On January 1, 2016, New York City's Commuter Benefits Law takes effect. Under the law, private employers with 20 or more full-time, non-union employees in New York City must offer covered employees the opportunity to enroll in commuter benefits programs to pay for their mass transit costs with pre-tax earnings.

What Is the Purpose of the Law?

The law's goal is to reduce transportation costs to employees, promote the use of mass transit, and lower payroll taxes for employers. Because federal income and social security (FICA) taxes are not imposed on such expenses, employees will be able to save on commuting expenses and employers will be able to reduce payroll costs.

What Are Commuter Benefits Programs?

A commuter benefits program is a plan whereby employers can offer their full-time employees the opportunity to use pre-tax income to cover certain IRS qualified transportation costs. Employees may use such pre-tax income to pay for various forms of transit, including the MTA subway and bus, Long Island Rail Road, Metro-North, Amtrak, New Jersey Transit and eligible ferry, water taxi, commuter bus and vanpool services. However, parking and bicycling expenses do not qualify. A list of mass transit providers, and qualified third-party providers that administer commuter benefits programs, are set forth in the Q&A below.

Alternatively, employers can provide (at their own expense) a transit pass or similar form of payment for mass transit transportation. However, if the employer-provided benefit is less than the maximum pre-tax transportation benefit that is allowed under IRS regulations (currently $130 for transit passes and commuter highway vehicles), then the employer must offer employees the opportunity to purchase pre-tax transportation fringe benefits in an amount equal to the difference.

What Employers Are Covered?

Only employers with more 20 or more full-time employees are covered. An employer's total number of full-time employees is determined by calculating the average number of full-time employees for the most recent three-month period.

Employers with more than one location are covered by the law, so long as they have 20 or more full-time employees in New York City. Chain businesses (i.e., businesses that share a common owner or principal who owns a majority of each location and are engaged in the same business or operate under a franchise agreement) are also covered by the law. Full-time employees at all of the chain business' locations in New York City are counted to determine the total number of employees.

Temp agencies are covered by the law and are considered the employer of each full-time employee they place in another organization. Thus, temp agencies that place 20 or more full-time employees in New York City must offer those employees transportation benefits. To determine whether an employee qualifies as full-time, temp agency employers should add the total number of hours worked by each employee in the most recent four weeks at all placements.

The law's requirements may be waived for certain employers. To qualify for a waiver, an employer must present compelling evidence that providing transportation benefits would be impracticable and create severe financial hardship.

Which Employees Are Covered?

Only full-time, New York City employees are covered by the law. A full-time employee is any employee who works an average of 30 hours or more per week, any portion of which was in New York City, for a single employer. To determine whether an employee is full-time, employers should calculate the average number of hours worked in the most recent four weeks.

The law covers full-time employees who work in New York City, regardless of their place of residence. New York City includes the Bronx, Brooklyn, Manhattan, Queens and Staten Island.

Full-time employees whose job duties require them to work only occasionally in New York City are still covered by the law, so long as they work an average of 30 hours or more per week, any portion of which was in New York City and if their employer has 20 or more full-time employees.

The law does not cover New York City residents who work outside of the city. Thus, employers are not required to offer commuter benefits to their employees who live in New York City, but who work in New Jersey, Connecticut, Long Island, Westchester or some other location,

What Are the Law's Recordkeeping and Administration Requirements?

Employers must give their full-time employees a written offer of the transportation benefits. Employers should maintain such records, and employee responses, for at least two years. A sample Employer Compliance Form – Offer of Commuter Benefits can be downloaded here.

Who Enforces the Law?

Initially, the Department of Consumer Affairs (DCA) will enforce the law although the proposed New York City Office of Labor Standards would be given enforcement responsibilities if such office is created by the City Council. While the law takes effect on January 1, 2016, employers will receive a six-month grace period — until July 1, 2016 — before the DCA can seek penalties. After July 1, 2016, employers will have 90 days to correct any violation of the law before penalties will be imposed.

What Are the Penalties for Noncompliance?

First violation penalties will range between $100 to $250, provided the employer fails to correct violations within 90 days. If a violation is not cured after the first fine, an additional fine of $250 will be issued for each additional 30-day period of noncompliance.

What Are the Employer Takeaways?

While many large New York City employers already offer such pretax transit benefits, the new law will require many smaller employers to put a qualified transportation benefit program in place. Thus, employers with employees in New York City must now determine whether they will be subject to the new law, and if so, the impact on their operations. Employers should therefore consider changes to the administration of their benefits programs, proper communications to employees regarding such plans and any payroll changes necessary to comply with the new law in 2016.

