As described in our earlier articles, "Mind the Gap! Pitfalls and Risks to Consider When Moving Production to the U.S." and "Navigating the Land of Opportunity: An Introduction to the Unique Legal System of the United States," the U.S. common law system provides fewer statutory protections to parties in a contractual relationship compared to the EU. The absence of these statutory protections allows sophisticated parties substantial freedom to negotiate. Yet, the lack of automatic safeguards can lead to lengthy and costly disputes for the unwary, particularly within the U.S.' litigious environment. Without the EU's self-executing protections, contracting parties in the U.S. must be certain to include all necessary protections within the "four corners" of their contracts. Accordingly, when operating in the U.S., one must understand that the specific provisions of a contract — and only those provisions — will govern the parties' rights, obligations, and legal exposure.

Statutory Protections in the EU

Unlike the U.S., the EU has adopted a variety of codified laws that apply to contracts, limiting the ability of the parties to negotiate specific terms but ensuring each party retains certain inherent protections. For example, Title 9 of the German Civil Code (BGB) governs contractual relationships between buyers and sellers. The code also regulates contractual relationships between architects, engineers, and customers; within these provisions, it provides warranties, termination rights, and the regulation of unit rates for a variety of services. Likewise, the HOAI (Honorarordnung für Architekten und Ingenieure), a German regulation, provides a fee scale for architects and engineers, setting minimum and maximum rates for specific services. Although the legality of certain aspects of the HOAI is currently contested under EU law, it nonetheless illustrates the protections afforded to EU contracts. These protections enable the parties to resolve their contract disputes expediently and inexpensively

To maximize the benefits of the U.S. contractual system, understanding the broader business climate is inevitable. The U.S. business climate differs substantially from the EU due to the size and how U.S. projects are completed. For example, unit price contracts (Einheitspreisverträge) are quite popular in Germany. These contracts are based on various laws in which the client pays for a specified outcome or amount of a product. Although unit-price contracts are commonly used successfully throughout the EU, they create various pitfalls if used in the U.S. For instance, unlike the EU, many U.S. contractors do not pay their employees rates derived from long-term, union-negotiated wages. Rather, these employees are paid according to the local market environment. Accordingly, a U.S. contractor that accepts a unit price contract must incorporate market risks into its bid, thereby protecting itself from a fluid labor market that may lead to the scarcity of subcontractors or marked increases in pricing. A good example is the oil and gas industry. When gas prices are high, substantial investments are made throughout the industry within a short period, which drains the labor market with the effect that wages are going up.

U.S. Approach: Mitigate Risk via Contract Selection

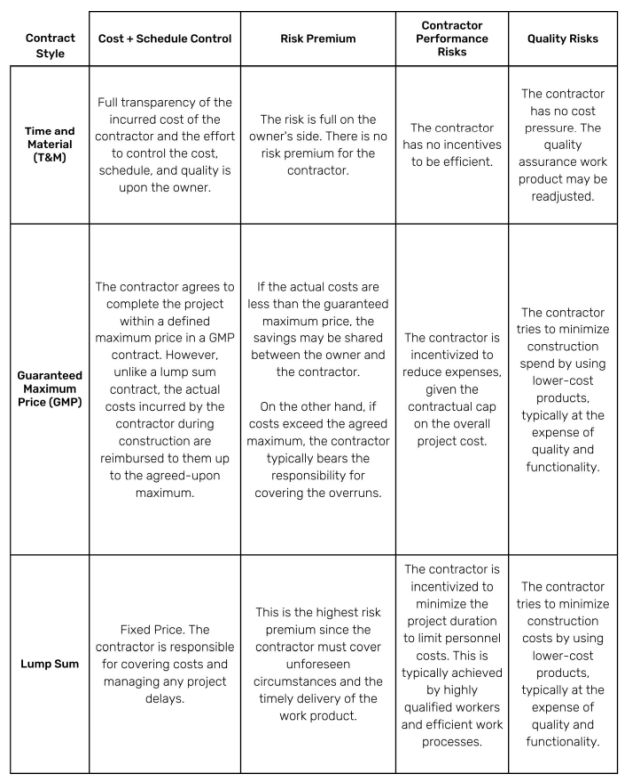

In light of the above-mentioned market risks and the lack of abundant regulatory safeguards, three different contracting structures have evolved in the U.S. for you to consider:

