The first decade of the new millennium started on a high note for the global aerospace and defense (A&D) industry, with outstanding financial performance around the world — only to be followed by the dot-com bust, the tragedy of 9/11, the ensuing wars in Afghanistan and Iraq, and the worst global economic downturn in nearly 80 years. Global A&D went from peak to trough twice. While most subsectors managed to end the decade with a strong bottom line, that outcome was not shared by all, with business jet output experiencing a devastating 50 percent cut in production and commercial aircraft orders suffering the worst order cycle in almost 20 years.

What is next for the global A&D industry? With a new year and a new decade just commencing, we turned to Tom Captain, A&D sector leader, Deloitte Touche Tohmatsu (DTT) Global Manufacturing Industry, and to Deloitte member firm sector specialists Michael Hessenbruch in Germany, Pauline Biddle in the United Kingdom, Didier Novella in France, Yuichiro Kirihara in Japan, Nidhi Goyal in India, and John Hung in China to hear their views.

Q: What global A&D trends do you see for 2010?

The global industry is truly at an inflection point and we see it continuing to move rapidly east — toward China, India, and the Middle East. These countries are expected to be large markets for A&D industry products and services, as well as participants in the supply chain.

For example, we see China growing its middle class by an estimated 600 million people over the next 20 years, which is expected to drive the demand for over 3,500 commercial aircrafts.1 There are approximately 100 business jets present in China.2 Due to relaxation of import tariffs, reduced landing fees, and expedited flight planning, China is expected to increase that number into the thousands over the next decade. In addition to being a consumer, China is expected to become a major player in commercial aircraft production, with an all-new regional jet in the test and certification process, and a next-generation single-aisle aircraft now on the drawing boards with a scheduled first flight in 2014. However, in terms of defense, China is expected to remain more of a "closed shop" as compared with other developing areas.

India is experiencing the same phenomena of upward mobility in the population, creating demand for air travel. And homeland security has become very important, in response to the Mumbai bombing tragedy. The Middle East is also accelerating in terms of investment. The United Arab Emirates (UAE) is a standout — investing significant resources in building an aerospace industry, with multiple announcements of joint ventures as well as industrial developments for component manufacturing and maintenance repair and overhaul (MRO). It is also a significant buyer of defense industry products in the form of airlift; intelligence, surveillance, and reconnaissance platforms; helicopters; tactical fighters; and missile defense. Though 2009 ended with the prospect of a sovereign credit crisis, leaders in the region have publically committed to becoming more self-reliant in its defense capabilities.

Q: What are the prospects in Asia for A&D?

In Japan, the commercial aircraft business has been the engine for industry growth for the last three decades, but has slowed down in 2009 with the global economic downturn. 2010 is also expected to be flat with only a modest rise in commercial aircraft parts production and no significant increases in defense budgets. Another factor is that aero-structures suppliers have been impacted by the delays on major commercial programs — but this sector is expected to slowly recover as rates of commercial aircraft production increase.

In China as noted above, rapid development for the commercial aircraft industry is anticipated over the next 10 years. There is a strong feeling that the Chinese aerospace industry has the potential to be a major new engine of economic growth as well as technological innovation for the country. Large, nationally funded scientific and applied technology projects will only further boost the aerospace industry's global market entry and competitiveness.

Similarly in India, the sector is growing at an unprecedented rate and emerging as a key participant in the Asia Pacific region. United States and European aerospace companies are now recognizing India as a critical market as well as a potential manufacturing partner. India is becoming one of the largest military spenders in the world and catching worldwide attention, with the third-largest defense procurement budget in Asia.3 In 2009 to 2010, US$30 billion has been earmarked for national defense. Of this, US$11.5 billion is to be spent on acquisitions for new weapons systems equipment and services.4 It is estimated that Indian defense procurement will rise to an estimated US$45 billion by 2012, which could make it one of the most attractive defense markets in the world.5

Q: What do you see happening with thesector in Europe?

In Europe, the era of the national government-backed champion is probably nearing its end. European Aeronautic Defense and Space Company N.V. (EADS) is now the dominant pan-European company. It has proven to be a commercially successful global competitor, although the issue of governmental economic assistance has been a point of controversy, especially for U.S. companies. During the past six months, competition has increased from nontraditional smaller companies that have demonstrated innovative approaches to technology programs that are capturing market share for government defense and space programs based on cost competitiveness, cutting-edge technologies, and program leadership. The European sector, with its strong focus on innovation, should benefit from the sectors' advances in data protection, biometric, and homeland security technologies. The key success factors will be the time to market and the efficient transnational combination of capabilities.

