While there are still mixed views expressed about Singapore as a tourist destination, there seems to be general agreement about one thing: Singapore has outclassed its rivals as the region's leading insurance and reinsurance hub. In this article, we look at some of the factors accounting for this, as well as emerging trends.

A few facts and figures

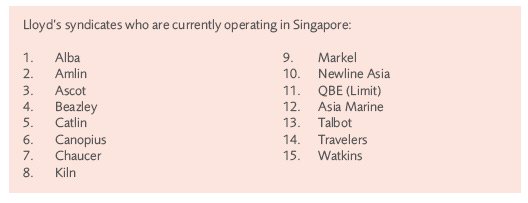

One example of how successful Singapore has been in attracting global insurance industry players is the exponential growth of Lloyd's syndicates setting up in Singapore. Lloyd's has created a specialist underwriting centre in Singapore by adopting the One Lime Street subscription style market for writing risks. This has proven to be very successful. In 2005 there were three syndicates. There are 15 today:

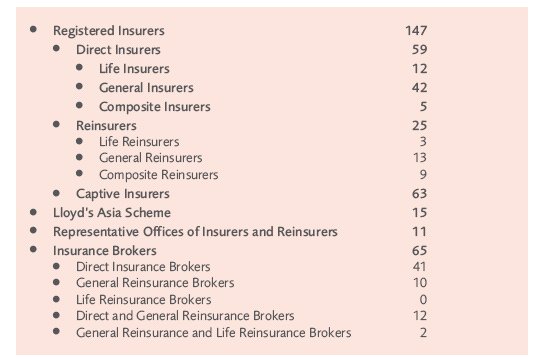

There has also been a significant growth in the companies market players flocking to the city with 147 registered insurers/reinsurers and 65 brokers:

Premiums in Singapore rapidly increased in 2007. For Singapore insurance fund business, gross premiums for direct insurers jumped to S$2.6 billion, and for reinsurers, to S$264.2 million. Similarly, gross premiums for offshore insurance fund business for the industry as a whole were up over 10 per cent to S$3.48billon.

Recipe for success

Why Singapore? Here are some of the reasons:

Location, location, location

Singapore's geographic location at the southernmost tip of West Malaysia has contributed to its success as the second busiest port in the world. Often described as the "gateway to the east", it is also within easy reach of South East Asia's tiger economies, India and China, and only a few hours away from Australia to the south, as well as Japan and Korea to the north. Its links and proximity to many Muslim countries also means that it is ideally positioned to take advantage of the potentially huge takaful market.

Pro-business environment

From a regulatory perspective, Singapore is an attractive place to do business. The Monetary Authority of Singapore, which is the central bank and regulator of the insurance industry, has received much respect and admiration for its strong regulatory, but at the same time commercial and user-friendly, approach in encouraging the development of the insurance industry in Singapore.

The tax and labour laws are generally designed to facilitate business and the local workforce is skilled and cost competitive. English (or its local version, 'Singlish'), is the main language of commerce.

Political and social stability

The government has ensured a benign corruption-free climate for foreign investment resulting in economic prosperity and a general standard of living for its population.

Sound legal system

Many of Singapore's laws remain heavily influenced by English law. Alongside the local courts system, there is also a thriving arbitration industry and Singapore is perceived to have the infrastructure capable of handling large or complex commercial disputes with arbitration panels drawn from the regional and international community of arbitrators.

Growing trends in the insurance/reinsurance industry

The trend towards growing numbers of entrants into the insurance/reinsurance industry has resulted in increased competition for business and some traditional lines of business are experiencing softening rates. However, opportunities exist in specialist lines such as marine, cargo, and energy (where (re)insurers should be able to benefit from Singapore being the world's second busiest port), and D&O, E&O and general PI (due to the influx of financial companies opening operations in Singapore and the region generally, or listing on the Singapore stock exchange). The Singapore authorities are keen for these specialist lines to develop, and offer incentives for certain classes of business which they are keen to encourage.

On the claims side, although many large claims are and will continue to be directed by claims teams abroad for some time, the growth of the market and associated infrastructure should lend itself to a shift to claims being handled at regional or local level. Speed of service is critical to good claims handling, and clients will increasingly expect their claims to be dealt with in real time.

It remains to be seen whether Singapore in the years to come will rival global insurance and reinsurance centres such as London or New York. By all accounts, it's certainly a promising start.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.