This article first appeared in newly released book from NERA Economic Consulting, 'The Line in the Sand: The Shifting Boundary Between Markets and Regulation in Network Industries'. With a foreword by Alfred E Kahn.

I. INTRODUCTION AND BACKGROUND

Emissions trading has emerged over the last decade as a major tool for controlling air pollution and climate change in both the United States and Europe. The European Union Emissions Trading Scheme (EU ETS) for carbon dioxide (CO2) launched in January 2005 has provided important experience and visibility for the approach and highlighted its applicability to climate change policy. Indeed, in the United States and Europe, virtually all of the major current programs and proposals to control CO2 and other greenhouse gases (GHG)—at least from power plants and other stationary sources—are based upon the emissions trading approach. The United States also has more than a decade of experience with emissions trading programs for other air emissions, and this earlier experience provides important lessons as well.

Compared to the alternative command-and-control approach, the concept of emissions trading is attractive for two major reasons. First, trading lowers the cost of meeting key air quality and climate change objectives. Providing sources with the flexibility to trade the right to emit—rather than requiring all sources to meet given emission standards—means both that the allowance market can be used to determine the least cost means of achieving objectives and that firms have continuing incentives to find cheaper means of reducing emissions. The second reason, and one less generally discussed, is that emissions trading provides environmental gains relative to a command-and-control approach—it provides greater certainty that targets will be met and avoids the environmental effects of giving exemptions to firms that find it difficult to meet the command-and-control standards. Extensive experience with programs over the last decade provides strong evidence that the theoretical economic and environmental gains are achieved in practice.

This chapter explains the concept of emissions trading and how it has been used for air emissions and climate change.1 We emphasize the importance of learning from the experience with existing programs, both those that have been in existence for decades to deal with air emissions and the recent programs to control GHG emissions. We first provide an overview of the concept, the three major types of programs, and the main elements that are typically specified in developing a particular program. We then summarize the air emissions programs in the United States and the lessons this experience provides. Section III considers applications to climate change, including the existing European cap-and-trade program and various proposals in the United States. Section IV summarizes the key issues that arise with regard to greenhouse gases, including public policy issues involved in designing programs and the issues for private firms subject to a trading program. The final section provides brief concluding remarks.

A. Concept Of Emissions Trading

The concept of emissions trading is simple. A cap-and-trade program sets an aggregate cap on emissions that defines the total number of emissions allowances, each of which provides its holder with the right to emit a unit (typically a ton) of a particular type of emission. The allowances are initially allocated in one of several ways, usually directly to participating sources. Each source covered by the program must hold permits to cover its emissions, with sources free to buy or sell allowances among themselves.

1. Economic and Environmental Gains

Giving regulated facilities the flexibility to trade emissions allowances reduces the compliance costs of achieving an emissions target, while the overall cap on the level of emissions provides certainty that the emission target will be achieved. Although it is not possible to provide precise measures of cost savings compared to hypothetical control approaches that might have been applied, the available evidence suggests that the increased compliance flexibility of emissions trading yields costs savings of as much as 50 percent.

While some skeptics have suggested that emissions trading is a way of evading environmental requirements, experience to date with well-designed trading programs indicates that emissions trading helps achieve environmental goals in several ways. First, when emission reduction requirements are phased in and firms are able to bank emissions reduction credits, the required emission reductions are achieved more quickly. Second, giving firms with high abatement costs the flexibility to meet their compliance obligations by buying emissions allowances eliminates the rationale underlying requests for special exemptions from emissions regulations based on hardship and high cost. Third, reducing compliance costs has resulted in tighter emissions targets, in keeping with efforts to balance the costs and benefits of emissions reductions. Finally, properly designed emissions trading programs appear to provide other efficiency gains, such as greater incentives for innovation and improved emissions monitoring.

2. Simple Example to Illustrate the Cost Savings from Emissions Trading

A simple numerical example illustrates how emissions trading can reduce control costs compared to a traditional approach based on setting uniform command-and-control standards. Typically, the cost per ton of reduction rises as the level of reduction required is increased, and this marginal cost could be substantially higher for one plant than another. Assume then that to reduce emissions to meet the standard, Plant I incurs a cost of $1,500 for the last ton of emissions reduced, while Plant II spends $3,000 for the last ton it reduces. These two facilities might be different plants within the same company, plants owned by different companies in the same sector, or plants in completely different sectors. They might be subject to a common regulatory standard or to completely separate regulations.

