The pharmaceutical and biotech industries are constantly developing, testing and patenting new medicines and drugs for release into the market. Artificial intelligence (AI), a powerful tool that can aid in addressing complex challenges, has been increasingly used in the pharmaceutical and biotech industries. AI and data analytics have been contributors to pharmaceutical research and development (R&D), specifically, in early drug discovery and designing successful clinical trials. This blog post will provide a breakdown of the involvement of AI within the R&D process of pharmaceutical and biotech companies and offer guidance on how its usage can be captured as part of the R&D tax credit.

Use of AI in Early Drug Discovery

During the early drug discovery process, identifying a development candidate usually requires an extended period of research. By incorporating supervised AI learning, pharmaceutical and biotech companies have significantly decreased the amount of time it takes for them to identify a development candidate. Supervised AI learning analyzes biological data to aid in identifying potential drug targets and can predict the activity and properties of a new drug candidate.1

Use of AI in Design of Clinical Trials

Designing effective clinical trials can be challenging and time consuming for pharmaceutical and biotech companies. The use of AI has helped companies streamline the preparation process of clinical trials and patient selection. By using predictive modeling, AI can leverage historical clinical trial data and patient characteristics to predict patient response, treatment efficacy and safety outcomes.2

Capturing AI Usage for the R&D Tax Credit

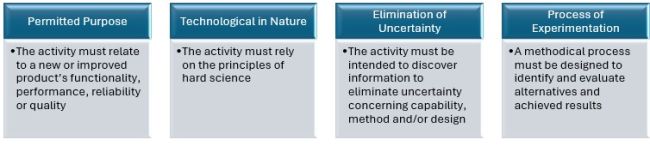

In order for activities conducted by a pharmaceutical and biotech company to qualify for the R&D tax credit, it needs to meet the IRS 4-Part Test:

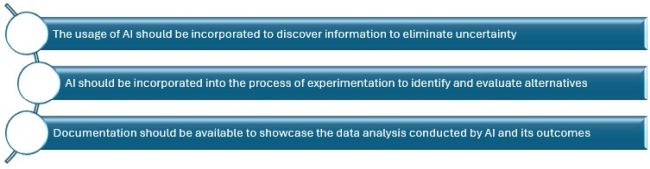

To capture the usage of AI for the R&D tax credit, pharmaceutical and biotech companies should be aware of the following:

Conclusion

Overall, AI will continue to be a key component to streamlining R&D for pharmaceutical and biotech industries. If your company uses AI as part of its R&D process and you want to accurately capture the efforts as part of your R&D tax credit claim, it is crucial to partner with a trusted tax advisor. .

Footnotes

1 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10385763/#sec3-pharmaceutics-15-01916title.

2. Ibid.

Originally published by 27 March, 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.