European A&D markets are still fragmented compared to the United States. A key factor is the much-reported lack of harmonization in requirements across the European Union and national self-interest and sovereignty issues.6 There remains an ongoing challenge to make European cross-border joint development and procurement programs meet expectations in terms of timing, cost, risk and program management, and capability. A case in point is the reported difficulties in the landmark pan-European defense program for the heavy lift A400M military program. It is expected that the lessons learned from this program will pave the way for a new era of more transparent, commercially viable, and competitive international collaborative programs over time.

In the defense market, the increasing support required from Europe for international efforts, mainly in Afghanistan, will keep operational spending at an important level in 2010. However, tightened governmental budgets in all European countries will lead to a decrease in defense spending in the future.

Q: What are your comments on the downturn in the commercial aircraft business?

There is a dichotomy in this industry that is perplexing to understand, in that 2009 was a record year for commercial aircraft manufacturing, with 979 aircraft produced.7 However, only 413 airplanes were ordered net of cancellations, thus creating the perception of a commercial aircraft "recession." As it turns out, this is true for orders but not for production. The reason for the record high production levels is that in the past four years, over 8,000 aircraft have been ordered, creating a six-year backlog for aircraft manufacturers (see Figure 1).

However, there is a sense of both caution and muted optimism among suppliers about the production forecasts for 2010, if an economic recovery is in sight and airlines can finance aircraft again. Should growth in travel occur as expected in 2010, commercial aircraft producers might be convinced that a reduction in production levels could be avoided, which would be a welcome relief to the thousands of suppliers to this industry. Once production and delivery of new generation commercial aircraft starts and the economy recovers, challengers will be emboldened to compete with the existing large-scale aircraft duopoly including the emerging competitors in China, Canada, and Russia.

China in particular has not been affected as much as other countries, given its robust economy, the size of its market, above, industry mergers and reorganizations will also drive development. Last year, Aviation Industries of China (AVIC) sold its automotive assets and is now targeted to become a publically listed company in five years.8 The Commercial Aircraft Corporation of China (COMAC) has also just come into existence and been making significant progress in commercial aircraft development.9

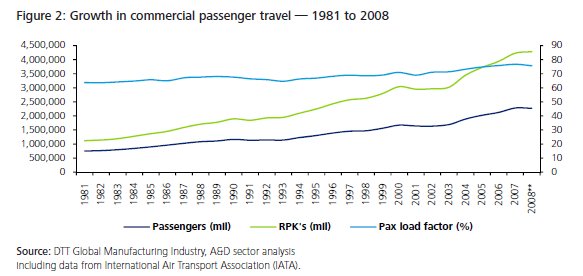

From a longer-term perspective, there is some comfort for the commercial aircraft industry as well, in that revenue passenger kilometers (RPK) growth has steadily increased over the last 30 years (see Figure 2). The expectation is that almost 30,000 new aircraft will be produced over the next 20 years based on the long-term forecast of increased leisure and business travel, not to mention freighter traffic.10

Q: What about global defense markets in 2010?

The global defense markets are likely to stay flat this year, primarily due to the softening of the U.S. defense market, the largest in the world. Cancellations of major weapons programs in the United States, coupled with cost overrun challenges on major programs around the world, will likely have an impact on additional spending.

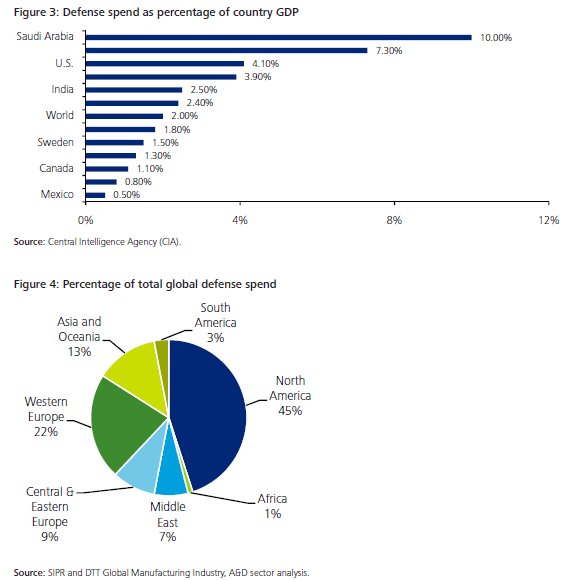

Even so, global defense spending will likely stay at approximately 2 percent of global GDP, with Saudi Arabia, Israel, and the United States spending a proportionately higher amount, with European and Asian countries spending less (see Figures 3 and 4).

