Key points from the 2009 Q3 Survey

- Financial optimism has reached the highest level since the CFO Survey started in September 2007.

- Credit cost and availability have improved over the last year, but most corporates continue to rate credit as costly and hard to obtain.

- 92% of CFOs think M&A will rise over the next year. 39% of CFOs are contemplating making corporate acquisitions this year.

- CFOs expect a sluggish economic recovery. Just 14% of CFOs expect a return to normal or trend rates of growth in their markets in 2010.

- Disruption in the financial system has fundamentally changed CFOs' preferences for financing their businesses.

- Bank borrowing is still out of favour, corporate bond and equity issuance increasingly in favour.

- CFOs are expecting a lasting shift by corporates away from bank borrowing as a source of capital.

- 81% of CFOs do not expect bank lending to corporates to rise until the middle of next year or later.

- In future companies are likely to be more financially conservative, running lower levels of corporate gearing and higher levels of liquid reserves.

- CFOs' views on valuations have changed markedly in the last two years.

- UK equities have gone from being seen as the most undervalued to an overvalued asset class.

- Commercial real estate has gone from most overvalued to least overvalued status. Government bonds are seen as the most overvalued asset class.

Despite doubts about the timing and magnitude of the recovery, UK CFOs have become markedly more optimistic about financial prospects for their own companies. For many corporates M&A is on the agenda again. Yet there is no expectation that we are on the verge of a strong recovery. CFOs expect activity in their own markets to remain sluggish through 2010. Debt reduction and financial caution are in favour and it is clear that CFOs think these trends are here to stay. Part of the explanation lies in uncertainties about the magnitude of the recovery and the continued difficulties corporates face in accessing credit. But CFOs also believe that the credit crunch marks a move to a new era of lower debt, less reliance on bank borrowing and a greater focus on liquidity.

Improving financial prospects

In September CFO sentiment about prospects for their own companies rose to the highest level since the Survey started in September 2007. The mood, however, is hardly euphoric. CFOs think that recovery in their own markets will only come slowly. 73% of CFOs are expecting growth in their own markets to remain sluggish next year and 12% expect an outright contraction. Just 14% of CFOs expect a return to normal or trend growth rates in their markets next year.

The caution about the outlook is captured in CFOs' plans for their own companies for the rest of this year. Most companies are not expanding, or likely to expand hours worked for current employees or to increase hiring before the end of this year. Only 11% of corporates expect to increase hours worked for existing employees before the end of this year. In terms of capitalising on the upturn, the areas which interest most corporates are raising capital spending and making corporate acquisitions. Given the weakness in M&A activity over the last year it is striking that 39% of CFOs say that their companies are making, or likely to make, corporate acquisitions before the end of this year. Attractive valuations, a better economic backdrop and improved access to capital may all be at work here. Optimism about M&A and private equity activity has now reached the highest level since September 2007.

Financial conservatism is back

This quarter's survey asked CFOs for their views on whether the recession and the credit crunch would cause lasting change to the way in which corporates structure their balance sheets. 70% of CFOs believe the change is, indeed, likely to be permanent. The general view is that the corporate sector is entering a new era of lower gearing and greater financial conservatism. CFOs believe that the downturn will permanently change balance sheets, with corporates running higher levels of cash or liquid reserves and relying more on equity and corporate bond finance and less on bank borrowing.

These changes are already starting to make themselves felt. Bank borrowing has gone from being the most attractive to the least attractive form of finance in the space of just over two years. Wholesale financial markets, rather than banks, are now seen as offering corporates the most attractive sources of external finance through equity and corporate bond markets. It is a measure of the shift in preferences that 18% of CFOs say they have used capital markets to raise finance to repay bank borrowing this year and a further 19% say they are likely to do so.

The views of CFOs ties in closely with recent trends in financial markets. Bank borrowing by corporates is contracting rapidly while issuance of corporate bonds and, in particular, equity has surged.

So while the economic outlook has improved, CFOs remain cautious. 79% think now is not a good time to take risk onto their balance sheets and debt remains out of favour. Many more CFOs plan to reduce debt over the next year than to raise it.

Credit costly and in short supply

The great majority of CFOs believe that short term interest rates are at low levels. Yet sharply lower market interest rates do not appear to be translating into proportionate declines in the cost of corporate credit. The majority of CFOs continue to rate credit as being costly although perceptions of the cost of credit have fallen over the last year. Similarly credit availability has improved from last year's lows, but most CFOs report credit remains hard to obtain. This situation is not expected to change quickly. 81% of CFOs do not believe that bank lending to corporates will increase until the middle of next year or later.

Valuations

Every quarter we ask CFOs for their views on the valuation of three major asset classes – equities, commercial real estate and Government bonds.

Views on valuations have changed considerably. This year's equity rally has caused equities to shift from being seen as the most undervalued to an overvalued asset class. Meanwhile, commercial real estate has gone from being the most overvalued asset class two years ago to the least overvalued. Government bonds remain, as they have been since the start of the year, the most overvalued of the three asset classes in the eyes of CFOs.