The same overall reduction in emissions could be achieved at lower compliance costs by tightening controls at Plant I by one ton and relaxing them at Plant II by one ton. Loosening controls at Plant II by one ton saves $3,000, whereas tightening controls by one ton at Plant I would raise costs by only $1,500, for a net savings in compliance costs of $1,500 to reduce that ton. Under a cap-and-trade program, each source would compare its own emissions control costs with the market allowance price and determine whether it is profitable to control more and sell allowances to others or to control less and buy allowances to cover the additional emissions. The trading mechanism allocates emissions reductions among sources in the most cost-effective manner, relying on individual information and self-interest—rather than administrative regulation—to determine compliance decisions by each individual source.

Suppose in this simple numerical example that the market price of an emissions credit or allowance were $2,000 per ton, and that the two facilities were initially allocated allowances consistent with the individual emissions levels required under the emissions standard. Figure 1 shows how each of the sources would gain from the market with regard to the last ton controlled.

Plant I (low-cost seller) gains by further reducing its emissions by one more ton than the standard requires and selling the allowance it no longer needs to Plant II; it receives $2,000 for the allowance but pays only $1,500 to achieve the reduction, for a net gain of $500. On the other side of the transaction, Plant II (high-cost buyer) is able to buy the allowance for $2,000 and reduce its compliance costs by $3,000, for a net savings of $1,000. Thus, the total savings in compliance costs of $1,500 for that ton is split between the buyer and the seller; both gain from trading.

B. Broad Types of Emissions Trading Programs

Three broad types of emissions trading programs have emerged: credit-based programs, averaging programs, and cap-and-trade programs. Although all share the feature of tradability, the three differ in important respects.

1. Credit-based Programs

Credit-based programs provide tradable credits to facilities that reduce emissions more than required by some pre-existing regulation (or other baseline). They allow those credits to be counted towards compliance by other facilities that would face high costs or other difficulties in meeting the regulatory requirements. Reduction credits are created through an administrative process in which the credits must be pre-certified before they can be traded.

The most significant issue for credit-based programs is establishing the baseline against which credits are calculated.2 Determining the baseline involves determining what the level of emissions would have been, absent the controls for which credits are claimed (e.g., introduction of specific emission control technologies). Early programs developed by the U.S. Environmental Protection Agency (EPA) in the late 1970s and early 1980s led to concerns about "paper credits," i.e., credits for reductions that would have been achieved without the incentive provided by the programs. The response was to limit significantly the credits that were allowed, with the result that these early programs yielded few cost savings.3 Similar concerns have been raised with regard to the credit-based programs established under the Kyoto Protocol.

2. Averaging Programs

Averaging programs involve offsetting emissions from higher-emitting sources with lower emissions from other sources, so that the average emission rate achieves a predetermined level.4 Like reduction credit programs, averaging programs provide flexibility to individual sources to meet emissions constraints by allowing differences from source-specific standards to be traded between sources. The primary difference between averaging and reduction credit programs is that reduction credits are created (or certified) through an administrative process whereas in averaging programs, the certification is automatic.

3. Cap-and-Trade Programs

A cap-and-trade program sets an aggregate cap on emissions that defines the total number of emissions allowances, each of which provides its holder the right to emit a unit of emissions. The permits are initially allocated, typically among existing sources. Each source covered by the program must hold permits to cover its emissions, with sources free to buy and sell permits among themselves. In contrast to reduction credit programs—but similar to averaging programs—cap-and-trade programs do not require pre-certification of allowances: the allowances are certified when they are first distributed. But cap-and-trade programs limit total emissions, a contrast to reduction credit and averaging programs that are not designed to cap total emissions.

4. Combinations of Types

A trading program might include more than one type of trading mechanism. As discussed below, both the Acid Rain Trading Program and RECLAIM include reduction credit supplements to the basic cap-and-trade program. In addition, a cap-and-trade program might provide for early reduction credits, which allow firms to get credits for voluntarily reducing emissions prior to the introduction of a cap-and-trade program. The credits obtained can be used to meet requirements once the cap-and-trade program goes into force.

