P>President Obama has signed the $787 billion federal stimulus package, which includes hundreds of billions of dollars for new public investments and tax cuts for business and individuals. Implementing that package will require developing priorities among potential projects. Economics can help by quantifying the likely employment gains from specific programs.

- How many jobs will be created by public investment? How do the estimates depend upon the sector? Upon the region?

- What is the time path of job creation? How is the time path influenced by the phasing of investment?

- How can the stimulus package target projects that enhance long-term growth as well as provide near-term stimulus? How would these longer-term effects add to the jobs impacts?

Answering these questions requires understanding the interrelationships in the economy. For this purpose, economists have developed models to estimate the employment and other economic impacts of expenditures and other government policies.

This paper provides a brief conceptual overview of where jobs come from - both directly and through secondary effects. It then describes the factors that can affect the job creation arising from a specific project, including both near-term gains and long-term growth. It includes an overview of the specific analytical tools that can be used to quantify the employment effects of projects and concluding remarks about the importance of using these tools to determine which projects have the "biggest bang for the buck" both in the near-term and the long-term.

A Conceptual Overview: Where Do Jobs Come From?

Economists typically focus on the jobs created in individual regions - such as major metropolitan areas or states - and divide the jobs created by a specific project or proposal into three distinct categories:

- Direct jobs are the jobs immediately associated with the project. For a new manufacturing facility, for example, direct jobs include on-site construction workers and, subsequently, the employees that operate the facility.

- Indirect jobs arise as a result of purchases of third-party goods and services by the firms constructing and operating the project. For example, construction of new physical infrastructure often requires steel; these purchases of steel bring about an increase in steel industry output that can create jobs in that sector. Subsequently, operation of a new facility can require the purchase of fuel, maintenance parts, and office supplies, also creating jobs in the relevant producing sectors.

- Induced jobs result from increases in consumption by the employees and owners of the direct and indirect industries and firms. For example, employees working directly on the construction of a new factory (and "indirect" employees of the firms that manufacture the construction supplies used to build the factory) accrue income through their employment. They use this income to purchase a wide variety of goods and services, including food, housing, health care, travel, and so forth. The consumption of these goods and services creates jobs in sectors throughout the regional economy.

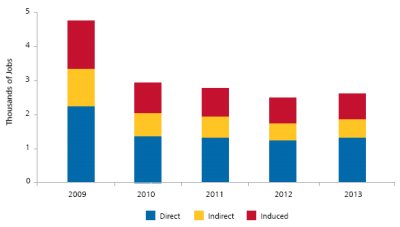

Figure 1 illustrates the jobs added by a hypothetical project, showing direct, indirect, and induced impacts relative to the "baseline" (i.e., employment levels without the project). Jobs are measured as the number of full-time-equivalent employment positions created; part-time positions and positions that do not last an entire year are included as fractions of a full position.

Figure 1: Employment Impacts of an Illustrative Project

Note: Estimates do not reflect any actual project.

Often, indirect and induced jobs represent 50 percent or more of the total employment resulting from a project. As the next section describes, however, a variety of factors can cause this ratio to vary substantially among projects.

Note that Figure 1 does not take into account the additional downstream effects that projects can have by lowering product prices or increasing productivity. Projects to improve the electricity infrastructure, for example, can lower the price of electricity, making electricity-using companies more competitive and thereby adding more employment. Similarly, transportation projects can lower transportation costs and thereby lower long-term costs for many sectors.

Factors Influencing The Job Impacts Of A Project

A wide range of factors - beyond "simple" size and cost - influence the job creation arising from a project, underscoring the need for specific project-by-project analysis. These factors include:

- Labor intensiveness and productivity. For some firms and industries, labor expenditures represent a dominant percentage of overall costs; in contrast, some sectors typically devote more to capital or other expenditures. All else equal, projects that are more labor-intensive create more jobs. Similarly, labor productivity (measured as dollars of output per worker) varies substantially among firms and industries. Where workers are more productive, investment will generate relatively fewer new jobs, but at a higher salary level, compared to an industry with lower productivity (all else equal).

