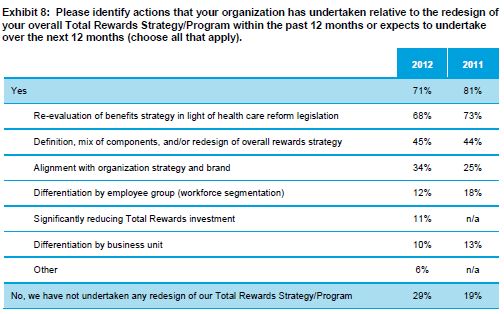

To gain a clear understanding of past and planned activities relative to the redesign of overall Total Rewards Strategy/Programs, the Top Five Survey asked respondents to identify actions that have been undertaken in the past 12 months or are expected to be undertaken over the next 12 months. While 29% are not planning any changes, over two-thirds of those that are planning changes (68%) expect to reevaluate their benefits strategy in light of health care reform. This is not surprising given that, as noted earlier, health care reform ranked number four on this year's Top Five priorities list. However, the slight decrease from 73% in 2011 may represent a slightly improving level of comfort among employers with health care reform.

Beyond health care reform, employers are broadly working on their overall rewards strategy and aligning their rewards programs with organizational strategy. Nearly half of those planning a change (45%) noted they are focused on "definition, mix of components, and/or redesign of the overall rewards strategy," and another 34% are focused on "alignment with organization strategy and brand". This links back to number five on the Top Five priority list, "clear alignment of our Total Rewards strategy with our business strategy and brand."

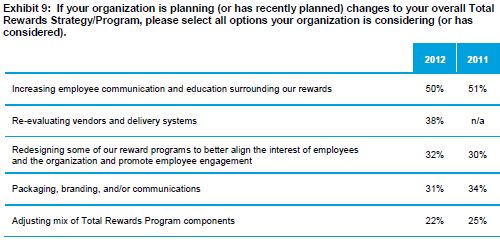

Narrowing the focus to identify specific changes to the overall Total Rewards Strategy/Program being considered over the next 12 months, respondents indicated the following areas of emphasis:

Three areas of focus relate directly to employee engagement ‒ improved communications, better alignment of reward programs, and packaging and branding. Given the significant investment that rewards represent, organizations face the constant challenge of earning – and measuring – an appropriate return on that investment either through dollars and cents, or through more intangible factors such as employee appreciation. This year's survey results point to an awareness that increasing the perceived value of benefits and engaging employees in making informed choices as consumers of benefits may be key steps in securing a meaningful ROI.

REWARDS AND MEDIA

Seeking the right generational fit

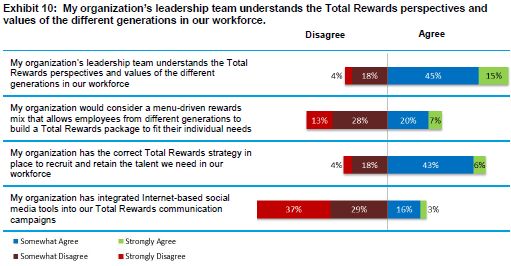

Today's workplace is demographically unique in that it spans four generations – Generation Y (under 30); Generation X (30-44); Baby Boomers (45-64); and Veterans (65 and older). For the fourth straight year, the Top Five Survey included questions designed to get to the heart of generational considerations as they relate to rewards programs. Most respondents (60%) believe their leadership recognizes the varying generational needs related to rewards, while just under half (49%) feel they have the correct Total Rewards strategy in place to recruit and retain the talent they need. This may point to a need for building a more effective bridge between the recognition of generational issues and the execution of an effective strategy to address them.

Focusing on rewards customization, we asked employers if their organization would consider "a menu-driven rewards mix that allows employees from different generations to build a Total Rewards package to fit their individual needs." Only 27% of respondents agreed while 41% disagreed (others were neutral/had no opinion). While potentially difficult to administer, this customizable approach may find a stronger foothold as employees seek more control and choice related to the rewards provided by their organization, and employers look for design strategies to help improve their ability to recruit and retain key talent.

