On January 30, 2020, the Federal Reserve Board (the "Board") adopted final rules (the "Final Control Regulation") to provide increased transparency and consistency around determining when an investor company has "control" over a target company for purposes of the Bank Holding Company Act ("BHCA") and Home Owners' Loan Act ("HOLA").1] The concept of control under the BHCA has enormous regulatory consequences, and the Final Control Regulation represents a major undertaking by the Board to streamline a complex area of law by incorporating a clear set of factors and thresholds taken from a diverse web of precedents into an easily understandable framework of rebuttable presumptions of control. However, the Final Control Regulation appears to raise various interpretive issues and to leave significant room for continued consultation with Board staff on matters of controlling influence.

Under the BHCA,2 a company has control over another company if, inter alia, the investor company directly or indirectly exercises a controlling influence over the management or policies of the target company.3 The Final Control Regulation seeks to flesh out this prong of control, which, unlike the bright-line control prongs under the statute, requires a fact-based determination.4

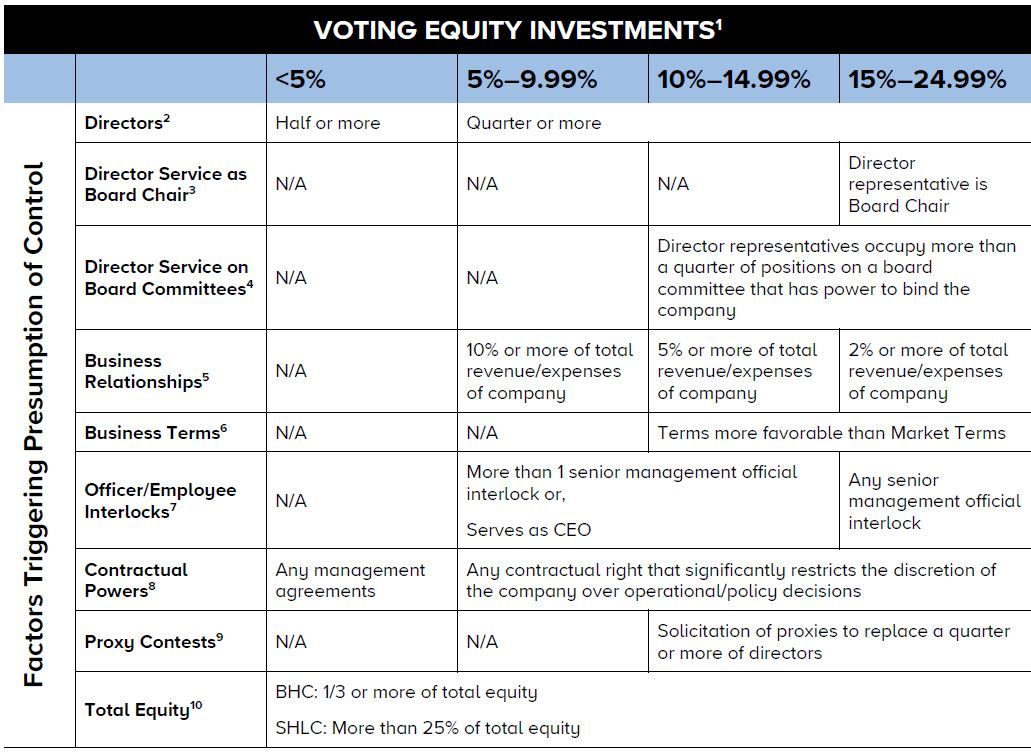

The key feature of the Final Control Regulation is a series of rebuttable presumptions of control based on tiered levels of ownership of voting securities and other relationships between the investor and target companies (e.g., governance rights, business relationships, and total equity). The three levels of ownership are 5, 10, and 15 percent of a class of voting securities. As an investor's ownership percentage of a class of voting securities of a target company increases, the investor company must generally limit other relationships with a target company to avoid triggering a rebuttable presumption of control over the target. Notably, the Final Control Regulation is not structured as a safe harbor; however, the Board has indicated that it generally does not believe control will be found unless a rebuttable presumption is triggered.5

Final Control Regulation vs. Proposed Control Regulation

The Final Control Regulation is broadly aligned with the Board's proposed regulation, which was released on April 23, 2019 (the "Proposed Control Regulation").6 The Board noted that, as with the Proposed Control Regulation, the Final Control Regulation is generally consistent with the Board's past practices with certain clarifications and adjustments.7 Arguably, however, the Final Control Regulation results in stricter standards in part because the rebuttable presumptions by their terms apply in all cases and contexts.

