The Prudential Regulation Authority's (PRA) consultation paper on "Refining the PRA's Pillar 2A capital framework" (CP3/17) introduces revisions to the assessment of capital requirements for credit risk. The changes are important for firms using the Standardised Approach (SA).

The consultation proposes that in setting Pillar 2A capital, supervisors assess whether the total amount of capital firms are required to hold exceeds what is necessary for sound management and coverage of risks. That judgement would be informed in part by comparing firms' Pillar 1 capital charges to the PRA's IRB benchmark i.

The changes are a response to concern that regulatory reforms have had the unintended consequence of requiring firms using the SA to hold more capital for certain types of assets than is required using IRB models. The consultation ties into ongoing work by the PRA to more closely align capital assessments to firms' risk profiles. Sam Woods, CEO of the PRA, has previously said that "[the PRA intends to] look at capital requirements in the round rather than assuming a simple 'sum of the parts' approach" ii.

Moreover, IFRS 9, the new accounting standard, has the potential to exacerbate differences between capital requirements under the SA and IRB approach. The consultation proposes introducing a separate benchmark for firms using IFRS 9 to deal with that.

In a speech made to coincide with the publication of the consultation iii, Martin Stewart, Director of Banks, Building Societies and Credit Unions at the PRA, noted that the PRA had taken steps previously to address these issues, including through changes to its supervisory approach and input to the work of the Basel Committee on Banking Supervision (BCBS) to make the SA more risk-sensitive, but that those measures may not be sufficient or timely enough iv.

The paper introduces significant changes for firms, although given the importance of supervisory judgement in the approach the implications for capital requirements may not become fully clear until the final proposals are implemented. Firms should also be alert to the increased scrutiny this will place on the effectiveness of risk management.

Firms have until 31 May 2017 to comment on the proposals. The new rules are expected to apply from January 2018.

The PRA has also launched a consultation paper clarifying its expectations for firms applying for IRB model approval, in particular in respect of demonstrating 'prior experience' and the use of external data for default estimations v.

Key implications

Compared to the PRA's current approach, there are a number of potential implications that firms will need to consider:

- Capital off-sets: The proposals remove the automatic adjustment of P2A add-ons due to an excess capital charge (assessed by comparison of the capital requirement to the benchmark) as firms will be required to first demonstrate sound management and adequate risk assessment. Firms can expect the PRA to be more rigorous in this assessment. Where it is applied though, the excess capital charge may be offset against the overall variable Pillar 2A add-ons, not just the credit risk component. This could enable a firm to achieve a reduction in its overall Pillar 2A requirement (and subsequently, where applicable, MREL requirement).

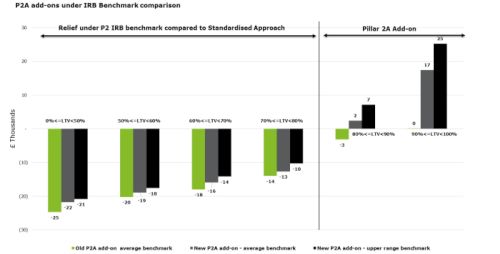

- The updated IRB benchmarks, coupled with the potential application of the upper quartile rather than average, may result in lower capital relief (excess capital) or even additional capital requirements for certain asset classes, as illustrated in Charts 1 and 2. Certain exposures, such as loans to SMEs do, however, receive a reduction in the average benchmark risk weight.

Chart 1: Prime mortgages vi

Chart 2: Buy-to-let mortgages v

- The new benchmarks could also lead to much higher capital charges for unsecured loans, including personal loans and credit cards (Chart 3). For example, the potential capital impact from the revised IRB benchmark for UK credit cards has increased by between approximately 43% and 99% (depending on the part of the benchmark range used).

Chart 3: Unsecured lending v

- IFRS 9 benchmark: Firms will need to assess how in practice the proposed relief from the double-counting that might occur offsets the decrease in capital due to increased provisions, in order to understand the overall implications of IFRS 9 for their capital position. This benchmark maintains a relatively higher divergence between IRB and SA capital compared to the non-IFRS9 benchmark, potentially resulting in higher excess capital charge offsets for certain exposures.

- CRE exposures: the PRA recommends that firms with material CRE exposures assign risk-weights from the EBA specialised lending category as the IRB benchmarks are not considered to be representative. (The longer-term capital implications are uncertain as the PRA is looking to further understand CRE compositions and exposures). Firms will need to specifically assess the materiality and enhance the quality of assessment of these exposures in their ICAAPs.

- Data and reporting: the PRA plans to introduce mandatory annual reporting of Pillar 2 data items on wholesale and retail credit exposures (FSA076 and FSA077). Although not expected to result in a large reporting burden, the PRA retains the ability to remove any proposed capital offsets between portfolios if it is not satisfied with the quality of data being reported. This focus on quality of risk data is consistent with broader initiatives in the EU vii and internationally viii.

- Business model analysis: The overall approach highlights the increasing importance of business model analysis, peer reviews, and soundness of risk management for supervisors in determining capital add-ons.

Conclusion

As well as an immediate effect on capital requirements, the proposals will have implications for modelling decisions and reporting capabilities. To fully understand the implications firms should undertake a detailed review of their current portfolio structures, assessing the risk profile and credit quality in order to estimate the size of potential capital add-ons under the revised approach.

Footnotes

i 'The PRA's methodologies for setting Pillar 2 capital', Statement of Policy, PRA, February 2017. http://www.bankofengland.co.uk/pra/Documents/publications/sop/2017/p2methodologiesupdate.pdf.

ii 'The revolution is over. Long live revolution!', speech by Sam Woods, Deputy Governor Prudential Regulation and Chief Executive Officer PRA, Bank of England, 26 October 2016. http://www.bankofengland.co.uk/publications/Documents/speeches/2016/speech933.pdf.

iii '"Harrowing the ploughed field"– refining the standardised capital regime', speech by Martin Stewart, Director of banks, building societies and credit unions, PRA, 3 March 2017, http://www.bankofengland.co.uk/publications/Documents/speeches/2017/speech965.pdf.

iv 'Annual Competition Report 2016', PRA, 30 June 2016, http://www.bankofengland.co.uk/publications/Documents/annualreport/2016/compreport.pdf.

v 'Internal Ratings Based (IRB) approach: clarifying PRA expectations - CP5/17', PRA, March 2017. http://www.bankofengland.co.uk/pra/Pages/publications/cp/2017/cp517.aspx

vi Calculations for each chart are based on a sample £1mn portfolio for the relevant assets, with the portfolio distributed evenly between the specified risk categories.

vii 'Final report: EBA Guidelines on ICAAP and ILAAP information collected for SREP purposes', EBA/GL/2016/10, EBA, 03 November 2016, https://www.eba.europa.eu/documents/10180/1645611/Final+report+on+Guidelines+on+ICAAP+ILAAP+(EBA-GL-2016-10).pdf.

viii 'Principles for effective risk data aggregation and risk reporting', Basel Committee on Banking Supervision, Paper 239, January 2013, http://www.bis.org/publ/bcbs239.pdf.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.