A company’s scarcest resource isn’t capital or even talent, it’s top management time. No amount of money can buy a 25-hour day or create an extra week to wrap things up at the end of the quarter. Yet despite its value, top management time is rarely managed systematically. As a consequence, crises of the moment often push aside deep discussions of strategy and investment. Important decisions either get put off or made too quickly without adequate consideration.

Last fall, Marakon Associates, in collaboration with The Economist Intelligence Unit, surveyed senior executives from 187 large, multinational corporations worldwide to learn more about the effectiveness and productivity of top management team meetings. Confirming observations from our own experience, the survey found that the vast majority of executive teams manage their time together poorly. Specifically, the research revealed that at most companies:

- Top management spends relatively little time together as a team;

- Of the time top management does spend together, very little is dedicated to discussing strategy;

- When top management does discuss strategy, its time is often not prioritized effectively, leaving too little time to address the issues and opportunities that have the greatest impact on the company’s long-term value; and

- Even when top management does discuss strategy and its time is focused on the right issues, the dialogue is typically not structured to produce meaningful decisions quickly.

In short, top management time is squandered and executive teams frequently struggle to reach the quality of decisions at the pace required to produce consistently superior performance.

A small number of leading companies – Alcan, ABN AMRO, Barclays, Boeing, Cadbury Schweppes, Cardinal Health, Gillette, Lloyds TSB and Roche, among others – are managing executive time very differently. These companies approach top management’s agenda with the same discipline and rigor that they do capital investment planning or manufacturing process engineering. The leadership teams at these companies concentrate their time together on addressing the issues and opportunities that most drive long-term value, and employ rigorous decision-making processes to produce high-quality decisions quickly.

Drawing on recent research and client experience, this article will show just how widespread the problem of wasted top management time is and the severe penalties companies suffer as a result. It will then describe seven techniques that successful companies are using to exploit top management time, enabling their leadership teams to reach better and faster decisions.

How Valuable Time Is Squandered

More than any other resource, top management time is scarce and highly valuable. Decisions made by the CEO, COO, CFO and other top executives determine most companies’ strategies, and frequently these decisions are made as a team. Both the quality and pace of top management decision making is important. Obviously, poor decisions made too quickly will destroy value. But great decisions made too slowly can hurt company performance as well. Superior performance demands great decision making at pace and, therefore, it is essential that top management time be managed effectively (see appendix, "How Decisions Impact Company Value").

To understand just how top executives manage their collective time together, we conducted a survey (see sidebar on page 6 for research methodology) that sought to answer the following questions: How much time do top executives spend together as a team? How is their time prioritized and managed? And how effective do they feel their meetings are in driving strategic decision making? The survey findings offer some interesting insights into how effectively companies exploit their executive teams’ time.

While the companies surveyed competed in disparate industries ranging from telecommunications equipment to wholesale banking to consumer foods, and in different geographic markets, there was remarkable consistency in the views of top management regarding the effectiveness of executive team meetings. Unfortunately, our findings support what many executives have long suspected – that top management time is all too often spent discussing issues having little or no direct impact on company value. More important, top management team meetings often fail to produce the quality of decisions or the pace of decision making required to drive superior performance. Specific findings included:

1) Top management teams spend relatively little time together – At most large companies, top management does not spend much time together as a team. In fact, executives at the companies surveyed indicated that they spend only about two days per month together in management team meetings – approximately 250 hours each year.

2) Companies employ ad hoc agenda-setting processes – Frequently, top management’s agenda is not managed in any disciplined or systematic way. Indeed, at half the companies surveyed (51%), top management’s agenda is either static (i.e., exactly the same from meeting to meeting) or established using an ad hoc process. Many executives responded that management agendas at their companies are driven by the "crisis of the moment" (e.g., "We have a production problem in unit A. Therefore, this month we will focus top management on unit A"); based on historical precedent (e.g., "Every November we review our human resource policies…"); or designed to be egalitarian (e.g., "Everyone in the room will get his or her chance to speak"). Few of the executives surveyed (5%) indicated that their companies have a "rigorous and disciplined" process for ensuring that top management’s time is focused on the issues most impacting company value.

