Insurance is part of our daily lives. Health insurance reimburses us if we get sick, life insurance safeguards loved ones if we pass away, and auto insurance reimburses others in case we cause an accident and injure someone else unexpectedly. Likewise, intellectual property (IP) insurance protects your company from the potentially high cost of litigation involving IP. The two main types of IP insurance are:

- intangible asset protection insurance: insurance that covers the cost of enforcing your company's IP if it is stolen

- IP risk insurance: insurance that covers the cost of defending against claims of infringement made by others.

Intangible asset protection insurance provides funds to enforce your company's IP and reimburses a company for fi nancial loss caused by IP theft. This type can be most useful for small to mid-sized manufacturing companies that may not be a typical target for patent enforcement actions. Such companies' value is in their trade secrets and knowhow, which gives them a competitive advantage. The risk for these companies is a former employee misappropriating trade secrets to benefi t a competitor, with litigation costing up to millions of dollars. Instead of paying for those enforcement costs out of pocket, insurance allows for a small and predictable payment on an annual basis such that if misappropriation occurs, seeking relief will be covered by the insurer, not your company.

IP risk insurance provides funds to defend against claims of infringement made by others. This type can be useful for technology companies that more routinely fi nd themselves targets of patent litigation or manufacturing companies that are required to indemnify their customers against claims of infringement.

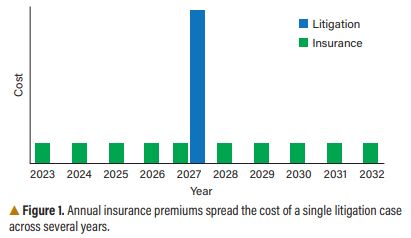

For regular targets of patent litigation, insurance simply provides more predictability and certainty in paying for the defense against such claims. As shown in Figure 1, instead of paying the high costs of patent litigation out of pocket at unpredictable times, insurance spreads the risk out to predictable annual premiums.

For those companies whose customers require that they be indemnifi ed in purchase agreements, insurance can provide protection against potentially high costs of indemnifi cation on otherwise low-value supply agreements. This type of insurance is also particularly attractive for companies that are backed by venture capital, especially following recent announcements of signifi cant funding. Announcements of an infl ux of funds paint a target on the backs of such companies. Insurance can help mitigate this risk.

The cost of insurance typically runs between 1–5% of the insurance policy's limit. So, purchasing a $1 million insurance policy will be less expensive than a policy with a higher $5 million limit. The policy limit is chosen to match the company's exposure. The specifi c percentage of the limit that becomes the policy's premium depends on several factors, including the insured's revenue, the extent of its indemnity obligations, the type of industry or sector, the sales geography, and any prior history of litigation or loss. These factors refl ect the reality that some types of companies are targeted more often than others in IP enforcement actions.

With such policies in place, you simply notify the insurer when your company becomes aware of a claim or circumstance that would give rise to coverage. The insured is most often free to select their own counsel. The insurer plays no role in litigation or settlement strategy, although the insurer must approve litigation expenses and settlement before the policy will reimburse those costs. The insurer will then cover the insured's legal fees and any damages awarded or monetary settlements negotiated prior to a trial. Even the costs to fi le petitions with the U.S. Patent and Trademark Offi ce to challenge patents asserted against your company are typically covered.

For those who think that their company already has insurance that will cover such things as claims of patent infringement or trade secret misappropriation, think again. Most companies have general liability insurance that expressly excludes losses due to claims of patent infringement and trade secret misappropriation and provides only limited coverage for claims of trademark and copyright infringement.

Currently, more than 77 million patents, trademarks, and other IP are in-force worldwide. The U.S. median patent infringement damages award is more than $10 million, and legal fees to take a typical IP infringement case to trial can routinely exceed $3 million. So, ask yourself, "Is my company insured against an IP disaster?"

Originally Published by Chemical Engineering Progress (CEP) Magazine

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.