Introduction

Since a ramp-up in enforcement actions over the past decade, the Securities and Exchange Commission (SEC) has settled an average of 10 Foreign Corrupt Practices Act (FCPA)-related cases on an annual basis from 2007-2012, with settlement amounts (including disgorgement, penalties, and fines) averaging just under $29 million.1 Previous research in this area has noted that the economic impact of FCPA enforcement actions can extend beyond the immediate settlement amounts.2

However, even in FCPA enforcement actions in which the fines, penalties, and/or lost business can be substantial, there is a notable lack of direct impact on financial statements of public companies. Many market observers might expect important negative developments in a company's business to result in financial reporting consequences, such as a restatement or an asset impairment. Yet, despite pairing the illegality of the act of bribing a foreign official with accounting provisions (known as the "books and records" and "internal controls" provisions) in the FCPA, the financial statement impact of FCPA enforcement has, to date, generally been limited to recognition of settlements with the SEC and/or Department of Justice (DOJ) as an expense recorded at the time of settlement. We explore the potential reasons for this limited impact on financial statements below.

FCPA Enforcement and Financial Statements

There are two periods during which a company's financial statements might be affected by FCPA-related regulatory actions: the financial statement impact during the period of alleged misconduct, and the financial statement impact during the period of investigation and subsequent enforcement/settlement. These periods occasionally overlap.

In general, the target company in an FCPA-related regulatory action is accused of bribing foreign officials during the period of the alleged misconduct, presumably in order to increase revenues and profits. Potential effects on financial statements during the period of alleged misconduct typically include:

- Mischaracterization of bribery-related expenses.

- Overstatement of current revenues.

- Potential need for a restatement.

For the period during and following the investigation and settlement, potential effects on financial statements include:3

- Additional expenses, including fines, penalties, disgorgements, and legal fees.

- Potential impairment of specific assets resulting from reduced cash flows and lost business.

We examined the SEC filings over the course of FCPA enforcement actions for two publicly traded companies whose common stock prices experienced declines following FCPA-related news: Siemens AG ("Siemens") and CNH Global N.V ("CNH"). Siemens' stock price declined by 5.36%4 following the resignation of its CEO after an investigation into alleged FCPA violations,5 while CNH's stock price declined by 7.68%6 following the announcement of its settlement with the SEC regarding its alleged FCPA violations.7

Notwithstanding the discussion above, the financial statement impact of FCPA enforcement actions is often limited. With our two sample cases, no asset impairments or restatements were reported. Instead, the accounting consequences were limited to legal and administrative costs of defending the enforcement action, and the disgorgements and fines associated with settlement.

CNH reported a $17.81 million settlement expense compared to a decline in market capitalization of equity of $291 million. Siemens reported $800 million in settlement expenses and $514.98 million in investigation expenses compared to a decline in market capitalization of equity of $5.9 billion.

Restatements and FCPA Enforcement

FCPA violations usually do not result in restatements of companies' financial statements. The reasons for a general lack of restatements could include:

- Except for possible reclassification issues, costs incurred and revenues recognized during the period of alleged FCPA violations are generally correctly recorded in the appropriate periods.

- Settlement and investigation expenses are generally correctly recorded in the periods in which they were incurred.

- Any impact of the discovery and cessation of alleged FCPA violations would affect future business prospects rather than the past.

- Current disclosures of any potential impact of alleged FCPA violations might be considered to be sufficient.

Asset Impairments and FCPA Enforcement

In addition to restatements, market observers might expect that an event with a negative impact on a company's prospects could lead to an asset impairment. However, asset impairments generally involve reducing the book value of recorded assets that are deemed to be overstated under GAAP. In the case of FCPA enforcement actions, there are reasons such impairments are not recorded. In particular, something that may surprise some non-accountants is that the market value of a company's core operations—in contrast to its acquired subsidiaries—generally does not appear on its own balance sheet. To understand this, it is instructive to examine how market value relates to book value for a company's core operations.