Despite substantial similarities between the Proposed Control Regulation and the Final Control Regulation, the Final Control Regulation differs from the Board's original proposal in certain key ways as discussed briefly here and described in more detail below along with other technical, but important, differences.

- Business Relationships: The Board originally proposed to measure and limit the revenue and expenses that each company receives from or pays to the other. The Board has revised its business relationship control presumption to consider the significance of such relationships only from the perspective of the target company and not the investor company. However, both revenue and expenses of the target company are subject to limits. The requirement to consider expenses is essentially a new feature of the controlling influence analysis.

- Total Equity: The Final Control Regulation simplifies the total equity control presumption by creating a uniform threshold of one-third of total equity held regardless of the amount of voting equity controlled by the investor company up to the 25 percent voting threshold. The Proposed Control Regulation (as well as the Board's 2008 policy statement addressing control considerations) had basically capped ownership of any class of voting equity at 14.9 percent when ownership of total equity exceeded 24.9 percent. The Board also decided not to adopt a provision that would have required an investor company to include a pro rata share of equity securities in a target company held by a non-subsidiary of the investor company.

Key Takeaways

- Investments in Banks and Bank Holding Companies ("BHCs"). In many respects, the Final Control Regulation makes it easier for certain kinds of investors in BHCs to obtain an interest in up to 24.9 percent of a class of voting securities without resulting in control.

- Investments by BHCs. On the other hand, the Final Control Regulation could make it more difficult for BHCs that are investors in start-ups or FinTechs, or are otherwise minority investors, to have other business relationships with those companies, including acting as lenders, without triggering a presumption of control.

- Investments by foreign banking organizations ("FBOs"). The Board generally rejected numerous proposals by commenters, including FBOs, seeking greater changes and more nuance to the Board's positions on control. In this regard, for example, the Final Control Regulation (like the proposed framework) does not distinguish between presumptions of control applying to FBOs and their investments outside of the United States and those applying to U.S. banks and BHCs.8

- Effective now, and with no grandfathering of existing investments. The effective date of the Final Control Regulation is April 1, 2020. However, as a practical matter, the Final Control Regulation is in effect immediately because the Board considers the finalized regulation as largely "consistent with the Board's current practices."9 The Board further indicated that it is not grandfathering existing investments, despite comments advocating such an approach. However, the Board did specify that it does not expect to revisit investment structures that Board staff has already reviewed (unless such structures have been materially altered since the time of original review).10

- Rebutting the Presumption of Control. Neither the Final Control Regulation nor the Final Release offers much guidance on how a rebuttable presumption of control might be rebutted. In the past, the Board has sometimes employed a set of passivity commitments in reaching non-control determinations; however, the Board has stated that it does not expect to rely on such commitments in the future, except in certain limited circumstances.11 At the same time, with a greater number of rebuttable presumptions of control, it seems likely that the presumptions might be triggered more frequently—and that investors might, in turn, seek to rebut the presumption more frequently—than previously.

In crafting the Final Control Regulation, the Board has generally favored simplicity over distinctions that would significantly increase the complexity of the rule and make it more difficult to apply in practice. Nevertheless, it is possible that some control-related factors that the Board explicitly declined to incorporate into its rebuttable presumption framework may still be relevant in specific circumstances. These include factors such as the existence of a larger or majority shareholder or of parties with larger business relationships that would be readily available to replace an investor's business relationships with a target company.

Overview of Rebuttable Presumptions of Control

The following chart summarizes the rebuttable presumptions. A more in-depth description of each of the triggering factors follows.

1. Voting Equity Investments

As under the Proposed Control Regulation, the Board has structured the Final Control Regulation as a tiered framework centered on an investor's level of ownership of any class of voting securities of a target company. The preamble to the Final Release notes that, under the BHCA,12 5 percent is the level of voting ownership at which the statutory presumption of non-control ceases to apply.13 Meanwhile, the BHCA specifies that an investor definitively controls another company if it owns, controls, or has the power to vote 25 percent or more of any class of voting securities.14 The Board's Final Control Regulation thus mainly applies to situations in which an investor holds between 5 and 25 percent of a class of voting securities. As shown in the preceding chart, the Board uses three thresholds for voting securities—5, 10, and 15 percent—as a starting point for its rebuttable presumptions of control. The ownership of voting securities in combination with other indicia of control applicable to the voting equity threshold determine whether a rebuttable presumption is triggered.