Greater optimism, but sluggish recovery

UK CFOs have become much more optimistic about the financial prospects for their own businesses.

Overall financial optimism has reached the highest level since the CFO Survey started in September 2007.

Yet CFOs think recovery in their own markets will come only slowly. Just 14% of CFOs expect a return to normal or trend rates of growth in their markets in 2010. 73% are looking for sluggish growth and 12% expect their markets to contract next year.

This caution about the pace of the upturn is reflected in CFOs' plans for their own businesses between now and the end of this year. Most CFOs are not yet contemplating increasing hiring or raising hours for existing employees.

Capital spending and corporate acquisitions are the two areas of greatest interest to corporates at the moment. Both have been hard hit by the recession: business investment has fallen by 21% in this cycle while acquisitions by UK corporates have fallen by 83%.

Optimism among CFOs about corporate and private equity activity has been on a rising trend this year. In the third quarter expectations for increasing activity in these sectors reached the highest level since the Survey started in September 2007.

Financial conservatism is back

70% of CFOs believe the recession will result in a permanent change in the way in which corporates structure their balance sheets.

The general view is that we are entering a new era of lower corporate gearing and greater financial conservatism. CFOs believe that in future corporates are likely to run higher levels of cash or liquid reserves, with more reliance on equity and corporate bond finance and less reliance on bank borrowing.

These changes are already starting to make themselves felt.

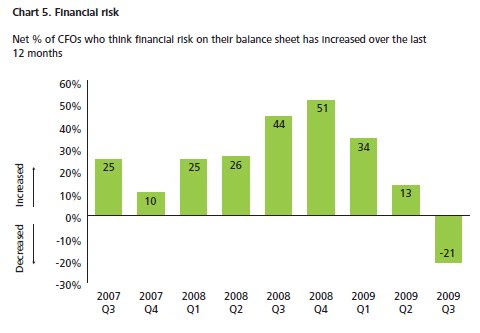

CFOs report that the degree of financial risk on their balance sheets fell in the third quarter after more than two years of increases. 79% of CFOs think now is not a good time to take risk onto their balance sheets.

The stabilisation of financial markets should have helped reduce financial risk for corporates. In addition, measures taken by companies themselves, such as

reducing debt levels and boosting liquidity, will have lowered levels of corporate financial risk.

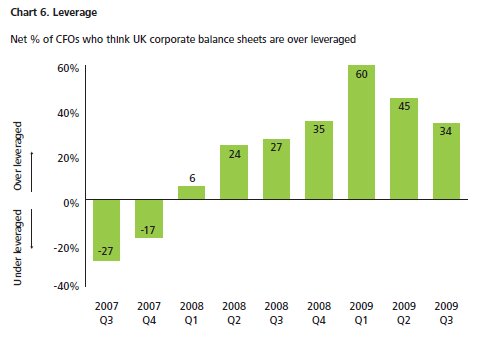

Chart 6 illustrates that debt remains out of favour with CFOs, albeit less so than in the last two quarters.

45% of CFOs say that they plan to reduce gearing in their own companies over the next year.

Financing preferences

Disruption in the banking system has fundamentally changed CFOs' preferences for financing their businesses.

Bank borrowing has gone from being the most attractive to the least attractive form of finance in just over two years. Wholesale financial markets, rather than banks, are now seen as offering corporates the most attractive sources of external finance through equity and corporate bond markets.

The views of CFOs tie in with recent trends in financial markets. Bank borrowing by corporates is contracting rapidly while issuance of corporate bonds and, in particular, equity has surged.

Consistent with this switch, 18% of CFOs report they have used capital markets to raise finance to repay bank borrowing this year and a further 19% say they are likely to do so.

Chart 8 shows that filling the gap created by the collapse of bank lending would require a far greater increase in corporate bond and equity issuance than has been seen so far.

As the credit crunch took hold corporates focused on managing cash flow and boosting liquidity. One feature of this was companies reducing or eliminating dividend payments and share buy backs.

Today most CFOs think that cash return to shareholder levels are low relative to normal levels.

The cash flow outlook for corporates is improving. 60% of CFOs expect free cash flow to increase for their company over the next 12 months.

Credit in short supply

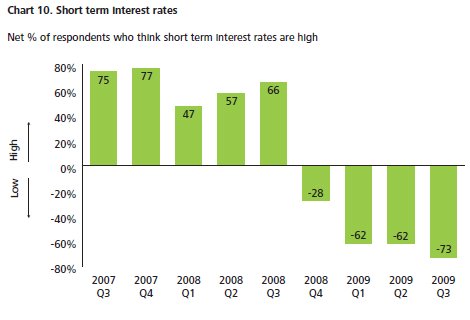

Since late 2007 the Bank of England has reduced UK base rates from 5.75% to just 0.5% and market interest rates have, with a lag, followed base rates down. The great majority of CFOs believe that short terms rates are now low.

