With the EU referendum only a few weeks away, this paper is designed to provide practitioners with an understanding of the impact of the uncertainty created by the EU referendum on M&A activity in the UK.

The UK M&A market is one of the most active in Europe and global investors often use UK as the gateway for expansion into Europe. For instance a key motivation behind Nikkei's acquisition of Financial Times was to turn a domestic Japanese giant into a global brand.

In 2015 M&A activity in the UK reached $494 billion, the highest year ending figure since 2007. However, M&A deal data shows a sharp decline in UK M&A deals in 2016. During the first quarter of 2016, domestic deals have nearly halved from $15.8bn in prior year to $9bn in current year. During the same period, outbound M&A activity also fell from $10.4bn in prior year to $4.3bn in the current year. Inbound deals have held up, propped up by handful of large deals, the inbound volumes fell from $51.4bn in Q1 2015 to $30.4bn in Q1 2016.

We believe there are many factors contributing towards this decline, including the slowdown in global economic growth, weak industrial output in UK, weakening of the British Pound Sterling (or GBP) and volatility in the credit markets, which have all been playing upon the CEO confidence. However, one of the other drivers behind this decline in activity is also the shroud of uncertainty created due to the upcoming referendum.

Impact in M&A markets – UK compared with Europe

The data highlights a more pronounced decline in M&A activity in the UK than in the rest of the EU zone, suggesting Brexit fears are playing strongly in the minds of investors. For instance, when we compare Europe excluding UK, with the UK deal data, it seems the decline in UK deal activity both in volumes and values is more pronounced than in Europe. Deal values in Europe increased by 40% Q1 of 2016 compared to same period last year, however in UK it fell by 44% during the same period.

This also underpins concerns over UK's role in European M&A recovery, since historically UK tends to be the most active M&A market in Europe. For instance in 2015 UK contributed 40% to the total deal values activity in Europe, this has sharply declined this year to 23% in the first quarter of 2016.

Uncertainty is weighing heavily on investment and deal decisions

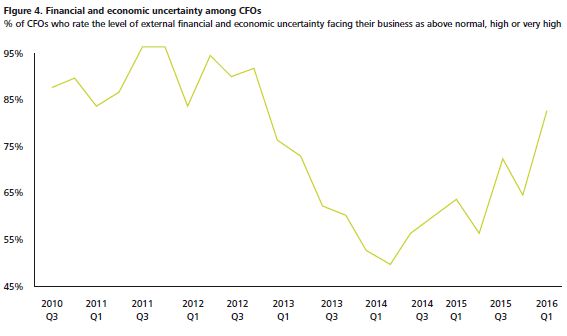

Based on the Deloitte CFO survey from Q1 2016, support among the Chief Financial Officers of the UK's largest corporates for staying in the EU has risen. The survey suggest 75% of CFOs say that it is in the interests of UK business for the UK to remain in the European Union, up from 62% in the fourth quarter of 2015. Brexit worries seem to be behind a marked increase in CFO perceptions of financial and economic uncertainty. It now stands at levels last seen in early 2013, at the tail end of the euro crisis.

M&A activity during times of uncertainty

The two recent events that mirror the current political uncertainty were the Scottish referendum (18 Sept 2014) and last year's UK general election (7 May 2015). In the months preceding the Scottish referendum, when the outcome of the referendum began to look more uncertain, deal values plunged. In sharp contrast, in the months before the general elections, deal activity continued unabated. This unusual pattern could be down to the fact, the polls were predicting a specific outcome for the general election, even though it proved to be wrong. On the other hand, the polls found the Scottish referendum too close to call, hence the level of uncertainty increased.

During the Scottish referendum, deals involving UK companies (acquirers or targets), announced deal value dropped by 45% from Q2, 2014 to Q3, 2014, while on the other hand in the months approaching the UK general elections, there was an increase of 71% from Q1, 2015 to Q2, 2015.

In the months leading to the EU referendum, markets have been experiencing a more pronounced dip in deal activity, suggesting this time around the uncertainty created by the situation is weighing more heavily on investment.

On frequent travels abroad, both clients and member firms regularly ask regarding the sentiment relating to Brexit and what to expect, should Britain decide to leave EU. We all have our views and there is no definite answer, however, it is clear from the data that the spectre of uncertainty has been weighing heavily on M&A and investment decisions in UK and should Britain vote to leave EU that period of uncertainty and corporate indecision may well prolong.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.