Take the United Kingdom, for example. 2010 is an election year, and whoever is elected will have the challenge of repaying the large national debt built up due to the global economic crisis. In that environment, maintaining, let alone increasing, defense spending at the expense of funding for education, health, and social security may be difficult to justify. But there does remain a conflict in the public's perception of defense spending. On the one hand, there are increasing calls to pull out of conflict zones. On the other hand, there is a call for extra equipment to protect troops currently in the theater of war. As a new strategic defense review takes place in the United Kingdom in 2010, these issues will be at the forefront.11 As would be expected, the major A&D companies and trade associations have already started to assert their place in the overall economy in an effort to minimize the impact of spending cuts and to gain recognition for the exports it achieves.

In contrast, in India, the prospects for the defense sector are strong. In light of the Mumbai attacks as well as the overall need to modernize its defensive capabilities, India's armed forces are expected to increase their purchases of new equipment and technology for the next 20 to 25 years. Liberalization of India's defense procurement policy offers a unique opportunity for Indian companies to provide services for the armed forces.12 Currently, about 70 percent of procurement in value terms is from foreign sources — with Indian companies supplying only around 25 percent of components and subassemblies to state-owned companies.13 But the situation is expected to change with the creation of more public-private partnerships. However, in the near-term, foreign companies will likely continue to have an edge in the supply of defense armaments and transfer of technology.

Q: How will the recent announcement by U.S. President Obama to deploy 30,000 additional troops to Afghanistan impact the global defense sector?11

Due to the nature of the campaign — in rugged terrain and the changing manner in which conflicts are addressed in the Afghanistan theater of irregular warfare — there is likely to be an equal increase in government-employed contractors, that is, non-active duty personnel, in the war zone. The A&D industry is expected to supply these contractors, with many of the contractors to be locally hired in Afghanistan.14

A&D companies will also receive orders for additional equipment, such as mine-resistant and ambush-protected all-terrain vehicles, electric generators, transport aircraft, and helicopters. Defense contractors will be called upon to help refurbish worn-out equipment. In addition, the surge will provide an opportunity for the industry to address critical new requirements, such as anti-improvised explosive device (IED) capabilities, alternative energy, light-weight transportable power sources, and precision engagement technologies. Companies that can develop and rapidly test and deploy these life-saving technologies will likely be winners next year.

Q: Will mergers and acquisitions be a major factor in 2010?

Consolidation activity in tier-one and tier-two suppliers to gain scale economies and increase industry asset utilization is expected to continue. However, it is not likely that any of the large titans — the top 10 A&D companies — will merge due to anti-competition laws, concentration of technology, and other antitrust matters. With relatively low valuations, the changing requirements for up-front risk-sharing investments, the expectation of fewer government competitions for large-scale programs and competition from nontraditional countries such as China, Japan, India, the UAE, and others, it is likely that mid-tier suppliers will look for the best deals before selling out. While bank debt is more expensive and harder to come by in the current environment, though A&D seems able to access debt more easily due to its long-term contracts and backlog visibility, a number of sector firms have built up robust cash positions during the recent buoyant defense-spending years. This gives them financial capacity for acquisitions with in a more stable economic environment.

American companies will likely accelerate their products and service diversification activity by entering adjacent and international markets as the U.S. government moderates its ability to purchase large complex weapons platforms. In addition, it is anticipated that large original equipment manufacturers (OEMs) will continue to acquire smaller companies to fill capability gaps in homeland defense, intelligence, information technology services, command and control, alternative energy, cybersecurity, and related technologies. These companies are likely to increase the creation of joint ventures to secure international sales and address offset requirements.

