Introduction

Women and Minority-owned Business Enterprises (W/MBEs) are one of the fastest growing — and least understood — sectors of the U.S. economy. While precise definitions of these corporate entities vary across various governmental and private sector groups, they are generally defined as businesses that are at least 51% owned, controlled, and managed by women or members of socially and economically disadvantaged minority groups. Defined as a unique sector in the late 1960s and formalized by a 1971 U.S. Executive Order, W/MBEs have grown to encompass approximately 7% of U.S. gross business receipts and are growing at an annualized rate nearly double that of the U.S. economy.

Despite this phenomenal growth rate, few industrial and commercial vendors have developed formal programs that cultivate and target W/MBE channels as part of their go-to-market approach. The failure to develop formal channel coverage programs, typically linked to the inherent definitional complexity of the W/MBE structure, provide competitors with a perfect opportunity to gain presence in this high growth channel. And channel presence — particularly in high growth channels — is the key to growing market share.

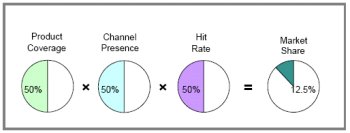

Figure 1: Frank Lynn & Associates' PPH " Model

|

Figure 1: In Frank Lynn & Associates' PPH" model, market share is the product of three factors: Product Coverage, Presence, and Hit Rate. Gaining presence within a high growth channel — such as W/MBEs — is one of the most efficient and effective methods of gaining market share. |

While W/MBEs derive significant sales volume without leveraging their special status, as a group, they are defined by their ability to participate in governmentally legislated "set aside" programs and voluntary private sector corporate "vendor diversity" programs. Both private and public sector initiatives are typically defined by an allocation of a certain percentage of governmental or corporate purchases to W/MBE suppliers. Because these programs do not typically restrict W/MBE purchases to specific product or service categories, they apply to every purchase category — making a W/MBE market coverage program relevant to manufacturers and service providers targeting virtually every industry sector.

Governmental W/MBE "set aside" programs are present in all sectors of the U.S. Federal Government, in 27 state-level governmental purchasing programs, and in hundreds of city, county, and regional governmental purchasing programs. Private sector "vendor diversity" programs are present in hundreds of corporations, including 25% of the Fortune 500. With this combination of support structures, W/MBEs are taking an increasingly important role in the marketplace, especially as U.S. demographics shift toward greater consumer diversity. With minority group purchasing power predicted to exceed one-third of the nation's total by 2045, private sector vendor diversity programs are expected to grow in importance as businesses court an increasingly diverse population.

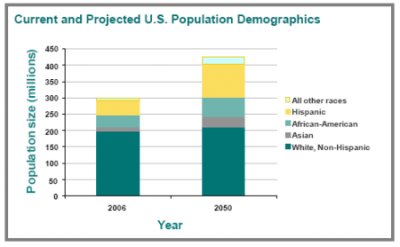

Figure 2: Current And Projected U.S. Population Demographics

|

Figure 2: The U.S. marketplace is predicted to experience dramatic growth and demographic change over the next several years. As more corporations develop strategies to capitalize on these changes, vendor diversity programs are likely to become more prevalent in the private sector — further boosting the W/MBE growth rate. |

Targeting The W/MBE Opportunity: A Formula For Growing Market Share

One of the challenges manufacturers face in establishing a W/MBE strategy within the context of their business is that 1) there are a wide range of W/MBE opportunities and 2) W/MBE opportunities are not defined by specific products and services — but by the ownership structure of the business entity that provides the product or service. Understanding the relevance and significance of this channel to your business requires careful consideration of the three primary "targets" that define the overall W/MBE opportunity within the overall U.S. economy.

Figure 3: Common Approaches That Target The W/MBE Opportunity

|

Figure 3: Manufacturers evaluating their growth prospects within this marketplace must evaluate their product and service portfolio for alignment with one or more of the three primary W/MBE "opportunity targets". |

Public Sector "Set Aside" Opportunities

This target defines the degree to which your products and services are sold to the public sector — particularly within states, counties, and cities that have significant structured W/MBE "set aside" programs. Public sector purchases are varied and wide ranging — encompassing purchases made by various governmental entities including schools, universities, hospitals, public works departments, administrative groups, and cross divisional purchasing entities.

