The signing of a double taxation agreement between the UK and the UAE in April 2016 was undoubtedly much anticipated and marks a new milestone in the successful expansion of the UAE's international tax treaty network.

Following ratification of the agreement by the two countries reacting parties, it came into force on 25 December 2016 and here we look at the key points and most relevant treaty provisions. The latest publications on this were made on the UK Government website on 18 January 2017.

The agreement appears to provide effective support to UK – UAE cross-border investments, and more generally, would contribute to the establishment of a more solid framework for the development of business relationship between the UK and the UAE.

Provisions are applicable from 1 January 2017 for taxes withheld at source in respect of amounts paid or credited as from this date, while other taxes will take effect for taxable periods (for individuals) and financial years (for corporations) beginning on or after 1 January 2017.

The provisions largely reflect the standard wording of the current OECD Model and UAE individuals and businesses do not seem to be disadvantaged as a consequence of their de facto tax exempt status in the UAE. The fact that the UAE in practice does not impose any form of direct taxation on individuals and (most) businesses is not an objective obstacle for them to claim benefits from the agreement.

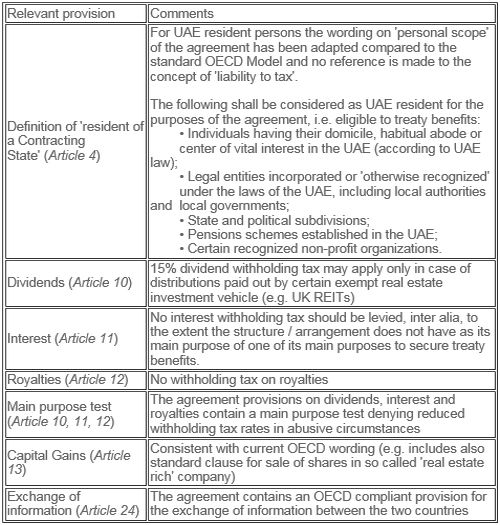

A summary of the most relevant treaty provisions is provided below:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.