A key to the control framework is defining what constitutes a voting security, a term which the Board understands expansively. The Final Control Regulation replaces the current definition of "nonvoting shares" with a definition of "nonvoting securities"15 that encompasses equity instruments issued by various types of legal entities and expressly permits certain defensive voting rights. Substantively, however, there is little change from the current definition, except that a holder of a limited partnership interest will be permitted to vote to replace a general partner for cause (and vote for a successor to a general partner removed for cause) without causing the limited partnership interest to be treated as a voting security.

The Final Control Regulation also provides standards for determining whether a person "controls" a security, including through the holding of options, warrants, and convertible instruments.16 In this regard, a person also controls securities if the person is a party to an agreement or understanding that restricts the rights of the holder of such securities. (There are certain enumerated exceptions to this general rule to accommodate certain common restrictions on securities.) This standard means that multiple persons can control the same securities. In addition, as described further below, the Board will treat a company as controlling securities of a target company owned by its senior management officials and directors when the company itself owns 5 percent or more of a class of voting securities of the target company (see Senior Management Ownership, below).

The Board recognizes several exceptions to this general approach.

- For instance, the Final Control Regulation incorporates the limited "blocker" exception for financial instruments that by their terms may not become voting securities in the hands of the current holder or any affiliate of the current holder and may only convert to voting securities upon transfer to certain entities (e.g., the issuer) or in a certain manner (e.g., a widespread public distribution).

- The Board acknowledges that securities held by an underwriter for a very limited period of time (e.g., only for a few days) for purposes of conducting a bona fide underwriting and only for the purpose of prompt resale do not raise control concerns.17

- Moreover, shares held in a fiduciary capacity may not be deemed controlled by the investor under certain circumstances (see Fiduciary Exception, below). However, there is no exception for shares held in merchant banking portfolio companies or small business investment companies.

Finally, the Final Control Regulation provides a method for calculating the percentage ownership of a class of voting securities, which takes into account both the number and voting power of shares controlled.18 Under the Final Control Regulation, the voting percentage will be calculated as the greater of the quotient of (i) the number of shares of the class of voting securities controlled, divided by the number of shares of the class of voting securities that are issued and outstanding, and (ii) the number of votes that may be cast by the person owning or controlling the shares, divided by the total votes that are legally entitled to be cast by the issued and outstanding shares of the class of voting securities.

2. Director Representation

Historically, the Board has limited a non-controlling investor's representation on a board of directors to one or two representatives, regardless of the size of the board. The Final Control Regulation provides that an investor who owns 5 percent or more of any class of voting securities would be presumed to control the company if it simultaneously controls a quarter or more of the board of directors. The Final Control Regulation thus relaxes the current standard for director representation.19

Nevertheless, if an investor's director representatives can make or block major operational or policy decisions at the target company, the presumption of control attaches even if the number of director representatives is less than the one-quarter threshold.20 This provision accounts for unusual situations in which a minority of the board can control a target company (i.e., when there are supermajority voting requirements or individual veto rights).

The Final Control Regulation also provides standards for determining whether an individual serving on a board is a representative of an investor company. In response to certain comments, the Final Control Regulation's definition of "director representative" includes any individual that represents the interests of an investor company through service on the board of a target company, which generally includes (1) current officers, employees and directors of the investor, (2) those who held such a position within the two previous years, and (3) any individual nominated or proposed to be a director of the target company by the investor.21 This definition is narrower and less prescriptive than that under the Proposed Control Regulation.22 The Board also specifically invited parties to contact Board staff if the party is uncertain as to whether an individual would be deemed to be a representative of an investor.

3. Director Service as Board Chair

As under the Proposed Control Regulation, the Final Control Regulation includes a presumption of control for situations in which an investor controlling 15 percent or more of any class of voting securities of a target company also has a representative serving as the target company's chair of the board of directors.23 This provision is a modest relaxation of the Board's previous standard, which raised controlling influence concerns when an investor held 10 percent or more of a class of voting securities while maintaining a chair position.24

4. Director Service on Board Committees

The Board stated that it has long considered investors maintaining representatives on a board committee of fewer than four members or on such a committee that has the authority to bind the company without full board approval to exert significant control over a target company.25 These committees typically include the audit, compensation, and executive committees. For investors controlling 10 percent or more of a class of voting securities, the Final Control Regulation permits investor representatives to hold one quarter (or less) of the seats on any such committee.26

5. Business Relationships

One of the Board's major revisions to the Proposed Control Regulation involves the business relationships presumption. As under the Proposed Control Regulation, the Board uses thresholds for levels of business relationships which, when combined with the investor's level of voting ownership interest in a target company, triggers a rebuttable presumption of control under the Final Control Rule. While the final threshold amounts are the same as those in the Proposed Control Regulation,27 the Board has simplified the presumption by requiring investor companies to measure business relationships only from the perspective of the target company.28

The thresholds are measured in percentage terms in relation to the annual revenues and expenses of the target company and bring a bright-line rule to an area of substantial previous uncertainty. Nevertheless, the consideration of the total expenses of a target company paid to an investor company is not a metric that had been widely employed in publicly available Board precedents and could serve to limit significantly the level of products and services an investor may provide to a target company.

