The high-profile public market debuts of tech unicorns Spotify and Slack are encouraging many late-stage, venture-backed technology companies to consider whether a direct listing makes sense for them. While a direct listing offers many benefits, the structure does not make sense for every company. In this article, we explore the pros and cons of direct listings relative to a traditional IPO and outline some key considerations before choosing this structure.

The Positives

If your company is fresh off a big fundraising round, doesn't need additional capital and is generating cash flow, then a direct listing may just be right for you.

Direct listings offer companies a number of key benefits:

Equal access to all buyers and sellers: In a direct listing, company insiders are not constrained from selling or distributing their pre-IPO shares by a lock-up agreement. They are free to sell their shares whenever and for whatever amount they want. Moreover, unlike in a traditional IPO, the shares in a direct listing are not allocated by the company to a small number of institutional investors. Instead, investors of all shapes and sizes (yes, even your grandfather and grandmother) can participate at the same time. As discussed below, the large investment banks have also not yet gotten comfortable with involving their research analysts in a direct listing process. Accordingly, unlike in a traditional IPO, companies in a direct listing have been unable to share detailed forward-looking projections with these research analysts. Instead, in a direct listing, companies have issued public-company-style guidance that is available to all investors. Moreover, since the investment banks are not able to set-up and attend investor meetings, companies that have pursued a direct listing have opted out of the traditional IPO roadshow, which consists of a one-to-two-week series of one-on-one meetings between the company's management team and the large institutional investors buying in the IPO. Spotify and Slack, for example, chose to educate their potential investors by holding an "Investor Day" via live streaming, opening access to a broader base of investors.

Market-based price discovery: In a traditional IPO, the price for a company's stock is determined based on demand from a small number of large institutional investors for a limited supply of a company's shares (often only representing 10-20 percent of the entire company). This scarcity in supply results in a stock price following an IPO that isn't necessarily reflective of what a purchaser of the stock would pay for the shares if more shares were available in the open market. This explains the stock price decline that companies often experience in advance of the lock-up expiration. In theory, a direct listing allows for true market-based discovery since all of a company's shares are available for sale and purchase on the first day of trading. Lower investment banking fees: While there is still a bit of mystery around how investment bankers charge for their services in a direct listing, the fees are generally lower than if the company were to do a traditional IPO. To get a sense: Spotify did its direct listing at a $29 billion market capitalization and paid $35 million in advisory fees; Snap went public at a $24 billion market capitalization and paid $85 million in underwriting fees. Slack did its direct listing at a $16 billion market capitalization and paid $22 million in advisory fees, while Lyft went public at a $24 billion market capitalization and paid $64 million in underwriting fees. Due to the more limited role that investment banks play in a direct listing, there is no need to have a large group of banks advising on a direct listing. This results in smaller overall fees being split amongst a smaller group of investment banks.

Similar to an IPO process with a bit less IPO-related documentation and process: A company doing a direct listing still selects investment bankers, holds an organizational meeting, prepares an S-1 registration statement, goes through the same lengthy SEC review and comment process, and has the same liability exposure. Despite all these similarities in the process, there are a few things that are streamlined in a direct listing. For example, you do not need to negotiate and enter into lock-up agreements and an underwriting agreement, and you do not need to go through the FINRA review process.

The Downsides

Despite all the positives, a direct listing is not for every company. Here are *some* of the downsides to consider if your company is thinking about doing a direct listing:

A direct listing is NOT (currently) a capital-raising event: One big misconception is that a direct listing is a capital-raising event for the company—like a traditional IPO. It is not. Companies doing a direct listing aren't currently raising capital. Even with massive pre-IPO fundraising rounds, many technology companies still need to raise additional capital in their IPO. There have been many instances of high-profile technology companies that have raised a lot of money prior to an IPO and still opted for a traditional IPO structure over a direct listing, including Uber, Lyft and Pinterest. Not being able to raise capital in a direct listing probably forecloses this structure for many technology companies, especially those that are not yet profitable or that do not have a clear path to profitability. Companies that do direct listings can raise capital in a follow-on offering afterward but if the company's stock price trades down following the direct listing, it may be unable to execute a transaction or have to do so under non-ideal terms. And as we discuss in "How to Prepare for a Direct Listing—Best Practices," although the SEC recently rejected an NYSE proposed rule change to allow for a company to raise capital and do a direct listing at the same time, we expect significant regulatory developments in the near future that will give companies more flexibility to pursue alternatives to a traditional IPO.