NEW YORK CITY'S COMMUTER BENEFITS LAW

Questions & Answers

Employer Coverage

Question: Which employers must offer commuter benefits?

Answer: Private employers with 20 or more full-time, non-union employees working in New York City.

Question: How is the number of full-time employees determined?

Answer: The total number of full-time employees is determined by calculating the average number of full-time employees for the most recent three-month period.

Question: What if an employer has been in business for less than three months?

Answer: Then the number of full-time employees is determined by calculating the average number of full-time employees per week for the period of time in which the employer has been in business.

Question: Which employers are exempt under the law?

Answer: Employers that have employees covered by a collective bargaining agreement (CBA). Note, however, that if the employer has 20 or more full-time employees who are not covered by a CBA, the employer must still offer those employees commuter benefits. Government employees are also excluded.

Question: Does an employer have to offer commuter benefits if its workforce is reduced to fewer than 20 full-time employees?

Answer: Yes. Employers must allow employees who were eligible for commuter benefits before a workforce reduction the same continued benefits throughout the remainder of their employment.

Question: Does the law apply to temp agencies?

Answer: Yes. A temp agency that supplies full-time employees to other companies is the employer of those employees. Thus, agencies that employ 20 or more full-time employees, who are placed in New York City, must also provide qualified transportation fringe benefits.

Question: Does the law apply to chain businesses?

Answer: Yes. Chain businesses are group establishments that share a common owner or principal who owns a majority of each location and are engaged in the same business or operate under a franchise agreement with the same franchisor (as defined in New York State General Business Law Section 681). Business owners must count full-time employees at all of the chain business' locations in New York City to determine the total number of full-time employees.

Covered Employees

Question: Does the law apply to part-time employees?

Answer: No.

Question: Who is considered a full-time employee?

Answer: A full-time employee is any employee who works an average of 30 hours or more per week, any portion of which was in New York City, for a single employer. Employers should calculate the average hours worked in the most recent four weeks.

Question: Does the law apply to employees who do not live in New York City but work in New York City?

Answer: Yes. The law covers full-time employees who work in New York City. It does not matter where employees live, so long as they commute in. However, the converse is not covered — that is, the law does not cover employees who live in New York City but who work outside the City limits.

Question: Does the law apply to employees working for a temporary staffing agency?

Answer: Yes. If the employee works an average of 30 hours or more per week for a minimum of four weeks, any portion of which was in New York City, the temp agency must offer the transit benefits if it has 20 or more full-time employees. To determine the number of hours worked each week, employers must add the number of hours worked by the employee in the most recent four weeks at all of the employee's placements.

Question: Does the law apply to employees who work for an employer located outside New York City but whose job responsibilities require them to work in New York City?

Answer: Yes. Employees who work occasionally in New York City are covered by the law, if they worked an average of 30 hours or more per week, any portion of which was in New York City and if their employer has 20 or more full-time employees.

Question: What if an employee doesn't want the benefit?

Answer: The employer is still in compliance so long as it has offered the benefit in writing.

Full-Time Employee Considerations

Question: If an employer has multiple locations, do all full-time employees count toward the total number of employees?

Answer: Yes. If an employer has more than one location in New York City, the employer must count all full-time employees at all New York City locations to determine the total number of full-time employees.

Question: If an employer is part of a chain business, do all full-time employees count toward the number of employees?

Answer: Yes. If an employer owns a majority of more than one establishment in the chain business in New York City, the employer must count all full-time employees at all locations in New York City to determine the total number of full-time employees.

Question: My restaurant employs 10 full-time employees and 10 part-time employees in New York City. Does my restaurant have to offer commuter benefits?

Answer: No. Although the restaurant employs 20 employees, only 10 of those employees are full time. The law does not apply to your restaurant.

Question: An employer has two restaurant locations in New York City. The first location employs nine full-time employees. The second location employs fifteen full-time employees. Would this employer be required to offer commuter benefits?

Answer: Yes, the employer must provide commuter benefits to all of its full-time employees because it has a total of 24 full-time employees at the two locations.

Question: An employer owns eight restaurants in New York City. Each location employs eight full-time employees. Would this employer be required to offer commuter benefits?

Answer: Yes. The business employs a total of 64 full-time employees at the restaurants. The business must provide commuter benefits to all of its full-time employees.

Covered Forms of Transit

Question: What types of transportation are covered under the law?

Answer: Employees may use pre-tax income to pay for transit passes on public or privately owned mass transit or commuter vans with a seating capacity of six or more passengers.1

Question: Does the law cover ferry services into and within New York City?

Answer: Yes. The law covers eligible ferry services into and within New York City.