C. Key Elements Of An Emissions Trading Program

All three types of emissions trading rely on preconditions to ensure a successful program. First and most importantly, all assume that an emissions control requirement has been put in place that requires emissions to be reduced to levels below what they otherwise would be. Credit and averaging programs will typically require a source-specific standard (e.g., maximum emissions rates); cap-and-trade programs require an aggregate cap on emissions combined with the provision that each source surrender allowances equal to its emissions. Second, the cost savings achieved by all three types of emissions trading depend upon variability in the costs of reducing emissions among emissions sources. Differences in emission control costs across emissions sources create the opportunity to reduce costs through trading. Third, in all three types of trading programs the requirements must be both enforceable and enforced. A corollary is that actual emissions or emissions rates must be accurately measured —otherwise it would be impossible to enforce the requirements because it would be impossible to determine whether sources were in compliance.

There are various methods of characterizing the many features that must be specified in an emissions trading program, some of which do not apply to all of the three basic emissions trading types. The following subsection lists5 the major features of emissions trading programs in three major categories: threshold features, design features, and implementation features.

1. Threshold Features

Threshold features define the cap and set up the basic structure and elements of the program.

- Cap and budgets. The cap is the target level of total emissions from covered entities under the emissions trading program. Budgets may be given for groups of emission sources, such as sources in different states or sectors, with the sum of budgets being the total cap.

- Covered entities specifies the universe of emissions sources that must participate in the trading program.

- Geographic or temporal flexibility or restrictions. Trading among different geographic regions can be restricted if there is evidence that emissions have substantially different effects when emitted in different locations. The trading program can also include options of banking and borrowing. To bank is to reduce emissions more than required in a given year and bank the surplus for future internal use or sale. To borrow is to reduce emissions less than required in a given year and borrow against future reductions, with the borrowed amount supplied by reducing more than required in subsequent years.

- Opt-in provisions allow additional sources to opt into the program.

- Timing specifies the start date and period of the emissions trading program and includes the possibility of separate phases for the trading program.

2. Design Features

Design features are the decisions that arise as the program is designed and turned into a specific regulatory program.

- Allocation of initial allowances is only relevant in cap-and-trade programs where some method is required to distribute the initial allowances. Common methods include various formulas to distribute initial allowances to participants on the basis of historical information (grandfathering) or of updated information (updating) as well as auctioning the initial allowances. Allocations can also be provided to nonparticipants (e.g., energy consumers) to compensate for costs they bear.

- Institutions established to facilitate trading may include third parties (e.g., brokers) to participate in trading or setting up ongoing auctions to increase liquidity and establish market prices.

- Banking rules govern banking and/or borrowing options.

- Safety valves are mechanisms to restrict the allowance price from rising above a certain level or to change the provisions of the trading program if the allowance price is above a predetermined level.

3. Implementation Features

A number of features are developed as the program is carried out.

- Certification of permits. This process applies to reduction credit programs, which require emission reductions to be certified before they can be traded.

- Monitoring and reporting of emissions. Methods must be designed to monitor and report emissions from each participating source.

- Compliance and enforcement provisions. These are developed to determine whether sources are in compliance and enforce the requirements if sources are not.

- Maintaining and encouraging participation. These activities aim to keep sources in the program and encourage participation of sources that are given the opportunity to opt in.

II. EXPERIENCE WITH EMISSIONS TRADING IN THE UNITED STATES

Emissions trading has been used extensively over the past decade to regulate air emissions in the United States. This section provides an overview of the major cap-and-trade programs and the lessons their experience provides.

A. Overview of Major US Cap-and-Trade Programs for Air Quality

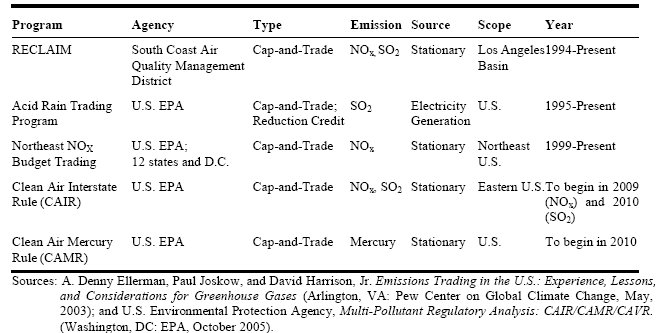

Table 1 summarizes the five major cap-and-trade programs that have been established in the United States. The US EPA has administered all these programs except for the Regional Clean Air Incentives Market (RECLAIM), the Los Angeles air basin program administered by the South Coast Air Quality Management District (SCAQMD).