Consider the hypothetical example below. At inception, the market value of Company A is equal to the initial $10 million equity investment by its founder. After Company A matures, the market value of the company increases beyond the book value of its net assets based on the discounted cash flow of projected future profits. However, GAAP dictates that a company cannot recognize this generated market value in its financial statements. Thus, while the market value of Company A might increase to $20 million, only $10 million in book value of net assets would be recorded in the financial statements.

Consider the possibility that an FCPA-related regulatory action decreases Company A's market value from $20 million to $15 million. Because this reduced market value is still greater than the recorded book values of net assets, the reduction would not likely result in a GAAP-based impairment. Thus, the financial statements would continue to show book value of net assets of $10 million.

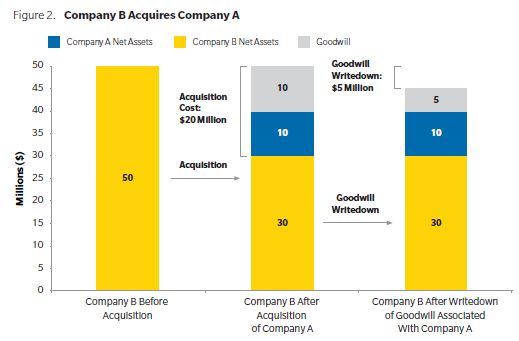

The question then arises as to whether an asset impairment could ever occur. The answer is yes, albeit with the caveat that the circumstances are quite specific. Let's assume that another hypothetical company—Company B—acquires Company A at a price equivalent to its $20 million market value immediately following its period of market value growth and prior to its FCPA violation. Let's assume that Company A operated as a wholly-owned subsidiary of the acquiring company following the acquisition. This acquisition is diagrammed below.

Observe that the acquisition of Company A leads to the recognition of the excess of its market value over the value of identifiable net assets on Company B's balance sheet in the form of goodwill. This $10 million in goodwill is generated based on the difference between the purchase price of $20 million and the amounts that were assigned to Company A's identifiable net assets when Company A was acquired. When the FCPA violation is subsequently discovered in the acquired Company A unit, a goodwill impairment of $5 million would likely need to be recognized pursuant to GAAP.

Conclusion

There is a notable lack of financial statement consequences associated with FCPA enforcement actions, despite the prominent books and records and internal controls provisions in the FCPA. Market observers should not be surprised at these findings. The roots of this phenomenon lie in the nature of accounting rules that form the basis of US GAAP. This suggests that a certain amount of analysis from both a financial and accounting perspective is required to understand the implications of an FCPA enforcement action on a company's financial statements.

Footnotes

1 Based on NERA's proprietary database of settlements and judgments in Securities and Exchange Commission (SEC) enforcement actions.

2 Conroy, Patrick, Wong, Raymund, "FCPA Settlements: It's a Small World After All," NERA Working Paper, January 28, 2009 (Published in Kroll Global Fraud Report, Issue 8, March 2009). See also Conroy, Patrick, Hunter, Graeme, "Economic Analysis of Damages under FCPA," NERA Working Paper, June 15, 2011.

3 Note that one potential important non-financial statement impact is any reduction in future revenues resulting from cessation of the allegedly illegal activity.

4 From a closing price of $124.42 on April 24, 2007 to $117.75 on April 25, 2007. There were 891,086,826 shares outstanding as of September 30, 2006 according to the company's 20-F filed December 11, 2006, implying a total decline in market capitalization of equity of approximately $5.9 billion.

5 "Siemens Chief to Stand Down as Company Battles Scandal," Deutsche Well, April 25, 2007.

6 From a closing price of $16.02 on December 19, 2008 to $14.79 on December 22, 2008 (December 20, 2008 and December 21, 2008 were not trading days). There were 237,169,370 shares outstanding as of December 31, 2007 according to the company's 20-F filed March 5, 2008, implying a total decline in market capitalization of equity of approximately $291 million.

7 "SEC Files Settled Books and Records and Internal Controls Charges Against Fiat S.p.A. and CNH Global N.V. For Improper Payments to Iraq Under the U.N. Oil for Food Program - - Fiat Agrees to Pay Over $10 Million in Disgorgement, Interest, and Penalties," SEC News Digest, December 22, 2008.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.