W/MBE opportunity within the U.S. Federal Government is primarily addressed by "set asides" established by the U.S. General Services Administration (GSA), the U.S. Small Business Administration (SBA) and various branches of the U.S. Military. Such programs stipulate specifically that up to 25% of federal government contracting be set aside for firms that fall under the SBA's definition of a "small business" — a definition that varies by industry classification. The 25% objective is further divided into sub-classifications, including a 5% goal for sourcing by women-owned small businesses, a 5% goal for sourcing by small businesses owned by members of socially and economically disadvantaged groups, a 5% goal for small businesses that operate in a historically underutilized geography, and a 3% goal for small businesses that are owned by service-disabled veterans.

Opportunity at the state level is centered in 27 states that sponsor statewide W/MBE development programs. Program goals vary widely by state. Ohio, which has one of the nation's most formalized programs, states a goal that 15% of its eligible goods are to be purchased by W/MBEs. Illinois maintains a goal of 19% of state procurement for W/MBEs, and Pennsylvania has informal goals of 10% on state-financed construction contracts and 5% on overall procurement. State-level "set aside" planning, as well as announcements and results of public bids, are typically posted on the official website of each participating state.

Opportunities on the county and municipal level — prominent in some of the largest entities — rival those of many states. Nine of the ten most populous U.S. cities sponsor define W/MBE "set aside" programs. The City of Chicago has certified approximately 3,000 W/MBE contractors. The Kansas City, MO School District lists a chart of recommended goals per category based on minority group and segment. Many large county governments — often charged with regional health care, public safety, and infrastructure responsibilities — also get into the act. For example, Illinois' Cook County — which, at a $3.2 billion 2008 budget, approaches that of Minnesota — mandates that 25 percent of public work contracts go to minority-owned businesses (MBEs) and 10 percent to woman-owned businesses (WBEs).

Simply put, if your product or service is consumed within the context of federal, state, county, or municipal government contracting, your go-to-market planning must include an overarching W/MBE presence strategy.

Figure 4: State-Level W/MBE Programs:

|

Figure 4: W/MBE "set aside" programs exist within the U.S. Federal Government, within 27 states, and in hundreds of municipal, county, and regional governments. W/MBE "vendor diversity" programs exist within 25% of the Fortune 500 and in thousands of other private enterprises. Altogether, W/MBEs represent up to 7% of U.S. business receipts and are growing at twice the rate of the U.S. economy. |

Private Sector "Vendor Diversity" Opportunities

The second relevance target is the degree to which your products and services are sold to the private sector companies that actively sponsor so called "vendor diversity" programs. Vendor diversity programs are voluntary initiatives established by corporations to ensure that their supplier base and contracting levels meet predefined criteria. Diversity criteria include women and minority owned businesses, small businesses, businesses that are headquartered or present within a specific geography, and other related factors. Such programs are typically managed within the corporate purchasing function, and give vendors who meet diversity criteria an edge over other contractors — when all other factors are equal.

Corporations with vendor diversity programs tend to fall into the following broad categories:

- Large, consumer-facing corporations Examples: auto

manufacturers, consumer packaged goods manufacturers

- Corporations operating in government-regulated industries

Examples: financial services, utilities

- Corporations with significant federal, state, and

municipal contracts Examples: energy, defense, IT, business

services, and office supplies

While the definition of the vendor diversity target is somewhat looser than that found within the public sector, the widespread presence of these programs warrants significant investigation for most product and service providers. At a minimum, firms must define the presence, absence, or emergence of vendor diversity programs within their largest accounts or most prominent opportunities. Firms with formal W/MBE strategies in place go beyond a basic scan — they incorporate vendor diversity into their formal account retention and acquisition strategies.

Supplier Diversity programs suffer from a significant misconception: that they are a form of "corporate charity", designed to help disadvantaged persons and businesses get a leg up in the marketplace. This is far from the truth. In fact, while Supplier Diversity programs make for good public relations, the policies are designed to capitalize on an expanding pool of consumers. For regulated companies or those that do business with the government, political pressure demands a focus on diversity. For companies that focus on the private sector, especially in consumer products, Supplier Diversity programs are a marketplace expectation; large companies without a such a program may well be at a disadvantage.