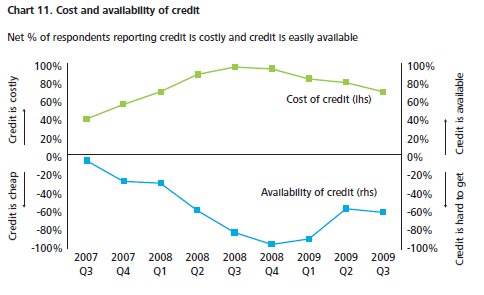

Perceptions of the credit costs faced by corporates have fallen over the last year, although the majority of CFOs continue to rate credit as being costly. Sharply lower

market interest rates do not appear to be translating into proportionate declines in corporate credit costs.

Similarly, credit availability has improved from last year's lows, but most CFOs continue to report that credit remains hard to obtain.

Lending by UK banks to non financial corporates has fallen by 3.5% over the last year and is expected by the IMF to continue contracting for several months to come.

Most CFOs, some 81%, do not expect bank lending to corporates to rise until the middle of next year or later.

Banks' views, corporate views

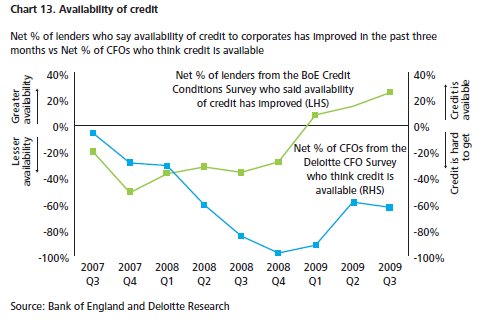

Over recent quarters a gap has opened up between CFOs' perceptions of the availability of credit and banks' perceptions of the supply of credit as reported to the Bank of England.

One possible explanation is that there are lags between changes in the supply of credit from banks and changed perceptions on the part of corporates about the availability of credit. This theory points to further improvements in credit availability for corporates in coming months.

The Bank of England's survey also examines why banks increase or decrease their provision of credit to corporates.

In the last 6 months increasing appetite for risk and an improving economic outlook have contributed to a growing willingness on the part of banks to lend. But the main factor behind the increased credit supply has been the ability of banks to access funds at attractive rates.

CFOs' views on asset valuations have changed markedly over the last two years.

Equity has gone from being seen as the most undervalued to an overvalued asset, while commercial real estate has gone from most overvalued to least overvalued. Meanwhile Government bonds continue to be seen as the most overvalued asset class.

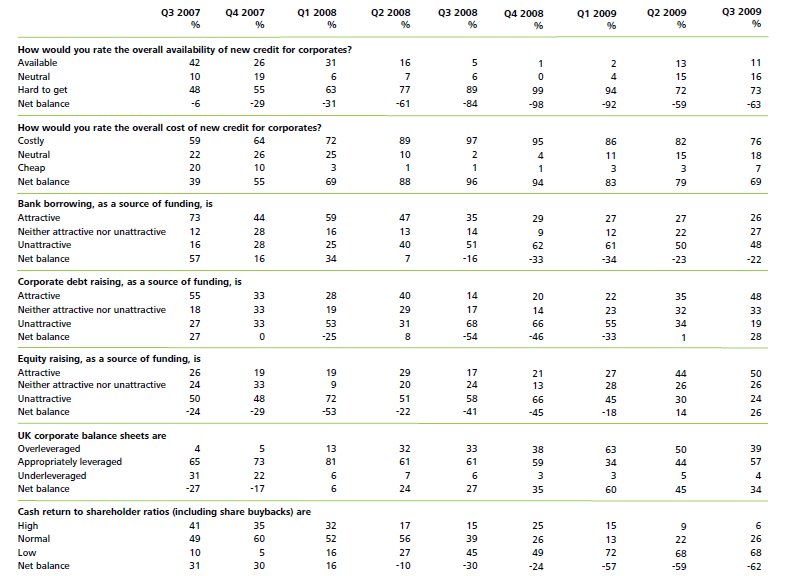

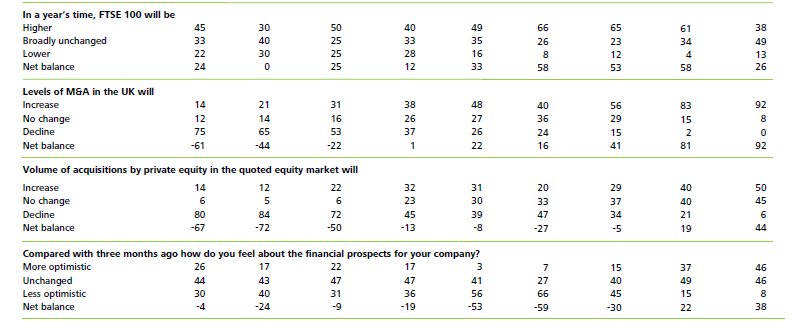

Data archive

A note on methodology

Many of the charts in the Deloitte CFO Survey show the results in the form of a net balance. This is the percentage of respondents reporting, for instance, that bank credit is attractive less the percentage saying bank credit is unattractive. This is a standard way of presenting survey data used by, amongst others, the CBI and the European Commission. To aid interpretation of the results, this table contains a full breakdown of responses to the questions covered in this report. Due to rounding answers may not sum to 100.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.