- Location of sources for major goods and services. Projects located in the US can purchase goods and services from a variety of geographic locations. As an example, a project procuring steel from China would be expected to have a reduced impact on US employment compared to one which purchased the steel domestically.

- Size of region. The region in which a project is located affects its job creation in two major ways. First, the cost and availability of supporting goods and services varies among regions, affecting, for example, the share of these goods and services that are sourced domestically instead of being imported. Second, the productivity of the local workforce can affect employment levels at both the project under consideration and its suppliers.

- Off-setting decreases. It is important to consider the possibility of offsetting reductions in employment within the region. For example, adding a new retail store generally contributes relatively little to overall employment, since economic activity - and employment - simply shift from other local stores that would have generated the activity themselves if the new store had not been built (although there may be some near-term construction-related increases).

These factors can have a significant effect on the total employment arising from a project. For this reason, performing "back-of-the-envelope" calculations using simple heuristics is, in general, an inappropriate way to estimate job impacts. Notably, using an illustrative multiplier to translate the "direct" job impacts of a project into total employment effects fails to capture all of the complexities described above.

Providing For Long-Term Growth As Well As Near-Term Stimulus

President Obama and others have emphasized that simply providing near-term stimulus should not be the only goal to justify hundreds of billions of dollars in federal expenditures - the projects also should provide for long-term growth. The archetypal public works project - digging holes and filling them up - provides near-term jobs but does not provide for long-term productivity and growth.

A major means of stimulating long-term growth is to increase productivity and lower costs, which provides for lower prices and increased demand for many goods and services. For example, as noted, large electricity modernization projects such as the "smart grid" would be expected to lower electricity costs and prices. Lower regional electricity prices in turn would lower the cost of production for energy-intensive firms and thereby create additional jobs.

Economists have, over several decades, developed sound empirical models to estimate the effects of major public and private expenditure programs on employment levels. As noted below, these models can be used along with sound information on the nature of the program and its likely direct impacts to quantify the job impacts of projects and proposals.

Tools For Estimating Complete Employment Effects

In the United States, three regional models are well suited to estimate the employment impacts arising from a proposed project.1

- REMI. The REMI model, developed and maintained by Regional Economic Models, Inc., is a state-of-the-art regional economic model that has been used extensively for forecasting and policy analysis. Unlike the other models, REMI dynamically models the behavior of markets within a region and incorporates market changes over time. As a result, it allows the user to analyze projects with considerable precision and detail and to model the dynamics of job growth. Moreover, REMI can be used to model the effects of changes in prices (e.g., electricity prices) on regional economies. REMI models can be constructed for any county, state, or combination of counties or states in the country, as well as for the US as a whole.

- IMPLAN. The IMPLAN model, developed by Minnesota IMPLAN Group, Inc., is a simpler model that lacks REMI's ability to model changes in employment over time. There are also more difficulties in modeling the effects of changes in production and commodity costs. Like REMI, IMPLAN is based on up-to-date data on every county in the US and contains a large number of industry sectors.

- RIMS. RIMS (Regional Input-Output Modeling System) multipliers are published by the Bureau of Economic Analysis, an agency of the US Department of Commerce. Like IMPLAN, they are available at the county level. As with IMPLAN, RIMS multipliers do not allow for explicit consideration of market and time dynamics.

Using these tools effectively also involves familiarity with the key inputs and other assumptions required to develop specific estimates. As with any model, sound inputs - based upon detailed knowledge of the project and the relevant sectors involved - are critical to developing credible estimates of jobs impacts.

Conclusions

The $787 billion federal economic stimulus package promises to provide major benefits to an economy struggling to overcome the most significant downturn in recent memory. Selection of specific projects to receive support under the proposed fiscal stimulus bill will be a complex process. Sound economic tools can help policymakers decide which projects have the "biggest bang for the buck" - both in near-term stimulus and longer term growth.

Footnote

1. Although the author has extensive familiarity with these models, this article does not represent a formal endorsement of any of these models.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.