1. Acid Rain Trading Program

The largest and best-known cap-and-trade program in the United States is the program for �ulphur dioxide (SO2) created by Title IV of the 1990 Clean Air Act Amendments. It is often referred to as the Acid Rain Trading Program because the major motivation for the program was to prevent acid rain damage. Because of its large scale and high profile, the success of the Acid Rain Trading Program contributed more than anything else to the change in attitude towards emissions trading in the 1990s, and it is often cited as an example for other applications.

The Acid Rain Trading Program created a national cap on SO2 emissions per year from electricity generating plants. During Phase I (1995 through 1999), the 263 electricity generating units emitting the largest volume of SO2 were subject to an interim cap that required projected average emissions to be no greater than approximately 2.5 lbs. of SO2 per million Btu of heat input. Phase II, beginning in 2000 and continuing indefinitely, expanded the program to include virtually all fossil-fueled electricity generating facilities and to limit emissions from these facilities to a cap of approximately nine million tons—which implies an average emission rate of less than 1.2 lbs. of SO2 per million Btu. The final Phase II cap will eventually reduce total SO2 emissions from electricity generating units to about half of what they had been in the early 1980s.

This cap on national SO2 emissions was implemented by issuing tradable allowances, each representing the right to emit one ton of SO2, equal to the total annual allowed emissions, and by requiring that the owners of all fossil-fuel-fired electricity generating units surrender an allowance for every ton of SO2 emissions. Allowances not used in the year for which they are allocated can be banked for future use or sale. These allowances were allocated to owners of affected units free of charge, generally in proportion to each unit’s average annual heat input during the three-year baseline period, 1985-1987. A small percentage (2.8 percent) of the allowances allocated to affected units are withheld for distribution through an annual auction conducted by the EPA to encourage trading and ensure the availability of allowances for new generating units. The revenues from this auction are returned on a pro rata basis to the owners of the existing units from whose allocations the allowances are withheld.

2. RECLAIM

While the Acid Rain Trading Program was being developed, regulators in the Los Angeles air basin were developing RECLAIM as an alternative means of achieving the emission reductions of nitrogen oxides (NOx) and SO2 mandated the 1991 Air Quality Management Plan. RECLAIM, approved by SCAQMD after a three-year process, and beginning operation in January 1994, was significant both in some of its provisions and as the first major example of a tradable permit program developed by a non-federal authority. The caps for both Nox and SO2 were set higher than expected emissions in the initial years, but the overall caps were reduced steadily so that by 2003, emissions from sources emitting more than four tons of either pollutant would be reduced to about 50 percent below early-1990s emission levels. From 2003 on, the caps have remained constant.

Several features of the design of the RECLAIM program distinguish it from the Acid Rain Trading Program. First, the program covers a heterogeneous group of participants, including power plants, refineries, cement factories, and other industrial sources. Second, the RECLAIM program distinguishes between emissions in two geographic zones. Since emissions in the Los Angeles Basin generally drift inland from the coast, sources located in the inland zone were allowed to use RECLAIM Trading Credits (RTCs) issued for facilities in either the inland or coastal zones, but sources located in the coastal zone could use only RTCs issued for facilities in the coastal zone. Third, the RECLAIM program does not allow banking. It does provide limited temporal flexibility, however, by grouping sources into two 12-month reporting periods, one from January through December and the other from July through June, and by allowing trading between sources in overlapping periods.