At the same time, social media continues to be a growing force in all aspects of a business's communications framework. Social media is used externally in marketing, public relations and recruiting while internally it is employed in knowledge management for sharing, innovating, reusing, collaborating and learning. But is social media being integrated in Total Rewards communication campaigns? The Top Five Survey asked the question and found that two-thirds of respondents disagreed and just 19% agreed. As Gen Y expectations for immediate access to information converge with new, useful and deployable applications, look for social media to penetrate the rewards space to a greater degree.

OTHER KEY FINDINGS

Rewards emphasis

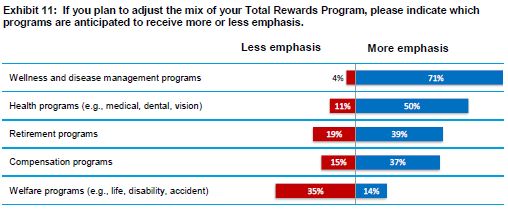

As organizations anticipate changes to rewards programs, the Top Five Survey asked which programs would receive more emphasis vs. less emphasis. Given that the cost of providing health care is the number one priority, it is not surprising to see wellness and disease management programs at the top of the emphasis chart. Organizations recognize that relatively small investments in prevention combined with effective management of chronic conditions may significantly reduce employee risks for high-cost clinical interventions in the future. Other areas of emphasis are shown in the table below.

Significantly, while employees have rated "my ability to afford to retire" as their top concern, looking at year-over-year comparisons, employer emphasis on retirement programs has decreased from 70% in 2011 to just 39% in 2012. The decrease in emphasis is even more significant considering the results of the 2011 Annual 401(k) Benchmarking Survey that revealed only 15% of employers believe most employees will be financially prepared for retirement.

Compensation

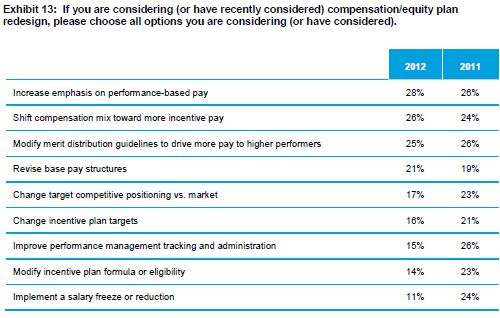

Compensation is the most visible of all rewards programs, and as such, it is subject to a great deal of scrutiny. However, based on the Top Five Survey, 2012 will be a relatively quiet year in terms of change with 40% of respondents indicating "we have not undertaken any redesign of our Compensation/Equity Program." For those organizations where actions have been taken, the high-level areas identified rank as follows:

Respondents were then asked to take a more granular view regarding options being considered related to compensation/equity plan redesign, while organizations considering a salary freeze or reduction dipped to just 11% compared to nearly one-in-four just last year, and 64% four years ago. The responses showed a decided focus on performance-based and incentive pay.

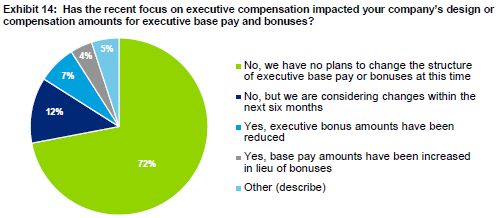

The Top Five Survey asked whether the recent focus on executive compensation impacted design compensation amounts for executive base pay and bonuses. The answer for 72% of respondents is a clear, "No, we have no plans to change the structure of executive base pay or bonuses at this time." This compares to just 7% who indicated that executive bonus amounts have been reduced. It remains to be seen if the political climate in 2012 will have any impact on executive base pay and bonuses in the year ahead.

Retirement

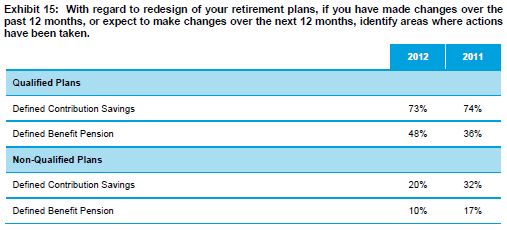

The majority (58%) of respondents to the Top Five Survey indicate that their organizations currently are not planning to redesign their retirement programs. For those that are making changes, the program components to be redesigned ranked as follows:

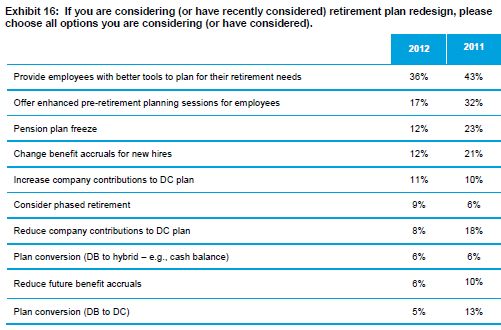

When asked to select specific options under consideration related to retirement plan redesign, the leading response was "providing employees with better tools to plan for their retirement needs." This is consistent with results from the 2011 Annual 401(k) Benchmarking Survey that revealed the top priority of 401(k) plan sponsors is improving participant readiness for retirement. This is also aligned with the top personal concern cited by 83% of respondents pointing to their ability to afford retirement, including post-retirement healthcare. Recognizing that preparation is the key, better tools along with planning sessions are steps that employers are taking in an attempt to respond to this concern.

Health and group benefits

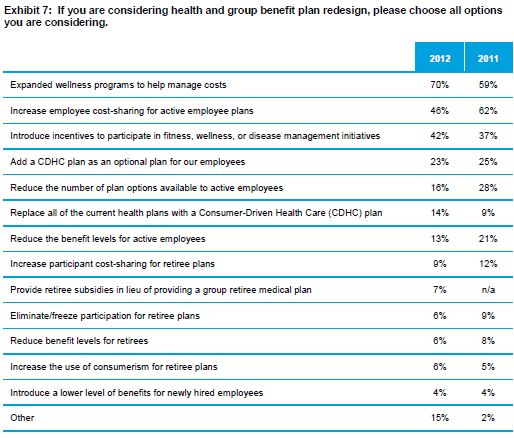

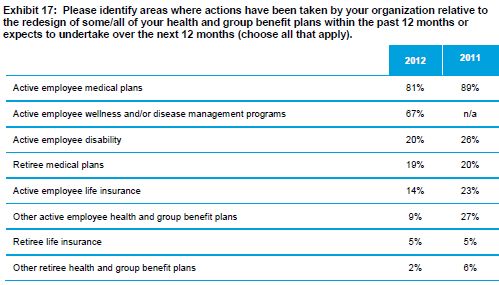

With the cost of providing health care trending higher each year and the uncertainty of how health care reform will impact future costs, employers continue to seek strategic approaches to help control and reduce these costs. The Top Five Survey asked respondents to identify areas where actions have been taken or are planned with respect to the redesign of their organization's health and group benefit plans. In all, 82% of employers are planning a redesign of health plans in 2012, identifying the following areas of focus:

The focus on employee wellness is second only to redesign of active employee medical plans where the most levers exist to influence cost. As noted, wellness and disease management programs are gaining increased attention and momentum. This is due in large part to the recognition that health and risk are correlated, and that employers own the risk, even if they choose to self-insure their health care plans. By reducing risk via prevention, early detection and chronic condition management, employers realize they can impact the health care cost trend.

Wellness may be a longer-term strategy, but it is being adopted by organizations seeking ways to improve the overall health status of their employee population. Supporting this health management trend is the improvement seen in wellness and disease management vendors in recent years along with the fact that these programs tend to be more palatable to employees when compared to increasing deductibles and/or contributions. Wellness may have become health and group benefit's "lever of last resort."

This point was further reinforced when respondents were asked to identify specific options under consideration for redesign, and the survey showed that wellness-related activities took two of the top three spots. For 2012, the ranking of those actions is:

It is interesting to note that increasing employee cost-sharing dropped from 62% in 2011 to just 46% in 2012. This could signal a shift in strategic approach wherein organizations may feel the cost burden on employees has reached a limit and that lever is no longer the most effective option from a talent attraction and retention perspective.

Seeking alternatives to health care cost management continues to be the challenge, and introducing a consumer-driven health care (CDHC) plan remains a strategic option for many employers. And employees are interested as reflected by respondents who – when wearing the "employee hat" – expressed interest in CDHC plans, with 23% indicating they would elect such a plan if available.

