This article looks at what Type "A" Reorganizations are and provides diagram examples that you can reference. You will find two standard Type A reorganization diagram examples and a Rev. Rul. 2008-25, 2008-1 C.B. 986 diagram example. We reference IRC § 368(a), IRC § 338 and other relevant Code provisions, and provide helpful tips regarding mergers of this kind.

What is a Type "A" Reorganization?

Under IRC § 368(a)(1)(A), a Type A reorganization is a "statutory merger or consolidation." An "A" reorganization must meet the requirements of applicable state corporate law or the merger laws of a foreign jurisdiction, as well as regulatory requirements in Treas. Reg. § 1.368-1 relating to business purpose, continuity of business enterprise, and continuity of shareholder interest.

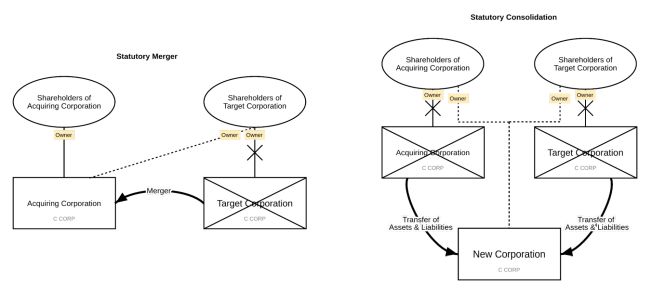

In a qualifying Type A merger, the assets and liabilities of the target corporation ("Target") must be transferred to the acquiring corporation ("Acquiror"), and the Target must dissolve by operation of law (Rev. Rul. 2000-5, 2000-1 C.B. 436). A consolidation, on the other hand, is a transfer of assets and liabilities of two or more existing corporations to a newly created corporation and the transferor corporations dissolve by the operation of law. In either a merger or consolidation qualifying as a Type A reorganization, the shareholders (and frequently the creditors) of the disappearing corporation(s), or at least some of them, become shareholders (and creditors) of the surviving corporation by operation of law.

Type "A" Reorganization Diagram Example

The diagram on the left depicts a Type A merger. Pursuant to state law, the Target Corporation merges into the Acquiring Corporation and ceases to exist.

The diagram on the right depicts a transaction that qualifies as a Type A consolidation. Pursuant to state law, the Acquiring corporation and the Target Corporation merge into a new corporation by transferring all their assets and liabilities and then dissolving. Both transactions must also satisfy the regulatory requirements in Treas. Reg. § 1.368-1.

Rev. Rul. 2008-25, 2008-1 C.B. 986 Diagram Example

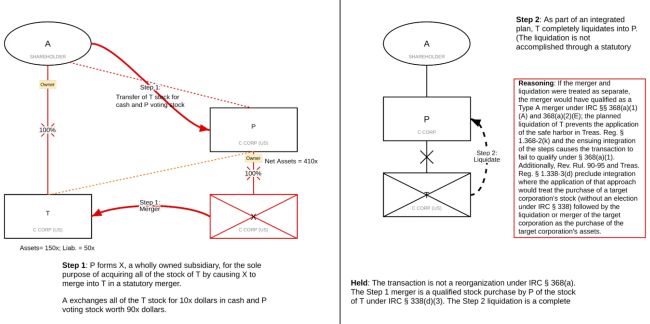

This diagram depicts a transaction described in Rev. Rul. 2008-25. In this revenue ruling, the initial step involved the merger of a transitory subsidiary (X) into a target corporation (T). Following this merger, and as part of an integrated plan, T completely liquidated into the acquiring corporation (P). The revenue ruling stipulates that, if the initial merger and the liquidation had occurred separately, the merger would have qualified as a tax-free reorganization under IRC § 368(a)(1)(A), by reason of IRC § 368(a)(2)(E).

However, in considering whether the transaction qualified as a reorganization under § 368(a), the IRS applied the step transaction doctrine and treated the overall transaction as a qualified stock purchase (under IRC § 338) for which no election was made under IRC § 338, followed by a liquidation of T into P under IRC § 332. Therefore, the revenue ruling holds that the first step of the transaction does not qualify as a Type A reorganization. The analysis indicates that further application of the step transaction doctrine to integrate the stock purchase with the subsequent liquidation would have resulted in treating a stock purchase as a taxable asset purchase, "which would violate the policy underlying § 338 that a cost basis in acquired assets should not be obtained through the purchase of stock where no § 338 election is made."

These diagrams use action arrows to signify the transfer of stock or assets and the Blue J labeling feature allows practitioners to customize entities, relationships, and actions. The color scheme and text boxes also help to describe the actions and visually connect the consequences of each action to newly-formed relationships between entities.

Blue J Diagramming's features are designed for the specialized needs of tax practitioners. With it, practitioners can use shapes and conventions they are already familiar with to easily capture relationships between entities and even propose or dissolve relationships and entities in a multi-step transaction. Our uniquely intuitive diagramming tool allows tax professionals to share and edit diagrams simultaneously, taking collaboration to a new level for firms.

Type "A" Reorganization Considerations

In structuring a multi-step transaction, practitioners must pay close attention to the potential application of the substance-over-form doctrine. In Rev. Rul. 2008-25, 2008-1 C.B. 986, a multi-step transaction involved a transaction otherwise qualifying as a Type A reorganization followed by a complete liquidation of the acquired corporation ("T") into the acquiring corporation ("P"). The IRS recharacterized the transaction as (1) a qualified stock purchase ("QSP") of T's stock by P, (2) followed by a complete liquidation of T governed under IRC § 332. The IRS reasoned that Rev. Rul. 90-95, 1990-2 C.B. 67 and Treas. Reg. § 1.338-3(d) both prevent application of the step transaction doctrine where the application of that approach would treat the purchase of a target's stock without a section 338 election followed by the liquidation of the target as the purchase of the target's assets resulting in a cost basis in the assets under IRC § 1012.

Blue J's diagramming tool provides a convenient way to visually represent multi-step transactions, including Type A reorganizations. We host example diagrams in our Blue J Folios, which provide a starting point for your research with an outline that summarizes the topic, relevant references to the Code and Treasury Regulations, common leading authorities on each topic, and a visualization of some of these authorities using our Diagramming tool.

Originally published 26 August 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.