3. Northeast NOx Budget Trading Program

The Northeast Nox Budget Trading program grew out of provisions in the Clean Air Act Amendments of 1990 that facilitated common actions by the District of Columbia and 12 states in the Northeastern United States6 to control regional tropospheric ozone (smog). The states adopted a cap-and-trade program to reduce Nox emissions from electricity generating facilities having 15 MW of capacity or greater and equivalently sized industrial boilers by about 60 percent from uncontrolled levels in a first phase (starting in 1999) and by up to 75 percent in a second phase (starting in 2003).7

A unique feature of the program is that it operates only from May through September, when Nox effects on ozone concentrations are greatest in this part of the country. Although the environmental objective is to reduce the incidence of ozone non-attainment, the program does not contain provisions that distinguish between the summer days when the ozone standard is exceeded and the days when it is not. Several ideas to address this problem were considered, but none were deemed feasible.8 Instead, the program relies on the decrease in the overall level of Nox emissions during the critical summer season.

4. Clean Air Interstate Rule

The Clean Air Interstate Rule (CAIR) was promulgated by the EPA in 2005 to set new standards on SO2 and NOx emissions from new and existing fossil fuel-fired electricity generation units in 28 Eastern states and Washington, DC.9 CAIR establishes two phases of caps for these air emissions, with the second cap lower than the first. Phase I of the Nox program takes effect in 2009, and Phase I of the SO2 program takes effect in 2010. Phase II for both Nox and SO2 begins in 2015.

When CAIR is fully implemented, annual SO2 emissions in the covered states are expected to drop by over 70 percent from 2003 levels, and annual Nox emissions are expected to drop by over 60 percent. Each state covered by the regulation can satisfy its emissions reduction requirement by participating in a cap-and-trade program based on the Acid Rain Trading Program for SO2 and the Northeast Budget Trading Program for Nox. States electing not to join the program are subject to firm caps on their emissions. However, the EPA considers participation in the cap-and-trade program to be the most cost-effective way for states to achieve their mandated emission reductions.10

5. Clean Air Mercury Rule

The Clean Air Mercury Rule (CAMR), promulgated by the EPA on March 15, 2005, sets standards for mercury (Hg) emissions from new and existing coal-fired generating units. Under CAMR, Hg emissions are capped at specific, nationwide levels to be achieved in two phases. The first phase, effective in 2010, establishes a cap of 38 tons per year; the second phase, effective in 2018, caps Hg emissions at 15 tons per year.

EPA expects that the 2010 target for mercury emissions will be achieved largely through the emissions control measures for CAIR. The increased use of flue gas desulphurization to reduce SO2 emissions and selective catalytic reduction to reduce NOx emissions also will reduce Hg emissions. Thus, in the early years, Hg emissions reductions will be a "co-benefit" of SO2 and NOx emissions reductions. As with CAIR, states may join a national cap-and-trade program to meet their Hg emissions budgets, but if they choose not to participate in the program, their emissions budgets are firm caps.

The cap-and-trade approach for mercury has led to litigation and various state proposals to limit possible interstate trading. While the states are concerned that trading could result in local hot spots, the EPA has concluded that the nature of the atmospheric transport of mercury and its local deposition makes such concentrated effects unlikely.11

B. Implications Of Experience With U.S. Air Quality Emissions Trading Programs

The experience of more than a decade with these various U.S. air quality programs provides some guidance on how emissions trading works in practice. The following are conclusions regarding the economic and environmental effects of this experience.12

1. Economic Gains from U.S. Emissions Trading Programs

The economic rationale for emissions trading is straightforward. By giving businesses the flexibility to reallocate (trade) emissions credits or allowances among themselves, trading can reduce the compliance costs of achieving the emissions target. Emissions trading appears to have been successful in its major objective of lowering the cost of meeting emission reduction goals. The high volume of trading observed in nearly all programs provides circumstantial evidence that participants realize substantial benefits from trading.

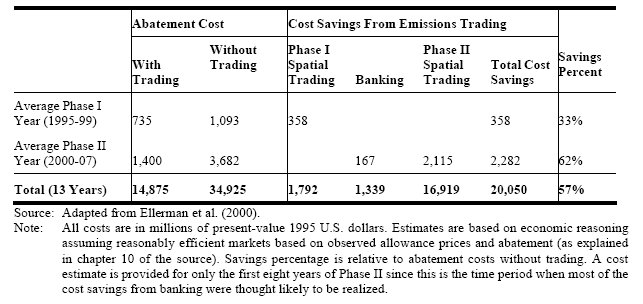

Table 2 summarizes the estimates calculated by Ellerman et al. (2000) of cost savings from trading in the Acid Rain Program attributable to different types of trading, i.e., the savings due to spatial trading in Phase I, banking between Phases I and II, and spatial trading in the more stringent and comprehensive Phase II.13