Question: Does the law cover vanpooling?

Answer: Yes. The law covers eligible commuter highway vehicles that seat at least six adults (not including the driver), use at least 80 percent of the mileage to transport employees between their residences and their place of employment and transport at least half of the adult seating capacity during the trips.

Question: Does the law cover carpooling?

Answer: No. Carpooling is not covered, unless the vehicle meets the requirements of a "commuter highway vehicle" under federal law.

Question: May employees use commuter benefits to pay for Access-A-Ride?

Answer: Yes. Employees who qualify for paratransit services may use pre-tax income to pay for their commute using Access-A-Ride, AccessLink or CCT Connect.

Question: May employees use commuter benefits to pay for a reduced-fare MetroCard?

Answer: Yes. Employees who qualify for a reduced-fare MetroCard may use pre-tax income to pay for their commute.

Question: Are qualified parking expenses covered under the law?

Answer: No. Qualified parking expenses are not covered by NYC's commuter benefits law. However, employees may use pre-tax income to pay for qualified parking expenses under federal tax law.

Question: Are CitiBikes covered by the law?

Answer: No. Bicycle rental fees are not qualified transportation fringe benefits under federal tax law.

Questions: Can employees use their commuter benefits to pay the cost of more than one mode of transit during their commute?

Answer: Yes. Employees can use their commuter benefits to pay for different eligible transit services during their commute.

Questions: What if an employee uses different forms of transportation?

Answer: Employees can use their commuter benefits to pay for different eligible transit services during their commute.

Administration of Commuter Benefits Programs

Question: What is a commuter benefits program?

Answer: A commuter benefits program is a program that certain employers can offer under the provisions of Internal Revenue Code Section 132(f) to their full-time employees to use pre-tax income to cover certain transportation costs.

Question: How do employees sign up for a commuter benefits program?

Answer: Employers must provide their eligible employees with the appropriate enrollment materials to participate in the employer-administered commuter benefits program or a third-party provider's commuter benefits program.

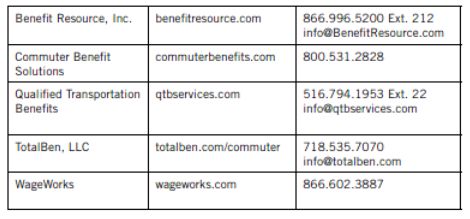

Question: What third-party providers are available to manage commuter benefit programs?

Answer: Following is a list of DCA-approved third-party providers:

Question: How long does a commuter benefits program take to set up?

Answer: Generally, a commuter benefits program can be set up within several weeks or less.

Question: Are there administrative fees associated with using a provider?

Answer: Yes. Third-party vendors may charge fees for administering commuter benefits programs. Administrative fees vary depending on the third-party vendor, the level of service sought and the number of participating employees. Vendors can provide employers with free quotes.

Question: Can an employer deduct the provider's administrative fee from its full-time employees' wages to set up a commuter benefits program?

Answer: No. Under New York State Labor Law, employers may not deduct the administrative fees associated with setting up a commuter benefits program from employees' wages.

Question: Can an employer administer a commuter benefits program without a third-party provider?

Answer: Yes. The law does not require employers to use a third-party provider. However, employers who decide to manage a commuter benefits program on their own should consult their tax advisers, accountants and attorneys.

Question: What if an employer already provides its employees with the opportunity to use pre-tax income to purchase qualified transportation fringe benefits?

Answer: An employer is not required to do anything further if it already offers its employees the opportunity to use pre-tax income to purchase qualified transportation fringe benefits as long as the employer offers the maximum monthly amount permitted by federal law on all eligible modes of transit.

Question: What if an employee decides not to enroll in an employer's commuter benefits program but wants to participate at a later date?

Answer: An employee may decide to use pre-tax income to purchase qualified transportation fringe benefits at a later date.

Recordkeeping Requirements

Question: Are employers required to give their full-time employees a written offer of commuter benefits?

Answer: Yes. Employers must give their full-time employees a written offer of the opportunity to use pre-tax income to purchase qualified transportation fringe benefits.

Question: What records does an employer have to keep?

Answer: Employers must keep records that demonstrate that each eligible full-time employee was offered the opportunity to use pre-tax income to purchase transit benefits and indicate whether the employee accepted or declined the offer.

Tax Considerations

Question: What is the maximum monthly amount that can be deducted from an employee's pre-tax income?

Answer: Currently, an employee can choose to deduct up to a maximum of $130 a month under federal law. There is no minimum amount.

Question: Are employers required to provide parking as a pre-tax benefit?