Moreover, who sets the top management team’s agenda is often not clear. As a result, it is often difficult to know how to get important issues in front of the group. At one company in our sample, top management’s agenda is set using a "first-in, firston" process – whereby the CEO’s secretary in effect sets the agenda by adding topics as they are phoned in by executive team members on a firstin, first-on basis. Not surprisingly, the top management team at this company frequently runs out of time before it has a chance to address the issues and opportunities with the biggest potential impact on the company’s long-term value.

3) Top management has too little time to address important strategic issues – There are many competing demands on top management’s time. All too often, crises of the moment and trivial administrative matters crowd out important strategy debates. On average, top management at the companies surveyed spend roughly three hours per month addressing strategic issues or making decisions regarding the company’s future strategic direction (including mergers and acquisitions). Top management’s time broke down like this:

|

Total Top Management Time |

250 hours/year |

|

Less: |

|

|

- Operating Performance Reviews |

62 |

|

- Crises of the Moment |

27 |

|

- Administrative Issues and Policy |

22 |

|

- Workforce Issues |

22 |

|

- Corporate Governance |

18 |

|

- Financial Policy |

14 |

|

- Investor Communications Guidance |

12 |

|

- Team Building |

11 |

|

- Succession Planning |

10 |

|

- Litigation |

6 |

|

- Community Service/Social Responsibility |

6 |

|

- Other |

3 |

|

Total Non-Strategy Time |

213 hours/year |

|

Time Remaining for Strategy Development/Approval |

37 hours/year |

Given the ad hoc process used to set priorities at most companies, it is not uncommon for 80% of top management’s time to be devoted to issues and opportunities accounting for less than 20% of a company’s long-term value. At one global financial services company, for example, top management spends more time each year

4) Top management meetings aren’t structured to produce real decisions – Even when the top management team is focused on questions of strategy, its time is often not structured to reach meaningful decisions. Indeed, most leadership team meetings (more than 65%) are not even intended to facilitate decision making. Instead, they are focused on "information sharing," "group input" or "group discussion." Is it any wonder then that few meetings (12%, according to our survey) consistently produce important strategy and/or organizational decisions, and most executives (56%) are not satisfied with the productivity and effectiveness of leadership team meetings at their companies?

The continued misappropriation of top management’s time can create a downward spiral: Insufficient time, combined with poor focus, produces few real decisions. Too few decisions, in turn, creates the perception that leadership team sessions have no real consequence – and therefore no value. Finally, the perception of wasted meeting time gives rise to the desire on the part of executives to spend even less time together in meetings – which, of course, results in even less time being made available for substantive decision making. Until this vicious cycle is broken, top management will be hard pressed to reach the quality of decisions at the pace necessary to drive exceptional value growth.

Seven Techniques for Exploiting Valuable Time

A handful of leading companies are managing executive time very differently, approaching the leadership team’s agenda with the same discipline and rigor as they do other management processes. These companies drive value growth by focusing top management’s agenda on the highest "valueat- stake" issues and then structuring top management dialogues to produce the greatest number of high-quality strategy and organizational decisions per minute of time spent meeting each year. These high performers have benefited from the multiplier effect that better decisions made quickly can have on financial results and, accordingly, have experienced significant increases in their value relative to industry peers.

Companies such as Barclays, Boeing and Cardinal Health have employed some or all of the following seven techniques to drive value growth through superior agenda management:

1) Spend more time together as a team – At some companies, top management simply does not spend enough time together as a team to enable them to address the number of important strategic and organizational issues they face. For these organizations, increasing the total number of hours the executive team spends together can result in a larger number of high-quality strategic decisions being made each year. While for most companies the total amount of time spent together is sufficient to reach the quality of decisions necessary to drive performance, for those that fall short in the number of hours top management spends together, allotting more time for meetings can accelerate value growth.

