On October 31, Governor Malloy signed into law changes to the Connecticut estate and gift tax. This legislation reduces estate and gift taxes as follows:

- For gifts made and estates of decedents dying during calendar year 2018, the Connecticut exemption increases to $2,600,000.

- For gifts made and estates of decedents dying during calendar year 2019, the Connecticut exemption increases to $3,600,000.

- For gifts made and estates of decedents dying beginning January 1, 2020, the Connecticut exemption will equal the then-applicable federal exemption amount. The federal exemption is adjusted for inflation each year and is currently scheduled to increase to about $11,200,000 as of January 1, 2018 assuming that the new tax law is signed by the President.

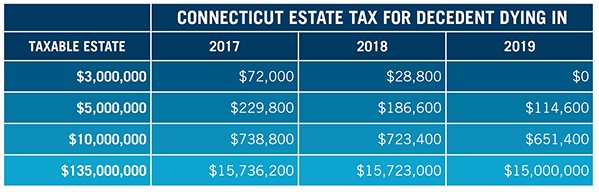

The new law also made minor changes to its estate and gift tax rates. Also, the cap on the maximum Connecticut estate or gift tax imposed will decrease from the current amount of $20,000,000 to $15,000,000 as of January 1, 2019.

The following chart illustrates the effect of these changes on the amount of tax due:

What does this mean to you?

For Connecticut residents whose documents already take into account the difference between the state and federal estate tax exemptions, no changes should be needed. However, married couples may wish to review whether changing title to some of their assets is necessary in order to take full advantage of the increased exemptions. If you have not updated your documents in the last few years, this may be an appropriate time for a more comprehensive review of your estate plan to ensure that it still meets your estate planning needs and objectives. Please contact us if you would like to discuss how these changes may affect you.

In addition, if you have previously made taxable gifts up to the limit of your Connecticut gift tax exemption, this may be an appropriate time to begin considering additional gifts to use the additional Connecticut exemption. Please contact us if you would like to review effective strategies for using your increased exemption.

New Jersey residents should be aware of the changes to the New Jersey estate tax, as described in our recent update (go to http://bit.ly/EPUOct2016).

Click here to read further Insights from Day Pitney

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.