Answer: No. Certain parking expenses can be paid as qualified transit fringe benefits under federal law, but NYC's Commuter Benefits Law does not require employers to offer parking as part of their commuter benefits program.

Question: What benefits does an employee gain by paying for commuting costs with pre-tax income?

Answer: Employees can lower their monthly expenses when they use pre-tax income to pay for their commute. For example, an employee with a tax rate of 30 percent who elects to pay $100 per month on transportation with pre-tax income, can save $360 annually.

Question: What if the cost of an employee's commute is more than $130 (the current maximum pre-tax deduction allowed)?

Answer: Many third-party providers offer programs where employees can put post-tax deductions in their account if they have monthly transit expenses that exceed the monthly pre-tax limit.

Compliance and Enforcement Considerations

Question: Can employees report noncompliance to the DCA?

Answer: Yes. Employees can report noncompliance to the DCA directly.

Question: When can the DCA issue violations against an employer for not complying with the Commuter Benefits Law?

Answer: Employers have a six-month grace period after NYC's Commuter Benefits Law takes effect on January 1, 2016, to begin offering commuter benefits to their employees. After July 1, 2016, DCA is authorized to seek penalties for failure to comply with the law. Employers will have an opportunity to correct any instances of noncompliance within 90 days, before DCA issues a violation.

Question: What are the maximum penalties under the law?

Answer: Employers can be fined from $100 to $250 for the first violation, provided they do not cure the violation within 90 days. If the violation is not cured after the first fine is imposed, an additional fine of $250 may be issued after every additional 30-day period of noncompliance.

Footnote

1 The DCA lists the following as qualified forms of transportation: Subway: MTA NYC Transit Subway. Bus: Academy Bus, Adirondack Trailways, Arrow Lines, Atlantic Express, Bonanza Bus Lines, Brown Coach, Carefree Bus Lines, Carl Bieber Bus Lines, CDTA, Centro, City of Long Beach Transit, Coastal Link, Columbia County Commuter Bus, Community Bus Lines, Community Coach, Connecticut Transit, DATTCO, DeCamp Bus Lines, Dutchess County LOOP Bus, Excellent Bus Service, Express Bus Service, FM Coach, Greater Bridgeport Transit Authority, Greenwich Shuttle, Greyhound, Hampton Jitney, HART Bus Service, Huntington Area Rapid Transit, Jetleds Coach, Joe and Jan Charter, Kelley Transportation, Lakeland Bus Lines, Leisure Line, Leprechaun Lines, Martz Trailways, Milford Transit, Monsey Trails, Morris County Metro, MSB Express Tours, MTA Bus – Express, MTA Bus – Local, MTA NYC Transit , Express Bus, MTA NYC Transit Local Bus, NFTA, NICE Bus - Long Island Bus, NJ Transit Bus, Norwalk Transit, NY Commuter, Olympia Trails, OnTrack, Peter Pan Bus Lines, Pine Hill Trailways, Putnam Area Rapid Transit (PART), Red and Tan Lines, RGRTA, Rockland Coaches, Rockland County Transportation, Roosevelt Island Red Bus, Shoreline/Hudson Transit, Schoharie County Public Transportation (SCPT), Schoharie County Transit, Shiloh Bus, Short Line, Sildan Shuttle, Suburban Transit, Suffolk County, Transit, Sunrise Coach Lines, Tappan ZEExpress, Trans-Bridge Lines, Trans Hudson Coach, Transport of Rockland, Upstate Transit, Valley Transit District, Waterbury Northeast Transit, Westchester Bee-Line Express Bus, Westchester Bee-Line Local Bus, Westport Transit, Yankee Trails. Rail: AirTrain – JFK, AirTrain – Newark, Amtrak, Connecticut Commuter Rail/Shore Line East, MTA Long Island Rail Road, MTA Metro-North Railroad, MTA Staten Island Railway, NJ Transit Hudson-Bergen Light Rail, NJ Transit Newark Light Rail, NJ Transit Railroad, NJ Transit River LINE, PATH, Roosevelt Island Tramway, SEPTA Rail. Paratransit: Access-A-Ride, Access Link, CCT Connect. Ferry: Davis Park & Watch Hill Ferry, Fire Island Ferry, Haverstraw Ferry, Hoboken Ferry, Liberty State Water Taxi, New York Water Taxi, NY Waterway, Sayville Ferry, Seastreak, TWFM Ferry. Vanpool: Easy Street, Easy Street Vanpool, Ken-Doo Transit, NJ DOT Vanpool Service, Royal Coachman, The Rideshare Company, Vanpool of New Jersey, Via Transportation, Inc., vRide.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.