The Board adopted other aspects of the business relationships factor as proposed. Thus, business relationships are measured annually based on consolidated annual revenues and expenses. Revenues, expenses, and principles of consolidation are to be applied in the manner implemented under U.S. generally accepted accounting principles ("GAAP"). In this regard, the Board clarified that revenue means gross income, not income net of expenses. Also, if a company does not prepare GAAP financials, then non-GAAP financial statements should be used, "while taking differences in accounting standards into account as appropriate."29 One area where the business relationship metric may be particularly problematic is with investments in start-up companies, where, for a short period of time (but more than one year), an investor might have a significant relationship with the target company measured in terms of the revenue and expenses of the target company.

6. Business Terms

Under the Final Control Regulation, an investor with 10 percent or more of a class of voting securities is presumed to control the target company if the investor enters into business relationships with the target that are not on market terms.30 The Board made no change from the Proposed Control Regulation in this regard.

7. Officer/Employee Interlocks

Under the Final Control Regulation, a senior management interlock results in a presumption of control if: (1) for an investor controlling 5 percent or more of a class of voting securities of a target company, there is (i) more than one senior management interlock or (ii) an employee or director of the investor serves as the CEO (or in an equivalent role) at the target company,31 and (2) for an investor controlling 15 percent or more of a class of voting securities of a target company, there is any senior management interlock whatsoever.32

To trigger these presumptions, an employee or director of an investor must serve as a senior management official in the target company. The Final Control Regulation defines "senior management official" to include "any person who participates or has the authority to participate (other than in the capacity as a director) in major policymaking functions of a company."33 Despite comments which criticized the presumption on the basis that the scope of individuals to be treated as senior management officials is unclear, the Board has retained the presumption and definition of senior management official as under the Proposed Control Regulation.34 In addition, the Board notes that the focus on senior management officials permits an investor to have multiple junior employee interlocks that would not increase the investor's ability to influence operations and policies at the target company.

8. Contractual Powers

The Final Control Regulation presumes control if an investor controlling 5 percent or more of a class of voting securities has any "limiting contractual right," defined as a contractual right that significantly restricts, directly or indirectly, the discretion of a company over major operational or policy decisions.35 As under the Proposed Control Regulation, the Final Control Regulation provides a litany of examples of limiting contractual rights36 as well as examples of contractual rights that are not limiting in nature (see Appendix A below for a comprehensive overview of these examples). For example, a contractual prohibition on engaging in particular activities is generally a limiting contractual right. However, in the preamble of the Final Release, the Board clarified that a contractual provision providing a reasonable and non-punitive mechanism for an investing company to reduce its investment to comply with the activities restrictions of the BHCA (or HOLA) would generally not be a limiting contractual right.37

Significantly, the Board has concluded that limiting contractual rights can be found in loan agreements. Thus, if an investor owns 5 percent or more of a class of voting securities of a target company, and if the investor is a lender to the target company, the investor will trigger a rebuttable presumption of control if the credit agreement includes provisions that constitute limiting contractual rights.

The Final Control Regulation also provides that management agreements raise significant controlling influence concerns. As in the Proposed Control Regulation, the Final Control Regulation defines management agreement to include an agreement where a company is a managing member, trustee, or general partner, or exercises similar functions.38] Accordingly, any management agreement triggers a presumption of control, even if an investor company holds less than 5 percent of any class of voting securities.39

9. Proxy Contests

The Board takes the position that a significant shareholder who organizes other shareholders to replace members of the board of directors may exercise influence over existing members of the board of directors. Under the Final Control Regulation, an investor owning 10 percent or more of a class of voting securities who solicits proxies to appoint a number of directors that equals or exceeds a quarter of the total directors is presumed to have control.40 The Board views this as a relaxation of the historic standard (which generally applied a rebuttable presumption of control to the solicitation of proxies on any matter in opposition to the recommendation of a board of directors) to allow investors more latitude to "engage in standard shareholder activities without raising significant control concerns."41