On average, spatial trading during Phase I reduced annual compliance costs by about 33 percent from the estimated cost of $1,093 million per year for a non-trading regime in which each affected unit must limit its emissions without any trading. During the first eight years of Phase II, the combination of spatial trading and banking is estimated to have reduced annual compliance costs by over 60 percent, from about $3.7 billion per year. Over the first 13 years of the program, the ability to trade allowances nationwide across affected units and through time is estimated to reduce compliance costs by a total of $20 billion, a cost reduction of about 57 percent from the assumed command-and-control alternative. This estimate is similar to that developed by other researchers,14 although it is less than the percentage cost savings sometimes claimed for emissions trading programs, including the Title IV SO2 cap-and-trade program.15

RECLAIM and the Northeast NOx Budget Trading program have not been subject to as careful a retrospective review, but both have experienced considerable trading activity, which suggests cost savings. Trading activity in RECLAIM has been substantial, with the overall volume in any given year exceeding the total annual allocation as a result of trading in future vintages. Studies done when the program was introduced estimated cost savings to be about 40 percent.16 The extensive trading suggests these cost savings have been achieved.

2. Environmental Gains from U.S. Emissions Trading Programs

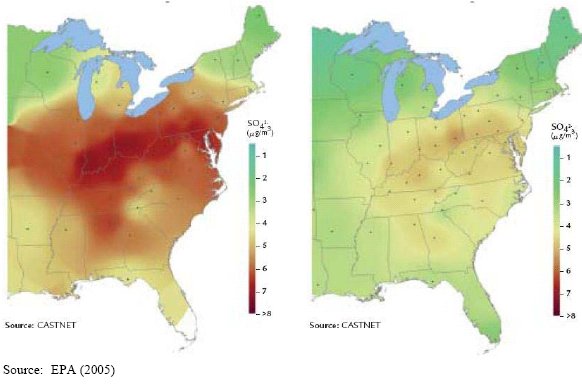

Although there were early concerns that emissions trading could compromise environmental quality—indeed, critics had sometimes portrayed emissions trading as a way of evading environmental requirements—in fact, experience to date has demonstrated the opposite. The use of emissions trading actually appears to have helped achieve environmental goals. The environmental gains possible with emissions trading are illustrated in Figure 2, which shows that ambient sulfate concentration in the eastern United States has been markedly reduced under the Acid Rain Trading Program.17

There are five major reasons why the increased flexibility associated with emissions trading can take credit for enhanced environmental performance.

a. Banking Created Incentives for Early Emission Reductions

Where emission reduction requirements are phased in and businesses can bank emission reductions—as was the case in most of the prior programs—the required reduction has been achieved faster. The early reductions may defer the achievement of future annual emissions control targets as the banked credits are used. However, as long as a positive discount rate is assigned to the benefits associated with emission reductions, accelerating the timing of the cumulative required emission reductions represents a net environmental gain.

b. Trading Eliminated Need for Special Treatment of Plants Where the Standard Cannot Be Met

In a command-and-control program, economic hardship or technical barriers can be alleviated only by relaxing the emissions standard. While often justified, these exceptions reduce the regulation’s environmental effectiveness because they are one-sided: standards are relaxed to avoid hardships for some facilities, but increased emissions cannot be offset by increasing standards at facilities for which abatement is less expensive or technologically easier. The net result is more emissions than would be produced by regulations that perfectly account for differences in compliance costs.

Allowing businesses for which abatement is costly or even technically infeasible to comply with environmental requirements by buying allowances, effectively paying others to reduce on their behalf, eliminates a feature of command-and-control programs that diminishes their environmental effectiveness. The result is a decentralized mechanism for offsetting emissions that does not detract from achieving the environmental goal.

c. Caps Prevented Emissions Increases Due to Increased Generation

Under an emissions limit approach, the emissions limit is typically expressed as units (tons or pounds) of emissions per unit of fuel burned or unit of electricity produced. Thus, if fuel input or electricity generation increases, the level of allowable emissions increases as well, and total emissions increase. In contrast, under a cap-and-trade program the cap represents a level of emissions, not an emissions rate, so changes in total fuel input or electricity generation do not affect total emissions.

