From 6 April 2016 all UK companies and LLPs (unless exempt) are required to keep a register of persons with significant control over them (a "PSC Register").

What is the PSC Register?

The PSC Register has been introduced with the aim of increasing transparency about the identity of the ultimate owners of companies and limited liability partnerships ("LLPs") and others who have significant influence or control over companies and LLPs.

The PSC Register records:

- Persons with significant control ("PSCs") – these are always individuals, who must meet one or more of the conditions for significant control (set out below) in relation to the company or LLP

- Relevant legal entities ("RLE") – these are: (i) companies or other legal entities under their governing law, (ii) that would satisfy one or more of the conditions for significant control in relation to the company or LLP if they were individuals and (iii) are subject to their own disclosure requirements because they keep a PSC Register or have other specified disclosure obligations

Conditions for significant control

| Companies | LLPs |

A PSC of company is an

individual who satisfies one or more of the following conditions in

relation to the company:

|

A PSC of an LLP is an

individual who satisfies one or more of the following conditions in

relation to the LLP:

|

10 important things to know about the PSC Register

1. Criminal offence

Failure to keep and maintain a PSC Register is a criminal offence for the company or LLP and every defaulting officer of the company or LLP, who may be liable to be imprisoned for up to two years or fined (or both).

2. Publicly available

The PSC Register will be a public document – it is expected to be open to inspection, anyone may ask for a copy and it will be part of the Confirmation Statement for the company or LLP. (The Confirmation Statement replaces the Annual Return from 30 June 2016.) The central public register at Companies House will give public access to all information on a PSC Register, other than the usual residential address of a PSC and (in some cases) the day of the date of birth of a PSC.

PSC information may also be withheld from public access, on application, if there is a serious risk of violence or intimidation for the PSC.

3. Establish a register

The PSC Register must never be empty. There are prescribed categories of information to be recorded for PSCs and RLEs (set out below), and official wording must be used to record matters such as:

- The conditions for significant control that are met

- The fact there are no PSCs or RLEs

- The fact that work is on-going to identify, or to confirm information with, PSCs and RLEs

| PSC

Details: Name, date of birth, nationality, country or

state where usually resident, service address, usual residential

address, date on which the PSC became registrable, conditions for

significant control that met and details of any restrictions on

using or disclosing the PSC's information. RLE Details: Name, address of its registered or principal office, legal form and governing law, register of companies in which it is entered and registration number, date on which the RLE became registrable and conditions for significant control that are met. |

4. PSC information

No information about a PSC may be entered into a PSC Register until confirmed with the individual.

Template notices for contacting (possible) PSCs and RLEs are provided in government guidance on the PSC Register.

5. Exemption from keeping a register

Companies and LLPs are exempt from keeping a PSC Register if they are already subject to other specified disclosure requirements by virtue of:

- Being an issuer listed on the London Stock Exchange and subject to the Disclosure and Transparency Rules

- Having shares admitted to trading on a regulated market in an EEA State other than the UK

- Having voting shares admitted to trading on certain markets in Israel, Japan, Switzerland or USA

Importantly, exemption applies only to the relevant company or LLP. In a group structure, other companies and LLPs in the group (unless also exempt in their own right) will be required to keep a PSC Register and the exempt company may be an RLE in relation to companies and LLPs sitting lower than it within the group.

Limited partnerships are not within the scope of the relevant legislation and are therefore not required to keep a PSC Register.

6. Registrable interests

As a general rule, the PSC Register only records the PSC(s) and/or RLE(s) holding a direct interest in the company or LLP.

By way of exception to the general rule, the PSC Register will 'look through' companies in a group that are not RLEs (eg foreign registered companies that are not (i) required to keep a PSC Register or (ii) subject to other specified disclosure requirements) and record the indirect holdings of PSCs and RLEs sitting higher in the group. This is further explained in the examples on the following page.

7. Significant influence and control

The work required to identify PSCs and RLEs is likely to be most complicated in relation to joint venture structures and complex partnerships arrangements. In these instances (and some others), it may be necessary to look carefully at the relevant governing documents and other arrangements relating to the company or LLP, including control and veto rights, to determine if significant influence or control arises. The government has issued guidance to assist with the analysis of significant influence and control.

It should be noted, that if significant control is established under one or more of conditions 1 to 3 (see page 1), it is unnecessary to note if condition 4 or 5 is also met.

8. Directors

A director carrying out the ordinary duties of a director will not need to be recorded as a PSC.

However, a director whose role or function goes beyond the ordinary understanding of the role of a director may be a PSC. For example, a CEO, CFO or COO (whether or not a director of a company) whose decisions are normally followed by a company may be a PSC of that company, and, similarly, a CEO of group company A (which owns all of the share capital of group company B) may be a PSC of group company B (even if she is not a director of group company B) if she is able to direct activities of group company B. A director who has a special relationship with a company, such as owning key assets used in the operations of its business, may also be a PSC1.

9. Obligations of PSCs and RLEs

PSCs and RLEs also have legal obligations to identify themselves to the appropriate company(ies) and LLP(s) and to respond truthfully to notices requesting information needed to complete or update the PSC Register. Failure to fulfil these obligations may be a criminal offence for the individual or legal entity, who may be liable to be imprisoned for up to two years or fined (or both).

10. Restrictions

If an individual or legal entity fails to respond to a notice regarding its status as a PSC or RLE, its shares, rights or other interests in the company or LLP may be made subject to restrictions such that the shares, rights or other interests may not be sold, transferred or exercised and no payments may be made in respect of the shares, rights or other interests.

A company or LLP must follow certain all procedures relating to the PSC Register, including issuing warning notices and restrictions notices, in order to place restrictions on shares, rights or other interests.

Examples

Company A PSC Register: Company B is the registrable RLE.

Company B PSC Register: Company C is the registrable RLE.

Company C PSC Register: Person 1 is entered as the PSC.

Person 1 is not recorded in the PSC Registers of Company A and Company B because it holds its indirect interest in these companies through RLEs.

If Company B was a BVI registered company (and therefore not an RLE):

- Company B would not have a PSC Register

- Person 1 would be entered as a PSC in the PSC Register of Company C, but would not be entered in the PSC Register of Company A as the interest in Company A is held indirectly through a chain in which there is an RLE (Company C)

If Company B and Company C were BVI registered companies (and therefore not RLEs):

- Company B and Company C would not have PSC Registers

- Person 1 would be entered as a PSC in the PSC Register of Company A, on the basis of holding an indirect interest in Company A through companies that are not RLEs

Company D PSC Register: Company E is the registrable RLE.

Company E PSC Register: Person 2 and Person 3 (assuming he/she has significant influence or control on the basis of minority voting rights, or otherwise) are entered as PSCs, on the basis that they have significant influence or control due to their indirect holdings in Company E that are held through companies that are not RLEs.

Company F and Company G are not required to keep PSC Registers because they are not subject to UK law.

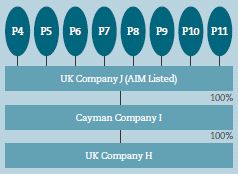

Company H PSC Register: Company J is the registrable RLE, on the basis of its indirect interest held through a company that is not an RLE (Company I).

Company I is not required to keep a PSC Register because it is not subject to UK law.

Company J is exempt from keeping a PSC Register as it is subject to other disclosure requirements as a company listed on AIM.

Persons 4-11 may or may not be identifiable from public records, depending on the size of their interests in Company J and whether these are disclosable under the AIM Rules.

Footnote

1 These are examples only. It will be necessary to consider the individual circumstances.

Register Of People With Significant Control

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.