Moreover, while the Board has historically viewed threats to dispose of large blocks of securities as presenting potential controlling influence concerns, the Final Control Regulation does not include a presumption of control based on threats to dispose of securities. The Board has taken the view that investors should be able to exit investments without raising control issues, and that this possibility imposes important discipline on management.42

10. Total Equity

In response to a number of comments on how to measure ownership of total equity of a target company, the Board has significantly simplified this presumption of control. The Final Control Regulation establishes a single total equity threshold of one-third for investors regardless of their voting equity interests in the target company,43 streamlining the presumption compared to the Proposed Control Regulation. In this regard, the Board had previously limited ownership of a class of voting equity to 14.9 percent if an investor owned 25 percent or more of a target company's total equity.44 However, the Board did not raise the absolute limit on ownership of total equity, which remains one-third (for BHCA purposes).

As in the Proposed Control Regulation, the Final Control Regulation also provides detailed standards for the calculation of an investor's total equity percentage of a target company.45 While the Final Control Regulation by its terms applies the total equity calculation to stock corporations that prepare financial statements under GAAP, the methodology would generally apply in other circumstances, as well. Significantly, the Board did not adopt a proposal that would have required an investor to include a pro rata amount of equity in a target company owned indirectly through an investment in a non-subsidiary of the investor.

The Board continues to include a list of features that would result in debt being characterized as equity for total equity calculation purposes.46 However, the Board clarified that the presence of a single equity characteristic in a debt instrument does not mean that debt must automatically be treated as equity.47 In addition, the Board confirmed that it expects debt to be re-characterized as equity only rarely and under unusual circumstances to prevent evasion of the control rules.48

With respect to when to measure, the Board revised the proposed total equity provisions so that, under the Final Control Regulation, an investor is only required to measure its total equity position at the time the investor makes an investment or acquires control over additional equity in the target company.49 The Board eliminated a requirement under the Proposed Control Regulation that an investor also measure total equity at the time the investor reduces its investment in a target company.50

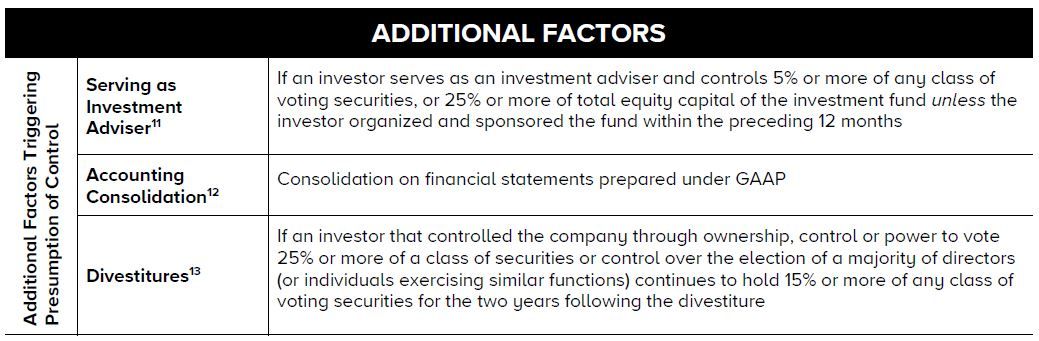

Additional Rebuttable Presumptions of Control

In addition to the core tiered framework described above, the Final Control Regulation includes several additional rebuttable presumptions of control as follows:

11. Serving as Investment Adviser

A presumption of control applies when an investor that controls 5 percent or more of any class of voting securities or 25 percent or more of the total equity capital of an investment fund simultaneously serves as the investment adviser to the investment fund.51 An "investment adviser" is defined as: (1) any person registered as an investment adviser under the Investment Advisers Act of 1940; (2) any person registered as a commodity trading advisor under the Commodity Exchange Act; (3) a foreign equivalent of such a registered adviser; or (4) a company that engages in certain of the activities enumerated in the Board's Regulation Y "laundry list" of permitted financial and investment advisory activities.52 Neither the Proposed Control Regulation nor the Final Control Regulation provides a definition of "investment fund" in the text of the regulation itself. However, the Proposing Release and Final Release note that an "investment fund" includes a wide range of investment vehicles, including: (1) investment companies registered under the Investment Company Act of 1940; (2) investment companies exempt from registration under the Investment Company Act; (3) foreign equivalents of registered investment companies or exempt companies; and (4) other investment entities, such as commodity funds and real estate investment trusts.53 The presumption does not apply if the investor organized and sponsored the investment fund within the preceding 12 months, i.e., during the fund's initial seeding period.54