Since the Acid Rain Trading Program began, fuel input and electricity generation have increased by approximately 30 percent, but SO2 emissions have decreased by nearly 40 percent. These trends are illustrated in Figure 3.

d. Potential Cost Savings Helped in Negotiating Environmental Targets

The flexibility of trading programs increases the likelihood of gaining consensus on the environmental goal and even adopting a more demanding goal. The allocation mechanism can win over those who might otherwise stand to lose the most from tighter regulations and, all other things being equal, the lower overall costs of achieving the target mean that more reductions are affordable.

The inclusion of emissions trading in the 1990 Clean Air Act Amendments broke what had been a decade-long stalemate on acid rain legislation.18 The Northeast NOx emissions trading program offered a better means of achieving compliance with the National Ambient Air Quality Standards for ozone, a goal that had long eluded these states (and a number of others) despite ample regulatory authority in the existing Clean Air Act. Similarly, regulators in Southern California adopted emissions trading in both SO2 and NOx as a more likely means of achieving the emission reductions that were already required. There also is evidence that the flexibility provided by the Averaging, Banking, and Trading (ABT) programs allowed more stringent emission standards to be set for various categories of mobile sources.

e. Trading Provided Incentives to Develop More Effective Control Technologies

Although evidence is limited so far, trading programs should create greater incentives for innovation in emission-reduction technologies than command-and-control regulations. While the latter may force some technological development, there is no incentive to go beyond the standard. Indeed, command and control regulations may be a disincentive because investments in developing more efficient abatement technology might be rewarded only by a tighter standard.

In contrast, the incentive to abate in cap-and-trade programs, where there is no specific standard for any single plant, is continuous across all levels of emissions, and any improvements in abatement technology will result in allowance savings.19 There is also empirical evidence that the Lead-in-Gasoline Program, a trading program administered by the EPA from 1982 to 1987, led refiners to adopt lead-reducing technologies more efficiently.20

Footnotes

1 Sections of this chapter draw on various previous papers and reports, including (1) David Harrison Jr., "Tradable Permits for Air Pollution Control: The United States Experience," in Domestic Tradable Permit Systems for Environmental Management: Issues and Challenges, J.P. Barde and T. Jones, eds. (Paris: Organization for Economic Cooperation and Development, 1999; (2) David Harrison, Jr. and Daniel B. Radov. Evaluation of Alternative Initial Allocation Mechanisms in a European Union Greenhouse Gas Emissions Allowance Trading Scheme. Report prepared for the European Commission, Directorate-General Environment (Cambridge, MA: NERA, March, 2002); (3) David Harrison Jr., "Tradable Permit Programs for Air Quality and Climate Change," in International Yearbook of Environmental and Resource Economics, Volume VI, Tom Tietenberg and Henk Folmer, eds. (London: Edward Elgar, 2002); (4) A. Denny Ellerman, Paul Joskow, and David Harrison, Jr. Emissions Trading in the U.S.: Experience, Lessons, and Considerations for Greenhouse Gases. (Arlington, VA: Pew Center on Global Climate Change, May, 2003); (5) and David Harrison Jr., Steve Sorrell, Daniel Radov, and Per Klevnas, Interactions of Greenhouse Gas Emissions Allowance Trading with Green and White Certificate Schemes. Report prepared for the European Commission, Directorate-General Environment. (Boston: NERA Economic Consulting, November 14, 2005). The views are those of the authors and not necessarily those of the other co-authors or the sponsoring organizations.

2 See David Harrison Jr., S. Todd Schatzki, Thomas Wilson and Erik Haites, Critical Issues in International Greenhouse Gas Emissions Trading: Setting Baselines for Credit-Based Trading Programs – Lessons Learned from Relevant Experience (Palo Alto, CA: Electric Power Research Institute, Inc., 2000).

3 Harrison (2002), op. cit.

4 In the context of GHG emissions, averaging programs sometimes are referred to using other terms, including "intensity-based programs," "rate-based programs" and "relative targets."

