Agile is bringing a new shape to the world of delivery management, successfully adopted from software development and advocating a less rigid delivery mechanism, the agile movement aims to drive improved outcomes across all industries. In the latest in our agile blog series focusing on insight from across Deloitte about the world of agile, we look at agile funding; demonstrating how the alignment of capital expenditure to an agile delivery approach is imperative in this new world of change.

Successful delivery outcomes depend on change practitioners having the ability to bridge the gap between agile product development, and the more traditional financial approval processes within an organisation. Effectively demonstrating to others how scaling this new thinking, and reprioritising the change agenda will increase efficiencies, saving both time and money.

Our experiences of shifting organisations from the more traditional sequential stage gates and drawdown of delivery, to an agile approach of signing off value streams and creating iterative development funds to be used against an unrefined scope can be daunting. As with all investment, individuals are looking for surety of success, reducing the risk of failed speculation. In this regard, untested methods simply aren't an option.

Along with a change of mind-set for those delivering initiatives, this transformation brings ambiguity to those further removed from the change, and in particular those controlling the purse strings, ultimately causing friction. However, this concern can be viewed in context against the control we believe an agile funding model can bring, ensuring focus is given to the real payoff rather than elements agreed to prior to real understanding being in place.

Consider the opportunity to better focus delivery objectives and tolerances against proof of concept feedback, and improving the financial decision making ability of the organisation. Traditionally, funding decisions require considerable effort to demonstrate that estimates and assumptions built into a business case are clarified. Unfortunately this method relies on accurate information, which is not always readily available, particularly when developing something new.

The Standish Group's CHAOS report (2015) highlights that only 71% of traditionally estimated projects achieve some of their benefits, compared to using agile techniques with a 91% success rate. Statistics like this hint at the inadequacies of the traditional funding mechanism for allocation of budgets. In our view this is driven by a number of factors;

- Projects are expected to spend their full investment and deliver, even if partway through it turns out that it was a bad idea

- Funding is tied to specific benefits which are mapped out against a macro environment months or years in advance

- There is limited opportunity to reprioritise or innovate based on change, and instead the analogy of the super tanker comes into play, with no one willing to correct course

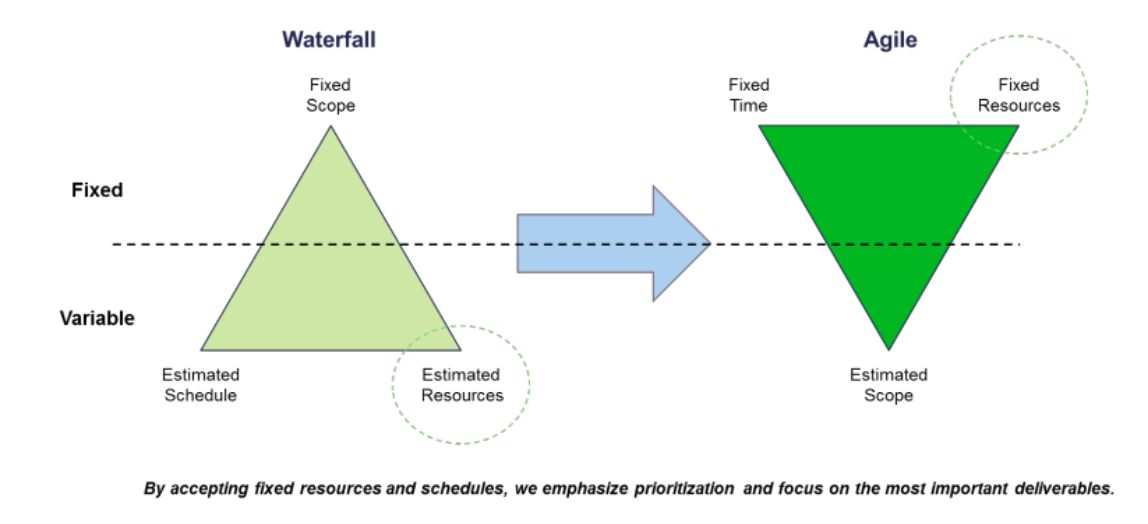

As we know, Agile requires new thinking and for the Agile professional to drive change within the funding equation. Instead of reliance being placed on defined scope, we could consider budgets that are measured against real delivery, the testing of hypothesis, and immediate customer feedback.

Deloitte (Agile funding model 2014)

This fundamental shift in approach of funding offers opportunities for the organisation to allocate financial approval in phases of delivery, rather than arbitrary stage gates. MVP's offer an opportunity for control to be established whilst attaining insight into the investment potential of particular developments, allowing for quick course correction when things are (or aren't!) working, creating agility within the change portfolio.

Agile change relies on a cultural shift for success, agile funding is no different. Senior leaders and product owners with real accountability are required to lead in agile and create a similarly clear path to using budgets effectively, and focusing on what needs to be achieved. Establishing a need for teams to work cohesively and be pragmatic about shifting priorities, whether these are driven internally or by the customer, and agreeing how funding can be used in the best possible way for the organisation.

The key consideration when beginning this journey is to ensure that the solution is scalable. Whilst gaining funding for a single agile delivery is key, the goal must be to embed the change. Crucial to the successful delivery is the ability to capitalise the opex expenditure from change, this both signifies the completion of activity (though does not prohibit further development) whilst at the same time providing a clear path for the organisation to assess performance and need for further investment.

Consider this new way of thinking similar to having a venture capitalist's mind-set, it requires an understanding of the full picture, and reacting to the financial data available in order to decide where to invest. A practical example of this is demonstrated by an ability in the agile funding world to combine run and change budgets, creating clear priorities for the wider organisation rather than individually managed budgets. Adding run activities and desired developments to a backlog allows for a near real time alignment of your business focus, and where to focus investment within your identified value streams.

Ultimately it is the role of the agile practitioner and their leaders to demonstrate the value agile methods can provide, with this role going beyond the delivery of the change, and extending to the responsibilities for the financial choices and decisions the organisation makes when delivering new propositions. Agile funding offers a real opportunity to change accepted methods, and adopt a new delivery paradigm.

You can find out more about Agile methodologies and DevOps practices in our earlier blog ' Why do organisations get Agile adoption wrong?'.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.