The Board did not adopt a proposed exception relating to the control of registered investment companies on the basis that the scope of the proposed exception was nearly the same as the threshold for control and the exception "raised many questions regarding how it would function."55

12. Accounting Consolidation

The Final Control Regulation includes a presumption (the "Accounting Consolidation Presumption") that an investor that consolidates a target company under GAAP is presumed to control the company. The Board adopted the Accounting Consolidation Presumption despite a number of comment letters which opposed the Board's formulation of the presumption.56 The Accounting Consolidation Presumption essentially represents a new control standard. The Board explained that it believes that the inclusion of GAAP consolidation as a presumption method will "reduce burden and uncertainty"57 and reflects the link between consolidation accounting and what the Board views as a controlling influence.58

In addition, the Board stated that while the rule only applies to companies that prepare financial statements under GAAP, the Board will likely have control concerns if a company consolidates under other accounting standards, especially those that are similar to GAAP. (The Board did not state a view as to whether International Financial Reporting Standards are similar to GAAP in this regard.) The Board also noted that the Final Control Regulation does not include a presumption of control when one company applies the equity method of accounting with respect to its investment in a target company. 59

The Board also addressed an issue that could arise if a U.S. branch of a foreign bank consolidates an asset-backed commercial paper conduit (causing the conduit to be controlled for BHCA purposes) and the foreign bank is required under Regulation YY to hold all of its ownership interests in U.S. subsidiaries through an intermediate holding company. The Board clarified that the contractual arrangements that cause the conduit to be consolidated would not be "ownership interests" for purposes of the Board's Regulation YY, and thus, the contractual arrangement may be maintained between the U.S. branch and the conduit. 60

13. Divestitures

In the Final Control Regulation, the Board has relaxed its long-standing position that a divestiture of a controlling investment is not effective for control purposes unless the divestiture reduces the investor's ownership to less than 5 percent of each class of voting securities of the target company. Instead, an investor that has controlled a company during the preceding two years is presumed to control the company if the investor continues to own 15 percent or more of any class of voting securities of the target company, even if no other indicia of control are present.61 While the 15 percent threshold is well below the 25 percent statutory bright line for control, the 15 percent threshold is well in excess of the 5 percent threshold that the Board has typically applied. In addition, the presumption continues for only two years.

The Final Control Regulation includes an exception to the presumption of continued control. The exception applies in situations where 50 percent or more of each class of voting securities of the target company is controlled by a single unaffiliated individual or company following the divesture.62

The other control presumptions outlined in this note overlay the divesture provision for determining whether an investor exercises a controlling influence over a company that is only partially divested.

As noted above, this provision represents a break with the Board's past approach to divestures (which generally required divestiture to below 5 percent of any class of voting securities in order to reach a non-control position).63 Though the Board still appears wary of divestiture transactions, the Final Control Regulation now recognizes that (i) the passage of time (two years) and (ii) a significant divestiture can lessen the influence exerted by a previously controlling shareholder.

Other Relevant Provisions

14. Senior Management Ownership

The Final Control Rule provides that if an investor company owns at least 5 percent of a class of voting securities of the target company, then all shares of the target company owned by the senior management officials, directors, or controlling shareholders of the investor (together with their immediate family members) are deemed to be controlled by the investor.64 This provision is not drafted as a rebuttable presumption of control, but rather as a rule regarding deemed control of securities (with a related reservation-of-authority provision). As a result, if (i) the investor company owns at least 5 percent of any class of voting securities of the target company and (ii) the investor company together with the senior management officials and directors of the investor (and their immediate family members) own 25 percent or more of any class of voting securities of the target company, then the investor will control the target company.

However, an exception to this rule arises in situations in which (i) an investor owns less than 15 percent of each class of voting securities of the target company and (ii) senior management officials and directors of the investor (along with their immediate family members) control 50 percent or more of each class of voting securities of the target company.65 In such situations, the Board suggests that the individuals, rather than the investor company, control the target company.

