Stock options' last hurrah? Well, maybe. Human resources leaders and CFOs need to know that executives who possess, as a group, $22.5 billion of vested, unexercised, in-the-money stock options,1 could exercise those stock options as we approach year-end. This may have major implications for companies and their HR leaders and CFOs.

The typical senior executive at a publicly traded company has approximately $2.4 million of in-the-money vested, unexercised stock option gains outstanding. The typical named executive officer group (i.e., generally, the top five executives) at a company has a total of approximately $8.2 million (and that's only the top five). Further, as with all data, there are outliers, such as the 55 individual executives who have more than $50 million each in vested unexercised stock option gains outstanding. Executives may be contemplating exercising some or all of their stock options as year-end approaches, for several reasons:

- The stock of many companies has recovered from the economic downturn of 2008–2009. Executives may wish to capitalize on the high stock price and adopt an investment/retirement strategy that mitigates some of the risk of depending on a single stock.

- Without legislative action, taxes are scheduled to increase in 2013. This means stock options exercised next year could be subject to a much higher tax rate, potentially resulting in millions of dollars of additional taxes for in-the-money, vested stock options that have not yet been exercised. First, the individual Medicare tax rate on wages is scheduled to increase from 1.45% to 2.35% in 2013 for wages in excess of $250,000 (joint returns) or $200,000 (other returns). Second, the 2001 and 2003 tax cuts are scheduled to expire at the end of 2012, which could raise the top ordinary income tax rate from 35% to 39.6%. Lawmakers are discussing whether to repeal or postpone these tax increases, but the potential for higher taxes in 2013 could spur a large increase in the number of options executives exercise before the end of the year. (For a discussion of whether it makes sense to accelerate tax this year, see Tax Insights: 2012-10.)

- Stock options, as a corporate long-term incentive vehicle, have become less prevalent, as other vehicles (such as performance-based long-term incentive plans (LTIPs) and restricted stock) have become more prevalent. Because executives control the timing of stock option exercises and the tax liability, this may be one of the last tax planning strategies available to executives (because with LTIPs, restricted stock and performance shares, tax liability/timing is triggered when shares vest, absent a section 83(b) election). Could this be the last hurrah for stock options?

What every HR leader and CFO should know

1. Financial metrics — Significant stock option exercises may affect company performance metrics used in bonus or LTIP plans, such as earnings per share (EPS) because of share dilution, return on equity or invested capital (ROE/ROIC) because of capital cash inflow, or total shareholder return (TSR) because of dilution or potential negative shareholder reaction.

2. Overhang/new share authorizations — Stock option exercises benefit a company's (simple) overhang calculation, which is one criterion reviewed when a company is seeking additional share authorization. However, proxy advisers' shareholder wealth transfer models should also be considered.

Takeaway: The exercise of a substantial number of stock options by the end of 2012 could have profound implications for both employers and executives:

- Employers − from a compensation and benefits perspective (and possibly a corporate accounting/tax perspective)

- Executives – from a tax and personal wealth strategies perspective

This Executive Compensation Insights focuses on the employer perspective, and specifically compensation and benefits. We recognize there are also significant executive considerations. Grant Thornton provides personal wealth strategy services to assist executives, including important planning considerations for stock option exercises. For information regarding these services, see www.grantthornton.com. In addition, for a discussion of wealth planning considerations amidst uncertainty regarding potential tax increases, see Tax Insights 2012-09.

3. Communications/proxy statement —The majority of stock options are exercised as cashless exercises with a sale reported on SEC Form 4. Shareholders may view this action negatively unless it is properly and proactively communicated. Furthermore, there are implications for next year's proxy statement, such as the stock option table, the compensation discussion and analysis section, and the beneficial stock ownership table.

4. Stock ownership/retention guidelines — Fifty percent to 90 percent of companies (depending on the market segment) have stock ownership guidelines for executives (and some for board members), and we expect such guidelines to continue over the next few years. However, few companies count the value of vested unexercised stock options toward the guideline. The method of exercise (cash, sell to cover, cashless) will result in varying amounts of share ownership and should be considered if below the guideline. Furthermore, some companies have stock retention guidelines, and, again, executives should factor that into their decision-making.

5. Executive compensation benchmarking — Executive pay actually "realized" is a contemporary topic among compensation committees, proxy advisers and their executive compensation advisers. With more emphasis on "realized" pay versus "grant date fair value" pay, stock option exercises are likely to affect current and future benchmarking.

6. Executive personal financial planning — Many companies offer financial/estate planning as a perquisite primarily to executives. It might be helpful (and some say a company fiduciary responsibility) for a company to provide for financial planning discussions and/or educational sessions for a broader group of employees who hold unexercised stock options.

7. Change-in-control/section 280G considerations — Stock option exercises could play a significant role in section 280G parachute payment excise tax strategies, since income recognized when stock options are exercised may be included in part of the base compensation that is used to calculate whether there are excess parachute payments. For example, for a change in control that occurs in 2013, stock option exercises that occurred in 2012 will reduce the amount of parachute payments that are treated as excess parachute payments subject to the excise tax.

8. Alignment with shareholders — Exercising stock options and retaining the shares after exercise will align executives with the upside and downside risk that all shareholders have in general (versus just the upside benefit that stock options afford). Furthermore, many research studies correlate company performance with executive stock ownership.

9. Attraction, retention and motivation — Significant stock option exercises, or lack thereof, could present an opportunity for a company to step back and redesign the overall long-term incentive program to attract, retain and motivate executives as effectively as possible. For example, should you change your type/mix of LTIP vehicle(s), compensation pay mix or compensation philosophy?

10. Trading windows,2 10b5-1 plans – Executive officers are subject to trading windows and should exercise stock options within such a window, but a significant stock option exercise may create float issues, and a planned, thoughtful, scheduled exercise/sale might be beneficial.

Grant Thornton's Compensation & Benefits Consulting practice has extensive experience helping clients work through executive compensation challenges. Attractive compensation plans are essential in recruiting and retaining qualified executives. Our team can help you determine the competitiveness of your executive pay program and design incentive plans that will reward your key employees for meeting goals and objectives tied to your company's success.

Footnotes

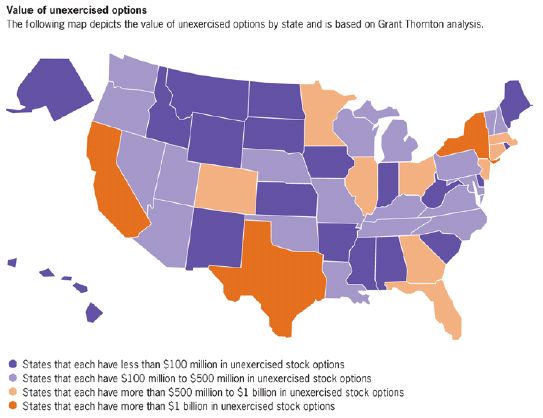

1 Based on Grant Thornton's analysis of 2,730 publicly traded companies reporting information on 9,293 named executive officers in all 50 states. All data effective as of the companies' most recent fiscal year-end, obtained from their proxy statements, using Kenexa's CompAnalyst Executive database. Executives may have exercised some stock options since their fiscal year-end, but stock prices are generally higher since then as well. Assumes all nonqualified stock options. See www.grantthornton.com/cbc for access to additional information and analysis, or contact Mark Tanis in our Chicago office.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.