The 1908 Model T was one of the first cars accessible to the masses. Car ownership continued to grow to the point where cars became a staple, so much so that by the 21st century, there were more vehicles in the United States than people with driver's licenses. But nearly a century later, the automobile market was over-saturated and the number of combustion-engine vehicles began to drop for the first time. During this decline, viable alternatives to combustion-engines emerged.

However, battery-powered electric vehicles (EVs), the main contender to combustion-engines, are hardly a staple item in 2022. According to a 2021 report, only 7% of U.S. adults said they currently own an electric or hybrid vehicle. This article series explores what else is needed for more consumers to transition to EVs and highlights opportunities for innovation to make the "staple EV" a reality.

All Electric by 2030

There are indicators that EVs will eventually comprise nearly 100% of total vehicles. For example, policy makers try to stimulate EV production through strict emission standards. And most major automakers have announced plans to electrify their vehicle fleets, as well as continue to advertise their current EVs. Not only are some car companies transitioning to all-electric, but there is an increasingly high number of start-ups exclusively producing EVs. Internationally, countries are offering cash rebates and tax bonuses for EV consumers.

Substantial investments back these promises. For example, one governor proposed to include a $10 billion investment in EVs over the next six years. One major automaker will invest $7 billion in EV projects. Even alliance partners are expected to announce plans to invest over $23 billion to jointly develop EVs, with a goal to offer more than 30 new EVs by the end of the decade.

Why the Hold Up?

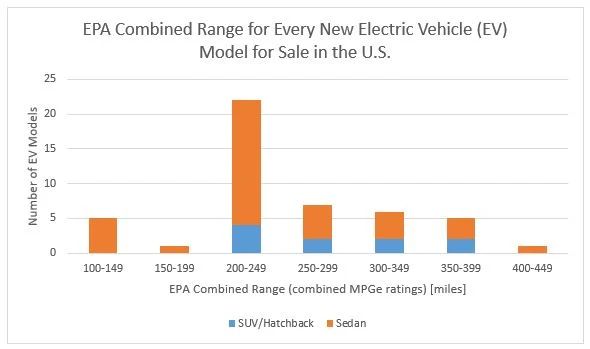

Perhaps the main reason there is yet to be a "staple EV" is due to what has become coined "range anxiety." Just like combustion engines powered by gasoline, EV batteries provide the EV with enough power to travel a specific distance, i.e., range, before needing to be charged. The most common type of charging can take anywhere from 4 to 12 hours. The weather can impact range, either due to impacts on battery performance or increased power usage to heating or cooling the EV. Below is a chart depicting the range of most EVs on the market.

Chart 1: EPA Combined Range for Every New Electric Vehicle, (Motortrend Car Lists, data available at, 2021 SUVs/Hatchbacks and 2022 sedans)

As illustrated in the chart above, most EVs have a range between 200-249 miles before needing a charge. Range anxiety is less of a problem for consumers who rarely travel long distances. A 2020 report divided the United Kingdom automotive market into nine segments, with the largest representing drivers who rarely travel long distances. However, there are still millions of long-distance commuters. That segment of the United Kingdom, along with all other long-distance drivers, need a solution to range anxiety.

Two Major Opportunities for Growth and Innovation

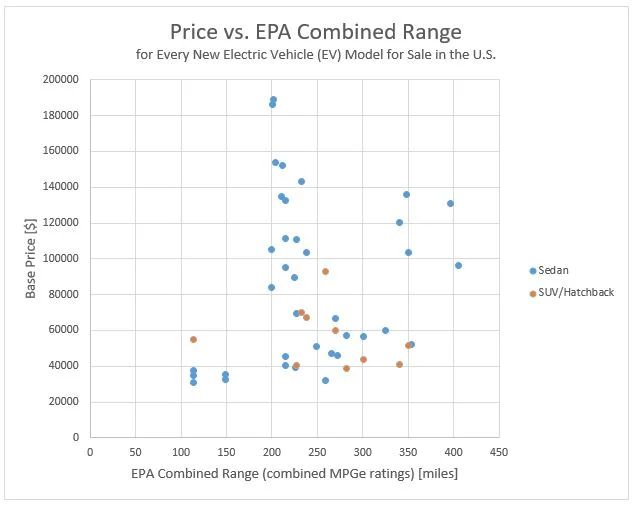

Two approaches to reducing range anxiety are 1) improvements to battery technology, and 2) ubiquitous fast charging infrastructure. Battery technology continues to improve, which is why some vehicles have a range in the 400-449 miles category in the chart above. However, as seen in the chart below, few EVs have the highest ranges and cost more than EVs with less range. But since there are a number of different kinds of EV battery systems used today, and many with different temperature regulation systems, there is ample opportunity for innovation to raise the average EV range.

Chart 2: Price vs. EPA Combined Range, (Motortrend Car Lists, data available at, 2021 SUVs/Hatchbacks and 2022 sedans)

Ubiquitous, fast charging infrastructure may also be a solution. Similar to batteries, there are many different charging solutions on the horizon and because not one has dominated, each possible solution has room for improvement. For example, easy to install personal chargers have been developed, however, a significant portion of urban populations do not have the space or ability to install a personal charger. Lack of convenience due to long charge times limits the gas station model, leading to a need for "fast chargers" or a new business model.

The Opportunities Ahead

To make mass market EV adoption a reality by 2030, ambitious start-ups and established companies alike will need to collaborate with government to develop and launch solutions that make the EV user experience better than combustion-engines in every way. This series will continue to explore the potential solutions and opportunities for innovation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.