2) Deal with "operations" separately from "strategy" – Reviewing operating performance and making strategy decisions are very different things. They require a very different mode of discussion and a very different mindset among the top management team. One of the most important actions a company can take to exploit top management’s agenda is to separate the time dedicated to strategy from the time devoted to reviewing operating performance. In our experience, the companies that are most successful hold separate meetings, with separate agendas and different team members. This prevents day-to-day operations from dominating the agenda and frees up time for substantive strategy debates.

3) Focus on decisions, not discussions – Our survey indicates that the majority of top management meetings (65%) are not oriented to decision making. Instead, they focus primarily on sharing information, obtaining group input and discussion. A number of companies have increased the focus of top management by simply indicating, explicitly, what the purpose of each agenda item is. They do this by labeling each item "C" for communication of information, "I" for gathering of input and "D" for decision making. Once this delineation has been drawn, companies find it easier to use other means to communicate information and gather input in advance of each meeting. It also helps clarify top management’s role in growing the company’s long-term value.

4) Measure the real value of every item on top management’s agenda – If top management were presented with a list of five potential issues and it knew that one of them was worth 20 times as much as the other four combined, it would naturally spend its time addressing the issue with the highest value at stake. The problem is, most executives aren’t presented with issues in this way. As a result, the highest value-at-stake opportunities go unresolved. In fact, 48% of the executives surveyed indicated that top management team meetings at their companies frequently get sidetracked and run out of time before the most important strategic issues can be addressed.

Thus, one of the first steps in improving the quality and pace of decision making is to introduce greater discipline into the agendasetting process and set priorities based on value at stake. Top management’s agenda must be focused only on the issues and opportunities that will have the biggest impact on the long-term intrinsic value of the company. Issues with lower value at stake should be addressed at lower levels in the organization.

5) Get issues "off" management’s agenda as quickly as possible – Once the right issues are on management’s agenda, it’s imperative that clear accountabilities be established for whomever is responsible for helping the team reach closure on each issue. Just as important, an unambiguous timetable must be established detailing when and how a decision will be reached on each issue and who must be involved in approving the final strategy. Clear accountabilities and strict timetables prevent the decision-making process from getting bogged down and help ensure that decisions are reached in a timely manner. Put differently, companies that focus top management on growing long-term value have just as rigorous a process for getting issues off of top management’s agenda as they do for getting the right issues on the agenda in the first place.

6) Get real choices on the table – Perhaps the most important requirement for effective decision making is the presentation of viable strategy options. Management must have at least three alternatives before any strategy should be discussed or approved. These must be real alternatives – not +5%/–5% options. Our research suggests that this practice is the exception rather than the rule at most companies. Only 14% of the executives surveyed said they are consistently presented with alternatives when considering questions of strategy.

Many companies find it helpful to separate top management’s discussion of alternatives from its ultimate selection of the best strategy. This practice has two benefits: First, it allows all viable alternatives to be put on the table – in essence, getting top management buy-in to the fact that all alternatives are being considered. Second, it can improve the selection process by giving top management confidence that the alternatives have been thoroughly evaluated before the recommendation was reached.

7) Make decisions stick – Often, the biggest challenge a top management team faces is agreeing on what was agreed in the meeting. Indeed, unless strategic decisions are translated into something tangible, they frequently become subject to reinterpretation or, worse yet, fall victim to "silent veto."

|

Research Methodolgy In the fall of 2003, Marakon Associates, in collaboration with The Economist Intelligence Unit (EIU), conducted a global survey of top executives (e.g., CEO, COO, CFO, business unit heads, etc.) who work for companies with market capitalizations of at least $1 billion. Representatives from 187 companies responded. The survey was designed by Marakon Associates and conducted by the EIU over the Internet between late August and early September 2003. The survey included 19 questions (14 content questions, five profiling questions). Content questions focused on:

The profile of the survey respondents broke down as follows:

|

Successful companies make the strategic decision-making process consequential by tying resource allocation to strategy approval. For these companies, the outcome of strategic planning is a "performance contract" that specifies the resources (time, talent and money) that will be required to execute the strategy, as well as the performance that management commits to delivering over time. This process makes strategic decisions stick. Moreover, performance contracts make strategy delivery easier to track. Over time, a business’ performance can be monitored relative to the terms of its contract. If a business fails to achieve its contracted level of performance, then the strategy goes back on top management’s agenda for reevaluation and eventual course correction.

