In 2010, Metro Bank was the first high street bank to be launched in the UK for over 100 years. Since then, the UK banking sector has continued to see an unprecedented number of new entrants, each challenging the traditional banking status quo with new and innovative business models, product offerings and technology.

This development has partly been stimulated by innovative technology offerings and the rise of FinTech, but also actively encouraged by a more pro-competition regime in the UK financial services industry.

In 2016, to streamline and simplify the bank authorisation process, the Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA) jointly set up the New Bank Start-up Unit (NBSU1). New Bank authorisations remain key in the PRA's 18/19 Business Plan2. In the next 3 years, the PRA expects this to lead to the supervision of 20-30 new banks.

While under the NBSU the process to become a bank has been simplified and made more transparent, firms must weigh the regulatory process in context of their business model and make an active choice about whether becoming a bank is the right route to the achievement of their business and strategic objectives.

Alternative authorisation routes

The key difference between becoming a bank and other types of financial services firms is the ability to accept deposits as a source of funding. Customer deposits are generally seen as a cheaper source of funding than wholesale funding and hence they may bestow competitive advantage on a new entrant bank. A strong reputation for service and competitive rates may also help build a large and loyal customer base for a bank's wider product suite.

As a new entrant into the financial sector, there are several licensing options available. The most important consideration in determining the appropriate licensing route is the activities the firm intends to undertake and the services it intends to offer.

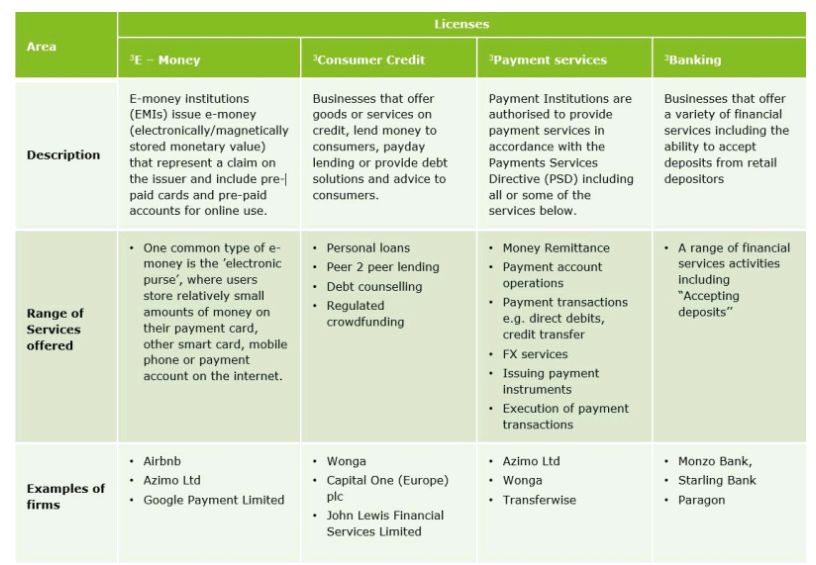

The table below sets out the key authorisation routes available to financial service entrants in the UK who are looking to offer activities similar to some of the activities performed by banks. Potential licensing options include obtaining mortgage lending, peer 2 peer lending and crowd funding permissions which can be done without necessarily applying for a deposit taking permission.

E-money and consumer credit firms tends to be popular routes for new entrants into the financial services industry - the authorisation process and initial capital requirements make them an attractive option to new entrants if it fits their proposed business model. A number of new entrants have also used these as an entry point into the financial services sector, moving on to become fully authorised banks at a later stage.

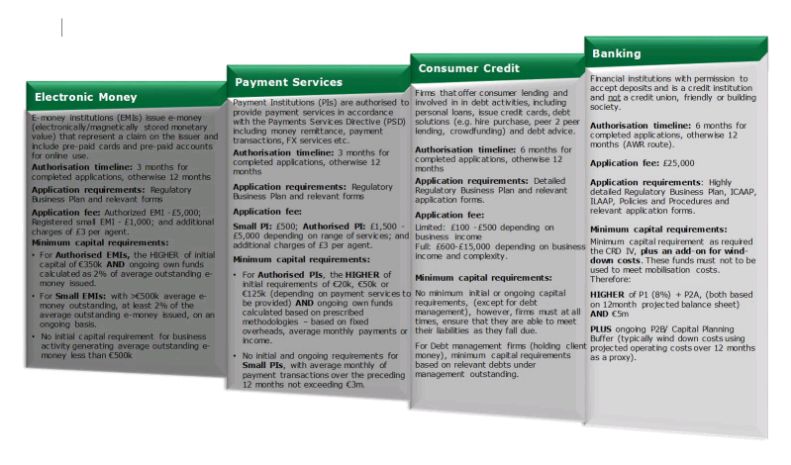

The illustration below sets out summary considerations for firm type alternatives:

Key considerations and implications

In many cases, we have seen a number of applicants go headlong into the bank authorisation process without fully considering the implications. The choice of route could have significant impacts, summarised below:

Firms must note that while the regulators have gone to great lengths to lower the barriers to entry in order to facilitate competition, becoming a bank is still no mean feat. The process for obtaining a banking license is far more rigorous than the other options and the capital, liquidity and general compliance requirements are significantly higher.

Conclusion

One of the building blocks to submitting a successful application is deciding on the appropriate licensing route. Choosing the wrong route could result in an unsuccessful application as well as the failure to achieve strategic objectives.

There are a number of examples of organisations that started down one of the alternative routes and are now fully authorised banks.

There are also a number of examples of firms that are currently authorised as PIs, E-money business or consumer credit businesses, who have made public their intention to obtain a full banking license in the future e.g. Zopa4, Babb and Cashplus.

These examples demonstrate that there is more than one route to success in the UK financial services sector.

Footnotes

1 Further information about the NBSU and related materials are available at www.bankofengland.co.uk/prudential-regulation/new-bank-start-up-unit

2 Available at https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/publication/pra-business-plan-2018-19.pdf

3 Further details on these licenses can be found on relevant FCA and PRA websites

4 Further information can be found on https://www.bankingtech.com/2018/05/uk-challenger-banks-whos-who-and-whats-their-tech/

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.