European A&D companies will likely continue to diversify by acquiring North American companies to establish and strengthen their position with the largest A&D customer in the world, the U.S. Department of Defense. However, the difficulties in forging a pan-European. defense procurement policy is limiting further significant consolidation opportunities for key sector companies, mainly due to national sovereignty. This creates lack of scale and cost redundancy of certain critical areas within countries and companies across Europe. These barriers are unlikely to be resolved soon and will likely slow or diminish consolidation initiatives.

In India, foreign acquisitions are expected to be more affordable at this time. Industry consolidation in India may be on the upswing for larger companies that have desire to enter manufacturing businesses. This would give them a presence abroad to interact and do business with OEMs and suppliers directly, while simultaneously harnessing the advantages that India as a manufacturing destination provides.

Q: What are your predictions for the future of the global sector?

In Europe, the evolution of A&D may be the same as the automotive industry, with large, dominant tier-one and tier-two suppliers expected to emerge. By joining forces, the European A&D industry has the opportunity in the long run to gain economies of scale and be more cost-competitive with better market access.

It is important to note that the sector to date has been fairly sheltered from the credit crunch due to the long-term nature of its contracts, and this can indicate that a downturn potentially has only been deferred, not avoided. For example, currently many UK firms are carrying strong order backlogs. These orders were placed or programs which started prior to the difficulties in the financial sectors and the redirection of funds away from large platforms into cybersecurity and asymmetric warfare needs. As these backlogs unwind over the coming years and the Western nations withdraw from the conflicts in Afghanistan and Iraq, new opportunities are expected to slow.

In Asia, the downturn certainly has hit the A&D industry in the past year and will probably continue to have some impact into 2010, especially in Japan. However, the steady growth of the sector in the long-term in Asia will benefit Japan as well. As for India, all segments in the aerospace industry are expected to show significant growth. With GDP growth of over 8.9 percent in the last five years and for 2008 to 2009 GDP was 6.7 percent which was significantly higher than many developing countries.15 The Indian government has also opened up the A&D industry to the private sector, positioning its market to be one of the fastest growing in the world. China will lead in the next 20 years with increased passenger travel and new aircraft orders and production, followed by other emerging regions including Latin America and Russia/CIS.16 Overall, Asia will continue to be an importer of A&D products for the next decade, but it will not be a surprise if the next EADS or Boeing is born in China, India, or Japan.

Conclusion

In the long term, a bullish future for the A&D industry is anticipated, despite its well-publicized current challenges. In retrospect, 2009 was the trough in the current economic cycle for the sector, and as the new decade begins, a steady climb is expected, thus our muted optimism for the sector. This is an industry that is only 106 years old, since the Wright Brothers' first flight in 1903. It has landed a man on the moon, created Global Positioning System (GPS), radar, the Internet, supersonic flight, and other innovations of historic importance. It kept Berlin alive after World War II through the humanitarian airlift. It brings aid to victims of natural disasters anywhere in the world, as we have seen recently in Haiti. This trend of innovation and contribution to society will only continue at an incredible pace in the years to come.

Footnotes

1 Boeing: Current market outlook 2008–2027

2 JP Morgan: All about Aerospace & Defense 2009

3 Stockholm International Peace Research Institute (SIPRI): Appendix 5A, Military expenditure data, 1999–2008

4 Union budget 2009-2010: Expenditure budget, Volume I, 2009–2010

5 Confederation of Indian Industry, Defence Division: Defence expenditure trend

6 NAFTA tax law and policy: "Resolving the clash between economic and sovereignty issues," by Arthur J. Cockfield

7 Anna Aero: "Airbus delivers record 61 in December, 498 for the year; Boeing ends year on 481," January 14, 2010

8 China Daily: "China's Changan Auto to acquire AVIC's auto assets," November 10, 2009

9 COMAC in Wikipedia

10 Boeing: Current market outlook 2008–2027

11 Defense-aerospace.com: "Fitting defence for the future: Toward the next defence strategic review," September 16, 2009

12 Business Standard: "No slowdown in defence sector for the next 25 years," February 27, 2009

13 The Economic Times: "India to raise defence procurement from domestic market," December 19, 2009 and Confederation of Indian Industry, Indian Defence Industry

14 The Washington Post: "Up to 56,000 new contractors likely for Afghanistan, congressional agency says," December 16, 2009

15 Government of India: Economic Survey 2008–2009

16 Embraer market outlook: 2009–2028

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.