MAKING THE MOST OF AVAILABLE BENEFITS

There are literally hundreds of millions of pounds available on an annual basis to support the development of business in the UK. However, it can be difficult to identify the appropriate scheme, the key drivers behind the scheme and the chance of success as schemes are frequently discretionary. To start this process you need to be able to define your investment plans.

Grant support - could I be eligible?

The starting point is to consider your medium-term investment plans. For example, do your three-year plans involve investment in one or more of the following areas:

- Capital expenditure: plant and machinery, fixtures and fittings, land and buildings

- Personnel: the recruitment, training and/or development of staff

- Research and development: the development of new products or services, either on your own or with third parties

- Business improvements: efficiency improvements, energy efficiency, carbon footprint reduction etc.

If so, there may be an opportunity to secure support towards your investment plans provided no contractual commitment has been made to your project.

Why Deloitte

We are one of the world's leading international business advisory practices, working successfully with a wide range of private and public clients to help them achieve their objectives. We have an experienced team of specialists who are dedicated to working in this arena.

The philosophy at Deloitte is to provide objective, realistic and practical business advice. Our role is to help operations grow and maximise their potential by taking advantage of credits and incentives.

Our UK practice has more than fifteen years experience working with companies to help them secure grant towards their investment plans. We have a 100% success record on UK grant applications throughout this period. Members of our team have spent time either working for, or seconded to, some of the key grant awarding bodies.

Our UK dedicated team works with a team of more than 100 grant consultants spread throughout Europe. We are able to work together to explore and support grant applications on a Europe-wide basis too.

MAKING THE MOST OF AVAILABLE BENEFITS

How Deloitte can help

We are able to provide support throughout the process. This can include:

- The grant schemes. Meeting with you to understand your medium-term plans for the business, researching and reporting back to you on grant schemes that meet your requirements.

- Advance warning on grant schemes. Early alerts on specific grant programmes that could meet your particular needs.

- Grant strategy. Through our detailed knowledge of the schemes we are able to provide you with a clear understanding of the merits of different grant funding routes. Some grant schemes are influenced by size of company and location of the project. We understand what this means in practice.

- The application process. We understand what the grant providers are looking for and can help you to position the project effectively.

- Meeting the grant providers. We provide a full hand-holding service that includes premeeting briefings and support to help ensure the application proceeds smoothly.

- The grant offer letter. Advice on any terms and conditions within the final grant offer letter.

THE OPPORTUNITIES

There are numerous grant and incentive schemes available for companies in the manufacturing sector. Understanding the grant system and completion of grant applications can be complicated. We have a team available to help.

Our Regional Development Services team

- Has more than fifteen years experience accessing grants

- Has a 100% success record on all applications over this period and around the country!

- Works with more than 500 grant colleagues to help clients access grants and incentives around the world

- Will help you understand how grants and incentives may be able to help you

- Provides a complete hand holding service throughout the grant application process.

Manufacturing project examples

- Secured a grant of £500,000 towards the rationalisation of a manufacturing business

- Secured a grant of £13 million for a new car component manufacturing project

- Secured a grant of £1.35 million towards a catalytic converter recycling project

- Secured a grant of £3 million to set up a new automotive and ICT centre of excellence for R&D

- Secured a grant of £3 million to invest in new equipment and technology which safeguarded 300 jobs for a manufacturing company

THE OPPORTUNITIES

The schemes

We have prepared a high-level introductory guide to some of the main grants and incentives available in the UK. We have summarised these in categories related to:

1. R&D incentives

1. R&D incentives (continued)

2. Investment projects

2. Investment projects (continued)

3. Staff training

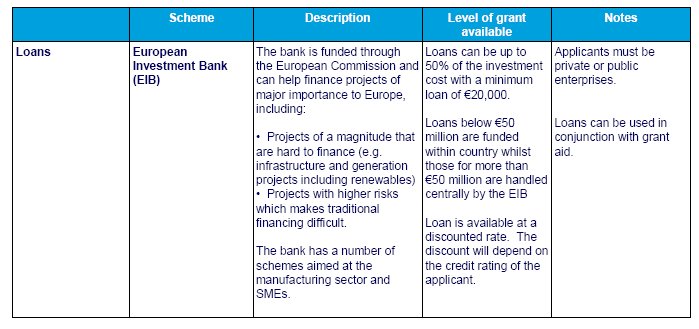

4. Energy efficiency

4. Energy efficiency (continued)

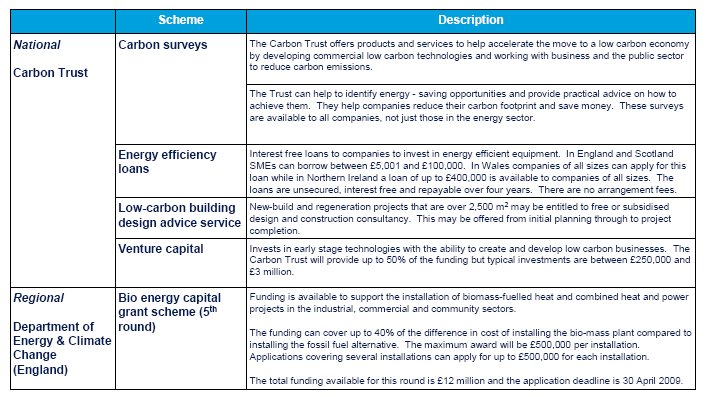

5. General business support

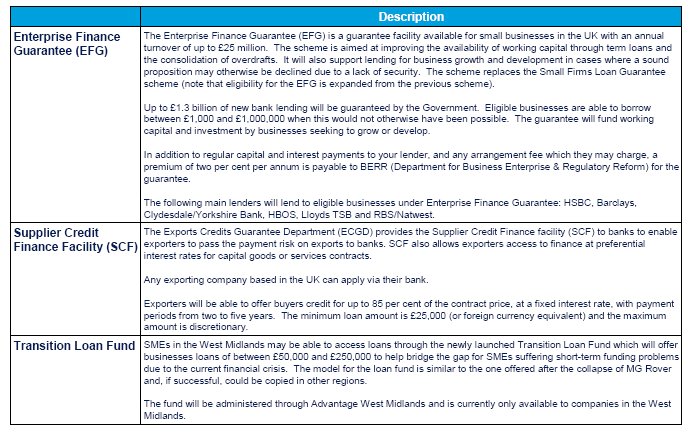

Appendix 1 - Examples of potential

projects

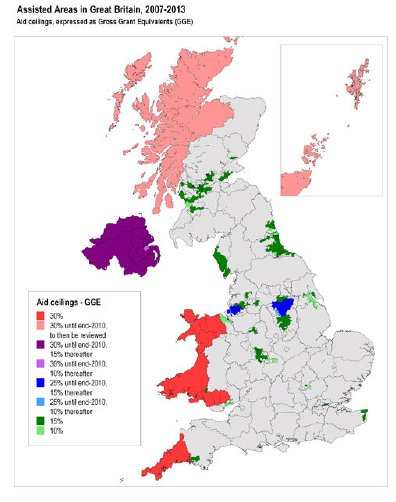

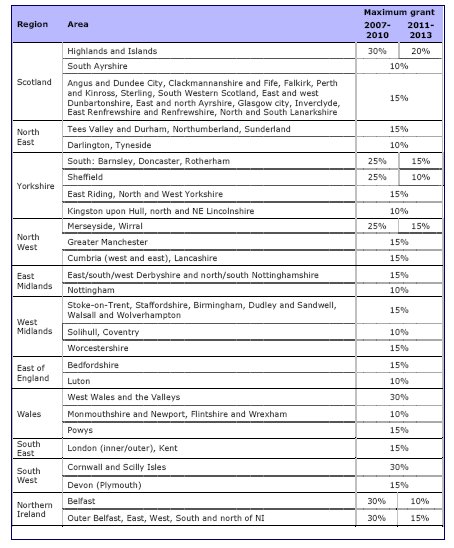

Appendix 2 - Assisted areas (investment grants)

Appendix 3 - SME definition

Micro, small and medium-sized enterprises are defined according to their staff headcount and turnover or annual balance-sheet total. In all cases they must comply with the full-time headcount requirement.

A medium-sized enterprise is defined as an enterprise which employs fewer than 250 persons and whose annual turnover does not exceed €50 million or whose annual balance-sheet total does not exceed €43 million.

A small enterprise is defined as an enterprise which employs fewer than 50 persons and whose annual turnover and/or annual balance sheet total does not exceed €10 million.

A micro enterprise is defined as an enterprise which employs fewer than 10 persons and whose annual turnover and/or annual balance sheet total does not exceed €2 million.

If your business owns more than 25% of other businesses, this will need to be taken into account when assessing your SME status.

If your business is more than 25% owned by one or more owners that are not classed as SMEs you may not qualify as an SME (public investment corporations and venture capital companies are exempted from the 25% threshold as are institutional investors provided they exercise no control over the business.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.