The Final Control Regulation does not define immediate family member, and the Board recognizes that the definition of "senior management official" is not precise.66

15. Fiduciary Exception

As under the Proposed Control Regulation, the Final Control Regulation maintains an exception from the above control presumptions to the extent that an investor company controls voting or nonvoting securities of a target company in a fiduciary capacity. The Final Control Regulation does not include a definition of "fiduciary capacity," but the Board stated that the primary example of the Board's traditional understanding of fiduciary capacity is that of a trust department of a depository institution that is authorized to engage in fiduciary activities. The Board invited parties to contact Board staff to seek clarification as to whether any particular holding of securities qualifies for the fiduciary exception.67

Under the Proposed Control Regulation, the fiduciary exception was available only if the holder did not have sole discretionary authority to exercise the voting rights.68 However, in response commenters' concerns, the Final Control Regulation provides that the requirement that the shares be held without sole discretionary voting authority applies only with respect to a target company that is a depository institution or a depository institution holding company. Thus, the fiduciary exception is available with respect to ownership of shares of non-depository companies even if the holder has sole discretion to vote the shares of such a company.69 Accordingly, the final rule's fiduciary exception generally parallels the different fiduciary exceptions in Section 3 (which relates to the acquisition of bank shares) and Section 4 (which generally relates to the acquisition of nonbank shares) of the BHCA.

Presumption of Non-Control

In addition to clarifying the circumstances which result in a rebuttable presumption of control, the Final Control Regulation includes a rebuttable presumption of non-control for instances in which (i) an investor holds less than 10 percent of each class of voting securities of the company, and (ii) is not presumed to control the second company under any of the presumptions of control.70

Control Presumption Under HOLA

The control presumptions of Regulation Y described above essentially apply to savings and loan holding companies ("SLHCs") on an equivalent basis under the Board's Regulation LL (which implements HOLA) with certain exceptions based on differences in the BHCA and HOLA statutes.

- Under HOLA, the definition of control applies to both individuals and companies controlling other companies, while control is limited to companies controlling other companies under the BHCA.

- Under HOLA, a person controls a company if the person has more than 25 percent of any class of voting securities of the company, rather than 25 percent or more of any class of voting securities under the BHCA.

- Under HOLA, a general partner of a partnership controls the partnership, a trustee of a trust controls the trust, and a person that has contributed more than 25 percent of the capital of a company controls the company.

- Under HOLA, there is no presumption of non-control for a company with less than 5 percent of the voting interests of the other company.

In the Final Control Regulation, the Board has clarified that contributed capital for purposes of HOLA generally has the same meaning as total equity in the context of the BHCA. The Board has further indicated that the rules for calculating total equity under the BHCA reflect how the Board expects to measure contributed capital under HOLA.71 Accordingly, the relevant total equity threshold under Regulation LL is 25 percent (not one-third, which applies with respect to BHCs as explained above).72

Special thanks to Caitlin Hutchinson Maddox for her contribution to this publication.

Appendix A: Examples of Limiting Contractual Rights

|

Examples of contractual provisions that would generally constitute limiting contractual rights73 |

Examples of contractual provisions that would generally not constitute limiting contractual rights74 |

|

|

Footnotes

1 Federal Reserve Board, Control and Divestiture Proceedings (January 30, 2020), available at https://www.federalreserve.gov/aboutthefed/boardmeetings/files/control-rule-fr-notice-20200130.pdf (the "Final Release"). The Final Control Regulation amends the Board's Regulations Y and LL, 12 C.F.R. Part 225 and 12 C.F.R. Part 238, respectively.

2 This note focuses on the regulations under the BHCA (Regulation Y) unless otherwise specified.

3 12 U.S.C. § 1841(a)(2)(C). The definition of control under HOLA is substantially similar to the definition under the BHCA, although there are some differences as noted below.

4 The statutory bright lines standards for control are (i) ownership, control or power to vote 25 percent or more of a class of voting securities of another company and (ii) control in any manner over the election of a majority of the directors or trustees of another company. 12 U.S.C. § 1841(a)(2)(A), (B).

5 However, the Board does caution that under a number of scenarios where a control presumption may not be triggered, safety and soundness considerations also need to be taken into account and might make a particular investment scenario impermissible. For example, features of an investment that limit a U.S. bank's ability to raise capital could be problematic even if the company that sought the limitation did not thereby acquire control of the bank. Final Release at 33 (note 37).

6 Federal Reserve Board, Notice of Proposed Rulemaking with Request for Comment, Control and Divestiture Proceedings, 84 Fed. Reg. 21634 (May 14, 2019) (the "Proposing Release").

7 In addition, the Board confirmed that its several earlier policy statements regarding control remain in effect to the extent not superseded by the Final Control Regulation. Final Release at 9 (note 23).

8 See, e.g., Comment Letter, Institute of International Bankers to the Board, July 15, 2019 (arguing that presumptions of non-control should be included in the final rule particularly with respect to investments made outside the United States).

