As we approach the end of the year, it is important to remind employers about a few legal requirements that will impact the New York business community in December 2015. Failure to comply with these requirements could subject an uninformed employer to substantial liability.

Minimum Wage Increases

Effective December 31, 2015, the minimum wage in New York will increase from $8.75 per hour to $9.00 per hour. This means that employers must make changes to their payroll prior to New Year's Day.

For those employers covered by New York's Hospitality Wage Order, the tipped minimum wage shall increase to $7.50 per hour and the overtime rate for tipped employees shall increase to $12.00 per hour. Please note that pursuant to the report and recommendations of the Hospitality Wage Board, food service workers (e.g., wait staff, bussers) and service employees (e.g., valets, bathroom attendants, coat check personnel) now are entitled to the same tipped minimum wage and overtime rate1.

Additionally, if a business qualifies as a fast food establishment, the minimum wage for fast food workers in New York City shall be $10.50 effective December 31, 2015, and the minimum wage for fast food workers in the rest of New York State shall be $9.75 effective December 31, 2015. (See " New York's Fast Food Wage Order Adopted: Minimum Wage To Rise to $15.00 Per Hour")

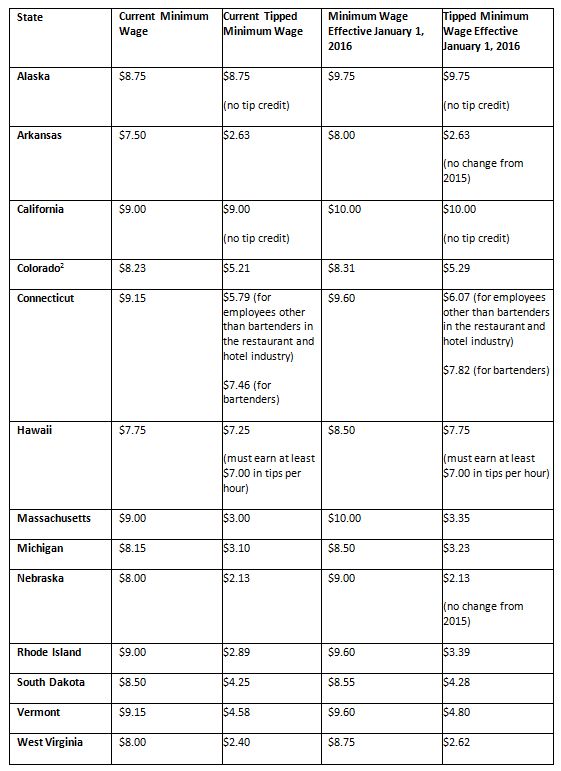

New York is not the only state or municipality in which the minimum wage will be increasing in the New Year. For those employers with operations in other states, please be cognizant of changes in other jurisdictions. For example, as the chart below indicates, effective January 1, 2016, the minimum wage will increase in a number of other states as well.

In addition to these January 1 increases, please be advised that:

- On July 1, 2016, Washington, DC will increase its minimum wage to $11.50 and Maryland will increase its minimum wage to $8.75; and

- On August 1, 2016, Minnesota will increase its minimum wage for large employers (annual gross sales of $500,000+) to $9.50 and for small employers (annual gross sales of less than $500,000) to $7.75.

Several municipalities throughout the country require the payment of minimum wages that are higher than the federal minimum wage and their respective state minimum wages. In 2016, several municipalities shall see increases in the local minimum wage, including, but not limited to:

- Portland, Maine ($10.10 on 1/1/16)

- Tacoma, Washington ($10.35 on 2/1/16 – election results not yet certified but reports indicate that measure passed)

- Seattle, Washington ($13.00, $12.50, $12.00 or $10.50 based on employer size and whether the employer makes contributions towards medical benefits on 1/1/16)

- Emeryville, California ($13.00 or $14.82 based upon employer size on 7/1/16)

- Birmingham, Alabama ($8.50 on 7/1/16)

- Berkley, California ($12.53 on 10/1/16)

- Los Angeles, California ($10.50 on 7/1/16 for employers with 26 or more employees)

- Oakland, California ($12.55 on 1/1/16)

- San Francisco, California ($13.00 on 7/1/16)

- Chicago, Illinois ($10.50 for non-tipped employees and $5.95 for tipped employees on 7/1/16)

- Johnson County, Iowa ($9.15 on 5/1/16)

- Louisville, Kentucky ($8.15 on 7/1/16)

- Montgomery County, Maryland ($10.75 on 10/1/16)

- Prince George's County, Maryland ($10.75 on 10/1/16)

Based upon the influx of increases in the minimum wage in 2016, it is prudent for employers to consult with counsel to determine if the minimum wage is increasing in the city, county and/or state in which the business operates.

Notice of Rate of Pay

Pursuant to New York's Wage Theft Prevention Act (WTPA), New York employers must provide a "Notice of Pay" form to all employees upon a change in their rate of pay. For all employers outside of the hospitality industry, the New York State Department of Labor (NYDOL) has opined that, as long as the new rate of pay is referenced in the employee's next pay stub, employers do not need to provide a new Notice of Pay as a result of the increase in the minimum wage.

Unfortunately, hospitality employers are not so lucky. Because of the language of the Hospitality Industry Wage Order, hospitality employers must provide a Notice of Pay form to those employees who are affected by the increase to the minimum wage (including all tipped employees) on or prior to December 31, 2015. The notice must contain the following information:

- The employee's normal rate(s) of pay and the basis thereof (e.g., hourly, shift, weekly, salary);

- If applicable, the employee's overtime rate of pay;

- The employee's regular pay day;

- Any allowances claimed against the minimum wage (e.g., tip credit, meal credit, lodging allowance, etc.);

- The name of the employer (including any "doing business as" name);

- The address of the employer's main office and a mailing address (if different); and

- The employer's telephone number.

The written notice must be signed by both the employer and the employee and must be retained by the employer for at least six years.

The NYDOL has issued sample Notice of Pay forms that employers may use. Although employers are not required to use the NYDOL forms, it is recommended that they do so in order to ensure full compliance with New York law. The NYDOL sample forms can be obtained from the NYDOL's website here.

In addition, the notice must be provided in both English and the employee's native language (if not English), provided the NYDOL has created a Notice of Pay form in the employee's native language. Currently, the NYDOL has issued forms in English, Spanish, Chinese, Haitian Creole, Korean, Polish and Russian, which are available on the NYDOL's website.

Footnotes

1. Please note that the new Hospitality Industry Wage Order has yet to be finalized. However, the increased rates were published in the February 24, 2015, Order of Acting Commissioner of Labor Mario J. Musolino on the Report and Recommendations of the 2014 Hospitality Wage Board.

2. Please note that the 2016 minimum wage increase in Colorado has yet to be acted upon, though it is expected that these will be the minimum wage and tipped minimum wage rates for 2016.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.