The Pensions Act 2008 is a significant change as for the first time employers will be required to contribute to their employees' pensions. From 2012, employers will be required to automatically enrol eligible "jobholders" into a qualifying workplace pension scheme, with a minimum employer contribution. The Department for Work and Pensions has been consulting on the detail of the auto-enrolment requirements.

Employers who already make some form of pension provision will need to focus on how to adapt current pension and payroll arrangements to comply with the new autoenrolment regime. Scheme rules, contracts of employment and staff handbooks will all need to be revised to deal with the deduction of contributions. But the many employers who do not make any form of pension contributions will also need to budget for the minimum contributions of three per cent of "qualifying earnings" (see below) when auto-enrolment comes into force. Unlike for stakeholder pensions, there is no exemption for employers with fewer than five employees.

The auto-enrolment duty applies from the first day (known as the "automatic enrolment date") that an individual satisfies the following criteria:

- he/she is a "jobholder", that is working in Great Britain under a contract of employment or any other contract to do work or perform services personally for another party; and

- is aged between age 22 and 75; and

- is paid "qualifying earnings" by an employer. Qualifying earnings are the gross earnings - including bonuses, overtime and statutory maternity, paternity and adoption pay - between £5,035 and £33,540 in a "pay reference period" of 12 months. There is power for this qualifying earnings band to be increased over time.

Employers will need to be able to identify those among their workforce who qualify for automatic enrolment and this could prove problematic for part-time employees or atypical workers, whose earnings fluctuate around the lower limit.

The draft Pensions (Automatic Enrolment) Regulations 2009 set out the procedure for automatic enrolment of jobholders into qualifying pension arrangements, including the procedure for opting out and deducting contributions.

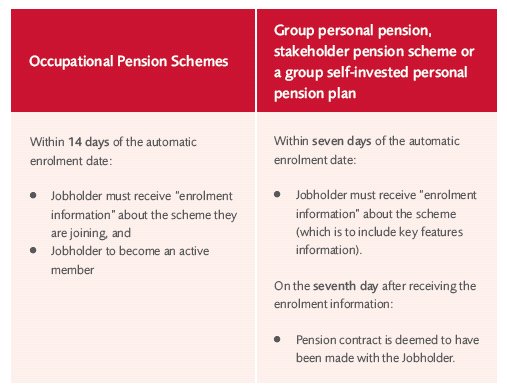

There are tight time frames within which employers must enable jobholders to become active members of a qualifying pension scheme, including requirements for providing the jobholder with information about enrolment and opting out. The deadlines are different depending on which type of pension scheme is used to discharge this new duty, with the options being:

- Defined benefit occupational pension scheme which is contracted-out or has an accrual rate of 1/120th of qualifying earnings for each year of service.

- Money purchase occupational pension schemes, where the employer pays at least three per cent of qualifying earnings and total contributions of eight per cent are paid.

- Group personal pension, stakeholder pension scheme or a group self-invested personal pension plan, where the employer contributes at least three per cent and total contributions of eight per cent of qualifying earnings are paid.

- The new personal accounts scheme, which is being established by the Personal Accounts Delivery Authority. Employers will again pay a minimum of three per cent with employee contributions of five per cent, but there will be a limit on contributions of £3,600 per annum. A separate consultation has commenced on the rules of the Personal Accounts Scheme.

It will be possible to postpone auto enrolment for up to 90 days provided that the jobholder will be enrolled into a defined benefit scheme or a money purchase scheme to which the employer pays at least six per cent and the total contributions are 11 per cent of qualifying earnings. No postponement is allowed if the jobholder is to be auto-enrolled into a personal account as the postponement option is intended to create an incentive for employers to continue to use higher-level provision than personal accounts.

Once enrolled, the active membership is deemed to have commenced from the Auto- Enrolment Date. The intention is that all employees will experience the effect of pension deductions from their first pay day (even if the payday arises before the member becomes an active member of the scheme).

Jobholders will be able to opt-out, but only after active membership has been achieved. This is to ensure that all jobholders see the effect pension deductions will have on their take home pay. The Act prohibits employers from taking action to induce an employee to opt out, so the Regulations require jobholders to obtain opt-out notice forms from the pension scheme. A jobholder will have 30 days to opt out from the date he/she became an active member (or received the enrolment information, if later, when auto-enrolled into an occupational pension scheme). It is unclear whether the current preservation rules - which allow a member to opt out of an occupational pension scheme within the first two years and claim a refund of contributions or a transfer value - will be amended.

The opt-out forms are to be returned to the employer to enable payroll deductions to be stopped quickly to minimise refunds. The employer will then have to notify the scheme of the decision within seven days, although there is nothing to prevent the opt-out form being completed on-line and submitted to employer and scheme simultaneously - indeed, this may be preferable given the time limits for returns of contributions (see below). Employers will also need to notify a jobholder within five days if the form is incorrectly completed.

A jobholder who opts out will be treated as never having been a member and will be entitled to a full refund of his or her contributions from the employer. This is an area where we think the regulations require further work. At present, member contributions must be paid over to a scheme by the 19th day of the month following the month of deduction. The draft regulations require the employer to repay contributions within 21 days of the opt-out notice being given (or, if later, by the second payday after notice is given.) In turn, the scheme must provide a refund to the employer within 21 days of receipt of the opt-out notice. It is easy to envisage a situation where contributions are paid over only to be returned shortly afterwards, possibly also creating an investment risk if markets moved significantly before the refund is paid. It may be simpler if the 19 day rule was amended so contributions are held in a separate bank account until the opt-out window closes.

The Government's response to the consultation and further information about the auto-enrolment process is due in the summer. The Pensions Regulator will police the auto-enrolment requirements and early indications are that it will take a stringent approach - akin to that of HMRC - issuing civil penalties. Details about the information to be provided to the Pensions Regulator are due to be revealed in the autumn.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.