9 Final Release at 86.

10 Final Release at 87.

11 Companies that have provided commitments in the past are not automatically relieved from such commitments, but must seek relief from the Board. The Board stated that it expects to be receptive to such requests. Final Release at 86.

12 12 U.S.C. § 1841(a)(3).

13 Final Release at 17. The preceding chart notes situations in which this non-control presumption may be subject to rebuttal.

14 12 U.S.C. § 1841(a)(2)(A).

15 12 C.F.R. § 225.2(q).

16 12 C.F.R. § 225.9(a).

17 See Final Release at 61.

18 12 C.F.R. § 225.2(u).

19 Final Release at 19.

20 12 C.F.R. § 225.32(d)(1)(ii).

21 12 C.F.R. § 225.31(e)(2).

22 Proposed 12 C.F.R. § 225.31(e)(2).

23 12 C.F.R. § 225.32(f)(1). See also Final Release at 22; Proposing Release at 21640.

24 Proposing Release at 21640.

25 Final Release at 22; Proposing Release 21640.

26 12 C.F.R. § 225.32(e)(2).

27 12 C.F.R. § 225.32(d)(4), (e)(3)(ii), (f)(3). See also Final Release at 25–26.

28 Final Release at 26–27.

29 Final Release at 28, note 36.

30 12 C.F.R. § 225.32(e)(3)(i). Final Release at 26.

31 12 C.F.R. § 225.32(d)(2)–(3).

32 12 C.F.R. § 225.32(f)(2).

33 12 C.F.R. § 225.31(e)(7).

34 Final Release at 31.

35 12 C.F.R. § 225.31(e)(5).

36 12 C.F.R. § 225.31(e)(5)(i) et seq.

37 12 C.F.R. § 225.31(e)(5)(ii) et seq.; Final Release at 78.

38 12 C.F.R. § 225.32(b).

39 12 C.F.R. § 225.32(b).

40 Final Release at 23.

41 Proposing Release at 21641; Final Release at 38.

42 Final Release at 38–39.

43 12 C.F.R. § 225.32(c).

44 Under the Proposed Control Regulation and Board precedent, an investor with a voting interest of 15 percent or more in another company could avoid control only by keeping its total equity percentage in the other company below 25 percent. An investor with a total equity interest of 25 percent or more (and below one-third), could avoid control only by limiting its voting interest to less than 15 percent. See Proposing Release at 21643.

45 12 C.F.R. § 225.34(b).

46 12 C.F.R. § 225.34(c).

47 Final Release at 72.

48 Proposing Release at 21651; Final Release at 72. In addition, the Final Control Regulation includes a provision (12 C.F.R. § 225.34(e)) that permits equity to be re-characterized as debt, although this is a provision the Board expects to be used rarely and only after consultation with Board staff. Final Release at 73.

49 12 C.F.R. § 225.34(e).

50 Final Release at 73.

51 12 C.F.R. § 225.32(h).

52 12 C.F.R. § 225.31(e)(4). The activities enumerated in 12 C.F.R. § 225.28(b)(6) include (i) serving as investment adviser to an investment company registered under the Investment Company Act, including sponsoring, organizing and managing a closed-end investment company; (ii) furnishing general economic information and advice; (iii) providing advice in connection with mergers, acquisitions, divestitures, and other similar transactions; and (iv) providing swaps related information and advice.

53 Proposing Release at 21644; Final Release at 40.

54 Final Release at 41.

55 Final Release at 43.

56 Final Release at 45.

57 Final Release at 46.

58 Final Release at 47.

59 Final Release at 47.

60 Final Release at 46–47.

61 12 C.F.R. § 225.32(i).

62 12 C.F.R. § 225.32(i)(2). The Board also noted that its prior precedents held that the presumption of continued control does not arise in situations where a company sells its subsidiary to a third company and receives stock of the third company as some or all of the consideration for the sale, as long as the selling company does not otherwise control the acquiring company. Final Release at 48.

63 Final Release at 47.

64 12 C.F.R. § 225.9(c)

65 12 C.F.R. § 225.9(c).

66 Final Release at 32.

67 Final Release at 54.

68 Proposed 12 C.F.R. § 225.32(j).

69 Final Release at 54.

70 An additional presumption of non-control generally applies when an investor owns less than 5 percent of each class of voting securities of a target company. See 12 U.S.C. § 1841(a)(3); § 225.33(b).

71 Final Release at 84.

72 Final Release at 84.

73 Final Release at 74–75.

74 Final Release at 76. The Board specified that these examples are "not intended to be a complete list of provisions that would or would not be considered limiting contractual rights." Final Release 74.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.