These seven techniques are by no means the only ways to improve the quality and pace of executive decision making. But they are simple changes that can have a big impact on a company’s long-term financial performance and value.

Concluding Remarks

The single most important constraint on the rate of value growth at most companies is the number of high-quality decisions top management can reach in the limited time it spends together each year. Few companies recognize this important constraint or put processes in place to deal with it effectively.

Were companies to think about top management time as their most precious resource, the processes they employ to develop and execute strategy would be very different from the ones typically seen at most large companies. Instead of strategic planning being about top management "off-sites" or "planning books," for example, it would be about ensuring that the top management team focuses its time and attention on addressing the most important issues, on considering all of the viable alternatives and on making the best possible choice in the shortest period of time. Accordingly, top management’s agenda would be systematically managed and continually "refreshed" – getting the right issues on and off the agenda as quickly as possible. In short, strategic planning would be designed to exploit valuable time and drive better decisions, faster.

Appendix: How Decisions Impact Company Value

To illustrate the impact of decision-making quality and pace on company value, imagine the following scenario:

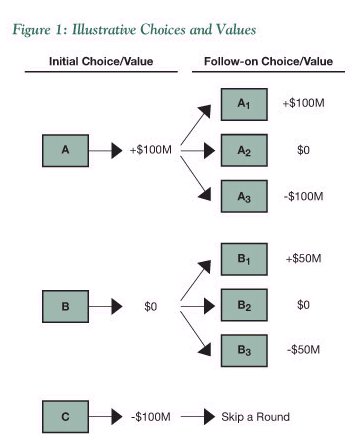

The top management team at a large corporation is presented with three strategic choices – Choice A, B and C – and each of these choices has a different impact on the company’s long-term intrinsic value.1 Choice A will increase the value of the company by $100 million; Choice B will have no impact on the firm’s value; and Choice C will reduce the company’s value by $100 million (see Figure 1).

Every time the top management team makes a decision, it has the opportunity to make a follow-on decision. But the payoff associated with this follow-on choice depends on the quality of the team’s initial choice. For example, if top management selects Choice A in the first round, then the value of the company will increase by $100 million and the team has the opportunity to make another choice (in Round 2) with a similar range of potential payoffs – +$100 million, $0 and -$100 million. If, on the other hand, the top management team selects Choice B in the first round, then the company’s value will not change, and the team can make another choice in Round 2. But in this case, the range of payoffs is smaller – let’s say +$50, $0 and -$50. Finally, if management selects Choice C in Round 1, then it loses $100 million and must skip a round before making another decision. In other words, the team makes no choice in Round 2, but can resume the selection process in Round 3.

This simulation can be run for any number of rounds, depending on the number of decisions the management team can make in a specified period of time. For the purposes of our example, we start with an "average" company with a beginning market value of around $300 million. If we assume that the top management team at this company has decision-making processes in place that enable it to select Choice A 40% of the time – with the remaining 60% split evenly between Choices B and C – and the team makes four major choices per year (one per quarter), then the expected improvement in value over five years would be $152 million. This improvement would be equivalent to roughly a 9% return (about what investors are expecting for the average company in today’s low-interest rate environment and, therefore, the company’s cost of equity capital).

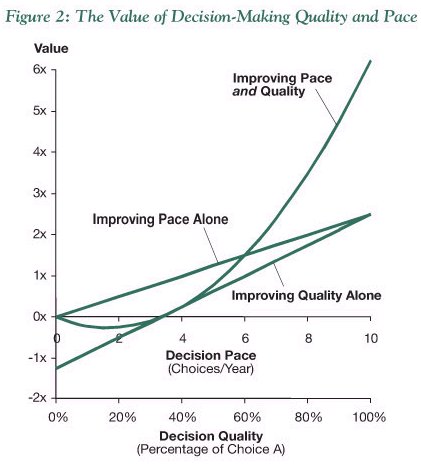

In this example, top management can increase the value of the company over time in one of two ways: (1) It can focus on improving decisionmaking quality and strive to choose Choice A a higher percentage of the time; and/or (2) it can focus on accelerating decision-making pace and strive to make more choices (at the same level of quality) in a given period of time. How much (and when) does the quality and pace of decision-making affect long-term value? Our simulation suggests the following (see Figure 2):