Other reward programs

In addition to the most common Total Rewards offerings, organizations continue to think about other rewards programs to engage employees and enhance perception of the overall Total Rewards package. Often these programs are relatively inexpensive to provide and administer but can be highly valued by employees. Among the 56% of employers that have initiated/expect to initiate redesign of "other" reward programs, the following were most frequently identified for redesign:

A noteworthy downward trend in "mandatory furloughs" continued this year. In 2010, 32% of organizations reported considering mandatory furloughs. This dropped sharply in 2011 to 16% and fell even further in 2012 to 11%. This seems a clear indicator that the more severe measures under consideration at the height of the financial crisis have subsided.

Administration

One of the key findings related to administration is that outsourcing is working. The survey shows a high percentage of employers satisfied or highly satisfied with their outsourced solutions. The satisfaction levels are strong across a broad range of categories including service timeliness (80%), service accuracy (79%), data administration and integrity (79%), web content and capabilities for employees (77%) and client service (77%).

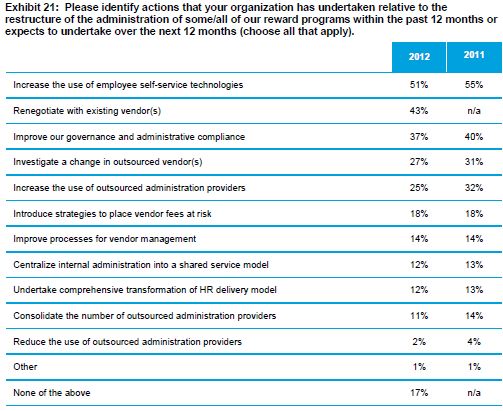

At the same time, 25% of respondents are planning to increase their use of outsourcing compared to just 2% considering a reduction. Surprising on two fronts is that 18% of employers plan to introduce fees at risk for vendor performance to their outsourcing engagements. This suggests that many contracts still do not have these provisions, and that employers still feel they are needed despite general satisfaction with service delivery.

While outsourcing is gaining high marks on satisfaction, organizations are still looking for improvements. 43% are planning to renegotiate with existing providers for better terms and 27% are considering changing providers entirely.

Across all sourcing strategies, two key areas of focus for employers are offering more employee self-service and decision support (51%) and improving governance and administrative compliance (37%). These two priorities directly reflect employer concerns with cost and regulation in rewards service delivery.

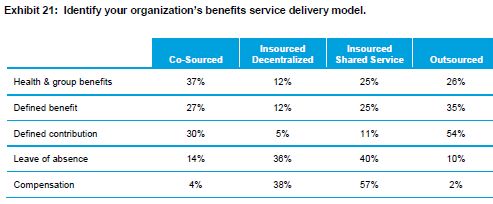

The rewards service delivery model varies by organization with models including co-sourced, insourced – decentralized insourced – shared service, and outsourced. A closer look at outsourcing finds that 54% of employers in the survey outsource their defined contribution administration, 26% health and group benefits, and 35% defined benefit.

TOP FIVE SURVEY METHODOLOGY AND DEMOGRAPHICS

In its 18th year, the 2012 Top Five Total Rewards Priorities Survey has been conducted annually since 1994. The survey is jointly sponsored by Deloitte and the International Society of Certified Employee Benefit Specialists (ISCEBS). The survey is developed and conducted by Deloitte Human Capital professionals, in collaboration with the ISCEBS.

Survey respondents were asked to respond as representatives of their employers with the exception of two questions targeting personal challenges and plans. For purposes of this survey, the phrase "Total Rewards" is defined as all compensation, benefits, perquisites and any other direct or indirect payments to employees.

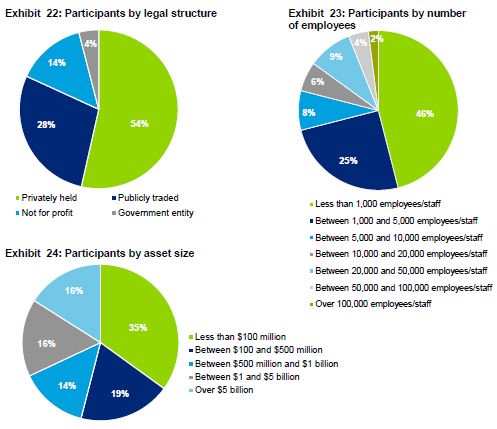

Conducted in December 2011, the survey was completed by 330 participants online. The survey respondents represent a diverse cross-section of the U.S.-based employer population by industry and size.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.