Many major corporations publish their W/MBE sourcing policies — providing manufacturers with a tailor made account management entry strategy. Some of the largest corporations with supplier diversity programs are members of the "Billion Dollar Roundtable". Founded in 2001, this group includes corporations that spend over $1 billion with W/MBEs and demonstrate best practices in a diverse supply chain. The current members include Altria Group, Inc., AT&T Corporation, Daimler/Chrysler Corporation, Ford Motor Corporation, General Motors Corporation, IBM Corporation, Johnson Controls, Inc., Lockheed Martin Corporation, The Procter & Gamble Company, Toyota Motor Manufacturing North America, Inc., Verizon Communications, Inc. and Wal-Mart Stores, Inc. Vendors doing business with these and other companies with strong vendor diversity programs should be aware of the state of their W/MBE channel program — and ignore this concept at their own peril.

Products And Services With Strong W/MBE Presence

The third relevance target is focused on the types of products and services that represent a preponderance of W/MBE contracting. Industry research reveals that W/MBEs tend to focus in four primary industries: healthcare products and services, building construction and maintenance, public infrastructure construction and maintenance, and product distribution and wholesaling. Not surprisingly, these product and service categories are also the largest categories within the U.S. economy as a whole — suggesting that W/MBEs are broadly represented in the U.S. marketplace, and providing further justification for the importance of W/MBE market coverage.

Within this context, "hypercompetitive" and "high value" commodity categories — where all participating vendors offer similar pricing, service levels, and product ranges — are particularly relevant within an overarching W/MBE coverage strategy. In these categories, the presence of a supplier or distributor W/MBE certification can make the difference between winning and losing. Because of the economic sensitivity inherent in such contracting, manufacturers and service providers must be acutely focused on a strategy that "picks the winners" — and does so within the context of W/MBE "tiebreakers".

The Future Of W/MBEs And What This Means For Your Company

Despite the tremendous growth in public and private sector "set aside" programs, the subject is not without controversy. Since its inception, there have been several high-profile court cases and legislative debates where "set-aside" policies have come under fire at the federal, state, and city levels. While such rulings have changed the tenor of W/MBE contracting in some geographies — such as the shift in public sector legislation terminology (from "requirement" to "goal"), political influence and inertia have maintained status-quo purchase levels for W/MBE contractors. Political pressure and marketplace demands ensure that meeting a W/MBE "goal" is just as important as meeting a W/MBE "requirement".

For example, despite terminating its state-wide W/MBE program in 1998, California remains one of the strongest states for W/MBE development; regional councils such as the Southern California Minority Business Development Council have become extremely influential in the absence of state guidelines. The continued growth of W/MBE businesses proves an important point — these businesses are here to stay and will continue to represent a significant coverage channel for manufacturers and service providers seeking to build market coverage.

Because the number of W/MBEs is increasing at a far faster rate than U.S. businesses as a whole, and because minorities are projected to play a far more significant role in the U.S. economy moving forward, it is clear that W/MBE status will continue to be a critical "tie breaker" in competitive governmental and private sector opportunities. Vendors without a W/MBE coverage strategy will be at a strategic disadvantage — particularly within certain geographies, product categories, and market segments.

Market Coverage 101 — Incorporating W/MBEs Into The Channel Mix

Even if your company does not have a formalized W/MBE coverage program, it is likely that some of your highest performing sales resources have incorporated W/MBE coverage into their daily account management practices. The first step in designing a W/MBE program is to recognize these "unidentified" channel opportunities within the company's current channel mix, and determine the level of business that accrues to the corporation on the basis of their W/MBE status. In many cases, only a small percentage of the success these channels have enjoyed is a direct result of their W/MBE status.

The second step revolves around defining the W/MEB opportunity that exists within major end-use accounts — particularly those deemed to be "at risk" and those that are included as part of major business development efforts. Whether these accounts are public or private sector, the account team must assess the potential benefit that will accrue if a specific W/MBE channel partner is leveraged within the account. Because W/MBE status is primarily a "tie breaker", the account team must be focused on defining value — they must not simply rely on the presence of a W/MBE channel to win the account.

The third and final step looks out into the marketplace to assess the overall coverage the company enjoys within relevant W/MBE channels. This activity is typically conducted as part of a local market management exercise — in which the corporation assesses all potential channels within a given geography for their overall impact on sales and their potential fit within the company's overall and geographic strategy. If no W/MBE channel exists, or none is available to the company within a given geography, the vendor must assess the costs and benefits of creating a W/MBE channel to target potential opportunity.

With the tactical process of incorporating W/MBE into the overall sales flow completed, vendors have the opportunity to leverage their W/MBE strategy by incorporating it into executive business development and marketing communications activity. Such efforts can create substantive good will among public and private sector accounts and serve as a formidable barrier to brand switching and account poaching by ill-prepared competitors.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.