5 Derived from Harrison (1999) and Ellerman et al. (2003), op. cit.

6 The twelve are the six New England states (Maine, New Hampshire, Vermont, Massachusetts, Rhode Island, and Connecticut) and the six Mid-Atlantic States (New York, New Jersey, Pennsylvania, Maryland, Delaware, and Virginia).

7 Technically, these phases are the second and third of a three-phase program. The first phase consisted of relabeling existing technology-based requirements and did not involve emissions trading.

8 Alex Farrell, "The NOx Budget: A Look at the First Year," Electricity Journal (March 2000), 83-92.

9 Although CAIR strengthens the cap on emissions from power plants only in Eastern states, the higher allowance prices give power plants across the country an incentive to reduce air emissions beyond levels of reduction without CAIR. Emission reductions at Colstrip are already being achieved because it has a flue gas desulfurization ("SO2 scrubber") system.

10 70 Federal Register 25228.

11 U.S. Environmental Protection Agency, Acid Rain Program: 2004 Progress Report (Washington, DC: EPA, October 2005).

12 This section draws heavily on Ellerman et al. (2003).

13 See A. Denny Ellerman, Richard Schmalensee, Paul L. Joskow, Juan Pablo Montero, and Elizabeth Bailey, Markets for Clean Air: The U.S. Acid Rain Program (Cambridge, UK: Cambridge University Press, 2000). Much of the cost savings from spatial trading and from banking are due to intra-utility trading, i.e., trading of allowances among units under common ownership. Ellerman et al. (2000) note (pp. 154-161) that in the first three years of Phase I, from 25 to 30 percent of the allowances needed to cover emissions at affected units with emissions greater than the allowance allocation came from sources external to the utility, or by inter-utility trading.

14 Curtis P. Carlson, Dallas Burtraw, Maureen Cropper, and Karen Palmer. "SO2 Control by Electric Utilities: What are the Gains from Trade?" Journal of Political Economy, CVIII, 6 (2000), 1292-1326 develops estimates of cost savings for Phase I and Phase II years. For 1995 (Phase I), they estimate gains from trade equal to 13 percent of the "No Trading" costs. In 2005 (Phase II), they estimate that overall compliance costs will be reduced by about 37 percent relative to "No Trading" costs. These estimates are similar to those based upon an econometric model in Carlson. See also Robert N. Stavins, "What can we learn from the grand policy experiment? Lessons from SO2 allowance trading," Journal of Economic Perspectives, XII, 3 (Summer 1998), 69-88 for a review of the SO2 program.

15 Potential cost savings of as much as 95 percent have been estimated for some theoretically possible emissions trading programs (Tom Tietenberg. Environmental and Natural Resource Economics, 5th ed. (Reading, MA: Addison Wesley Longman, 2000). Note that a confusion of allowance prices with average incurred costs led official Administration spokesmen to claim cost savings of 90 percent for Title IV (Anne E. Smith, Jeremy Platt and A. Denny Ellerman, The Costs of Reducing Utility SO2 Emissions—Not as Low as You Might Think. MIT/CEEPR Working Paper 98-010 (August 1998).

16 David Harrison, Jr., and Albert Nichols, An Economic Analysis of the RECLAIM Trading Program for the South Coast Air Basin (Cambridge, MA: NERA, March 1992).

17 An ancillary benefit is the significant improvement in the quality of environmental data that results from the monitoring requirements of emissions trading programs. Typically, emissions are not monitored under command-and-control regulation since compliance is determined by inspection to ensure that (1) the mandated equipment is installed and working or (2) the mandated practices are being followed. The information obtained from monitoring under trading programs should contribute to better understanding of and solutions to remaining environmental problems.

18 See Ellerman et al. (2000), op. cit.

19 Byron Swift, "How Environmental Laws Work: An Analysis of the Utility Sector’s Response to Regulation of Nitrogen Oxides and Sulfur Dioxide under the Clean Air Act," Tulane Environmental Law Journal, XIV, 2 (2001), 309-425.

20 Suzi Kerr and Richard Newell, Policy-Induced Technology Adoption: Evidence from the U.S. Lead Phasedown. RFF Discussion Paper 01-14 (Washington, DC: Resources for the Future, May 2001).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.