The FCA has announced that from 2018 it intends to apply the recently introduced senior managers and certification regime to investment firms and asset managers. The FCA has said that it will issue a consultation document shortly and firms that may be affected will have the opportunity to comment on the proposals.

The senior managers regime was introduced in 7 March 2016 for banks, building societies, credit unions, PRA-designated investment firms and branches of foreign banks operating in the UK. It works alongside the new certification regime for these entities which is due to "go live" in March 2017.

The FCA has stated that the aim of the new rules is to: "Enhance and embed a culture of accountability" and to put an "Increased focus on smaller numbers of senior functions, supported by responsibility maps".

Whilst we do not know exactly how the senior managers and certification regime will be implemented for investment firms and asset managers, we know that it will be based on the current regime for banks. The FCA says that the new rules will be applied in a proportionate manner and that they will remove / reduce certain burdens / requirements (we just don't know which burdens / requirements will be removed or reduced yet). The aim of this note is to set out the basics and key features of the regime in place for the banks, to enable some early planning / consideration at this time.

The Basics: there are three strands to the new regime:

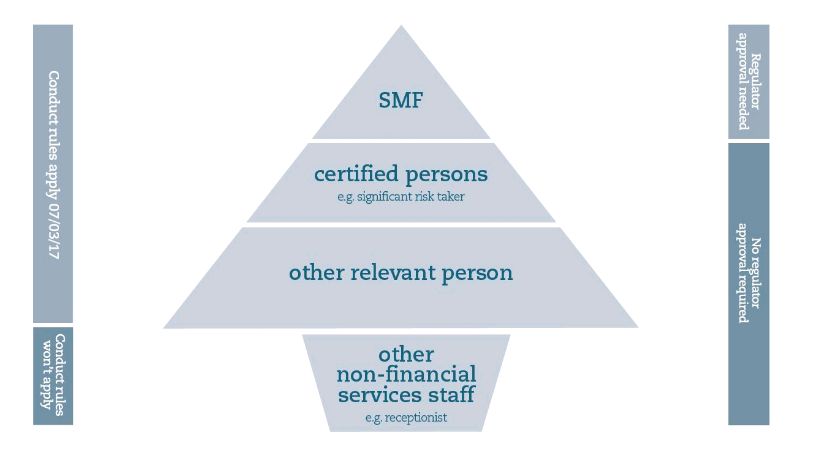

The Senior Manager Regime ('SMR') focuses on individuals performing a senior management function (SMF). The regulators approve individuals wishing to perform these SMFs before they can be appointed to their specific role.

The Certification Regime applies to the employees of relevant firms who, in the light of their roles, could pose a risk of significant harm to the firm, or any of its customers. These individuals are not pre-approved by the regulators but must be certified by their firms that they are fit and proper for their roles on a continuing basis.

Conduct Rules: new conduct rules will apply to those in SMFs, those in certified roles, and also a wider group of staff in a firm (other than those who essentially have nothing to do with the financial services that are provided (a receptionist is used as an example although this should be questioned)). The conduct rules that apply to SMFs are more extensive than those that apply to others in a firm.

The Key Features:

Responsibility Mapping: firms must decide who is responsible for specific prescribed responsibilities and notify the regulator. This requires a firm to have mapped out all of its functions, and all of the duties and tasks which are undertaken, and to identify where responsibility for these things sits.

People Mapping: identification of SMFs, certified persons and those covered by Code of Conduct rules, and appropriate training and agreement with all.

Fitness and propriety checks: firms have a continuing duty to ensure that individuals who work for them are fit and proper. To comply, firms should:

- hold regular appraisals and performance reviews

- carry out additional checks if necessary, depending on the nature and level of an individual's responsibilities

Regulatory References: new rules on regulatory references will apply to banks from 7 March 2017. We think it likely that these rules will be extended more widely.

Whistleblowing Champion: new whistleblowing rules for banks came in from 7 September 2016. We think it likely that these rules will also apply more widely.

Timeline:

- Not confirmed but expected - by or during Spring 2017: consultation paper re extending SMR and Certification Regime more widely

- Not confirmed but expected – by or during Autumn 2017: final rules on SMR and Certification Regime for firms outside of those already covered [note likely that regulatory reference rules and whistleblowing rules also to be introduced]

- During 2018 (exact timing tbc): Senior Manager and Certification Regimes will be applied to all FSMA firms – via Bank of England and Financial Services Act 2016 s.21 (not yet in force). It is expected that SMR and certification regime implementation dates will be split as per the banks but not yet confirmed.

What Do Asset Managers Need To Know About Impending FCA Regulation

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.