No ability for the company and its board of directors to set the price for the shares or control investor allocations: If your company or board of directors wants to set the price of the shares sold and choose the investors that will buy shares in the offering, then a direct listing isn't for you.The trading price of the stock following the direct listing is completely beholden to the whims of the market. Moreover, companies can't pick and choose which investors they want to allocate the shares to. Unlike a traditional IPO, where companies have a say in the allocation of shares, and are able to place the shares with long-term, high-quality institutional investors, companies in a direct listing will have a stockholder base composed of any investor that decides to buy the shares on the open market.

No research analyst education process: In a traditional IPO, companies spend significant time with their investment bank research analysts that will cover the company and its stock following the IPO. Ensuring that these research analysts have a clear understanding of a company's business is critical as the research that these analysts publish can have a significant impact on a company's stock price. By all accounts, the process of spending time with the research analysts and building a forward financial model that has been vetted with the research analysts is very useful for companies and allows analysts to build deep familiarity with the companies they are covering. Unfortunately, due to regulatory restrictions that limit what can be shared with research analysts that are not a part of your underwriting syndicate, the investment banks have not yet gotten comfortable with allowing their research analysts to participate in a direct listing. Instead, both Spotify and Slack issued public-company-style financial guidance shortly before their IPO. As a result of the research analyst limitations, companies that do a direct listing are deprived of the valuable exercise of spending time educating the analysts as they would in a traditional IPO process. Moreover, while a company that is very well known may draw research analyst coverage regardless of whether their investment bank was engaged in a direct listing, companies that are less well known that try to do a direct listing may not get research coverage.

Need to create a liquid market for your shares on the first day of trading: There is a lot of uncertainty in a direct listing because it is unclear who will sell and buy shares on the first day of trading. In a traditional IPO, you know who the buyers are and the bankers have a good sense of the trading patterns of your IPO investors in the after-market. In a direct listing, that certainty goes out the door and the market for your shares will be limited by the number of shares that your insiders choose to sell on the open market. An illiquid market on the first day of trading could result in negative consequences for the stock price. Accordingly, companies need to spend a lot more time educating their insiders, including employees, about the direct listing process and how to sell shares, if they so choose, immediately after the stock begins trading. Also, some of the company's founders and venture capitalists will likely need to sell on the first day of trading to create an active and liquid market for the shares. Finally, the employee education process needs to occur much earlier than it otherwise would in a traditional IPO. Since employees can trade on the first day of trading, the shares need to be prepared for sale, and employees need to be educated about issues like insider trading prior to the first day of trading.

Lots of heavy lifting by management to educate investors: Because the investment bankers in a direct listing are not involved in setting up and attending investor meetings and with no traditional roadshow and research analyst modeling process, the onus falls on the company's management team to take control of, and run, the investor education process. Companies that do not have a management team that is experienced with navigating the complex public offering landscape may be better served by a traditional IPO, in which the investment bankers are able to assist with the investor education process.

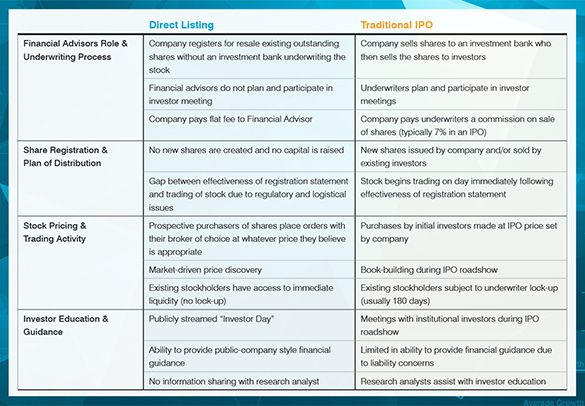

Table 2: The Pros and Cons of a Direct Listing.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.