1) The quality of top management decision making drives value growth – Decision-making quality impacts value significantly. In fact, for the "average" company described above, improving quality from 40% to 50% would more than double the value of the company in just five years – increasing value growth from 9% (the cost of equity capital in our illustration) to more than 19%.

For companies that face choices with significant downside risks (that is, where making the wrong choice can have a substantial negative impact on company value), improving decision quality is vital. Top management will almost always be better off taking additional time to make decisions in order to improve the quality of the result in these cases. This may explain why companies like Boeing are painstaking in their approach to new airplane programs and why Dow Chemical thoroughly debates every new ethylene plant. In these cases, the capital markets reward decision-making quality.

2) The pace of top management decision making drives value growth – Decision-making pace also impacts value, and probably more than most executives realize. In our illustrative simulation, the same "average company" could double its value in just five years by accelerating the pace of top management decision making from four decisions per year to eight decisions per year – taking value growth from 9% to roughly 16%.

For companies in fast-moving industries – such as software and telecommunications equipment – improving the pace of decision making is even more critical. In these industries, decisionmaking throughput not only determines a company’s future options, but also the payoffs associated with its current set of choices. In other words, when executives speak of a "window of opportunity," they are referring to the limited time available to make a first-round choice. If management misses this window, then it will not have the ability to make future choices, and the payoff associated with its current set of choices will be diminished. Accordingly, companies like Cisco Systems and Veritas Software strive to make decisions quickly and learn from their mistakes rather than take longer to develop better information and lose any first-mover advantage. In these cases, the capital markets should reward decision-making pace.

3) There is a multiplier effect between decisionmaking quality and pace – For management teams that succeed in improving both the quality and pace of their decision making, the impact on value can be magnified through a multiplier effect. For example, in our simulation, of the same "average" company were able to improve the quality of decision making from 40% to 60% and accelerate the pace from four to eight decisions per year, then the company’s value would increase more than five-fold in five years, and shareholder returns would improve from 8% to more than 40%!

This is a key reason why companies like General Electric and Cardinal Health in the U.S. and Lloyds TSB in the U.K. consistently produce superior performance year after year. These companies have management processes that focus the leadership team on making the highest number of high-quality strategic decisions each year. GE, Cardinal and Lloyds have all exploited the multiplier effect of better and faster decision making to accelerate their value growth. Top management at these companies has discovered that the quality of leadership’s decisions need not trade off with the pace of the team’s decision making. In fact, many companies find that the more decisions top management makes each year, the better it becomes at making decisions – further amplifying the effect of the quality-pace value multiplier.

The conditions described in our simple illustration mirror the situation top management teams face every day. Indeed, teams are constantly confronted with important choices, all with different potential payoffs (both positive and negative). The quality and pace of their decision making has a direct impact on company value as well as the value of future options. Great decisions create more valuable options than okay decisions, and okay decisions create more valuable options than poor decisions. Furthermore, great decisions made quickly create even more valuable options than great decisions made slowly.

Business is a game of choices. To be assured of winning, top management must formulate the best possible strategy alternatives and make the best possible choices faster than competitors.

Footnote

1 Intrinsic value is the present value of expected future cash flows over the remaining life of the business.

Michael Mankins is a Regional Managing Partner in Marakon's San Francisco office. He can be reached at mmankins@marakon.com.

Marakon Associates advises some of the world’s best-known companies on the issues that most drive their performance and long-term value. The firm’s focus on value creation enables it to bring an original, independent view and unique expertise to the critical challenges business leaders face. Marakon has offices in Chicago, London, New York, San Francisco and Singapore.