1. Time and material (T&M)

2. Guaranteed maximum price (GMP)

3. Lump sum contracts

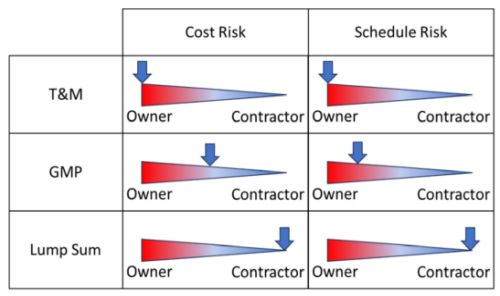

These structures are largely based on the distribution of the risks between the contractor and the owner and employ a distinct method to achieve the customer's needs while preserving interest and competition among contractors. Figures 1 and 2 illustrate the differences in risk allocation between the parties within these three major contract styles.

Figure 1: Risk distribution of commonly used contracting structures in the U.S.

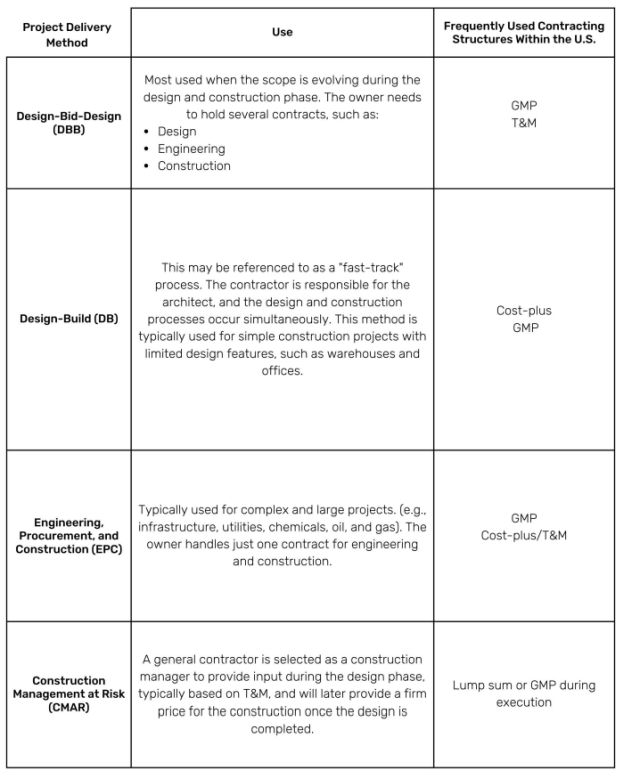

Lump sum and GMP contracts require a well-defined scope of work. These contract styles are typically employed when the owner can specify the desired outcome. For example, a company may solicit bids for the construction of a climate-controlled warehouse. This type of contract defines a project according to the customer's desired functionality and specific needs. Contractors receive a precise description of the desired work, and the scope often includes the entire project. The lump-sum contract will specify the size of the warehouse as well as the specific type of air conditioning necessary to satisfy the customer's needs. Contractors understand the customer's functional requirements before their bid submittal. Once the contract has been awarded, the contractor is obligated to bring the project to fruition. Conversely, lump sum contacts are typically employed for engineering, procurement, and construction (EPC), construction managers at risk (CMAR), and design-build project delivery methods, as indicated in Figure 3 below.

T&M and cost-plus contracts are on the other end of the scale and are frequently used as a less desirable, albeit necessary, alternative from the owner's perspective. These contracts are generally employed when the scope is unknown or will be dynamic throughout the project scope. T&M bidders quote an hourly wage as well as the materials necessary to complete the project. In these scenarios, the contractor retains significant latitude with respect to the time spent and materials used in the project.

Identifying the most suitable contract structure ultimately depends on the work product and the project delivery methods that should be part of any project procurement strategy. Factors such as scope maturity, varying labor conditions, project complexity, and the anticipated extent of the owner's involvement should impact the corresponding risk assessment to identify the optimal project delivery method and contract structure.

Figure 3 provides an additional overview of project delivery methods in design and construction with the typically associated contracting structures used in the U.S.

Figure 2: The three most used contract styles in the U.S.

Figure 3: General overview of project delivery methods and associated contracting styles commonly used in the U.S.

Although project delivery methods and contract styles are also known in Europe, companies typically need third-party support to assess the best strategies by acknowledging the lack of protections and different market conditions in the U.S.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.